9 August 2017

In H1 2017 financial Ferrexpo performance figures have been slightly above our expectations. Despite decrease of sales volume in natural terms (tons), Ferrexpo EBITDA increased y-o-y by 79% and made USD 287M (vs. our earlier projections of USD 260M).

Key financials

USD M

H1 2017

H1 2016

Change, %

Revenues

591

458

29%

EBITDA

287

160

79%

EBITDA margin, %

49%

35%

-

Operating Cash Flow

194

142

37%

Key operating and financial performance figures:

2016

2015

Change, %

Sales volumes, k tons

5 065

6 017

-16%

Average 62% Fe iron ore price, USD/t

74.4

51.7

44%

Average pellets premium , USD/t

43

21

105%

Average C1 cash cost, USD/t

31.7

25.7

23%

EBITDA, USD M

287

160

79%

Volume of iron ore pellets realization decreased y-o-y by 16% along with decline of output by 10% due to maintenance program.

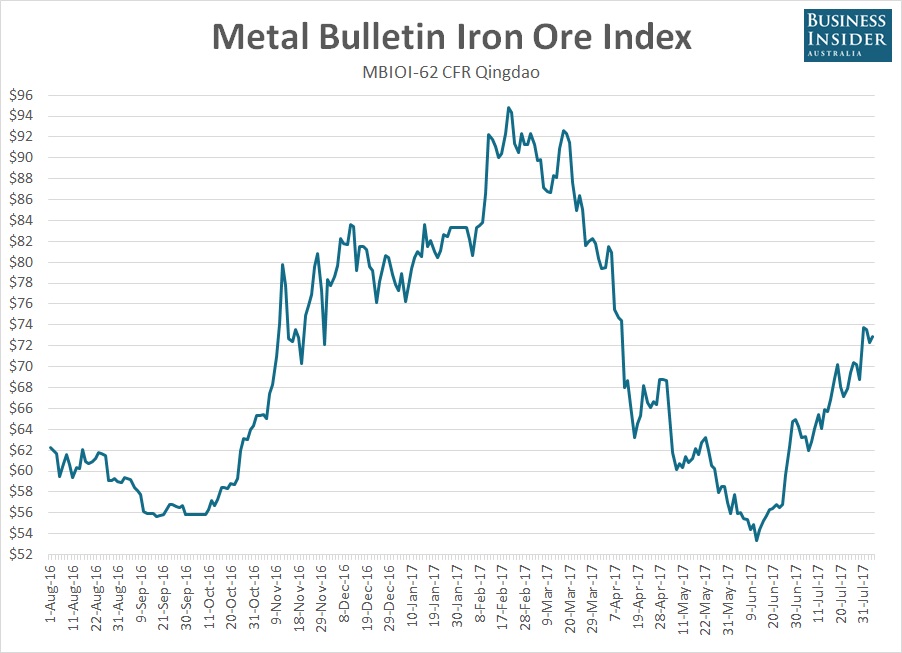

Average global iron ore (62% Fe CFR China) in H1 2017 made USD 74.4/t vs. USD 51.7/t in H1 2016 and USD 65/t in H2 2016. Global iron ore price reached its peak at more than USD 90/t in late February before falling to USD 55/t in June (current level is close to USD 70/t):

Pellets premium (difference between price of pellets with 65% Fe content and general 62% Fe iron ore index) in reporting period has been on the very good level of USD 43/t well above our previous estimations (USD 30-35/t) as well as premiums in H1 2016 (USD 21/t).

Pellets premium is rather high due to restricted supply as one of main Ferrexpo competitors – Samarco- is still out of the market with unclear perspectives of operations re-launching not earlier than in Y2018.

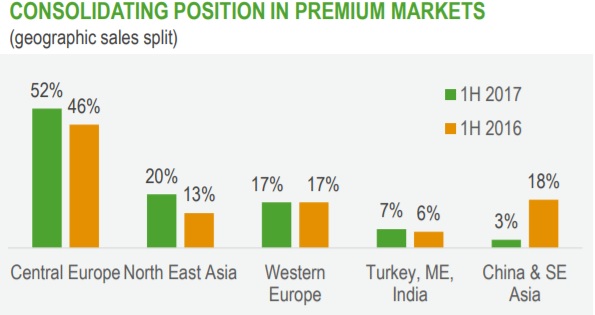

Focus of Ferrexpo on premium production quality is clear, along with it there have been some changes in sales geography in reporting period. Ferrexpo largely decreased pellets supplies into China and other South East countries, having increased realization in Japan and South Korea (which was also named as strategy of the company). Central and East European countries consumers remain key for Ferrexpo:

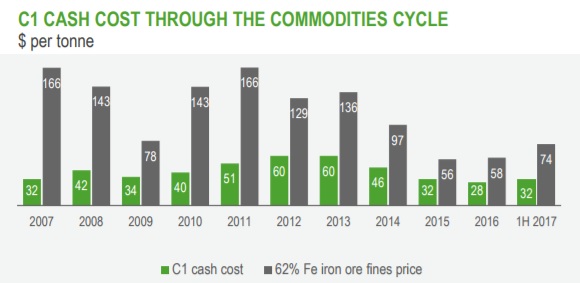

C1 cash cost of the company in reporting period remained almost unchanged vs. H2 2016 having made USD 31.7/t. C1 cash cost of the company during latest years looked as follows:

Positive for Ferrexpo has been the fact that in reporting period operating cash flow of the company grew y-o-y as well and made USD 194M (difference between EBITDA of USD 287M and operating cash flow was related to increase of Inventory stock by USD 63M due to better production dynamics vs. sales and interest paid of USD 26M).

Part of operating cash flow has been directed to dividends payment (USD 39M), but we mainly note that in H1 2017 Ferrexpo repaid to its creditors USD 163M of debt principal. Cash outflow related to investments made USD 45M (total expectations for Y2017 – USD 100M). As a result of above-mentioned developments cash balance of the company decreased from USD 145M as of 31.12.16 to USD 92M as of 30.06.17.

According to existing schedules in H2 2017 Ferrexpo is to repay its creditors USD 68M, in Y2018 – about USD 300M. At the moment the group has several options for refinancing (in particular the company negotiates new pre-export facility of USD 350M with the pull of international lenders). According to information disclosed during conference call with investors current plans of the company assume decrease of its net debt from current USD 481M by another USD 100M till the end of current year and by USD 100-150M in Y2018.

In general current balance sheet structure and quality of the company is rather good:

USD M

31.12.16

30.06.17

Total Assets

1 163

1 206

Fixed Assets

804

891

Current Assets

359

315

Equity

323

533

Debt

734

574

As for Ferrexpo financial performance projections for H2 2017, according to our estimations with average iron ore price index at USD 60/t, average pellets premium at USD 35/t, with stable cost of production (which is expected to be the case under current market fundamentals), EBITDA will make USD 180-200M.

Because of iron ore prices high volatility long-term forecast is more complicated to construct. We just note that Ferrexpo remains the company with one of the lowest cost of pellets production, so due to recent improvement of balance sheet structure has good margin of safety for its activity. Main risk for the company is geopolitical.

Popular on site:

Kernel Q4 FY2017 operating report

MHP reports H1 2017 financials

Interpipe reports its main operating results for Y2016