1 November 2016

Ukrainian soybeans market is ready for new records

After relatively bad 2015/16 season, soybeans became popular crop among Ukrainian farmers again. Due to record-high yields and rather good world prices, profitability of soybeans growing increased.

Common information

Historically soybeans have not been typical crop for Ukraine, but situation gradually changes. During last ten years sown area under soybeans increased by four times, average yield during last five years is about 2.0t/ha, while in mid-2000s it made only up to 1.5t/ha. Despite this fact Ukraine is still behind its peers as for yields figures (for example average yield in Brasil during last ten years is about 2.8t/ha, in USA – more than 3.0t/ha), so we see huge potential for growth of soybeans production in Ukraine. General statistics of soybeans growing in Ukraine during last years looks as follows:

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

422

1.45

613

2006

715

1.24

890

2007

583

1.24

723

2008

538

1.51

813

2009

623

1.68

1 044

2010

1 037

1.62

1 680

2011

1 110

2.04

2 264

2012

1 411

1.71

2 410

2013

1 351

2.05

2 774

2014

1 800

2.17

3 900

2015

2 100

1.79

3 761

2016 est

1 860

2.20

4 092

Because of good yields soybeans production in current season is estimated to be record-high, despite decrease of sown area vs. previous season.

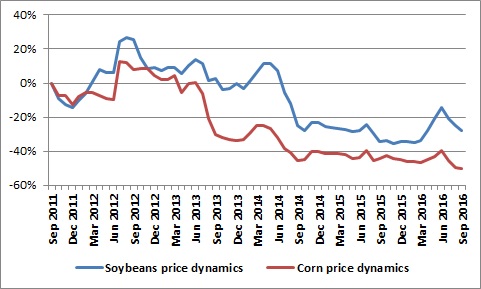

Soybeans world prices dynamics during last five years looked as follows (in comparison with corn):

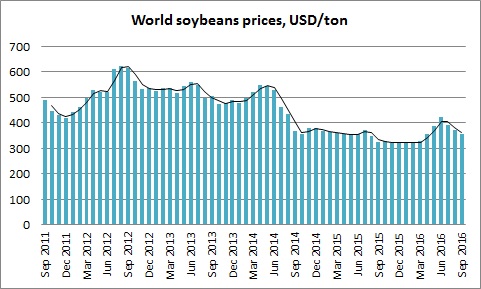

In absolute terms world prices during last five years are represented on the following chart:

As a result of good yields, better than for other crops prices dynamics, in MY2013/14 soybeans have been one of the most profitable crop for Ukrainian farmers, so in following two years soybeans area significantly increased – from 1.35M ha in Y2015 to 1.8M ha in Y2014 and 2.1M ha in Y2015. Soybeans became especially popular crop for farmers of Poltava, Kyiv, Khmelnitskiy and Zhitomir regions, where climate conditions are relatively more favorable for soybeans growing vs. other Ukrainian regions. As a result during last three years three regions (Kyiv, Khmelnitsky and Poltava) accounted for about 35% of total Ukrainian soybeans sown area. Agri-companies with high-cost model of production operating in these regions (such as Svarog, ATK) demonstrated much higher than average soybeans yields (in the range of 3.0-4.0t/ha).

In Y2015 situation for soybeans producers worsened. Main reason was draught in part of Ukrainian regions (including above-mentioned favorable for soybeans production regions), which took place in July-August’15 and negatively influenced corn and soybeans yields of Ukrainian producers. As a result yields in target for soybeans regions declined by 1.0-1.5t/ha, in Ukraine on average – from 2.17t/ha in Y2014 to about 1.8t/ha.

Current season

As because of drought Ukrainian farmers decreased sown areas of winter crops in Autumn’15 it was expected that soybeans sown area will further grow in Y2016. In fact because of two factors – 1) decreased yields and profitability of soybeans cultivation in Y2015, 2) not much favorable for soybeans planting weather conditions in some regions of Ukraine in May, – soybeans sown area in Y2016 was reduced to 1.85M ha. Instead of soybeans farmers preferred to sow more sunflower seeds, which was the most profitable crop in last season.

In general, in current year, after finishing of sowing campaign, weather conditions in Ukraine have been favorable for soybeans growing. As a result as of October 30 soybeans were harvested from 1.6M ha of area with record-high yield of 2.2t/ha. Total harvest in current season is estimated up to 4.1M tons.

As for soybeans prices, local Ukrainian prices are almost perfectly linked to world ones. So, after rally in April-June (during Q2 2016 world soybeans prices increased by more than 30%, for comparison, during the same period of time corn prices grew by about 15%), Ukrainian farmers had an opportunity to sell part of its harvest on forward terms with quite high prices, locking rather good profitability (provided no negative surprises on yields side). Since May prices decreased by about 15%, but they are still by 5-10% higher than in previous season (in October Ukrainian CPT price has been in range USD 355-370 per 1 ton).

Prices remain on rather good for producers level despite record–high soybeans production in the world. Reason is the fact that soybeans consumption growth rate exceeds production growth, so despite growth of total world soybeans production in new season by 18M tons, slight deficit is expected on the market. China accounts for more than 60% of total world soybeans import, which means situation on the market highly depends on its demand.

Profitability

Speaking about profitability of soybeans growing in current season, first of all we estimate average soybeans net cost at about USD 500-550 per 1 ha (high-cost producers have net cost of USD 600-700 per 1 ha, main components are seeds&crop protection, while fertilizers application (unlike corn) is not significant). We estimate that during last three years net cost per 1 ha declined by about 20-30% (depending on applied technology, generally in line with price decrease) - because of lower inputs prices and UAH devaluation. With yield of 2.2t/ha and current CPT soybeans price of USD 365/ton, we expect that average margin of producers is about 30-35%. For those farmers which sold at least 30% of their production in May-June on forward terms profitability is higher. We also estimate that because of very good yields profitability of high-cost producers in current season will be higher than market average.

Apart from formal profitability, soybeans, unlike sunflower seeds, is one of the best crops from crops rotation perspectives, especially as preceding crop for rotation with corn and wheat (that is why a number of sizable Ukrainian agro-holdings use simple corn/soybeans rotation in proportion 60/40 or 50/50). The trick is, due to the fact that soybeans leaves nitrogen in soil, it allows to use less nitrogen fertilizers for next crops (wheat, corn) growing. This fact should also be taken into account estimating real profitability of soybeans cultivation.

Holdings data

Last seasons data for soybeans sown area and yields of largest Ukrainian public agri-holdings is represented in the following table:

Season

2016 est

2015

2014

2013

MHP

Sown area, ha

n.a 35 831 25 460 16 860

Yield per 1 ha, tons

2.6 1.6 2.1 2.2

Kernel

Sown area, ha

58 200 65 144 66 544 61 000

Yield per 1 ha, tons

2.7 1.8 1.8 1.4

Astarta

Sown area, ha

41 388 71 050 63 700 56 250

Yield per 1 ha, tons

2.2 2.1 2.1 2.2

IMC

Sown area, ha

6 400 12 303 8 202 4 400

Yield per 1 ha, tons

3.4 2.5 1.8 1.8

Agrogeneration

Sown area, ha

8 354 7 768 4 000 4 829

Yield per 1 ha, tons

1.8 1.7 1.9 1.6

Such companies as MHP, Kernel, IMC (as well as some other non-public companies) significantly increased its soybeans yields in Y2016, driving average yield in Ukraine up. Following record-high yields Industrial Milk Company already announced that it will expand its soybeans sown area in Y2017.

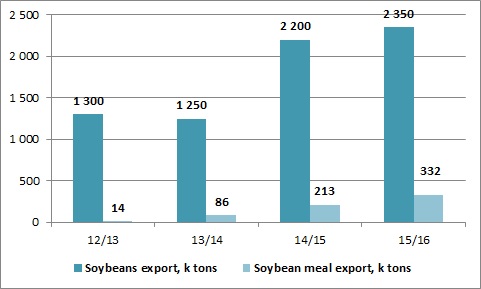

Export and domestic crush

During last years more than 50% of Ukrainian soybeans production is exported, but due to crushing capacities increase (the most notable cases launching of soybeans crusher by Astarta in the beginning of Y2014 and by MHP in H2 2015), domestic crushing volume also grew – in last season it made close to 1.2M tons, growth vs. MY2014/15 made 14%, crushing volumes more than doubled during last four years.

After launching of its crushing enterprise, Astarta became the largest soybeans processor (we estimate its share in last season at about 18-19%), followed in last season by MHP (despite in last season facilities have been mainly loaded at 50% of total capacity, in Q3 2016 capacity utilization already reached 80%, so we expect growth of MHP market share in new season) and Protein Production.

On average 720-750 tons of soybean meal and 150 tons of soybean oil is produced from 1k ton of soybeans. Soybean meal is used as source of protein for fodder production, so is partially consumed domestically, partially – exported (in last season export made 332k, about 35% of total production). 85-90% of produced soybean oil is exported.

Soybeans and soybean meal export dynamics is represented on the chart below:

With increase of oilseeds crushing capacities in general one can expect growth of crushing volumes in new season. On negative side here is that because of outbreak of African Swine Fever (ASF) in Ukraine at the moment main part of Ukrainian producers can not export soybean meal to Belarus, which has been main consumer of Ukrainian meal during last years. As a result exporters try to find new markets for Ukrainian production.

Summary

As a summary, we see huge potential for increase of soybeans production and processing in Ukraine. Chinese demand for soybeans remains rather good, profitability of soybeans cultivation for Ukrainian agrarians is growing again, soybeans are good from crop rotation perspective, so we expect that in middle-term perspective its sown area in Ukraine will definitely increase.

Ukraine is still behind its peers from yields point of view, so we see large reserve to increase total harvest volume from this side. Pre-condition – usage of better-quality seeds and other inputs.

With significant increase of general oilseeds crushing volumes in Ukraine, we expect gradual growth of soybeans crushing volumes as well.

Popular on site:

Ukrainian sugar market - new perspectives

MHP releases Q3 2016 operating report

View on Ukrainian agri-holdings biological assets revaluation