01 February 2016

Ukrainian Agri- Market

During last ten years average sown area of agricultural crops in Ukraine made close to 27-28 mln ha, thereof about 15 mln ha – grains&leguminous crops. Loss of Crimea and part of Donbass led to decrease of total area under crops by about 1.5 mln ha, so that in Y2015 sown area made 26.7 mln ha (grains – 14.6 mln ha).

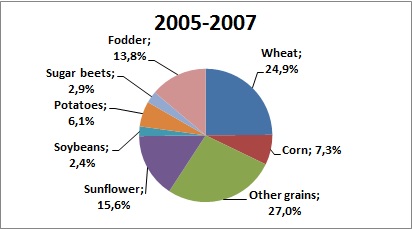

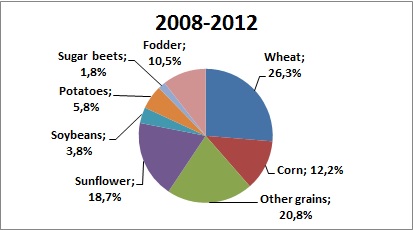

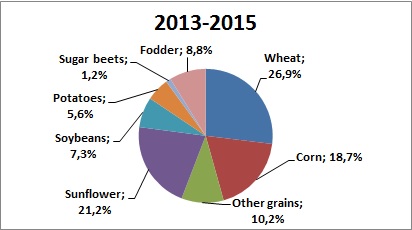

In the structure of sown area by products during last years the share of corn, sunflower seeds and soybeans significantly increased mainly at account of fodder crops and other grains:

Wheat remains main traditional crop for Ukrainian farmers, moreover, in a view of less net cost per 1 ha vs., for example corn, (especially important in period of farmers working capital shortage, which took place during last couple of years) and rather good yields, it regained additional popularity:

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

6 571

2.85

18 699

2006

5 511

2.53

13 947

2007

5 951

2.34

13 938

2008

7 054

3.67

25 855

2009

6 753

3.09

20 866

2010

6 284

2.68

16 844

2011

6 657

3.35

22 324

2012

5 630

2.80

15 761

2013

6 566

3.39

22 278

2014

6 015

4.01

24 121

2015

6 833

3.88

26 491

Average net cost per 1 ha for wheat is estimated in the range USD 400-500, while for corn it is two times higher.

Like for main part of other Ukrainian crops wheat yields have clear growing trend, mainly in a view of fundamental factors such as application of better technology, better seeds quality and more fertilizers usage. Market consolidation (though not very fast during last period of time because of scarcity of financing sources and worse general market conditions, due to which financial performance of agri-holdings worsened, not allowing them to expand as quickly as they did in Y2011-13) can be considered as additional reason of yields growth trend.

Weather conditions during last two seasons have been especially favorable for wheat production, which resulted in record-high yields per 1 ha and total harvest (allowing also to export record volumes). Situation is expected to change in current season because of unfavorable weather conditions during autumn sown campaign. According to the State Statistics Service, Ukraine planted winter wheat for the harvest-2016 throughout the areas of 6.0 mln ha, a decrease of 12% compared with last year, the losses areas are estimated at the minimum rate of 5%.

Above-mentioned situation with winter crops (not only wheat, but also rapeseeds and barley) will lead to increase of sown area under spring crops in current season.

Last years’ statistics for corn looked as follows:

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

1 660

4.32

7 167

2006

1 720

3.74

6 426

2007

1 903

3.90

7 421

2008

2 440

4.69

11 447

2009

2 089

5.02

10 486

2010

2 648

4.50

11 919

2011

3 544

6.44

22 838

2012

4 370

4.79

20 922

2013

4 825

6.40

30 900

2014

4 625

6.16

28 500

2015

4 100

5.73

23 500

Corn has been the most marginal crop during FYs2010-2013, it became especially popular among large agro-holdings, so that sown area under corn significantly increased. In Y2015 sown area decreased in a view of lack of working capital which forced part of farmers to shift from corn towards less “expensive” crops. After high levels of yields per 1 ha in FYs2013-14 because of draught in August’15 in several regions of Ukraine, in Y2015 average net yield declined (at that it still remains on relatively high levels).

Soybeans and Sunflower seeds popularity also increased during last years, because of relatively (vs. corn) lower net costs per 1 ha and rather good profitability (for soybeans – till current season). As a result both sown area and yields increased:

Soybeans

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

422

1.45

613

2006

715

1.24

890

2007

583

1.24

723

2008

538

1.51

813

2009

623

1.68

1 044

2010

1 037

1.62

1 680

2011

1 110

2.04

2 264

2012

1 411

1.71

2 410

2013

1 351

2.05

2 774

2014

1 800

2.17

3 900

2015

2 100

1.79

3 761

Sunflower seeds

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

3 743

1.26

4 706

2006

3 964

1.34

5 324

2007

3 604

1.16

4 174

2008

4 306

1.52

6 526

2009

4 232

1.50

6 364

2010

4 572

1.48

6.772

2011

4 739

1.83

8 671

2012

5 194

1.61

8 387

2013

5 051

2.19

11 051

2014

5 257

1.93

10 134

2015

5 003

2.23

11 165

In current season soybeans harvest was less than expected mainly in a view of already mentioned draught in August, while sunflower seeds are less susceptible to negative effect from draught, so that in Y2015 record-high sunflower seeds harvest was demonstrated. Currently sunflower seeds are considered the most profitable (on average) crop for farmers, along with it, crops rotation practices assume that suflowers can be sown on the same land once in 5 years at most (better once in 7 years). It means that potential for sown area under sunflowers increase is almost exhausted. On the other hand soybeans is very good from crops rotation perspectives, so that despite temporary decrease of its profitability, one can expect further increase of sown area and yields (mainly because of better technology and seeds quality application) in the future.

As for new season, according to the State Statistics Service, Ukraine planted winter crops for the harvest-2016 throughout the areas of 7.8 mln ha, a decrease of 13% compared with last year (9 mln ha). In particular, winter wheat planted areas reached 5.98 mln ha (down 12%), winter barley - 983.4 thsd ha (down 11%), winter rye - 145.3 thsd ha (down 12%), and winter rapeseed - 655.2 thsd ha (down 26%). Serious drought during the autumn planting campaign became the main reason for such significant reduction of the planted areas under winter crops. As a result, one can expect that sown area under spring crops – corn, soybeans sunflower and, may be, sunflowers (though such increase can not be sustainable from general crop rotation perspectives).