5 April 2017

Due to growth of Mining division sales and improvement of Metallurgical division profitability, in January 2017 financial performance of Metinvest improved vs. previous months.

According to statement of the company in January its revenues amounted to USD 598M, which is much higher vs. December (USD 502M). Moreover it is the highest monthly level of sales during the last period of time. Main growth factor – increase of prices: for semi-finished products by 12% vs. previous month (during last 3 months increase made more than 30%), finished – by 4% (+10% starting from October), iron ore pellets – 5.5% (+41%).

Taking into account prices dynamics we note significant increase of semi-finished products (both slabs and square billets) realization in natural terms: in January it made 163k tons (disregarding pig iron), which has been by more than three times higher than average monthly volume during Q4 2016. Sales of finished products in tons increased vs. December by 7% up to 658k tons (driven by growth of Zaporizhstal flat products realization).

As a result Metallurgical division proceeds made 79% of total Metinvest revenues in January (USD 472M) with EBITDA margin at 12.5% (vs. 7% in December and 10% in November). Total EBITDA of the segment doubled vs. December and made USD 59M.

As for Mining division, firstly we note considerable increase of realization volumes – both Intragroup and to 3rd parties. Intragroup sales of the segment in January made USD 243M, which is much higher vs. previous months. External sales of Mining division amounted to USD 126M (vs. USD 99M in December), EBITDA margin – 37% (41%).

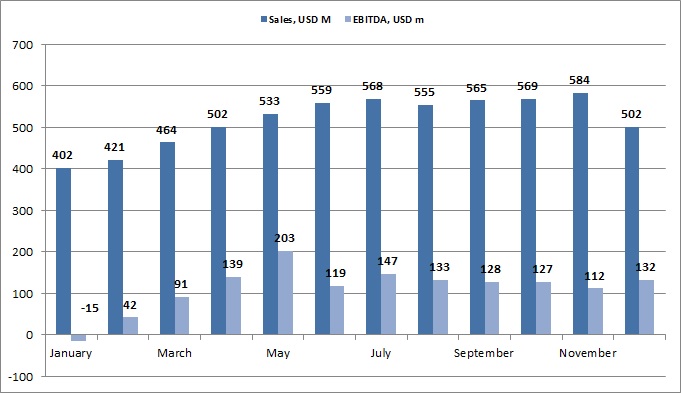

As a reminder in Y2016 revenues of Metinvest made USD 6.2bln (vs. USD 6.8bln in Y2015), EBITDA – 1.359bln:

Operating cash flow dynamics is still much worse vs. EBITDA, in January Metinvest EBITDA made USD 155M (the share of JVs – USD 35M), operating cash flow before interest and taxes paid – USD 63M. However we note that the difference in January arose in a view of JVs share and due to increase of VAT receivables amount.

Because of negative situation in the East of Ukraine (transport blockade of territory non-controlled by Ukrainian government, loss of control by Metinvest of enterprises situated at the non-controlled territory, continuing shelling of Avdeevka), one can expect significant worsening of operating and financial performance of the group in February-March.

See all news

All about Metinvest

Popular on site:

Interpipe - fighting for survival

Ferrexpo reports its production for Q4 2016

Epicenter-K - leader of Ukrainian DIY retail market