17 May 2017

In last reporting quarter Astarta improved its performance in terms of sales volume but profitability has been lower than expected. Despite this fact the company keeps its deleveraging, further improving balance sheet quality.

Key Financials

EUR k

Q1 2017

Q1 2016

Sales

147 993

70 221

EBITDA

44 060

43 150

EBITDA margin, %

30%

61%

Net Profit

30 740

18 794

In a view of large grains and sugar stocks in the end of Y2016 (due to good MY2016/17 crops and much slower than expected grains realization in Q4 2016, which was related to logistics problems), revenues of the company more than doubled y-o-y and reached EUR 148M. Revenues breakdowns by business directions looked as follows:

EUR k

Q1 2017

Q1 2016

Change, %

Sugar

68 530

29 062

136%

Soybeans processing

21 387

14 788

45%

Farming

48 502

18 955

156%

Dairy

8 362

6 343

32%

TOTAL

147 993

70 221

111%

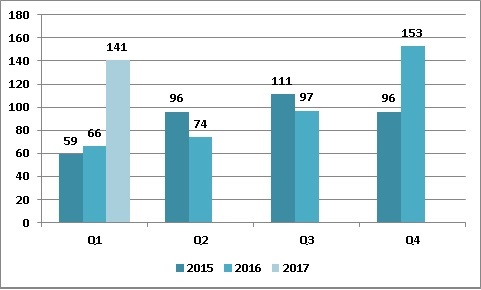

In Q1 2017 sugar sales made EUR 68.5M or 46% of total Astarta revenues. Y-o-y growth of segment revenues made 135% due to more than twofold growth in sugar realization volume in tons and 9% increase of average realization price (up to EUR 466/t). As was already reported by ShareUAPotential, export has been main driver of Astarta sugar sales in current season (since September). Quarterly sugar realization dynamics is represented on the chart below:

Grains sales in tons showed significant (+160%) y-o-y growth, main reason – problems with logistics (railcars shortage) led to relatively low volumes of grains realization in Q4 2016 and high stocks as of Y2017 beginning (so that significant increase of grains sales in Q1 2017 was expected). In money terms sales of grains made EUR 49M (thereof 90% - export), while weighted average realization price declined y-o-y by about 4%.

In March’17 Astarta started its spring sowing campaign. Total sown area in new season is to make about 235k ha, corn is to make 25% of total (19% in Y2016), wheat – 21% (unchanged), sugar beets – 20% (unchanged), sunflower – 14% (11%), soybeans - 13% (vs. 17% in Y2016, which means the company will rely more on 3rd parties in soybeans origination to provide for its soybeans processing facilities operations).

Soybeans crushing segment performance in Q1 2017 improved as well – in reporting quarter Globyno plant crushed 60.1k tons of soybeans (+2%), while volume of segment’s revenues made EUR 21.4M (+45% y-o-y due to increase of both volumes and average realization prices). In Q1 2017 Astarta market share among soybeans crushers has been at 22%, by volume of its operations the company remains the largest crusher in Ukraine. Taking into account expected growth of soybeans sown area in Ukraine by 4%, gradual growth of yields during last years, assuming normal weather conditions during vegetation period, the company expects ample availability of raw materials on the market in new season.

Sales in Dairy segment of the group in Q1 2017 made EUR 8.4M (+32% y-o-y, volumes have been stable, while growth was reached due to higher average raw milk realization price). Average daily cow’s productivity further grew – by 3% vs. Q1 2016.

As for profitability figures, in Q1 2017 total Astarta EBITDA made EUR 44M, which has been just slightly higher than in Q1 2016, despite significant increase of sales. There are several reason of such performance – first of all in Q1 2016 there was unusually high amount of other operating income related to VAT refund (EUR 13.5M), second – selling and distribution expenses in Q1 2017 have been by EUR 4M higher y-o-y due to higher share of export in sugar sales, third – presence of gain from biological assets revaluation in amount of close to EUR 10M in both periods (gain has smoothing effect on profits).

If we adjust gross profit of the company (which does not take into account VAT refunds in Q1 2016 and SG&A expenses) on gain from biological assets revaluation, adjusted GPM (gross profit margin) for Q1 2017 is close to 28% vs. 33% in Q1 2016. Discrepancy is not significant, though not fully logical, taking into account all fundamental factors (realization price, net cost, etc.).

Important to note also the fact that net operating cash flow of the company remains good – in Q1 2017 it made EUR 82M (vs. EUR 34M in Q1 2016) and was directed to bank loans repayment (EUR 39M) and investments (EUR 12M). In addition cash balance of the company since 31/12/16 increased by EUR 30.5M.

Balance Sheet structure

EUR k

31.03.17

31.12.16

Total Assets

572 469

574 570

Fixed Assets

293 971

280 014

Current Assets

278 498

294 556

Inventory

201 004

222 615

Equity

378 357

353 175

Debt

115 705

158 313

As for assets structure, its main changes during reporting quarter have been related to decrease of sugar and grains stocks (by EUR 78M vs. 31/12/16, though stock of finished production of Astarta remains high – at EUR 103.5M as of 31.03.17 vs. EUR 69.3M as of 31.03.16). On the other side biological assets of the company increased by EUR 19M, which has been related to start of spring crops plantation.

Financial structure of Astarta remains quite good. After repayment of EUR 39M of bank loans during Q1 2017, total net debt of the company stands at EUR 73M (vs. EUR 135M a year ago). Current Net Debt/EBITDA is estimated at 0.5x, Debt/Equity – 0.3x.

According to our estimations financial standing of the company remains quite good.

Popular on site:

Avangard reports Y2016 financials

MHP reports Y2016 financials

Kernel reports financials for Q2 FY2017