23 December 2016

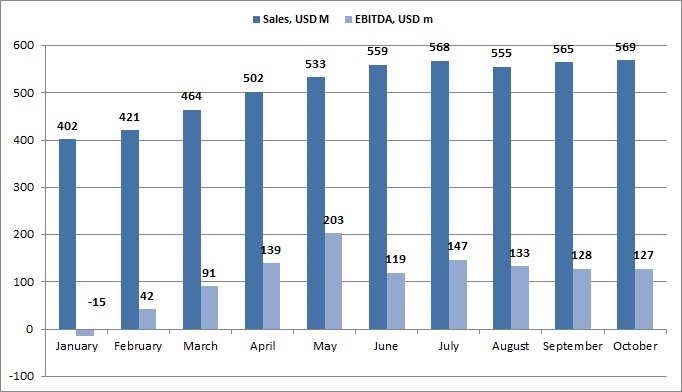

According to the statement of the company in October’16 its revenues made USD 569M (monthly volume of revenues is on the stable level during last six months), EBITDA – USD 127M. For 10m 2016 revenues – USD 5.1bln, EBITDA – close to USD 1.1bln:

Metinvest showed negative EBITDA during November’15-January’16, when ore&metal prices have been on the lowest levels during last years.

In last reporting month Steel division accounted for 83% of total Group sales (USD 472M) with EBITDA margin of 15.5%, Mining disivison – USD 97M of sales (to the thrird parties) with 32% EBITDA margin.

Due to several reasons (the share of JVs in EBITDA, increase of Inventory and Receivables), operating cash flow of the company is still much lower than EBITDA (USD 33M in October).

Taking into account current situation on steel&ore markets (prices are close to two years’ highs) we expect better financial results in November-December and maintain our forecast of Y2016 Metinvest EBITDA in the range of USD 1.4-1.5bln.

All about Metinvest

Popular on site:

Arcelor Mittal Ukraine is to increase its steel output in Y2016 up to 7M tons

>Ukrainian crude steel output in November increased by 3.3%, production of steel pipes – by 13%

Ukrainian farmers are finishing harvesting campaign