Astarta is a vertically integrated Ukrainian agri-holding, a leading sugar producer (20-25% market share in recent years), soybean crusher (20-25%) and milk producer. As of Y2022, the company's land bank is 220,000 hectares, Astarta is among the TOP-5 Ukrainian agricultural holdings.

Sugar production

The Ukrainian sugar market has always been quite difficult for its players, not all of which (including such companies as Kernel and Ukrlandfarming) were able to work efficiently on it.

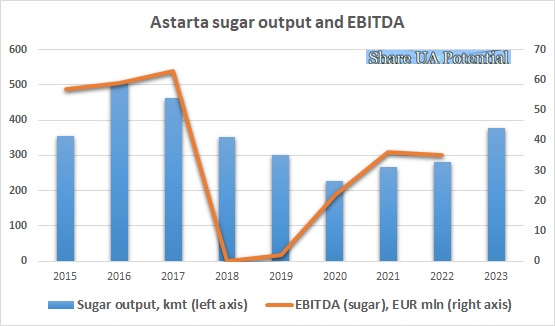

To succeed in the market, you need a) to have high operational efficiency; b) be prepared for significant volatility of operational and financial performance. A recent example. In 2016-17, Ukraine set records for sugar exports, and producers received high profits. But in 2018-19 (after a significant drop in the world price of sugar), the situation changed radically - producers began to build up surplus stocks, while profitability was almost zero.

This situation led to a decrease in production and a shortage of sugar in Ukraine in the summer of 2021.

One of the companies that significantly reduced production was Astarta. Due to the decrease in the yield of sugar beet (from 46 t/ha in 2019 to 42 t/ha) and the output of sugar from 1 ton of beet (from 15% to 13%), Astarta reduced sugar production from 302k tons in 2019 to 226k tons in 2020.

Astarta responded to the crisis situation on the market by selling two of its seven (as of 2020) sugar factories (factories sold were located in the Kharkiv region). So as of the end of 2022, five factories were owned by the group. The profitability of sugar production was almost zero in 2018-19, but along with the rise in prices in the domestic market, starting from the second half of 2020, it started to improve.

In 2021, the situation finally stabilized. Astarta produced 340,000 tons of sugar (including more than 70,000 tons of imported and processed cane sugar), while the profitability of sugar beet production per ton almost reached the level of 2016-17.

EBITDA of the sugar segment in 2021 amounted to EUR 36 million.

In 2022, due to the war, the demand for sugar in Ukraine decreased, but the market was in relative equilibrium (which was also helped by the lifting of restrictions on the export of sugar to the EU). Astarta's sugar sales profitability indicators for the first 9 months of 2022 approximately corresponded to Y2021.

Processing of soybeans

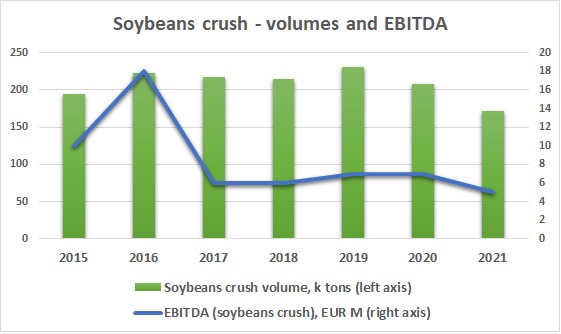

After the soybean processing complex was launched in early 2014, Astarta became the market leader in terms of processing volumes.

It should be noted that after reaching the peak in 2015 (2.1 million hectares), in the following years, the area under soybeans in Ukraine decreased (1.3 million hectares in 2020 and 2021). It led to increased competition for raw materials between crushers and reduced the profitability of processing.

Only in 2022, after the start of the war, the situation with the profitability of processing began to improve (the EBITDA margin doubled - from 8% to 16%). The reason is a decrease in domestic purchase prices for soybeans, while the company was able to direct its export sales to new logistics routes (even increasing the volume of processing by 20% compared to last year).

In recent years, the share of export in the total turnover of the segment is more than 75%. Astarta is secured with its own raw materials for processing by approximately 30%, the rest of soybeans has been purchased from 3rd party farmers.

Production of milk

Regarding the dairy business, firstly we note that in general, milk production in Ukraine is quite fragmented (the share of households in the total production is about 70%), so with a market share of 2%, Astarta is one of the largest Ukrainian producers.

Astarta is one of the leaders among Ukrainian milk producers in terms of efficiency (22.6 kg per cow per day in 2021). The dairy segment is an important part of the overall vertically integrated business structure of the holding as a whole. This direction is a consumer of by-products from beet processing and sugar production, as well as a supplier of organic fertilizers for crop production.

Farming

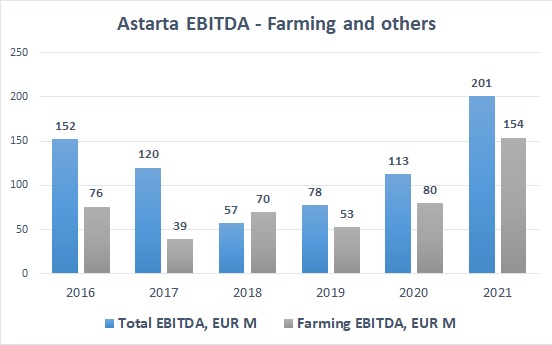

During 2018-2020, grains growing segment was the main profit center for the company as a whole (this was especially evident in 2018, when sugar and milk production were unprofitable).

The company demonstrates stable yields per 1 ha, which are far from the record-highs in Ukraine, but reflect the general strategy of Astarta as a middle-cost producer. With a total land bank of 220,000 hectares, Astarta is the fifth largest agricultural holding in Ukraine, its silo capacity is 550,000 tons, and the company also owns a fleet of 200 grain wagons.

100% of cultivated soybeans and beets are consumed internally by other segments, while other grains are almost completely exported.

The drought significantly affected the yield of the main crops in 2020, for example, the yield of corn decreased from 8.7 t/ha in 2019 to 6.9 t/ha in 2020 (at the same time, the increase in world grain prices supported the profitability of the segment). But in 2021, everything turned out for the best - high yields (8.6 t/ha for corn) and high world prices led to a significant increase in the direction's profits (EBITDA in 2021 almost doubled - 154 million euros against 80 million euros in 2020).

Astarta debt burden

In general, Astarta has always been a company quite conservative in terms of debt burden. Therefore, after growth in 2018 (due to certain grains and sugar overstocking), during 2019-20 the group repaid its creditors more than 170 million euros of debt.

At the end of 2021, the company's total debt amounted to only 38 million euros.

The war affected the company's activities primarily due to the blockade of Ukrainian ports. Fortunately, Astarta sold most of its 2021 corn crop early in 2022. Due to this fact, it largely avoided liquidity problems in the first months of the war.

Then, as with many other companies, the pace of grain sales slowed, and inventories began to grow.

On the other hand, the stable and profitable operation of the sugar segment, as well as the favorable situation for the soybean processing segment, supported profitability.

As for liquidity, during 2022, Astarta attracted new loans in the amount of about 80 million euros, which allowed the company to have a margin of safety to avoid liquidity problems.

The company's quite balanced policy regarding its development together with business diversification allows us to talk about the stability of the company's financial situation, despite all external troubles.

Operating performance

| 2021 | 2020 | 2019 | 2018 | 2017 | |

|---|---|---|---|---|---|

| Sugar output*, k tons | 266 | 226 | 302 | 352 | 463 |

| Soybeans crush, k tons | 172 | 208 | 231 | 215 | 218 |

| Milk output, k tons | 97 | 93 | 96 | 106 | 110 |

* - disregarding 73k tons of white sugar produced from imported raw cane sugar in Y2021

Sown areas and yield of main crops:

| Season | 2023/2024 | 2022/2023 | 2021/2022 | 2020/2021 | 2019/2020 | 2018/2019 |

|---|---|---|---|---|---|---|

| Corn | ||||||

| Sown area, ha | 19 100 | 38 000 | 59 000 | 60 580 | 66 780 | 63 470 |

| Yield, t/ha | 10.3 | 9.0 | 8.6 | 6.9 | 8.7 | 9.8 |

| Soybeans | ||||||

| Sown area, ha | 56 900 | 40 000 | 31 000 | 27 390 | 32 400 | 23 790 |

| Yield, t/ha | 3.1 | 2.9 | 3.0 | 2.3 | 2.5 | 2.9 |

| Wheat | ||||||

| Sown area, ha | 42 000 | 55 000 | 47 000 | 47 917 | 50 200 | 51 490 |

| Yield, t/ha | 5.7 | 4.8 | 5.8 | 4.8 | 5.1 | 4.7 |

| Sunflower | ||||||

| Sown area, ha | 28 200 | 30 000 | 28 000 | 40 450 | 31 040 | 40 350 |

| Yield, t/ha | 3.0 | 3.0 | 2.7 | 2.2 | 2.9 | 2.9 |

| Sugar beet | ||||||

| Sown area, ha | 38 900 | 33 000 | 33 000 | 34 500 | 35 255 | 39 435 |

| Yield, t/ha | 58 | 49 | 47 | 43 | 47 | 46 |

| Total land, ha | 220 000 | 220 000 | 220 000 | 220 000 | 230 000 | 235 000 |

Financial information

| Євро, млн | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|

| Revenue | 491 | 416 | 448 | 372 |

| Gross profit | 219 | 122 | 91 | 95 |

| EBITDA | 201 | 113 | 78 | 68 |

| EBITDA margin, % | 41% | 27% | 17% | 18% |

| Net profit | 122 | 9 | 2 | -18 |

| 31.12.21 | 31.12.20 | 31.12.19 | 31.12.18 | |

| Total Assets | 691 | 511 | 759 | 745 |

| Fixed assets | 345 | 317 | 472 | 404 |

| Current assets | 345 | 194 | 287 | 341 |

| Inventory | 268 | 129 | 210 | 250 |

| Cash | 12 | 22 | 12 | 13 |

| Equity | 495 | 337 | 439 | 366 |

| Debt | 38 | 53 | 147 | 226 |