3 April 2017

Despite significant improvement of Avangard operations profitability in the last quarter of Y2016, lenders can count on only small portion of operating income, generated by the company, and should be ready for new round of tough negotiations with its principal owner.

Q4 2016 financial results

Key financials

USD M

Q4 2016

Q4 2015

Change, %

Sales

45.0*

53.7

-16%

EBITDA

11.3*

12.9

-12%

EBITDA margin, %

25%

24%

n.a.

Net Profit

-17.8

-7.9

n.a.

Traditionally for Ukrainian market last quarter of a year has been relatively successful for local industrial eggs producers, which is related to seasonal growth of prices (during the quarter Ukrainian eggs prices grew by more than 40%).

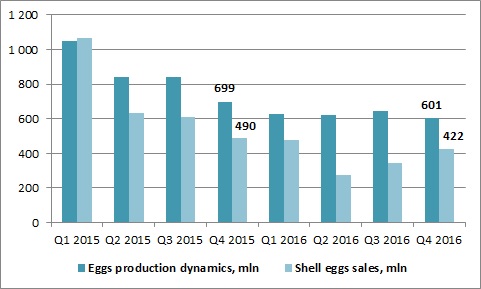

In Q4 2016 total Avangard eggs production made 601M pieces, which is by 14% lower y-o-y and by 7% lower than in previous quarter. Volume of shell eggs sales (422M pieces in Q4 2016) declined y-o-y by 14%, but grew vs. Q3 2016 by 23%.

Volumes of eggs processing grew as well (307M eggs was processed in Q4 2016, which has been by 45% higher y-o-y). Along with it, because of negative situation on main export markets, dry eggs products realization grew y-o-y just by 4%, which resulted in some overstocking for this type of production (though in general finished goods stocks of Avangard as of 31.12.16 have been relatively stable vs. Q3 end at about USD 22.5M).

As a result total revenues of the company (disregarding grains trading operations) in Q4 2016 made USD 45M, by 16% lower y-o-y. Due to growth of average realization price vs. previous quarters in Q4 EBITDA margin of Avangard increased up to 25% (6% in previous quarter).

In absolute terms in the last reporting quarter EBITDA of the company made about USD 11.3M, on positive side we note decrease of Avangard Tax Receivables (mainly VAT Receivables, as Avangard obtained VAT refund) in Q4 by additional USD 10M, which represents cash inflow for the company as well. Though on negative side is the fact that both above-mentioned positive factors did not lead to increase of resulting operating cash flow of the company.

Net Operating Cash Flow of Avangard (taking into account paid interest) in reporting period made USD -1.3M (along with it operating cash flow before interest payments made just USD 3.0M). Difference between EBITDA and operating cash flow is related to increase of trade receivables and inventory.

Trade receivables during Q4 2016 increased by USD 5M, which can be partially explained by growth of sales in last quarter, however, if that is the case, it should lead to increase of operating cash flow in Q1 2017. In reporting quarter Inventory grew by USD 4.5M as goods for resale (not related to main operating activity of the company) increased by USD 10M.

Y2016 results

Key financials

USD k

Y2016

Y2015

Change, %

Sales

141.1*

229.9

-39%

EBITDA

1.6*

-1.4

%

EBITDA margin, %

1%

n.a.

n.a.

Net Profit

-56

-158

n.a.

In Y2016 total eggs production by Avangard made 2.5bln (-25% y-o-y, the share of the company in total Ukrainian industrial eggs output made about 30%). Sales of shell eggs decreased y-o-y by 46% (1.5bln pieces), which has been only partially offset by the growth of eggs processing (+35% to 1.0bln). Shell eggs production and sales dynamics during last period of time looks as follows:

As a result in Y2016 total Avangard revenues (disregarding grains sales) decreased vs. previous year by almost 40% and made USD 141M.

In Y2016 EBITDA of the company made USD 1.6M, it includes loss from assets write-off in amount of USD 15M. Disregarding this loss EBITDA would be USD 16M with 11-12% margin, which is still lower vs. competitors (according to preliminary results of Ovostar, EBITDA margin of this company in Y2016 made close to 30%). Average shell eggs selling price of Avangard is not much different vs. Ovostar, which means much higher net cost (management of Avangard does not share this opinion).

Even despite significant difference vs. competitor’s results, main negative factor for the company is that operating cash flow (disregarding interest paid it made USD 1M) remains much lower vs. EBITDA. Reason – changes in assets structure: increase of Inventory and Trade Receivables, decrease of Trade Payables.

As a result, basing on presented financials, Avangard has no cash flow to service the debt, source of interest payments in Y2016 – cash on hand as of beginning of the year.

Balance Sheet structure

USD M

31.12.16

30.09.16

31.12.15

Total Assets

529

548

624

Fixed Assets

383

392

430

Current Assets

146

156

194

Inventory

70*

73

72

Trade Receivables

41

34

57

Cash

12

14

31

Equity

139

158

235

Debt

344

345

336

Balance sheet structure of the company remains weak. From one side, taking into account current profitability of operations, we have doubts regarding Avangard fixed assets valuation. On another side we note questionable assets in general Current Assets structure (for instance, Inventory at about USD 62M, Trade Receivables of USD 41M, prepayments and other current assets at USD 14.4M). It means that potentially part of these assets will be written off from the company’s books.

As of 31.12.16 formal Equity of the company makes about USD 138M. Taking into account above-mentioned uncertainty with assets quality, we can estimate that in reality Equity of Avangard is negative, assets of the company and its activity is fully financed by its liabilities.

Total debt of Avangard as of 31.12.16 made USD 344M, amount of paid in Y2016 interest was at about USD 10M, average effective interest rate – close to 3%. As a result, basing on our opinion, during further negotiations with its lenders on restructuring terms (maturity of main part of liabilities is Y2018), Avangard will push its creditors to either obtain significant part of the debt write-off or debt prolongation for several years with minimal interest rate (and uncertain further recovery perspectives).

Popular on site:

Kernel reports financials for Q2 FY2017

MHP reports Y2016 financials

Ovostar - Q4 2016 operating report