Business description

Kernel is the world's largest producer of sunflower oil, Ukraine's number one grain exporter and the country's largest agricultural holding.

In the agricultural market of the country, in almost every nomination, Kernel is number one. The number one exporter of grain and sunflower oil, the largest land bank in the country, grain storage facilities, private fleet of grain carriages.

And all this was developed by the owners and management of the company practically from scratch.

Kings of the fat and oil industry

Andriy Verevskyi started his activities on the grain market of Ukraine back in 1993 in Poltava and until 2002 worked in various positions in Ukrainian and international companies. In 2002, he purchased the Poltava MEZ, and in 2004, the Kernel company was created, and a more active development of the sunflower processing business began. First the crushing plant in the Luhansk region (as well as the "Schedryi Dar" trademark) was acquired, and then - in 2006 - the assets of Mykhailo Veselskyi's Eurotek group (in particular, the "Stozhar" TM).

In those years, new acquisitions were financed mainly by reinvested profits and bank loans. At the end of the 2007 financial year (June 30, 2007), the group's credit load was significant - total debt was about $155 million against revenues of $350 million and assets of $275 million.

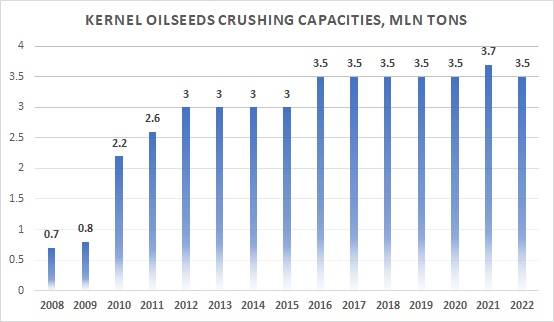

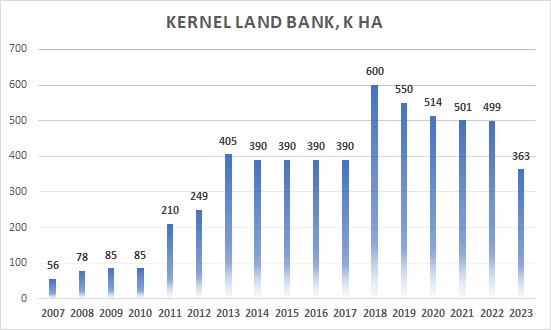

It was risky to further increase leverage, but capital was needed for development in high-margin markets, so in 2007 Kernel conducted an IPO on the Warsaw Stock Exchange, selling 38% of the company's shares for $218 million. The group, which owned three crushing plants, 56 thousand hectares of land and two dozen elevators, was valued at more than $570 million.

At the beginning of 2008, Kernel made an additional placement of shares, during which it attracted another $82 million.

Certainly, as we now understand, the end of 2007 and the beginning of 2008 was almost the best time for an IPO in the last 20 years, and Kernel was lucky to attract significant funds, which were used to purchase a grain terminal in Illichivsk (with a transshipment capacity of 4 million tons of grain per year), the construction of a new crushing plant (Bandurka) was started, and the increase of the land bank continued (from 56,000 hectares to 85,000 hectares at the end of the FY2009). Finally, in 2010, the sunflower processing business of the Allseeds group was acquired (purchase price - about $70 million), as a result of which Kernel's total crushing capacity increased to 2.2 million tons of sunflower seeds per year.

Kernel turned into the largest sunflower processor and grain exporter in Ukraine. Just in time - from 2010 to 2015, the Ukrainian sunflower seeds harvest practically doubled, and sunflower oil began to conquer Asian markets.

Leading agricultural holding in the country

In 2011, Kernel acquired the Ukrros group, which made it possible to increase the company's land bank from 85,000 hectares to 210,000 hectares (as well as take a leading position in the Ukrainian sugar market, although Kernel got rid of its sugar assets two years later). In order to finance this deal, the purchase of the Illichivskiy crushing plant, as well as the purchase of oil refining assets in Russia, Kernel continued to raise equity capital, making two additional placements of shares on the Warsaw Stock Exchange (in 2010 for $81 million, in 2011 for $140 million).

Kernel became the only Ukrainian public company whose owner did not retain a controlling stake (Andrii Verevsky's share in Kernel was 41% at the end of FY2011).

The years 2012-13 were very favorable for the company both from the point of view of grain growing (significant increase in global grains prices) and oilseeds processing (due to not very high competition among processors). Kernel continued its active development - in April 2013, the company Druzhba Nova (with a land bank of 106,000 hectares) was purchased. Initially, there were certain problems with the integration of the new asset into the group's structure, but over the next two years these issues were resolved.

Then situation worsened. In 2014, Crimea was annexed by Russia, and a military conflict began in Eastern Ukraine. These events were accompanied by a significant economic downturn, so it became much more difficult for Ukrainian companies to attract new loans and extend existing ones. In this situation, Kernel froze its development and directed all operating cash flow from the business to pay off debts. During the 2015-2016 financial years, the company paid off about $400 million in debt, reducing it by more than half.

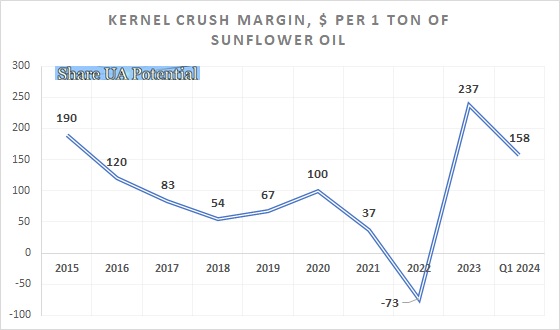

Another negative market factor was a significant decrease in sunflower processing margins in Ukraine, which occurred due to growth of processing capacities.

Despite this, Kernel entered 2017 in good shape (operational and financial). The company began to look for new opportunities for investment. There were (unsuccessful) negotiations regarding the purchase of the assets of the bankrupt Mria, and then, in the end, two agricultural holdings were purchased - UAI (190,000 ha) and Agro-Invest Ukraine (28,000 ha). As a result, Kernel's land bank increased to 600,000 hectares, the group became the number one agricultural holding in Ukraine.

To finance its investment activities, the company issued Eurobonds for $500 million in 2017. This Eurobonds placement was the first for Ukrainian companies since 2013, and had significant demand among investors.

Funds from the issuance of Eurobonds were also directed to investments in other segments - in the 2018 fiscal year, Kernel began the construction of a new crushing plant in Western Ukraine, as well as the expansion of its grain terminal in Illichivsk. In 2018-19, about 3,500 grain wagons were purchased. Also in 2018, Avere, a grain trading company headquartered in Switzerland, started its activities.

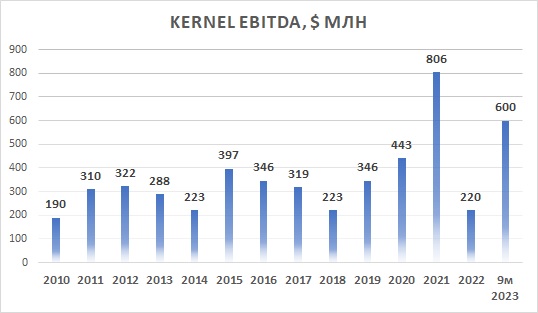

Overall, FY2018 was a challenging year for Kernel, with sunflower crushing margins falling to an all-time low, grains and oilseed syields declining, and global grain and oilseed prices remaining at relatively low levels. The group finished the year with the lowest profit since FY2011.

* - EBITDA - operating profit excluding depreciation

Best year ever

The years 2019 and 2020 were relatively successful for the company. Kernel increased volumes of sunflower processing (to a record 3.4 million tons), as well as grain exports (7.9 million tons in financial year 2020, largely due to increased grain terminal transshipment capacity). The profitability of the main business segments also recovered compared to 2018.

In terms of financial performance financial year 2021 (July 2020 – June 2021) was absolutely the best in the history of the holding.

The increase in world prices for grains and oilseeds allowed Kernel to significantly increase the profitability of grains growing. EBITDA per hectare increased from the average over the last four years $260 up to $790. The segment's total EBITDA increased to $397 million.

In the trading and infrastructure segment, Avere showed an excellent result. In favorable conditions for trading in a volatile market and rising global commodity prices, in financial year 2021 Avere earned about $250 million for Kernel (excluding Avere's management share, which was $137 million).

So even despite the decrease in the profitability of sunflower crush (the EBITDA of the segment was $56 million compared to $152 million a year ago), the overall financial result of Kernel in 2021 was an absolute record. Revenue amounted to $5.6 billion, EBITDA – $806 million, net profit – $506 million.

In the same year, Kernel announced its development strategy for the next five years - growth of grain exports to 15 million tons per year, sunflower processing - to 6 million tons per year.

To achieve these goals, Kernel planned to increase its land bank to 700,000 hectares, increase its grain handling capacity in ports by an additional 5 million tons, as well as its sunflower processing capacity by 1.5 million tons.

The impact of full-scale invasion

Fiscal year 2022 started even more optimistically than the previous one. The main reason for this was the record grain and sunflower harvest in Ukraine in 2021, as well as the still high world prices for grain and vegetable oils. As a result, in the first half of the 2022 fiscal year, the EBITDA of the Farming segment alone amounted to about $360 million, while the total EBITDA of the company was $608 million. Kernel exported a record 5.7 million tons of grain and processed 1.5 million tons of sunflower.

Against the backdrop of favorable market factors, Kernel pursued an extremely aggressive policy, trying to maximize the amount of sunflower seeds and grain origination. In addition, the commodities prices at the end of 2021 were significantly higher compared to the previous year, so the Kernel's working capital needs to finance the record purchase volume also increased.

In money terms, the company's inventory as of 12/31/21 was at $1.5 billion ($961 million a year ago), and this additional need for working capital was financed by debt, which increased from $1.2 billion as of 12/31/20 to $1.7 billion. Part of the loans was raised to cover seasonal financing needs, so the share of the short-term loans in total debt was significant ($840 million).

At the same time, Kernel actively invested in development, repurchased its shares from the market (in the 2022 financial year, $97 million was allocated to share buyback programs), and even in the third quarter of the 2023 financial year (January-March 2022) made an investment into cryptocurrency in the amount of about $150 million (calling it a liquidity management tool).

A full-scale Russian invasion found the company at the peak of season with maximum inventory and debt. The stoppage of exports through Ukrainian Black Sea ports was an absolute shock. Also, immediately after the beginning of the invasion, Kernel stopped all sunflower processing plants (processing resumed at the Poltava crushing plant only in April, operations on the five more plants were gradually re-started only until the beginning of September, while two more crushers were located in the occupied until September 2022 territory of the Kharkiv region).

In total, in its report for the 2022 financial year, Kernel estimated its losses from military hostilities at more than $500 million.

Also in April 2022, the company's board of directors made one of the most controversial decisions in Kernel history. To improve the company's liquidity situation, it was decided to sell part of the assets in the Farming segment (with a total land bank of 134,000 hectares, located in Western Ukraine). The only potential buyer of the assets was the structure associated with the principal shareholder of Kernel - Andriy Verevsky (the amount of the deal made $210 million).

Considering that at that time the cryptocurrency was still on the Kernel balance, the fact that in April Ukraine had already started exporting grain and oil via alternative routes, and Russian troops had already been pushed back from Kyiv (so the threat to the very existence of the Ukrainian state was much less than at the beginning of March), the sale of one of the company's best assets in order to improve its liquidity with a delayed principal payment (Kernel immediately received prepayment of only a $20 million, another $190 million - during March - June 2023) looked somewhat strange.

The sale of Kernel's assets to Verevsky (while keeping the cryptocurrency investments) led to negative reaction of investors on the Warsaw Stock Exchange - in our opinion, largely due to this sale, in 2022 Kernel had the worst share price performance among all Ukrainian public companies.

Anyway, Kernel was able to carry out the 2022 crop plantation, and as of June 30, 2022, its balance sheet structure was acceptable. The debt remained almost unchanged at $1.7 billion, with $448 million in cash, $120 million in crypto-assets, $954 million in inventory, and $162 million in future crops. All these assets fully covered the debt, while repayment of short-term liabilities was postponed until the middle in 2023.

In August 2022, the grain corridor from Ukrainian deep-sea ports began to operate. Due to the country's large grain and sunflower seeds stocks on supply side, the margins of grain exporters (especially owners of logistics assets such as port terminals) and the profitability of sunflower processing have reached the highest level in the last decade, and the profitability of Kernel's operation has increased significantly.

For the period July 2022 - March 2023, Kernel's EBITDA indicator was $600 million, operating cash flow before changes in working capital - $634 million, total operating cash flow - $583 million (Kernel gradually reduced inventory balances, while the amount of receivables increased).

Kernel's balance sheet structure as of March 31, 2023 also looked quite acceptable.

Due to profits, reduction of inventory, sale of cryptocurrency (in October-December 2022), Kernel significantly increased the amount of cash - up to $881 million as of March 31, 2023 (according to the company's additional announcement - up to $1.1 billion as of June 30, 2023 ), reducing the amount of debt to $1.5 billion.

Financial standing of the company looked fully acceptable.

Verevsky vs. minority shareholders

The story of the corporate conflict between the founder and the largest shareholder of Kernel and the company's minority shareholders becomes one of the biggest conflicts in the history of Ukrainian public companies sector.

The first action of the drama was the aforementioned sale of Kernel's assets to Andrii Verevsky at the end of April 2022, as a result of which (in our opinion) Kernel's share price in 2022 has fallen more than the share price of other Ukrainian public companies.

Out of the blue was the announcement made by the company at the beginning of March that Andriy Verevskyi (who at that time owned 38% of Kernel's shares) plans to buy out the shares of other shareholders in the company and delist it from the Warsaw Stock Exchange.

The decision on delisting was made by the Board of Directors of the company, which did not comply with the legislation of Poland, but was in line with the legislation of Luxembourg, where the parent company of the group is registered.

The proposed buyout price of 18.5 Polish zlotys was based on the company's average stock market quotations in the six months prior to the announcement (so, aside from the war in Ukraine, they were influenced by stories of asset sales and cryptocurrency investments).

On the other hand, according to Polish law, Polish pension and insurance funds are not allowed to own shares in non-public companies, so they were forced to sell their shares to Verevsky.

So, as a result of the tender, the principal shareholder purchased 36% of the company's shares, and his share in Kernel increased to 74% (or 80.4% of the shares that have the right to vote at the general meeting of shareholders, since almost 8% of the shares were previously acquired from the market by Kernel itself in terms of share repurchase program).

After the tender, Kernel submitted an application for delisting, but till the mid-September the Polish supervisory authority had not yet made a decision.

Meanwhile, at the end of August, Kernel announced the tender for an additional issue of shares of the company in the amount of $60 million among existing shareholders of the company. The formal reason is the demands of creditors as a part of restructuring of Kernel's credit facilities.

The tender was structured in a way to make it almost impossible for small shareholders to participate in the new placement (the main requirement was that only qualified investors could participate in the tender, and the majority of minority shareholders did not fall under this category), so in fact the tender was completely managed by Verevsky.

According to the results of the tender, Kernel issued 216 million new shares at a price of about PLN 1 per share. For comparison, at the time of the tender, Kernel was quoted at 11 zlotys per share on the Warsaw Stock Exchange, and before the full-scale Russian invasion, Kernel shares were quoted at 60-65 zlotys.

We will leave the assessment of the legality of these actions to the regulatory authorities and the court (in case the minority shareholders will defend their rights there), but we can note that due to the tender, Andriy Verevsky significantly diluted the share of the minority shareholders - from 19.6% to approximately 6%.

If the share of the main shareholder reaches 95%, he can announce a forced squeeze-out of shares belonging to minority shareholders and concentrate 100% of the ownership of the company in his hands.

Operating performance figures

| 2022* | 2021 | 2020 | 2019 | 2018 | 2017 | |

|---|---|---|---|---|---|---|

| Sunseeds crush, kmt | 2 187 | 3 183 | 3 436 | 3 164 | 3 136 | 2 959 |

| Sunoil sales, kmt | 967 | 1 367 | 1 518 | 1 619 | 1 420 | 1 207 |

| Grains export, kmt | 7 969 | 8 013 | 7 902 | 6 094 | 4 646 | 5 060 |

*-Kernel financial year starts in July and finishes in June

Sown area and key crops yield:

| Season | 2022/2023 | 2021/2022 | 2020/2021 | 2019/2020 | 2018/2019 |

|---|---|---|---|---|---|

| Corn | |||||

| Sown area, ha | 150 000 | 255 000 | 255 000 | 231 000 | 222 000 |

| Yield, t/ha | 8.5 | 9.3 | 8.0 | 8.5 | 9.8 |

| Wheat | |||||

| Sown area, ha | 35 000 | 64 000 | 73 000 | 97 000 | 100 000 |

| Yield, t/ha | 4.5 | 6.1 | 4.9 | 5.9 | 5.1 |

| Sunflower | |||||

| Sown area, ha | 130 600 | 154 000 | 149 000 | 137 000 | 132 000 |

| Yield, t/ha | 2.5 | 3.0 | 3.0 | 3.5 | 3.2 |

| Total land bank, ha | 363 000 | 500 000 | 510 000 | 514 000 | 550 000 |

Financial information

| $ mln | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Revenues | 5 331 | 5 595 | 4 107 | 3 960 | 2 403 |

| Gross profit | 652 | 906 | 462 | 334 | 160 |

| EBITDA | 220 | 806 | 443 | 346 | 223 |

| EBITDA margin, % | 4% | 14% | 11% | 9% | 9% |

| Net income | -41 | 506 | 123 | 179 | 56 |

| 30.06.22 | 30.06.21 | 30.06.20 | 30.06.19 | 30.06.18 | |

| Assets | 4 185 | 3 996 | 3 165 | 2 464 | 2 211 |

| Fixed Assets | 1 662 | 1 713 | 1 634 | 1 207 | 1 006 |

| Current Assets | 2 523 | 2 284 | 1 531 | 1 256 | 1 204 |

| Inventory | 1 116 | 709 | 555 | 667 | 675 |

| Cash | 448 | 574 | 369 | 77 | 132 |

| Equity | 1 686 | 1 948 | 1 494 | 1 346 | 1 178 |

| Debt | 1 696 | 1 085 | 966 | 769 | 751 |

| 2022 | 2021 | 2020 | 2019 | 2018 | |

| Operating cash flow | -305 | 461 | 269 | 199 | 82 |

| Financing cash flow | 476 | -48 | 226 | 30 | 77 |

| Dividends | -34 | -35 | -21 | -20 | -20 |

| Investing cash flow | -294 | -205 | -203 | -241 | -156 |

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer