15 November 2016

After drop in Q1 Milkiland stabilized sales volumes, so in Q3 2016 total revenues have been slightly higher than in two previous quarters. The company keeps litigation process and at the same time restructuring negotiations with its lenders.

Key financials

EUR k

Q3 2016

Q3 2015

-

9m 2016

9m 2015

Sales

39 027

48 586

-

112 938

146 243

EBITDA

5 874

6 788

-

16 665

22 859

EBITDA margin, %

4.8%

6.5%

-

4.7%

6.5%

Net Profit

-9 696

-13 997

-

-24 810

-38 093

Total revenues in money terms in Q3 2016 made EUR 39.0M, slightly higher than in previous quarter, though vs. Q3 2015 decline made 20%. If we compare sales figures for nine months, decrease made 23%, it was related to all geographical and business segments:

Sales in key segments

EUR k

9m 2016

9m 2015

Change, %

Cheese&butter

38 331

51 086

-25.0%

WMP

62 099

78 998

-21.4%

Ingredients

13 387

16 159

-17.2%

Russia

72 171

86 161

-16.2%

Ukraine

32 923

48 883

-32.6%

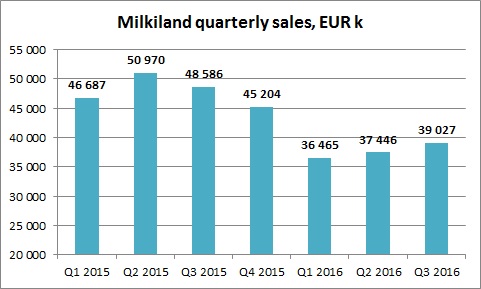

Quarterly sales dynamics of the company during last period of time looked as follows:

Performance in Ukraine worsened mainly on the back of further UAH devaluation and increased by more than 20% hard cheese import from EU due to implementation of free-trade agreement (which up to now works against Ukrainian cheese producers – domestic cheese production declines). As a result Ukrainian sales of Milkiland in EUR terms slumped y-o-y by more than 30% in both Q3 and 9m.

If in 1H 2016 EBITDA of Ukrainian operations made EUR 1M, in Q3 2016 it was already close to zero (raw milk prices in Ukraine started to grow in the end of summer).

In addition in Q3 the company slowed down development of hard cheese production in Russia. If in 1H 2016 y-o-y growth made 50% (over 3kmt of hard cheese was produced on facilities of Syrodel cheese making plant), reported for 9m 2016 production figure is 3.78k tons, which means in Q3 output factually declined y-o-y, contributing to general decrease of hard cheese sales by 30% (in Q3 2016 vs. corresponding period of previous year).

Along with it we can note lower rate of sales decline and improved profitability related to Russian operations in general. Russian revenues in Q3 declined y-o-y by 10.5%, while EBITDA margin exceeded 8% (vs. 6.2% in H1 2016).

In 9m2016 general profitability of Milkiland further dropped – EBITDA margin comprised 4.7% vs. 7% a year ago, so that total EBITDA value made EUR 5.3M, while debt servicing ability remains below marginal (the company pays approximately half of accrued interest – in 9m 2016 total interest paid made EUR 4.5M). On positive side is that fact that in July the company reached agreement on restructuring of its USD 14.5M debt to Credit Agricole bank with decrease of interest rate and extension of maturity till Y2019. Along with it, negotiations with Raiffeisen and UniCredit on restructuring of USD 58.6M syndicated facility are still not finished (successful restructuring is critically important). So the company can still be tempted to show lower profits to push its creditors and obtain more favorable restructuring terms.

After significant amount of bad assets write-down in Y2015 (including deposit in related bank), during last reporting period balance sheet structure of the company has been more or less stable:

Balance Sheet structure

30.09.16

31.12.15

31.12.14

Total Assets

180 187

186 550

239 851

Fixed Assets

134 249

145 959

148 217

Current Assets

45 938

40 591

91 634

Equity

20 604

34 650

94 593

Debt

113 268

112 124

102 930

Popular on site:

Astarta reports financials for Q3 2016

MHP releases Q3 2016 operating report

Kernel reports financials for financial year 2016