18 September 2017

Financial performance of Avangard during reporting period has been week, the company keeps negotiations with its lenders on debt restructuring.

In H1 2017 total eggs production by Avangard made 993M pieces, by 20% lower y-o-y. Main reason of decline – sharp fall of eggs processing volumes – from 459M in H1 2016 to 204M pieces. Reason of decline – overstocking in the end of Y2016 amid significant decrease of eggs products sales – in H1 2017 y-o-y decline made 57%.

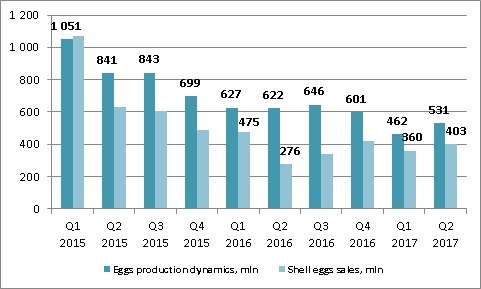

General eggs production dynamics during latest quarters looked as follows:

Avangard share in total Ukrainian industrial eggs production in reporting period comprised 24.6%.

Shell eggs sales of the company in H1 2017 increased y-o-y by 2% up to 763M pieces. Due to weak export (in Y2016 eggs export by Avangard decreased y-o-y by 40%, in H1 2017 – by another 21%), the group increased its sales on domestic market (which especially refers to Q2 2017, when Avangard increased its volumes of realization in natural terms vs. Q2 2016 by about 50%).

Average shell eggs selling price in reporting period made UAH 0.95/egg (-29% vs. H1 2016). Due to gradual export recovery starting from July and seasonal factors we expect growth of average selling price starting from Q3.

Key financials for H1 2017

USD M

H1 2017

H1 2016

Sales*

54 706

64 777

EBITDA

-8 984

-12 608

EBITDA margin, %

n.a.

n.a.

Net Profit

-11 718

-32 607

As a result of above-mentioned negative factors (decrease of shell eggs and egg products export, decline of average selling price), in H1 2017 total Avangard revenues (disregarding grains sales) declined y-o-y by 30% to USD 45M.

Official EBITDA of the company comprised USD -9M, according to latest Avangard report, main reason is average selling price decline with relatively stable net cost per one egg.

According to financial report of the closest Avangard competitor – company Ovostar Union – in H1 2017 its EBITDA made USD 7M with margin of 19% (and average shell eggs selling price of UAH 1.3/egg). We note that main part of price difference is related to two main factors: 1) higher share of export in total sales of Ovostar (for shell eggs – 36% vs. 13% for Avangard) and 2) on domestic market Ovostar operates in higher price segment vs. Avangard.

As for the cost side, we note that Avangard purchases grains for fodder production from related entities, so there can be manipulations with purchasing prices.

In the structure of income of the company in reporting month USD1.2M are state subsidies, in the costs structure we note negative effect from biological assets revaluation (USD -4.5M) and also loss from current assets write-down (USD -1.2M). Disregarding mentioned losses financial performance of Avangard would be better (in H1 2017 operating cash flow of the company made USD -1.9M).

During reporting period Avangard paid to its creditors USD 1.9M of interest under its loans.

Balance Sheet structure

USD k

31.12.16

30.06.17

Total Assets

529 491

534 749

Fixed Assets

383 462

392 791

Current Assets

146 029

141 958

Inventory

69 899

74 751

Trade Receivables

40 628

29 160

Cash

12 570

12 608

Equity

138 810

120 464

Debt

352 129

375 394

Main changes in balance sheet structure during reporting period referred to decrease of Inventories (disregarding biological assets) by USD 9M (due to decline of grains for resale stock, while volume of Inventory related to main eggs business has been stable, biological assets increased by USD 12M) and Receivables (by USD 9M, which is positive for Avangard).

General balance sheet structure of the company remains weak. From one side, taking into account current profitability of operations, we have doubts regarding Avangard fixed assets valuation. On another side we note questionable assets in general Current Assets structure (for instance, Inventory at about USD 75M, Trade Receivables of USD 29M, prepayments and other current assets at USD 13.8M). It means that potentially part of these assets will be written off from the company’s books.

As of 31.12.16 formal Equity of the company makes about USD 120M. Taking into account above-mentioned uncertainty with assets quality, we can estimate that in reality Equity of Avangard is negative, assets of the company and its activity is fully financed by its liabilities.

Total debt of Avangard as of 30.06.17 made USD 375M, the company keeps further talks with its lenders on debt restructuring terms (maturity of main part of liabilities is Y2018). Avangard will push its creditors to either obtain significant part of the debt write-off or debt prolongation for several years with minimal interest rate (and uncertain further recovery perspectives, current effective interest rate stays at about 1%).

Popular on site:

Ovostar reports Q2 2017 financials

MHP reports H1 2017 financials

>Ukrainian grains market 2017