17 July 2017

Ukrainian grains market

Ukraine keeps breaking new records in grains and oilseeds production ensuring its role as one of the global breadbaskets.

According to official statistics (which in general corresponds to USDA data) total Ukrainian grains harvest in MY2016/17 made 66M tons, which has been by 10% higher vs. previous season and by 3.6% higher than previous record set in MY2014/15. Moreover, such result has been achieved despite decrease of grains planted area vs. previous seasons.

Grains export from Ukraine in MY2016/17 made record-high 43.8M tons, which has been significantly higher vs. previous record of 39M tons set in previous season.

Sown area

During last ten years average sown area of agricultural crops in Ukraine made close to 27-28 mln ha, thereof about 15M ha – grains and leguminous crops. Loss of Crimea and part of Donbass led to decrease of total area under crops by about 1.5 mln ha, so that in Ys2015-17 sown area made about 26-27M ha (thereof 14-15M ha comprised grains area).

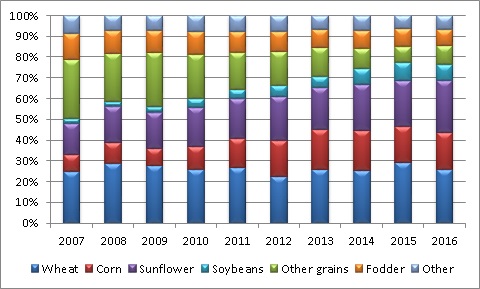

Changes in sown area structure by type of crops during last decade are represented on the chart below:

We note that in the structure of sown area by crop types during last years the share of corn, sunflower seeds and soybeans significantly increased mainly at account of fodder and other grains (barley, rye, oats, etc.). Main reason – good profitability of corn, sunflower seeds and soybeans growing for the farmers. Wheat area has been relatively stable, more depending on weather conditions in autumn during sowing campaign.

In MY2016/17 total sown area for grains in Ukraine made 14.4M ha, which has been by 2.5% lower y-o-y. Main reason – lack of rainfalls in autumn 2015, which led to the fact that area under winter crops has been significantly reduced (as a result total wheat area decreased from 6.8M ha in MY2015/16 to 6.2M ha). At account of winter wheat Ukrainian farmers considerably increased sown area for sunflower seeds (growth from 5.1M ha up to more than 6M ha).

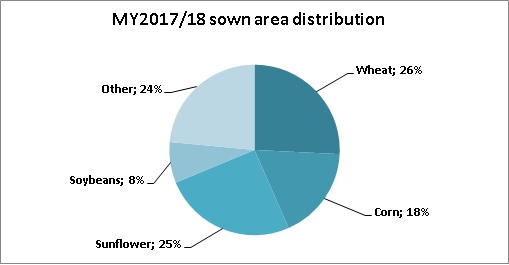

In MY2017/18 sown area breakdowns look as follows:

k ha

Wheat

Corn

Sunflower seeds

Soybeans

2015

6 833

4 080

5 105

2 100

2016

6 190

4 240

6 073

1 860

2017*

6 450

4 500

5 600

1 900

Yields and total crop

Yields of main crops in Ukraine during last decade demonstrated upward trend. Main reason of such dynamics (disregarding fluctuations related to different weather conditions) is improvement in technology, i.e. better seeds and other inputs quality, more extensive usage of fertilizers, better machinery. As for application of fertilizers, during last ten years it more than doubled (in Y2016 alone y-o-y growth made more than 20%).

As a result of mentioned developments yields and total crops dynamics for main grains and oilseeds during last years have been as follows:

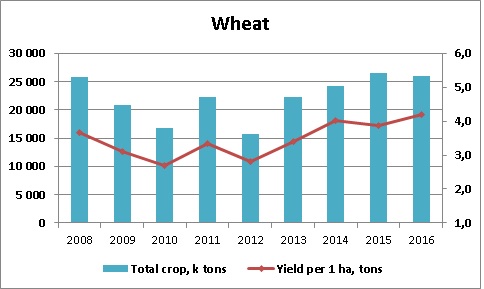

During last three seasons total wheat crops in Ukraine has been at around 25M tons, while yields are at about 4t/ha. In last season wheat yield has been record-high at 4.2t/ha, though because of lower sown area under winter wheat total wheat crop (26M tons) was lower vs. previous year’s (26.5M tons).

In last season average net cost for wheat growing can be estimated at about USD 350-400/ha. Profitability of wheat cultivation for the farmers – 30-35%.

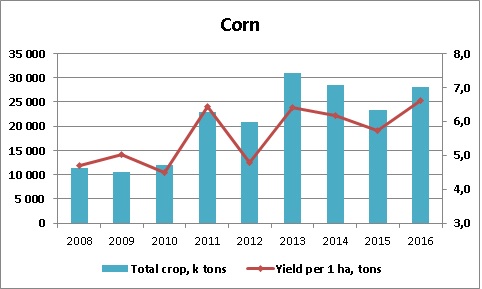

Ukrainian farmers significantly increased corn yields and total crop since Y2013 (in this year the only time in Ukrainian agrarian history total corn harvest exceeded 30M tons). In Y2015, because of draught in central part of Ukraine (Kyiv, Zhitomir, Khmelnitskiy, partially Vinnitsa regions), average corn yield in Ukraine declined to 5.7t/ha, before growing up to record-high 6.6t/ha in Y2016.

In last season average net cost of corn growing can be estimated in the range USD 500-600/ha. Profitability of corn cultivation for the farmers in MY2016/17 – about 40-45%.

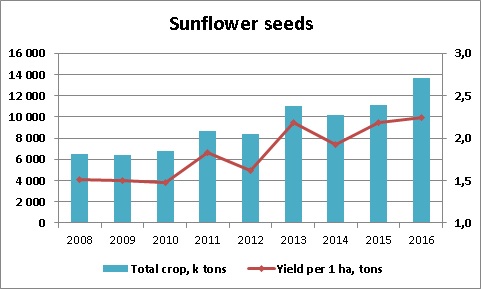

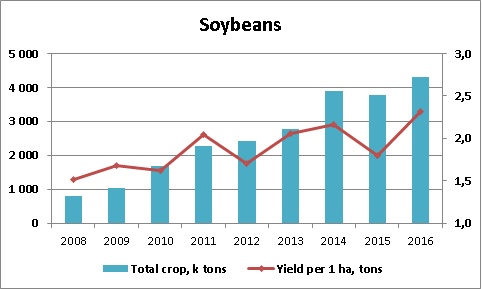

Both sunflower seeds and soybeans yields and crops have been demonstrating steady growth which can be seen on the charts below:

In MY2016/17 Ukraine demonstrated record-high yields for both sunflower seeds and soybeans.

MY2017/18

Despite certain difficulties with sowing campaign in Autumn’16 (draught in several regions in September followed by rainfalls), because of favorable conditions in winter (with good snow coverage), winter crops conditions in early spring have been good (at least better vs. previous year). After that came frost in April and in the beginning of May and lack of rains in Central Ukraine in May-June, which led to worsening of winter crops conditions from one side as well as underdevelopment of spring crops (mainly corn) from another side.

As a result it is expected that total grains crop in Ukraine in current year will be lower than in previous one. For winter wheat expected crop is to be around 24-25M tons (current USDA forecast – 24M tons), for barley – about 7.5M tons. As for spring crops, decisive phase for their development is to be in the end of July – beginning of August. If the weather will be favorable, yields are to be not much lower vs. previous season (current USDA forecast for corn – 28.5M tons).

According to USDA projections total grains crop in Ukraine in current season is to make 61M tons.

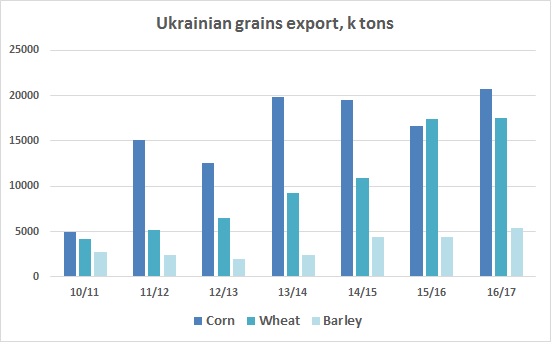

Export

During last years Ukraine became one of the most important players on the global market. As was noted above, total export in MY2016/17 made close to 43.8M tons, thereof 17.5M tons was wheat export, 20.7M tons – corn and 5.4M tons – barley export. Ukrainian accounted for 17% of total world barley export (3rd place), 12% of total corn export (4th place) and 10% of wheat export (6th place).

Ukrainian grains export statistics for several latest season looks as follows:

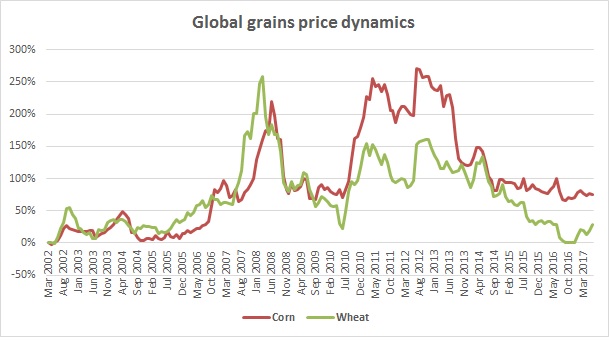

Prices

Global prices dynamics for corn and wheat (since Y2002) is presented on the chart below (CBOT prices dynamics):

We additionally note that corn and soybeans prices in Ukrainian port are significantly dependent on global prices, correlation is quite high (premiums can vary, though their variation is much lower than underlying prices variation). On the other side wheat and barley prices in Ukrainian ports are less dependent on CBOT wheat prices, they more depend on factual sales prices by which international traders sell Ukrainian grains at destination. It means that correlation between Ukrainian export prices for wheat and CBOT wheat quotations is much lower than for corn and soybeans.

Largest agri-holdings

At the moment two largest Ukrainian agri-holdings by the size of their land bank are Kernel (slightly more than 600k ha after recent acquisition of Ukrainian Agrarian Investments and Agro Invest Ukraine) and Ukrlandfarming (estimated land bank is 550-600k ha).

Two largest Ukrainian agri-holdings are followed by NCH (land bank about 400k ha) and MHP (370k ha).

Other noticeable holdings are Astarta (250k ha), Mriya (180k ha), IMC (137k ha), Agroprodinvest (120k ha), Agrogeneration (120k ha) and others.

Popular on site:

Ukrainian sunflower seeds and oil market

Ukrainian soybeans market is ready for new records

View on Ukrainian agri-holdings biological assets revaluation