Business description

MHP is a leader of Ukrainian poultry market with 70% of industrial production and 30% of domestic consumption with one of the strongest Ukrainian food brands Nasha Riaba.

MHP's business is largely vertically integrated. The company is mby ore than 80% provided with feed of its own production (3 feed production enterprises). The total land bank of MHP is 370 thousand hectares (the company belongs to the TOP-5 largest latifundists of Ukraine), which allows it to fully provide itself with corn for fodder production and 20-30% with sunflower (restriction on sunflower cultivation - according to the general rules of crop rotation, sunflower can be grown on the same land no more frequently than once in every 5 years).

Own production of feed allows the company to also receive additional profit from the sale of vegetable oil, which is a by-product in the processing of oilseeds (since the main for MHP product of crush - meal - is used for feed production). Thus, Myronivsky Khliboprodukt is one of the leading sunflower oil producers in Ukraine. The company exports 100% of the oil produced.

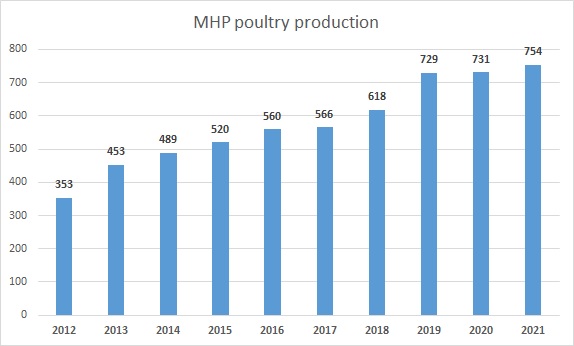

The total production capacity of MHP for the production of poultry meat is 750 thousand tons per year. Over the past years, the company has been developing its Vinnitsa project, which, after full launch, will increase the total capacity to 850 thousand tons. The production plan of the company in Ukraine for the coming years:

With the growth of production, the company is actively developing export operations - as a result, the export of poultry meat increased from 125 thousand tons in 2015 to 374 thousand tons in 2020. The geography of supplies is quite wide - from the EU to the Middle East and Africa.

One of the strategies for MHP's operations in the high-margin EU market was the purchase of production assets there. Processing plants in the Netherlands and Slovakia were the first to be acquired, with the main investment in this market coming at the end of 2018, when MHP acquired Perutnina Ptuj, a leading Slovenian chicken producer. In 2020, the production volume of this enterprise amounted to 63 thousand tons of poultry meat.

Since May 2008, MHP shares have been listed on the London Stock Exchange under the symbol MHPC. The percentage of shares in free float is 37%.

Operating activity*

| 2021 | 2020 | 2019 | 2018 | 2017 | |

|---|---|---|---|---|---|

| Poultry sales, k tons | 704 | 700 | 670 | 594 | 533 |

| Poultry export, k tons | 402 | 374 | 357 | 287 | 221 |

| Average poultry meat sale price, $/kg | 1.67 | 1.34 | 1.47 | 1.47 | 1.34 |

| Sunflower oil sales, k tons | 207 | 372 | 436 | 365 | 339 |

*-disregarding Perutnina Ptuj

Sown area and yields of main crops:

| Season | 2021/2022 | 2020/2021 | 2019/2020 | 2018/2019 | 2017/2018 |

|---|---|---|---|---|---|

| Corn | |||||

| Sown area, ha | 163 295 | 155 094 | 140 221 | 123 398 | 121 908 |

| Yield, t/ha | 10.0 | 5.6 | 9.4 | 10.9 | 7.3 |

| Wheat | |||||

| Sown area, ha | 36 773 | 40 827 | 46 797 | 48 379 | 48 676 |

| Yield, t/ha | 5.9 | 5.1 | 6.4 | 6.1 | 6.0 |

| Sunflower | |||||

| Sown area, ha | 88 256 | 93 713 | 65 447 | 72 981 | 68 931 |

| Yield, t/ha | 3.2 | 2.8 | 3.6 | 3.2 | 3.0 |

| Rapeseeds | |||||

| Sown area, ha | 21 522 | 30 857 | 41 233 | 38 541 | 31 968 |

| Yield, t/ha | 3.3 | 2.6 | 3.0 | 3.3 | 3.3 |

| Soybeans | |||||

| Sown area, ha | 22 879 | 19 118 | 38 197 | 37 558 | 39 684 |

| Yield, t/ha | 2.5 | 2.3 | 2.7 | 3.1 | 2.1 |

| Total sown area, ha | 351 440 | 356 046 | 359 476 | 362 880 | 356 080 |

MHP belongs to the middle+ cost agro-producers, which means a relatively high production cost per 1 ha (more intensive use of fertilizers, high quality seeds, etc.). As a result, the company demonstrates quite high yields compared to its competitors.

The land bank is mainly located in Vinnitsa, Cherkasy, Kyiv, Zhytomyr and Khmelnytsky regions.