5 February 2017

After rally in January main part of public Ukrainian companies’ share prices during last week slightly declined. Exception is Ferrexpo, which grew by 8.7%, extending monthly gain to more than 15%.

Stocks

Largest Ukrainian companies share prices weekly dynamics

Company

Currency

Price

Weekly change, %

Monthly change, %

Capitalization, USD M

MHP

USD

9.0

1.1%

2.4%

951

Kernel

PLN

76.8

-4.0%

20.3%

1 535

Ferrexpo

GBP

155.6

8.7%

15.7%

1 146

Astarta

PLN

61.4

-2.4%

13.6%

385

Ovostar

PLN

90.5

1.7%

4.6%

136

IMC

PLN

8.9

-3.9%

10.9%

70

Share price of Ukrainian pellets producer rebounded after drop in the beginning of previous week, when market became aware of the fact that second largest shareholder – Wigmore Street Investments – fully sold its stake in Ferrexpo to institutional investors (some large investment funds such as BlackRock Inc among them). On Friday Deutsche Bank analysts updated its target price for Ferrexpo at GBP 230 per share vs. current level of GBP 155.6.

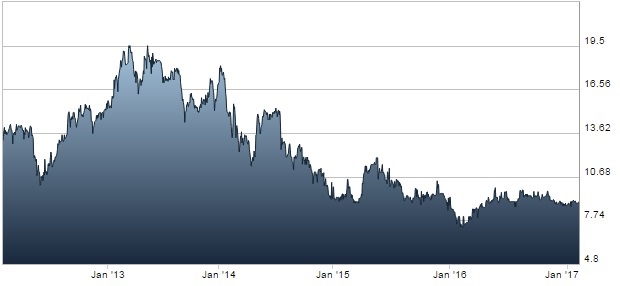

During last months share price of MHP, the largest Ukrainian poultry producer, has been fluctuating in the range of GBP 8.7-9.1 per share with quite low volatility. MHP is lagging behind other largest Ukrainian public companies, such as Kernel and Astarta, which demonstrate quite good dynamics during Y2016 – beginning of Y2017. Historical MHP share price chart is represented below (source - LSE ):

As for Ukrainian companies quoted in Warsaw, during last week we mainly saw small correction after significant growth in January, when Kernel share price grew by 25%, Astarta – by 16%, Industrial Milk Company – by 15%. WIG-Ukraine index finished the week by 3.5% lower vs. previous week close.

Commodities

Chinese New Year holidays led to limited activity on the markets of steel and iron ore, at that on Friday, after China opened after the holiday, metals tumbled – Shanghai rebar fell 7%, iron ore futures – by 5.5%. Main part of industry analysts expect that current iron ore price levels (close to two-year highs) are not sustainable, for example, Goldman Sachs forecasts they will gradually decline to USD 55/t till the end of Y2017. Another bearish sign is that Chinese iron ore port inventories currently sit at the highest levels seen in over over a decade.

Agri-commodities prices remain stable on international markets and Ukrainian ports as well. During last week corn traded on CPT terms (at Ukrainian ports) at USD 153-155/t, wheat – USD 154-167/t (depending on quality), soybeans – USD 375/t, sunflower oil – USD 740/t (slight decline vs. previous week).

Popular on site:

Interpipe - fighting for survival

Epicenter-K - leader of Ukrainian DIY retail market

ATB-Market - history of success