28 September 2016

View on Ukrainian agri-holdings biological assets revaluation

It’s a common knowledge that during last several years Ukrainian agri industry has been one of the most appealing sectors of Ukrainian economy. But it is also obvious that management credibility remains one of the main risks for investors and creditors of Ukrainian agri-holdings.

Cases of Mriya, Sintal, Ukrzernoprom, and less notorious ones, like Ukrlandfarming and KSG Agro largely worried foreign investors and can be seen as factors that impede foreign investments into attractive in general industry. Transparency of reported figures and their general credibility are real concerns of foreign investors and creditors, while biological assets and sometimes overly aggressive accounting assumptions (mis)used for their revaluation can be selected as one of such points of concern.

Current IFRS standards, namely IAS 41 standard, allows agricultural companies to report their agricultural produce and crops in fields not at cost but at fair value less estimated cost to sell. Fair value calculation is based on several principal assumptions: harvested area for a certain crop, its expected yield per 1 ha, realization price forecast, expected costs of harvesting works, storage and realization expenses, and finally, discount factor. It means that in theory management of any agri-holding has rather “good” tool to manipulate its company’s EBITDA, net profit etc.

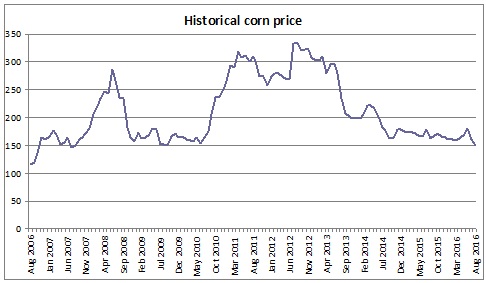

Of course different companies use quite different assumptions for biological assets revaluation and below we present a bit of analysis on how far aggressive assumptions have been used by Ukrainian public agri-holdings, such as Kernel, MHP, Astarta and IMC. Only the last one can be characterized as pure agri-producer, while others are more vertically integrated companies largely involved in other business segments. Also it should be clear that aggressive biological assets revaluation does not automatically mean that any company which uses it is by definition is a bad company. But it is important part of any agri-company assessment and analysis. And its importance was lastly proved in 1H2013, when significant drop in agri-commodities prices took place:

As a consequence of assumptions used for revaluation in 1H 2013, Ukrainian companies have shown at best zero profits in 2H2013 (for Kernel situation was exacerbated by operational difficulties in Y2013):

EBITDA, USD M

1H 2013

2H 2013

Kernel - farming segment

54.3

-48.1

MHP - farming segment

39.0

0.0

Astarta - farming segment

51.7

-16.3

IMC

51.5

-2.0

From crop mix perspectives, all four are in line with main crop rotation principles, though with some differences in general mix.

Average sown area distribution during several last years:

Kernel

MHP

Astarta

IMC

Corn

39%

43%

20%

53%

Wheat

15%

16%

20%

8%

Sunflower seeds

19%

14%

6%

18%

Soybeans

18%

7%

23%

5%

Sugar beets

18%

Specificity of Astarta as largest sugar producer and soybeans crusher in Ukraine – about 20% of area under sugar beets (according to crop rotation practices sugar beets can be cultivated on the same land ones in 4-5 years) and soybeans. IMC is slightly more than others focused on corn (operating in favorable for corn regions). Kernel experimented with sunflower seeds sown on 26% of total area in Y2013, but then returned to more reasonable 15% (from crop rotation perspective sunflower seeds can be sown on the same land once in 5-7 years, though in Ukraine some companies do it much more frequently, concentrating on short-term results as sunflower seeds during last years have been one of the most profitable crop).

From cost/yield strategy point of view out of four presented companies, MHP can be named as higher-cost producer (having relatively large cost per ha, but higher than average yields), others – typical middle-cost producers, historical average yield per 1 ha data is represented in table below:

Kernel*

MHP

Astarta

IMC

Corn

6.1

8.4

7.4

6.8

Wheat

4.5

5.5

4.7

4.5

Sunflower seeds

2.2

3.1

2.5

2.4

Soybeans

1.6

1.9

2.1

1.8

So, basing on above-mentioned parameters we see certain similarity between agri-business of all four companies, so can compare aggressiveness of their assumptions for biological assets revaluation (at least we can compare results of their Farming business segments).

From data quality and transparency perspective, companies are different: on our view IMC provides the best quality of data with all necessary break-downs for revaluation assessment (biological assets breakdowns with all assumptions, sales volumes breakdowns by the type of crop in money and natural terms). In addition IMC factually has no vertical integration, so realizes its crops to the third parties (can not artificially re-distribute profits between business segments). Quality of Kernel information is slightly worse (breakdowns of capitalized expenses by crop type are not provided, only their book values), followed by Astarta (also no break-downs of capitalized expenses by type of crop, large share on inter-segment sales), while MHP, on our view, has the lowest quality of information between all four (factually no break-downs of biological assets by crop type, large share of inter-segment sales).

Sum-up of presented in companies’ reports information as for biological assets revaluation is presented in following table:

30.06.2013

30.06.2014

30.06.2015

30.06.2016

IMC

sown area, k ha

110 647

123 082

121 872

120 633

Total book value, USD k

134 574

114 435

102 088

102 741

Book value per 1 ha, USD

1 216

930

838

852

Gain from revaluation, USD k

74 960

48 733

37 596

48 833

Gain from revaluation per 1 ha, USD

677

396

308

405

Astarta

sown area, k ha

203 265

208 459

210 303

216 207

Total book value, USD k

299 955

262 868

168 036

166 301

Book value per 1 ha, USD

1 476

1 261

799

769

Gain from revaluation, USD k

104 230

110 845

57 397

51 411

Gain from revaluation per 1 ha, USD

513

532

273

238

Kernel

sown area, k ha

386 742

372 852

386 240

n.a.

Total book value, USD k

239 823

178 493

144 088

n.a.

Book value per 1 ha, USD

620

479

373

n.a.

Gain from revaluation, USD k

55 050

29 693

15 624

n.a.

Gain from revaluation per 1 ha, USD

142

80

40

n.a.

MHP

sown area, k ha

287 000

290 000

340 000

355 000

Total book value, USD k

250 627

153 425

184 763

251 169

Book value per 1 ha, USD

873

529

543

708

Gain from revaluation, USD k

22 000

42 740

31 000

76 000

Gain from revaluation per 1 ha, USD

77

147

91

214

Basing on above information historically IMC and Astarta have been the most aggressive with biological assets revaluation, while MHP – least aggressive.

IMC became significantly less aggressive in biological assets revaluation in 1H2014, in aftermath of relatively weak results of Y2013 crops realization in 2H2013 and 1H2014 (after large booked profit in 1H2013). Despite this fact, as of now Industrial Milk Company uses the most aggressive assumptions as for revaluation vs. peers, showing all the profits related to crops of any given season far before starting of harvesting campaign (corn – main crop of IMC – is harvested in September-November). For current season expected (with shown gain from revaluation) EBITDA per 1 ha is USD 400, basing on market fundamentals, we see the company will achieve this level of profits (in new season), but such practices are perceived as a risk for the future (especially taking into account absence of vertical integration and lack of diversification).

Astarta largely reduced its aggressiveness with revaluation in Y2015, but still accounts main part of its profits (in farming segment) before crops harvesting. For Astarta risk is mitigated by general business synergy between business segments and non-aggressive approach to its business development. For the current season EBITDA per 1 ha of USD 238 is seemed to be easily achievable, taking into account current situation on the market.

Kernel showed huge losses in 2H 2013, even despite its accounting assumptions have been much more modest vs. two above-mentioned companies. Reason of this fact were general problems with farming operations, which seem to be resolved now (by the way, Kernel completely changed management of its farming division), in a view of improved yields and segment profitability, though approach to biological assets revaluation remains conservative. The company shows main part of profits after crops realization.

MHP remains conservative with its approach to revaluation, also showing main part of profits after harvest realization, though the company is less transparent with its figures, so that detailed analysis is impeded. The only negative point that is worth to be noted is increased gain in 1H2016, which factually allowed the company to fulfill its Eurobond covenant. Otherwise EBITDA per 1 ha of USD 214 is achievable, taking into account significantly better perspectives of new season’s crop (vs. last year’s).