13 September 2016

Ukrainian sugar market - new perspectives

Ukrainian sugar industry has always been rather complicated market and a lot of its former players – including large agri-holdings like Kernel (5% market share in Y2012) and Ukrlandfarming (9% market share in Y2012) – being not able to operate efficiently decided to leave it.

Supplying sugar for the whole former USSR, after the country became independent Ukraine faced huge overcapacity of obsolete production facilities (total production in Y1990 was at close to 5.0M tons). CIS countries started to substitute Ukrainian product by sugar from other origins and own production, while on the other markets Ukrainian sugar was not competitive. As a result industry has been in crisis during the whole 90-s (in Y2000 production was already lower than 1.5M tons, which was not sufficient to cover domestic consumption). Ukrainian sugar market became rather closed one – with almost no export and import operations:

Year

Sugar beets

Sugar

Sown area, k ha

Yield, tons/ha

Total yield, k tons

Production, k tons

Consumption, k tons

Export, k tons

Import, k tons

2010

501

27.4

13 749

1805

1704

65

90

2011

532

35.2

18 740

2586

1758

51

48

2012

458

40.3

18 439

2143

1713

174

10

2013

280

38.5

10 789

1263

1686

163

11

2014

331

47.5

15 734

2053

1559

40

7

2015

237

43.6

10 331

1459

1600

153

4

2016f

284

45.8

13000

1850

1600

450

10

It is worth to note that as domestic sugar consumption during FYs2000-12 was relatively stable at 1.7-1.8M tons (starting from Y2013 consumption decreased to about 1.6M tons in a view of loss of Crimea and part of Donbass, and also sugar confectionery export to CIS countries fall), situation on the market and main players’ profitability were highly dependent on weather conditions and volumes of production. In case weather conditions have been favorable, production – high, market was oversupplied, so that prices dropped along with profitability of producers. Facing such developments sugar beets producers significantly reduced sown area under sugar beets which led to sugar underproduction, deficit on the market, growth of prices and producers’ profitability. Such volatile market conditions led to the already mentioned fact, that such players as Ukrlandfarming or Kernel decided to leave sugar market and concentrate on grains and oilseeds.

Other players – the most notable example is market leader Astarta – concentrated on vertical integration and improvement of efficiency – plants have been renovated, consumption of natural gas (main component of sugar beets processing costs) reduced. As a result, despite oversupply on domestic market during last years (notably because of record-high sugar beets yields in Y2014 sugar production exceeded consumption by 500k tons), vertically integrated producers (we define producers to be vertically integrated in case they are at least by 40-50% self-sufficient in own sugar beets) remained profitable. Market leaders regulated Ukrainian market by their supply, cutting it and increasing carry-over stocks after periods of over-production. In a view of relatively large difference till recent time between export sugar price and domestic one, for producers it was more profitable not to export sugar, but to finance storage of stocks and sell sugar on domestic market under higher price with some delay (in was the case, for example, in Y2015).

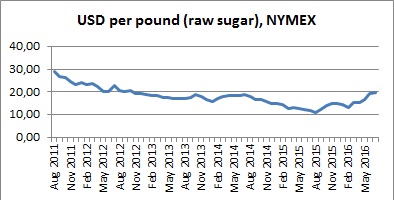

Such situation continued till the beginning of last season, when world sugar prices started to grow (main reason – expected for the second consecutive season sugar deficit after several years of surpluses; as for Ukrainian prices one should also bear in mind magical for exporters word "devaluation"):

As a result, in May’16 export sugar prices exceeded domestic one and main part of Ukrainian producers started to think about export operations. As of today, world market remains favorable for Ukrainian producers: domestic price is about USD 470 per 1 ton, while world (London market) price is USD 550 (export price for Ukrainian producers is by USD 15-40 per 1 ton lower than London price). Expected Ukrainian sugar production for current season is 1.8-1.9M tons, consumption – 1.6M tons, taking into account estimated carry stocks at about 250k tons in the end of last season, 400-500k tons can be exported.

We see main problems for Ukrainian sugar export to be non-established logistics and quality of Ukrainian sugar (though such companies as Astarta, Radekhov, Svarog are not expected to have problems with quality). On the other side it can not be excluded that in first months of new season export will outpace projected figures. In this case increase of domestic prices can be forecast, which will also improve profitability of producers and lead to increase of production in short-term future. But even without it, we see profitability of typical vertically integrated Ukrainian producer as good, assuming net cost for sugar beets growing at about USD 1-1.2k per 1 ha, we estimated net costs of 1 ton of sugar at USD 270-350 (depending on efficiency). With current sugar price of USD 450-470 per 1 ton (on the local market), profitability seems to be quite good.

And lastly, a couple of words about largest Ukrainian sugar producers. Astarta takes the lead with stable about 25% share during last years, followed by Ukrprominvest (14% share in Y2015) and Radekhov-Tsukor (13%). Other noticeable producers are well-known Ukrainian agri-holdings Svitanok, Svarog and others.

As a summary, being fully aware of uncertainty related to volatile world sugar prices, we see general prospects of Ukrainian sugar industry in general, and it’s the most efficient market players in particular, as rather good.