Business description

Interpipe is one of the largest Ukrainian private companies, vertically integrated pipes and railway wheels producer.

The group was formally established in Y2005 (when production and trading enterprises have been combined into one group), parent company of the group is Interpipe Limited (Cyprus), principal subsidiaries (production companies – residents of Ukraine) are as follows:

- Interpipe Nizhnedneprovsky Tube Rolling Plant – seamless pipes and railway wheels producer

- Interpipe Novomoskovsk Pipe-Production Plant – welded pipes producer

- Interpipe Niko Tube – seamless pipes producer

- Interpipe Steel – steel billets producer

Ultimate beneficiary owner of the group is Ukrainian businessman Mr. Viktor Pinchuk.

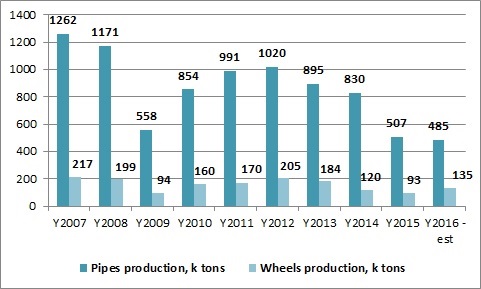

Peak production volumes of the group (since its formal establishment in Y2005) have been reached in Y2007, when Interpipe produced 1 260k tons of seamless and welded steel pipes and 217k tons of railway wheels. Pipes and wheels output dynamics of the company since Y2007 is represented on the chart below:

In Y2007 the group started construction of new electro-metallurgical steel mill, which was put into operation in October’12. Total production capacity of new mill is about 1.3M tons of steel billets per annum, it substituted outdated and inefficient blast furnace at Nizhnedneprovskiy Tube Rolling Plant (which produced part of steel billets for the group needs before putting into operation of new steel production facilities).

Launch of new steel mill allowed the company to eliminate key operating risk – it fully secured Interpipe in steel billets for seamless pipes and railway wheels production. It was also supposed that own metal scrap collection enterprises in Lugansk and Dnipropetrovsk would provide the company with up to 70-80% of its needs in metal scrap, so that level of vertical integration of the company was estimated as rather good.

Total amount of investments into the project made close to USD 700M and was financed almost fully by bank loans (debt burden of the company increased from USD 188M as of 31.12.06 up to USD 944M as of 31.12.08). In addition to new investments financing, credit funds have been used to pay dividends of USD 421M in Y2007.

In the same year shareholder of the company negotiated merger with the largest Russian pipes producer TMK and actively prepared for an IPO.

IPO plans have not been materialized due to financial crisis started in Y2008 (interesting is the fact that in the end of Y2007 market capitalization of one of group’s production enterprises - JSC Interpipe Nizhnedneprovsky Tube Rolling Plant, – basing on its share price at Ukrainian stock exchange PFTS, exceeded USD 2bln). Merger was not realized as most likely both parties did not agree on their shares in combined company.

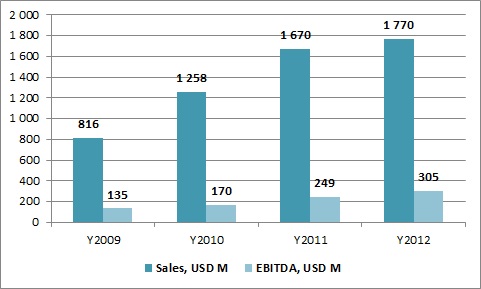

As pipes and wheels production can be regarded as rather cyclical industry, operating and financial performance of Interpipe significantly worsened in H2 2008 - Y2009: production fell by about two times, revenues – by 58% (from USD 1.9 bln in Y2008 to USD 816M), EBITDA in Y2009 made just USD 134.9M (vs. USD 440M in Y2007). As a result Interpipe defaulted on its obligations towards creditors (as of 31.12.09 debt burden of the company consisted of bonds in amount of USD 199M and bank loans of USD 684.5M), suspended principal payments under outstanding credit facilities and started negotiations on debt restructuring.

Major restructuring was completed by the end of Y2011. In accordance with its terms creditors provided Interpipe with new financing of USD 135M to finish construction of steel mill, established new loans and bonds maturities and new schedule of debt principal repayments (starting from H2 2012 and till Y2017). Also in frames of restructuring shareholder of Interpipe injected into the company USD 65M of cash and provided additional stand-by means in the form of Letter of Credit in amount of USD 40M to secure funding for Interpipe Steel Project completion.

After finalization of restructuring, steel mill construction completion and general market recovery during FYs2010-12 positions of Interpipe and its perspectives seemed to improve, however, in reality already in Y2013 Interpipe defaulted on its obligations again, due to several reasons its operating and financial performance during last years significantly worsened.

During FYs 29013-15 production of both pipes and wheels halved, sales and profitability dropped, in Y2013 Interpipe started negotiations with its lenders on new restructuring terms, up to the moment it is not finished.

Latest financial report of the company available on its web-site is for Y2012, no reports for further periods are present (reason – ongoing restructuring negotiations), so below we present factual financial figures for FYs2011-12 and make our estimations as for Interpipe financial performance thereafter (basing on available information regarding production&sales dynamics).

Financial information (latest available)

| USD M | 2012 | 2011 |

|---|---|---|

| Sales | 1 770 | 1 670 |

| Gross Profit | 406 | 310 |

| EBITDA | 305 | 250 |

| EBITDA margin, % | 17.2% | 14.9% |

| Net Profit | -72 | 41 |

| 31.12.12 | 31.12.11 | |

| Total Assets | 2 094 | 1 963 |

| Fixed Assets | 1 206 | 1 138 |

| Current Assets | 887 | 825 |

| Inventory | 381 | 324 |

| Cash | 120 | 137 |

| Equity | 553 | 450 |

| Debt | 1 044 | 1 026 |

Financial performance of the company largely improved during FYs 2010-12 period (vs. Y2009), revenues and EBITDA figures are presented on the following chart:

In line with terms of the first restructuring (finished in Y2011) in Q4 2012 Interpipe repaid to its creditors first debt principal tranche in amount of about USD 70M, another USD 100M have been repaid in H1 2013.

Along with it in Y2013 activity of the company was negatively impacted by restrictions imposed by Russian Federation for different types of Ukrainian export – first of all, import duty at 19% was established for Ukrainian steel pipes (it substituted quotas for duty-free supplies, which in Y2012 was at 300k tons of pipes). Taking into account average profitability of Interpipe pipes sales in Russia was at about 20%, for the company it meant almost zero margin for its Russian pipes sales. This fact along with other occasional trade restrictions on Russian side since H2 2013 led to sharp decline of realization on this market.

If in Y2012 the share of sales in Russia made 30% of total pipes realization of Interpipe (annual volume made close to 300k tons), in Y2015 the share comprised just 10% (or about 50k tons in absolute volume, so realization slumped by 6 times). Pipes realization on Ukrainian market fell as well (from about 200k tons in Y2012 to slightly more than 100k tons in Y2015), reason – general economic crisis in Ukraine accompanied by significant decline in new investments volume.

Situation was significantly exacerbated by the fact that starting from Y2013 Russia almost stopped Ukrainian railcars purchases (in Y2011 export into Russia accounted for more than 70% of Ukrainian railcars realization). Ukrainian railcars production declined by two times in Y2013, in Y2014 it made close to 5k, in Y2015 – 1 054 railcars (vs. 52 700 in peak Y2011). Decrease of railcars production by Ukrainian enterprises led to sharp fall of demand on railcars wheels produced by Interpipe.

As a result if in Y2012 Interpipe sold on Ukrainian market close to 130k tons of wheels (65% of total production), in Y2015 – only 16k tons (17% of total).

To mitigate decrease of sales in Russia and Ukraine, Interpipe started to change its focus to other markets – NAFTA, Europe, MENA. As for pipes special focus was on US market where shale oil revolution took place. Despite significant market growth, US authorities protected it from foreign companies, so that Interpipe was not able to significantly increase its pipes sales in USA (moreover considerable decline of world oil prices during FYs2014-15 led to slump in US drilling activity and to decline of demand on pipes).

On the other side after EU decreased part of import duties for Ukrainian seamless pipes in Y2012, the company tried to increase its presence on this market (volumes of pipes realization in EU countries in Y2015 made more than 100k ton vs. just 65k tons in Y2012).

In wheels segment, Interpipe tried to somewhat increase its presence on the Russian market (increasing annual volumes of realization from 40k tons in Y2012 up to about 60k tons during following two years with decline to 35k tons in Y2015), developed its EU operations (wheels supplies to EU made almost 30k tons in Y2015) and started to supply wheels to US market.

Due to all stated reasons, in Y2015 Interpipe produced just about 500k tons of pipes (two times lower than in Y2012) and close 90k tons of wheels (-55% vs. Y2012). Geographical sales of pipes and wheels distribution during last years changed in the following way:

2012

2015

Change, %

Sales, k tons

Share, %

Sales, k tons

Share, %

Pipes

Ukraine

211

21%

106

21%

-50%

Russia

307

30%

51

10%

-84%

Other countries

502

49%

350

69%

-30%

Wheels

Ukraine

132

63%

16

17%

-88%

Russia

42

20%

33

35%

-22%

Other countries

37

18%

45

48%

20%

In addition due to lower internal demand volumes of crude steel output by Interpipe Steel declined from about 1M tons in Y2013 (production facilities were launched in October’12) to 596k tons in Y2015.

As a result of all a/m developments and with first signs of recovery of Ukrainian railcars market (in Y2016 railcars production doubled), it is estimated that in Y2016 Interpipe increased production and sales of wheels by 45% (up to 135k tons). We expect that for pipes dynamics is to be worse – slight decrease by 3-5% vs. precious year (factual data for January-November’16 – production of 446k tons of pipes, -3% y-o-y, negative factor is that production of more marginal seamless pipes declined by about 7%).

It is expected that in Y2016 steel output will slightly grew (up to 650-680k tons), additional restrictive factor during last years – deficit of metal scrap on Ukrainian market (we also note that because of conflict in the East of Ukraine Interpipe lost one of its metal scrap collection enterprises – in Lugansk).

As for financial performance and financial situation of the company in general, we estimate that Russian restrictions on Ukrainian pipes import and slump in domestic railcars production in Y2013 led to decrease of revenues of the company by about 12-15% (from USD 1 770M in Y2012 to about USD 1 500M). EBITDA had to decline more significantly – from USD 304M in Y2012 to about USD 240-250M (despite positive effect from putting into operation of new steel mill), and main part of decline most likely happened in H2 2013 (when Russia cancelled duty-free quota for Ukrainian pipes import). It led to inability of Interpipe to repay to its creditors scheduled principal payment at close to USD 106M. The company started new rounds of negotiations with its lenders regarding new restructuring terms (negotiations are not finished yet).

As was mentioned, during Y2014-15 output and sales of pipes in natural terms significantly declined, in addition, selling price decreased as well (by 15-20% on average in Y2015 vs. Y2013), so, according to our estimations, in Y2014 total revenues of Interpipe made about USD 1 150M, in Y2015 – in the range of USD 600-700M.

As for EBITDA estimations, in Y2012 EBITDA margin was at about 17%, then declined due to import duty imposition in Russia in Y2013. During FYs2014-15 main supporting factor for profitability was UAH devaluation, on negative side – metal scrap deficit in Ukraine, decrease of output volumes (due to operating leverage the share of fixed costs grew, negatively affecting profitability). To decrease fixed costs in Y2015 Interpipe reduced its staff by 3k persons.

We can estimate EBITDA of Interpipe in Y2015 at USD 70-80M with growth to USD 100-120M in Y2016:

USD M

2012 - fact

2013

2014

2015

2016

EBITDA estimation

305

240

180

75

110

Taking into account necessary maintenance investments (which are most likely at the annual level of USD 30-40M), current free cash flow of the company, which can be directed to the debt servicing is quite low – USD 70-80M. It means that without considerable volumes of pipes and wheels realization growth, Interpipe is not able to provide for more or less normal servicing of its debt (standing at about USD 1bln) without significant haircut (with interest rate of 5%, assuming current production level and only maintenance investments, about 15-20 years would be needed for the company to fully repay its debt).

On positive side is the fact that despite highly negative business environment during last four years, the company keeps operating, became more flexible and efficient, constantly works on development of operations on the new markets (such as sales of wheels in USA). So, in case market situation improves, so that Interpipe will be able to increase its output and realization by 25-30%, perspectives of the company will be much better, which also refers to level of loans recovery for lenders of the company.