The Ovostar company is one of the leading producers of chicken eggs in Ukraine, its share among industrial producers in recent years is more than 20%.

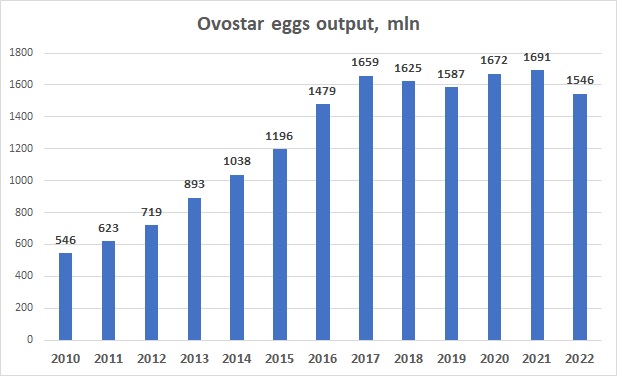

The average annual Ovostar eggs output volume during 2016-2022 was 1.6 billion pieces (in 2022, the production volume decreased by 9% compared to the previous year and amounted to 1.546 billion pieces). The focus of the company is the production and sale of branded eggs (TM Yasensvit), the export of shell eggs, as well as the production of dry and liquid egg products, which are sold to Ukrainian and international food producers.

The production facilities of Ovostar are located in the Kyiv region. The poultry farms of the group are located in the village of Krushinka of the Vasylkiv district and the village of Stavishche, also within the structure of the group there is a compound feed plant, incubator and other assets.

IPO and rapid development

The Ovostar Group was created by Boris Belikov and Vitaly Veresenko in 2008 as a result of the merger of such assets as the Ukraine Poultry Farm, Krushinsky Poultry Complex and others.

In 2011, Ovostar carried out an IPO on the Warsaw Stock Exchange, raising $33.4 million (in frames of the IPO, 25% of the company shares was sold, the total capitalization of Ovostar made $133 million). The funds received in frames of the IPO were directed by the company to business development and a significant increase in production capacity.

If in 2010 the total Ovostar flock was less than 3 million heads, and the production of eggs - about 550 million pieces, by 2016 both figures increased almost three times - the number of chickens was 7.6 million heads, and the production of eggs - 1.479 billion pieces.

The total amount of the company's capital investments (not including investments in increasing the number of hens) during 2012-16 was about $55 million (more than half of it in 2012, after the IPO).

It should be noted that with fairly active growth and investments, Ovostar's policy of attracting debt financing has always been very conservative - its debt has always remained at a fairly low level for the past ten years.

Eggs market stagnation

In the period after 2012-13, the general situation on the Ukrainian chicken egg market worsened, which affected the profitability of the leading egg producers.

Firstly, there was a reduction in the demand for eggs in the domestic market due to the Russian annexation of Crimea and military operations in Donbas. Egg consumption in Ukraine decreased from 13.3 billion pieces in 2014 to 11.4 billion pieces in 2016.

Secondly, there were problems with exports - due to military actions in the Middle East region, supplies to Iraq, which was previously a key export market for Ukrainian eggs producers, significantly decreased. Also, due to bird flu outbreaks in different regions of Ukraine, some of the main importing countries of Ukrainian eggs and egg products (UAE, Saudi Arabia, EU countries) at different points of time completely or partially suspended the import of eggs from Ukraine.

We should also note the significant devaluation of the hryvnia in 2014-15, which negatively affected the profitability of producers due to a more significant increase in feed prices compared to egg prices (both in UAH terms).

As a result the volume of eggs output in Ukraine and the profitability of producers have been decreasing since 2014 (very significant losses were incurred by the largest producer of eggs in Ukraine - agricultural holding Avangard, whose production volume was halved during 2014-15).

Despite all this Ovostar continued to increase production, increasing its market share (from 7% among industrial eggs producers in 2013 to 20% in 2017).

Given the limited demand in the domestic market (any excess supply led to a collapse in prices), the company actively developed export supplies of both eggs and egg products (for example, Ovostar became the leader of the Ukrainian market in terms of production and export of liquid egg products).

On the domestic market, taking into account the geographical proximity of the group's production facilities to Kyiv, in which the purchasing power of the population is greater compared to other regions of the country, this region is the key for the company.

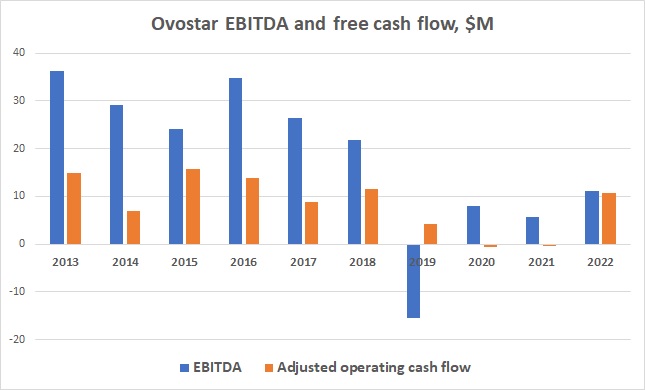

Ovostar's profit figuress in absolute terms were good and relatively stable, but it should be taken into account that at the same time the company's production and sales of eggs increased significantly, so profitability per unit of production decreased.

It should also be taken into account that the formal Ovostar profitability (for example, basing on EBITDA - operating profit before depreciation) should be treated with caution - it does not always reflect the real picture in business for two reasons - revaluation of biological assets (hens flock), as well as constant the need for investments into biological assets (can be regarded as flock maintenance).

From the point of view of financial reporting, investments in the renewal of flock are not reflected in either the EBITDA or the operating cash flow figures. So, in our opinion, the best indicator that reflects the state of affairs in Ovostar's business is the operating cash flow adjusted for the amount of investments into biological assets.

The dynamics of Ovostar's EBITDA, as well as the company's adjusted operating cash flow over recent years, are shown in the graph below:

Recent history and impact of a full-scale invasion

The years 2017-19 were relatively good for both Ukrainian egg producers in general and Ovostar. The total group flock in those years was about 7.5-8 million, the production on average made 1.6 billion eggs per year (of which exports were at the level of 550 million pieces, approximately the same amount was eggs processing, the rest – sales at the domestic market).

Financial figures were not very high but stable. Over those three years, the company's total adjusted operating cash flow was nearly $25 million positive.

But the period starting in 2020 was the most difficult in the history of the group. It all started with a significant increase in world prices for grain and oil crops, which led to a significant growth of feed prices. At the same time, due to restrictions on the side of importing countries, exports decreased (in 2020 by 20%, in 2021 – by more than 50%), so an oversupply formed in the domestic market, which put pressure on prices.

In 2020, egg prices in Ukraine on average remained almost unchanged compared to the previous year, with a fairly significant increase in the production cost. In 2021, egg prices increased, but this was only enough to keep the producers close to breaking even - during 2020-2021, Ovostar's adjusted operating cash profit was close to zero.

It should also be noted that in 2021, the total production of chicken eggs in Ukraine decreased by 14% compared to the previous year and amounted to 14.1 billion pieces. Among the manufacturers, Avangard still had the biggest problems (partly due to Ukrainian anti-corruption authorities investigation of the activities of the company's main shareholder, Oleh Bakhmatyuk).

Despite the negative situation on the market, in 2021 Ovostar even increased egg production compared to the previous year (up to a record 1.691 billion eggs). In general, the share of Ovostar among industrial egg producers in 2021 was 24%. Considering the export restrictions and problems of Avangard, Ovostar significantly increased its share in the domestic market.

The full-scale Russian invasion had a major impact on the Ukrainian egg market in general and on the activities of the Ovostar group in particular.

The hostilities on the territory of the Kyiv region in spring had a significant impact on the company's output. The egg processing plant in Makarov was practically at the epicenter of the invasion of Kyiv region, the poultry farm in the Vasylkiv district was also in the immediate vicinity of the hostilities.

The hostilities had a significant impact on the logistical routes of fodder supply, as well as on the sales volume. In addition, the mass migration of the population outside of Ukraine had a significant impact on the reduction of domestic consumption of eggs and egg products in Ukraine.

Ovostar reduced its total flock from 8.4 million to 6.26 million (as of 06/30/22) during the first half of the year due to a reduction in domestic consumption and unclear export prospects.

On the other hand, Ovostar's main competitors suffered much more.

Avangard lost the Chornobayivka poultry farm, the largest in Europe (about 3 million laying hens died there), two poultry farms of another of the largest Ukrainian producers - the Inter-Agrosystem group - remained on the occupied territory of the Zaporizhzhia region (one more poultry farm - in Gulyaipole - is factually situated on the front line).

According to estimates of the Union of Poultry Breeders of Ukraine, due to the full-scale Russian invasion, Ukraine lost about 20% of the industrial potential of egg production.

So among the largest Ukrainian egg producers, Ovostar was the least affected by the full-scale invasion. In 2022, the total production of eggs by the group amounted to 1.546 billion pieces, 9% less than in the previous year. Egg sales decreased by 6% compared to last year and amounted to 1.081 billion pieces.

It is interesting that despite the problems in the first quarter, due to the opening of the European market (in addition, the EU canceled all tariffs on Ukrainian goods), Ovostar increased the volume of egg exports by 10% - in 2022 it amounted to 290 million pieces (most of it exports to EU countries, which in monetary terms increased three times compared to 2021).

Given that due to household egg production (which has quite significant seasonality – summer production exceeds winter production by more than two times), until the end of summer 2022, the supply of eggs on the domestic market exceeded demand, and prices remained low. By the beginning of the fourth quarter, Ovostar was more focused on exports.

But during September-October 2022, due to a decrease in egg production by households, as well as a partial recovery of demand for eggs in Ukraine, domestic egg prices more than doubled, which contributed to the improvement of Ovostar's profitability figures.

The company's adjusted operating cash flow in the last quarter of 2022 made $5.4 million (we note gradual catch-up of flock maintenance investments in H2), which is equal to the figure for the previous nine months (when there was under-investment due to decrease of the flock).

Because of significant improvement in financial performance figures, in December 2022 the Board of Directors of Ovostar decided to pay interim dividends to its shareholders in the amount of EUR 3.9 million. The general financial standing of Ovostar remains good. The business is financed mainly through equity, the company remains conservative in attracting debt financing. As of the end of 2022, the total amount of loans in the company's balance sheet made $11 million, with the amount of cash at $12.1 million.

Operating figures

| 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

|---|---|---|---|---|---|---|

| Flock, mln | 7.2 | 8.4 | 8.0 | 8.1 | 7.6 | 7.7 |

| Eggs production, mln | 1 546 | 1 691 | 1 672 | 1 587 | 1 625 | 1 659 |

| Shell eggs sales, mln | 1 082 | 1 150 | 1 104 | 1 147 | 1 381 | 1 195 |

| Shell eggs export, mln | 264 | 290 | 349 | 525 | 587 | 529 |

| Eggs processing, mln | 427 | 501 | 552 | 577 | 530 | 541 |

Financial information

| $k | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|

| Revenues | 135 626 | 133 366 | 98 907 | 104 654 | 124 967 | 98 688 |

| EBITDA | 11 100 | 5 700 | 8 000 | -15 500 | 21 900 | 26 500 |

| Net Profit | 6 087 | 1 655 | 2 592 | -20 016 | 17 459 | 22 918 |

| 31.12.22 | 31.12.21 | 31.12.20 | 31.12.19 | 31.12.18 | 31.12.17 | |

| Assets | 110 695 | 141 019 | 131 314 | 145 815 | 145 573 | 131 023 |

| Fixed Assets | 46 568 | 91 490 | 88 209 | 93 696 | 81 772 | 67 423 |

| Current Assets | 64 127 | 49 529 | 43 105 | 52 119 | 63 801 | 63 600 |

| Inventory | 22 132 | 28 481 | 24 354 | 27 854 | 31 745 | 22 921 |

| Cash | 12 181 | 2 435 | 1 626 | 4 478 | 14 346 | 14 958 |

| Equity | 83 921 | 109 889 | 104 404 | 120 951 | 126 812 | 106 916 |

| Debt | 10 929 | 20 131 | 10 765 | 10 390 | 9 331 | 13 618 |