25 August 2017

In reporting period financial results of the largest Ukrainian sugar producer and soybeans crusher have been in line with our expectations, general financial standing of the company remains good.

Key Financials

EUR k

H1 2017

H1 2016

Sales

250 317

147 780

EBITDA

96 155

109 188

EBITDA margin, %

38.4%

73.9%

Net Profit

72 570

75 220

In a view of large grains and sugar stocks in the end of Y2016 (due to good MY2016/17 crops and much slower than expected grains realization in Q4 2016, which was related to logistics problems), revenues of the company increased by 70% y-o-y and reached EUR 250M. Revenues breakdowns by business directions looked as follows:

EUR k

H1 2017

H1 2016

Change, %

Sugar

108 079

60 327

79%

Soybeans processing

42 657

37 999

12%

Farming

80 328

35 043

129%

Dairy

15 314

12 002

28%

TOTAL

250 317

147 780

69%

Profitability of main business segments of Astarta looked as follows:

EBITDA

H1 2017

H1 2016

Sugar

41 831

27 186

Margin,%

39%

45%

Soybeans crush

3 965

8 449

Margin,%

9%

22%

Farming

46 127

73 953

Margin,%

n.a.

n.a.

Dairy

11 088

5 412

Margin,%

n.a.

n.a.

Total EBITDA

96 155

109 188

Margin,%

38%

74%

In H1 2017 Astarta sugar sales made EUR 108M or 43% of total proceeds. Y-o-y growth of segment’s revenues made almost 80%. Reasons – both growth of sales in tons (+60%) and average sales prices increase (+12.5% up to EUR 466/t).

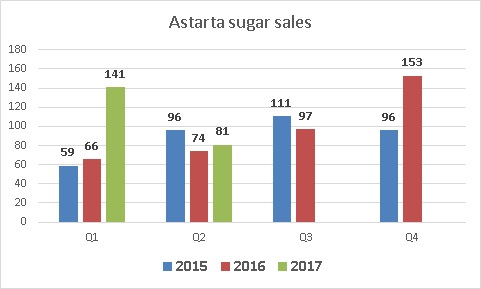

As we noted earlier, export became main factor of Astarta sugar sales growth in current season. Export supplies have been the most active in the last quarter of Y2016 and first quarter of Y2017. Total sugar export of the company in current season (September 2016 – July 2017) made about 230k tons (more than 30% of total Ukrainian sugar export). General quarterly sugar sales dynamics of Astarta during last years looked as follows:

In Q2 2017 sugar sales of the company decreased vs. previous quarter mainly due to considerable decrease of sugar stocks in the beginning of reporting period. We can also note significant decrease of sugar export price since February. As a result we can hardly expect that in new season Ukraine will repeat sugar export records of current season. Despite it, we forecast that Astarta will keep sugar export despite global sugar price is now by approximately 25-30% lower than Ukrainian domestic price (Ukrainia sugar production is expected to exceed consumption by about 600k tons, so to support local prices main producers should continue sugar export operations).

Segment’s EBITDA in H1 2017 made EUR 42M (with 39% margin), which is very good result (a year ago EBITDA comprised EUR 27M with margin of 45%, we also note that in H1 2016 there was positive “accounting” effect from UAH devaluation, when influenced net cost of sold sugar).

According to our estimations total Sugar segment EBITDA in the current season is to make about EUR 75M.

As for Farming segment, despite expected revenues growth (proceeds of the segment nominated in EUR increased y-o-y by 2.3 times, sales in tons – by 2.4 times), its financial results formally worsened. Segment’s EBITDA in H1 2017 made EUR 46M (vs. EUR 74M a year ago).

To main reasons of such worsening – decline of income related to VAT compensation (due to changes in Ukrainian VAT tax legislation) and decrease of income from biological assets revaluation (by EUR 11M – from EUR 46.3M in H1 2016 to EUR 35M). Disregarding these two factors, segment’s EBITDA would grow y-o-y by EUR 15M.

We note that Astarta has always been quite aggressive in its biological assets revaluation (accounting main part of its profits from farming activity before crops harvesting). Current decrease of income from biological assets revaluation can be a sign of more conservative approach from one side, but can be also related to lower crops yields expectation for the new season. According to financial report, Astarta wheat yield in new season made 5.1t/ha, which has been by 15% lower than in Y2016 (the company has already finished early crops harvesting).

Results of Astarta in soybeans crushing segment worsened as well. In H1 2017 volumes of soybeans crush remained flat y-o-y (118k tons), along with it segment’s revenues grew vs. H1 2016 by 14% up to EUR 43M. Despite revenues growth, due to considerable decrease of crushing margin segment’s EDITDA declined from EUR 8.5M a year ago to EUR 4M (with 9% EBITDA margin).

In H1 2017 proceeds in Dairy business segment made EUR 15M (+28% y-o-y). Main growth factor – increase of average sales price, which was connected to general upward trend for global milk prices along with growth of Ukrainian milk products export (mainly refers to butter). Sales of raw milk in natural terms (tons) has been flat y-o-y (at 52k tons).

Dairy segment EBITDA in reporting period significantly grew y-o-y (up to EUR 11M), reason – income from biological assets revaluation in amount of EUR 8M (vs. loss of EUR 1.2M a year ago). Disregarding this income segment’s EBITDA would make EUR 3M.

In total in H1 2017 Astarta EBITDA made EUR 96M, by EUR 13M lower y-o-y.

Net Operating Cash Flow of the company in reporting period made EUR 61.4M, difference vs. EBITDA has been mainly related due to income from biological assets revaluation (included into EBITDA).

Balance Sheet structure

EUR k

30.06.17

31.12.16

30.06.16

Total Assets

603 835

574 570

510 342

Fixed Assets

281 279

280 014

237 465

Current Assets

322 556

294 556

272 877

Inventory

229 763

236 354

215 820

Equity

410 070

353 175

305 364

Debt

130 563

158 313

160 316

As for assets structure, main changes in it vs. 31.12.16 have been related to seasonal factors (Astarta sold last year’s crops and incurred expenses related to new season harvest). We specially note increase of cash balance up to EUR 31M (vs. EUR 12.4M as of 31.12.16 and EUR 16.5M a year ago).

Financing structure of Astarta remains good. As of 30.06.17 Equity of the company stood at EUR 410M, Debt/Equity ratio – 0.3x. During last 2.5 years Asratra decreased its debt burden by more than EUR 120M (almost by two times). As for current debt structure, EUR 94M (out of total EUR 130M) is represented by current liabilities, along with it, we do not expect any problems with short-term debt prolongation or renewal.

According to our estimations financial standing of the company remains quite good.

Popular on site:

Ukrainian grains market

MHP reports Q2 2017 financials

Kernel Holding - operating results for Q4 FY2017