8 February 2017

In the last reporting quarter the largest Ukrainian steel and ore producer generally worsened its operating performance, for the whole Y2016 crude steel and coke output grew, while production of iron ore concentrate decreased.

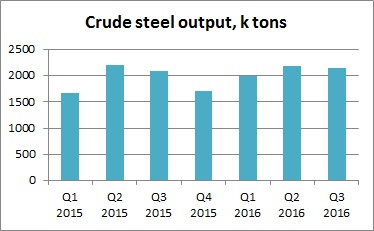

Crude steel output

Quarterly production figures

k tons

Q3 2015

Q4 2015

Q1 2016

Q2 2016

Q3 2016

Q4 2016

Crude steel

2 082

1 712

1 998

2 191

2 149

2 058

Iron ore concentrate

8 189

8 213

7 911

7 902

7 137

6 692

Coke

1 140

1 113

1 124

1 066

1 126

1 009

Coking coal

844

803

799

781

740

732

In reporting quarter crude steel output of Metinvest decreased vs. previous quarter by 4%, but increased y-o-y by 20% (because of low base – in Q4 2015, because of negative situation on the world market, part of Metinvest steel-making facilities has been idle).

Decrease of steel output vs. Q3 2016 mainly resulted from certain logistic problems related to delivery of raw materials to Mariupol (where two largest steel mills of the group are situated), namely - ongoing work to increase the throughput capacity of the Kamysh-Zarya railway station (its low capacity has been one of the bottlenecks in the groups operations during last period of time).

Also, taking into account logistics issues, Metinvest decided to realize a major overhaul of basic oxygen furnace #3 and maintenance work on basic oxygen furnaces #1 and #3 at Ilyich Steel. As a result volume of crude steel output by this mill decreased vs. Q3 by 10%

In Q4 2016 Metinvest coke production declined vs. previous quarter by 10%, as is reported by the company, due to general steel production decrease. Main question related to this segment of the group – if it has sufficient coke reserves to cover at least short-term needs of the group in case of Avdeevka Coke operations suspension (this enterprise, which produces main part of coke for the group needs, is situated in the epicenter of recent conflict in the East of Ukraine escalation, so it’s activity was almost fully paralyzed for several days). At the moment it is main short-term risk factor for activity of Metinvest.

In Q4 2016 iron ore concentrate production by Metinvest decreased by 445k tons vs. previous quarter – to 6 692k tons – as a result of the need to restore overburden removal volumes, which fell amid the liquidity constraints since Y2014 and till 1H 2016.

Main production results of Metinvest for Y2016 as a whole are represented in table below:

k tons

Y2016

Y2015

Change, %

Crude steel

8 393

7 669

9%

Iron ore concentrate

29 640

32 208

-8%

Coke

4 325

4 087

6%

Coking coal

3 051

3 285

-7%

Relatively good steel and coke output dynamics are mainly conneted to low base of Y2015: in Q1 operating activity of Metinvest was impeded due to escalation of war conflict in the East of Ukraine, in Q4 output declined due to negative situation on the world steel market.

All reports

All about Metinvest

Popular on site:

Interpipe reports its main operating results for Y2016

Ukrainian crude steel and pipes output grows in January

Ferrexpo reports its production for Q4 2016