The Epicenter Group is one of the largest Ukrainian retailers, the absolute leader in the DIY segment, as well as one of the largest agricultural holdings in the country.

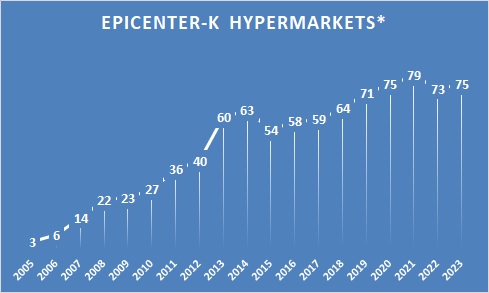

Total number of shopping malls and hypermarkets of the group as of beginning of Y2024 was 75 with a total retail area of more than 2 million square meters. Most of the shopping operate in the format of shop-in-shop, which allows the group to have the widest assortment of goods - from construction materials to electronics and grocery.

In terms of product range, Epicenter is the undisputed number one among Ukrainian retailers which operate mainly in the offline segment.

Also, Epicenter belongs to the TOP-10 leading Ukrainian agricultural holdings in terms of the size of the land bank and to the TOP-5 in terms of total grain storage capacity.

The group has a fairly good financial standing and, as always, ambitious plans for further development.

When speed matters the most

The history of Epicenter-K began in the mid-nineties, when Halyna and Oleksandr Gerega began selling ceramic tiles imported from Poland on Kyiv markets.

In 1996, the first small tiles store was opened, occupying only 25 square meters, and a little later the company Zermet AGS was found, whose operational activities were handled by Oleksandr, while Halyna was responsible for finance.

In 2000, Zermet AGS was already the second company in terms of sales of tiles after the market leader at that time, Agromat.

At the end of the 90s, the Gerega couple had an idea to build a construction materials hypermarket in Kyiv. Or, to put it differently, firstly a dream appeared, after visiting the Auchan and Leroy Marlin hypermarkets in Poland – the opening of similar hypermarket in Ukraine seemed unrealistic at those times.

In the early 2000s, the dream began to materialize. The hypermarkets of the French chain Castorama in Poland were taken as an example. With the idea of building a large hypermarket, Gerega couple approached the Kyiv authorities - and, apparently, they found some understanding there, because in the future, Epicenter had no problems in relations with the authorities.

By the way, during 2012-2014, Halyna Gerega herself was the deputy mayor and secretary of the Kyiv City Council, and Oleksandr Gerega was a MP.

Oleksandr and Halyna Gerega, the owners of the Epicenter group

One way or another, the first DYI hypermarket Epicenter-K was put into operation in Kyiv on Bratislavska Street in December 2003.

The area of the first Epicenter-K hypermarket was 17,000 square meters, the construction cost was approximately $6.5 million.

In the summer of 2004, Gerega already started building a second hypermarket. The new Epicenter-K store was located beside the Metro grocery hypermarket near the Kyiv ring road. It was the first retail park in the capital of Ukraine - zone where various hypermarkets and shopping malls generate visitor traffic for each other.

Part of the Epicenter-K hypermarkets were built using credit funds - already at the end of 2004, the amount of Epicenter's debt to banks amounted to more than UAH 10 million (at the end of 2005, the debt burden of the company increased to the level of UAH 71 million, in 2007 it was already almost UAH 800 million - $160 million under USD/UAH rate of those time).

Active expansion took place - in 2006, the network consisted of six hypermarkets, in 2007 - 14, in 2008 - 22. 2005-2008 were the period of construction market boom in Ukraine, the total volume of construction grew by 20-30% per annum, so the demand on construction materials was significant.

At the same time, competition on this market segment was significantly lower compared to other areas of retail - main competitors were old-style markets with highly fragmented sellers, so the profitability of hypermarkets operation was significantly higher compared to other Ukrainian retail segments (such as food retail or electronics).

Other companies that were represented at that time in the modern DYI hypermarkets segment - Nova Liniya (the main owners of which were investment funds East Capital and Dragon Capital), and foreign players - Praktiker, OBI and Leroy Marlin.

It was Epicenter-K and Nova Liniya that developed at the highest pace, foreign players at that time had a hard time on the Ukrainian market, so they were much less aggressive in their development.

Epicenter and Nova Liniya actively competed for the best locations of hypermarkets in the largest cities of Ukraine, and gradually Epicenter started to win this competition.

The biggest advantage of the company in those years was speed - the ability to quickly and effectively “solve land issues”, the speed of hypermarkets construction (new stores were built in an average of 120 days), as well as the overall speed of decision-making (in this regard, there was big advantage over the Nova Liniya, not to mention foreign chains).

As of 2008, there were 22 hypermarkets in the Epicenter-K network, and 13 hypermarkets in Nova Liniya. In the same year, the total turnover of the Epicenter-K company was UAH 6.2 billion, Nova Liniya – UAH 2.2 billion.

Significantly growing in scale and becoming an increasingly important off-taker for its suppliers, Epicenter-K started to receive exclusive terms and conditions for the supply of goods, seeking not only a significant delay in payment for goods (by 120-180 days, which is significantly more than in other retail areas), as well as payment literally "after the sale of the goods".

Such terms allowed the company to have the widest possible range of products, paying less attention to inventory turnover (in general, in retail, this indicator is one of the most important from the point of view of operational efficiency).

Despite the crisis of 2008, Epicenter-K remained a financially stable company, so in the following years the growth was significant - as of the end of 2012, there were 40 hypermarkets in the network, the company became a dominant player on the market, and began to squeeze other players out of the market, opening hypermarkets (with a wider assortment/lower prices) relatively close to the locations of competitors' stores.

In 2013, Epicenter acquired the Nova Liniya network, while Praktiker and OBI decided to leave Ukrainian market. The French chain Leroy Marlin remained the only foreign network among international retailers in the format of DIY and construction materials.

After the takeover of Nova Liniya (which at that time included 16 DIY supermarkets), the total number of stores under the management of the Epicenter-K group increased to 60.

A store within a store

In 2013, in parallel with the process of taking over Nova Linia, the owners of Epicenter began to take an active interest in entering the Russian market.

The company was considering land plots for the construction of its hypermarkets in the Russian capital, reports appeared in the press that Epicenter-K is ready to build more than twenty stores in Russia within ten years. As always, the group approached the new project dreaming big.

But the beginning of the Russia-Ukraine war fundamentally affected the company's plans. Moreover, the significant devaluation of the hryvnia during 2014-15 and the loss of hypermarkets in Crimea and Donbas (nine markets were lost in total, although it is not known for sure when the Geregas lost control over assets in the occupied territories) prompted Epicenter-K to focus more on stabilization of the current financial situation and integration of the Nova Liniya than on further development.

Banks mainly financed the chain in foreign currency, besides, the group imported a significant part of its products, so the devaluation of the hryvnia had a significant impact on the company's activities.

It helped the company that in relative terms (compared to sales and operating profit), the network's debt burden was not high, especially given Epicenter's monopoly market position.

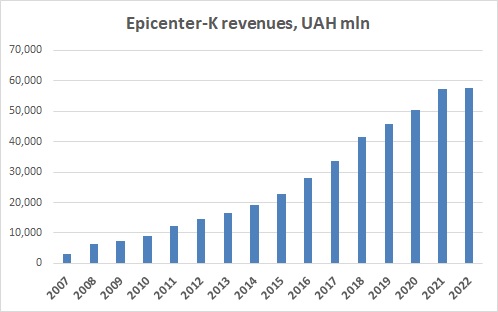

In 2014, the turnover of the network amounted to UAH 19 billion (another UAH 3 billion was the turnover of Nova Liniya), EBITDA – more than UAH 2 billion, with a total debt towards the banks at the end of the year of UAH 1.7 billion.

In the next two years, Epicenter significantly reduced its debt (at the end of 2016, it decreased to UAH 500 million with a revenue of UAH 28 billion), so the overall financial standing of the company remained at a very decent level.

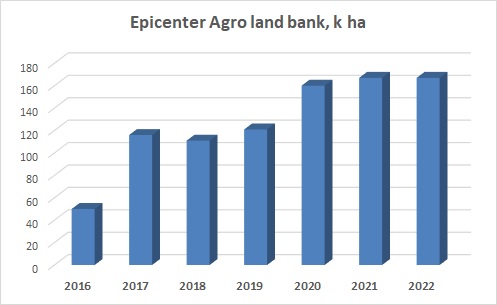

It was after the big crisis of 2014-15 that the owners of the group decided to open a new major direction of business - in the agri sector. Everything started with the export of grain and oilseeds, which allowed Epicenter to partially hedge currency risks and optimize VAT payments, and already in March 2016, the Gerega family acquired the first major asset in agriculture - the Vinnytsia Agro-Industrial Group, which operated a land bank of 41,000 hectares.

As for the development of the hypermarket network, Epicenter has changed its focus. First, the company began to open relatively small supermarkets in towns with a population of less than 200,000 inhabitants (before that, the focus was only on large cities).

Secondly, Epicenter developed the direction of shop-in-shop, opening concept stores inside its hypermarkets.

Back in 2009, the company began to develop a network of Deco stores - with goods for decoration, gifts, textiles and tableware. Later, other shop-in-shop chains appeared - E.Pic children's stores (2011), Furniture Centers (2014), Intersport sports stores (2015), TseTe technology and electronics appliances stores (2018), Light Studio, Ceramics Center and others.

Separately, we would like to note the opening in 2020 in its shopping centers of own modern food supermarkets - Epicenter has become a food retailer as well.

Developing new separate stores-in-stores, as well as updating the exterior of its shopping centers, making them more modern, Epicenter has taken a big step from relatively narrowly focused DIY hypermarkets (with a focus on construction materials) to full-fledged shopping centers.

In general, the pace of opening new commercial facilities slowed down. During five years, from 2014 to 2018, only 14 shopping centers were opened, mostly of a smaller format compared to the existing ones. Taking into account the loss of stores in Crimea and Donbas, the number of hypermarkets in the chain (Epicenter-K and Nova Liniya) increased not so significant - from 60 at the end of 2013 to 64 at the end of 2018.

* - since 2013, including Nova Liniya hypermarkets

Due to the stabilization of the general economic situation in the country and the increase in the purchasing power of the population in comparison with the crisis years, the turnover of the Epicenter-K company grew at a faster rate compared to the trading areas, reaching the mark of UAH 37 billion in 2018 (not taking into account the revenue from the export of grains and oilseeds).

2019-2021, on the contrary, became a period of more active development of the network. In 2019, eight new shopping centers were opened, in 2020 (despite the Covid epidemic and lockdowns), the network increased by another four, and at the end of 2021, the total number of shopping centers of the group was already 79.

In addition, the company reconstructed and rebranded the Nova Liniya hypermarkets, and also opened several E.Pic, Intersport and Deco stores in shopping centers not related to the Epicenter group (for example, in Kyiv's Retroville and Dream shopping centers).

Finally, the group actively developed the online trade segment. The 27.ua online store was launched in 2016, later it was renamed epicenterk.ua, on the basis of which a marketplace was established already in 2020.

Despite the big ambitions, the Epicenter marketplace is still far from the market leader Rozetka, but epicenterk.ua has regularly been in the TOP-3 online stores in recent years (the main competitors are Comfy and Allo online stores).

As for financial performance, the revenue of Epicenter-K in 2021 amounted to UAH 57 billion (excluding grain and oil exports - UAH 55 billion), EBITDA (according to official financial statements) - UAH 7.2 billion, net profit - UAH 4.2 billion.

Taking into account the profits of related companies - such as Epicenter-N (which owns part of the real estate of the group), Nova Liniya, as well as companies representing Epicenter Agro - Agroholding-2012, Interagroinvest, Lotivka Elit, and others - according to our estimates, the total official EBITDA group in 2021 amounted to more than UAH 12 billion ($450-500 million at the exchange rate of that year).

As of the end of 2021, the bank debt of the Epicenter-K company amounted to about UAH 6.5 billion, related agricultural companies (according to our estimates) - UAH 2 billion, so the financial condition of the group was good.

Agroholding

The Epcenter-K group started its activities on the agricultural market of the country in 2015, and for the first time people started talking about Epicenter as a noticeable agricultural holding in 2016, after the acquisition of the Vinnytsia Agrarian-Industrial Group with a land bank of about 40 thousand hectares.

The following year, Epicenter acquired the assets of the international trader Glencore, as well as Obolon-Agro, increasing its land bank to 110,000 hectares.

Finally, having acquired part of the assets of the Svarog group in 2020, as of the beginning of 2021, Epicenter Agro concentrated 160,000 hectares of land under its management, becoming one of the largest Ukrainian agricultural holdings.

At the same time, the company made significant investments in the development of silo capacities, and as of the same year, 2021, Epicenter Agro had 15 silos with a total storage capacity of 1.5 million tons. In terms of grain storage capacities, Epicenter is among the TOP-5 largest companies in the country.

The main part of the group's land bank is located in Khmelnytskyi, Vinnytsia and Kyiv regions, which are good regions in terms of weather conditions. Khmelnytskyi region (in which more than 50% of the land of the Epicenter is located) in recent years has generally been the leader among all Ukrainian regions in terms of the average yield of most crops.

Taking into account the significant financial resources of Epicenter Agro, the company could afford to be high-cost producer, having a high cost per hectare, but also yields significantly higher than the national average.

In the group's crop rotation in the years before the full-scale invasion, the main crop was corn, which occupied about half of the cultivated area. The remaining crops were traditionally occupied by wheat and sunflower.

In 2018 and 2019, Epicenter Agro's corn yield exceeded 10 t/ha, wheat - 6 t/ha. In 2020, as in the country as a whole, yield indicators decreased (to 7-8 t/ha for corn, compared to the average for Ukraine of 5.4 t/ha), but already in 2021, corn yield exceeded 11.5 t/ha ha (which became a new record for the group).

Wheat yield in 2021 was 6.5 t/ha, sunflower - almost 3.5 t/ha. The total harvest of Epicenter Agro farms in 2021 amounted to more than 1.2 million tons.

The main companies of Epicenter Agro are Agroholding-2012, Interagroinvest, Lotivka Elit, STOV Dovira, Vinnytsia Industrial Group and Agrofirma Medobory. According to our estimates, which are based on the official financial statements of these companies, the total EBITDA of Epicenter-Agro (not taking into account the results of the company Epicenter-K, which remains the main exporter of agricultural products) in 2021 was UAH 3.7 billion, in 2022 – UAH 1.4 billion.

According to information of the company itself, during the years 2016-21, the total amount of the group's investments in the development of the agricultural segment exceeded UAH 10 billion (of which more than UAH 6 billion was directed into the development of the silo capacities). The source of investment was mainly the reinvested profit of both the agri- segment itself and the Epucentr-K network of shopping centers. As of the end of 2021, the debt of the companies of the agricultural segment of the Epicenter group was almost UAH 2 billion, and at the end of 2022 it was more than UAH 2.6 billion.

A full scale invasion

Thanks to a record grain and oilseed crop in 2021, Epicenter Agro had significant grain and oilseed stocks at the start of the full-scale Russian invasion.

Presence of the large storage capacities, which are more than sufficient for one-time storage of the group's entire annual harvest, helped a lot.

Since the agricultural assets of the holding are located mainly in Central and Western Ukraine, the operational activities of Epicenter Agro were not affected by the full-scale invasion. From a financial point of view, the main impact was a significant limitation of export logistics of grain and oilseeds, as well as a decrease in domestic prices for grain in Ukraine.

In terms of crop rotation, in 2022 the company began to reduce corn plantings, increasing planting areas under sunflower and other oilseed crops. In 2023, this trend continued, the share of corn in the total crop rotation was already less than 40%, the share of oilseed crops (sunflower, soybean, rapeseed) was 43%.

The 2023/24 season did not start very optimistically for the entire Ukrainian agricultural sector. After ten months of operation, the "grain corridor" from the Ukrainian Black Sea ports was stopped in July 2023 (it was resumed in October), besides, the world prices for the main grain and oilseeds decreased significantly. Despite the near-record yield of major crops in 2023, the profitability of Ukrainian farmers (if we can talk about profits at all) during the first half of the 2023/24 season was minimal.

Epicenter Agro's reaction to the current situation - in 2024, the holding plans to abandon the cultivation of corn. According to the company's plans, sunflower will occupy 36% of the cultivated area, soybean - 23% (the highest figure in the company's history), rapeseed - 10%, wheat - 25%.

The holding also currently plans to develop its own processing of oilseed crops. At the end of 2023, Epicenter announced plans to build an industrial park in the town of Horodok, Khmelnytskyi region, which will house three plants - for bioethanol production, oilseeds processing, and waste processing. The structure of the complex will also include a solar power plant, a thermal power station and an elevator.

Regarding the impact of the full-scale Russian invasion on the activity of the network of shopping centers and construction hypermarkets, already in the first weeks of the war, three Epicenter shopping centers were destroyed - in Chernihiv, Mariupol and Buchi. Several more shopping centers were located in the territory occupied by Russia.

After the de-occupation of Kherson, the group resumed the operation of two hypermarkets in this city, but the first of them was completely destroyed as a result of a Russian missile attack in February 2023, the second was damaged as a result of an attack in May of the same year.

As of the beginning of 2024, the total number of shopping centers under the Epicenter and Nova Liniya brands is 75. The turnover of the Epicenter-K company in 2022 was UAH 57.6 billion (almost unchanged compared to 2021), the net profit was UAH 3.6 billion. The total amount of the company's debt as of the end of the year is UAH 8.2 billion, equity is almost UAH 26 billion. The operational activity of the chain of shopping centers and hypermarkets (the chains' inventory) is almost 100% financed by deferment of payments to suppliers.

In the first nine months of 2023, the revenue of Epicenter-K increased by more than 25%, so based on the results of the entire year of 2023, we can expect good financial performance of the company.

The group's plans for 2024, in addition to the start of investments in its own processing of grain and oilseeds, include the completion of the construction of a logistics center in Khmelnytskyi, as well as two modern shopping centers - on the Odesa highway in the suburbs of Kyiv and in Bucha (on the site of a hypermarket destroyed as a result of military hostilities).

Epicenter recently made an investment of EUR 10 million in Intersport Polska. By combining the procurement and logistics systems of Polish and Ukrainian Intersport, Epicenter plans to gain additional efficiency and scale the activities of both networks.

Despite the full-scale war, Epicenter continues its development in the main segments of activity, the group has a stable financial standing and good operational and financial results.

Epicenter-K Key Financials

Mln UAH

2019

2020

2021

2022

Revenue, VAT excl.

45 650

50 382

57 255

57 627

Operating profit

4 450

5 085

4 899

6 439

Net income

3 750

3 171

4 168

3 605

Bank debt

2 775

4 910

6 506

8 166

Inventory Period, days

175

Payables Period, days

185

Popular:

Nova Poshta - the biggest postal services company in Ukraine

Kernel Holding - the history of the largest sunoil producer in the world

ATB-Market - the biggest Ukrainian food retailer