ATB Market is the largest Ukrainian food retail chain both in terms of the number of supermarkets and total sales, with a market share of 30%.

Beginning of the story

The history of the largest Ukrainian retail chain ATB Market dates back to 1993, when several businessmen from the Dnipropetrovsk region created the company AgroTechBusiness, which became engaged in the wholesale trade of fuel, agricultural products and spare parts for agricultural machinery. The list of founders of the company at the beginning of the period included Yevhen Ermakov, Serhiy Tarasyuk and Yaroslav Korchevskyi.

Another person, related to the group - Gennadiy Butkevich - in the early nineties headed the Dnipropetrovsk Department for Combating Organized Crime, and then was the head of the security service of the largest Ukrainian companies of that time - first "Sodruzhestvo" owned by Viktor Pinchuk and Yulia Tymoshenko, and then EESU (Yulia Tymoshenko).

It was the income received while working in this position, according to Butkevich himself in an interview with Dmytro Gordon in 2020, that allowed the group to purchase equipment for the meat processing and to launch operations of the Yuvileyny meat processing plant. In its turn profits from meat processing in the following years provided for a stable cash flow for the development of other business directions, including retail trade.

The retail business started with six stores in Dnipropetrovsk (now Dnipro) in the early nineties. By the end of the 1990s, their number had grown to thirty. Then in Y1998 the company ATB-Market (abbreviated from AgroTechBusiness) was established.

At the same time, changes in the structure of group shareholders took place. Firstly Viktor Karachun, who was one of the managers of Agrotechbusiness before that, became one of the company’s shareholders. By the way, it was Viktor (he was later responsible for the general commercial activities of the group) who had the idea to turn stores of the old Soviet-style into self-service supermarkets. Also, according to information from some open sources, Viktor's wife is related to Antonina Ulyakhina, Yulia Tymoshenko's aunt.

This fact, as well as Gennady Butkevich's connections with Yulia Volodymyrivna, gave rise to rumors about Tymoshenko's connection the ATB Market network.

At the beginning of the group's activities, the "distribution" of responsibilities among shareholders was as follows. Ermakov was responsible for production, Karachun for trade, Tarasyuk for construction and development. Butkevich mainly dealt with strategic issues and business security.

In the following years, other important changes took place in the structure of the company's shareholders - first, Yaroslav Korchevsky left the list of the owners, and in 2005, Serhiy Tarasyuk, who as a result of the split of the business became the sole owner of the Yuvileyny meat processing plant (after leaving the structure of ATB-Market owners). Later Tarasyuk tried to launch his own retail chain Cent, but this project was not successful, and in 2011 these stores were sold to the Varus chain.

In its turn ATB group began to develop another meat-processing factory - Favorite Plus, and after a few years this company became the main supplier of meat products to ATB Market (TM Myasna lavka and TM Dobrov). Currently, Favorite Plus and the Kviten confectionery factory are the main production assets of the group. Favorite Plus revenue in 2022 amounted to UAH 4.5 billion, Kviten’s revenue the same year – UAH 1.2 billion.

The structure of shareholders of ATB Corporation has remained unchanged since 2005 - the company is owned in equal shares by Gennadiy Butkevich, Yevhen Ermakov and Viktor Karachun.

Discounter

Even before the split, several interesting changes took place in the group's business. The owners of the network actively studied the European experience in the development of retail trade and initially decided to develop self-service supermarkets in the "hard discounter" format, copying the business model of the German chain Aldi.

In 2002, reformatting took place - the goods were placed in boxes, the assortment was narrowed to 800 product items, while the goods were significantly cheaper than in competitor stores. The idea did not work - the memories of the deficit years during the collapse of the USSR were very "fresh" in the minds of Ukrainian consumers, so they did not like the austere format of the stores.

Despite the failure, the owners of the network understood that the Ukrainian retail market has a high potential for development. Financial resources were also available. Mistakes were analyzed - the owners went to Europe again, and this time the Lidl chain was chosen as a typical model for development.

The ATB chain switched to the format of a soft discounter - the assortment was expanded to 3,500 items, the stores became more like supermarkets. Stores were firstly opened in relatively small cities of Dnipropetrovsk and neighboring regions (where there was practically no competition at that time). The group tried not to rent, but to buy out or build new stores, the average trade area of one store was about 500 square meters.

ATB also started to build its own logistics - already at the beginning of its activity, following the example of German discounters, the company's single warehouse was transformed into a modern and efficient distribution center. In the future, effective logistics allowed the company to minimize warehouse space at each of the stores, saving on the total area of the supermarket (and, accordingly, on investments in opening new retail outlets).

Expansion

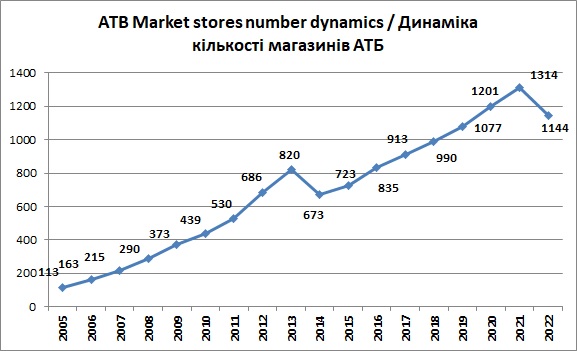

Operational and financial figures of ATB Market improved quite rapidly. The company opened 30-50 stores per year - if at the end of 2003 there were 85 supermarkets in the chain, at the end of 2007 - already 215. ATB's sales during the same period increased from UAH 580 million to UAH 3 billion.

At that time, the chain took first place in Ukraine in terms of the number of stores. At the same time, due to the significantly smaller average store area, revenues of ATB were still lower vs. other largest Ukrainian retailers - Fozzy Group, Metro, Furshet and Velyka Kyshenya.

In 2006, Rinat Akhmetov's SCM group, which was developing its own Brusnychka food retail chain, negotiated potential cooperation with the ATB chain in 2006, and within a year there were rumors that the owners of ATB were looking for a foreign investor to finance further expansion (reportedly there was an interest from the Russian X5 Retail and Lithuanian Maxima).

Those years were peak from the point of view of the interest of foreign investors in buying Ukrainian companies in general, but unlike the banking sector, where many deals on the sale of local business to foreigners were recorded, most of the negotiations of Ukrainian retailers with foreign investors ended in nothing.

The financial crisis of 2008-2009 was the time when ATB developed itself into a nation-wide chain - the company managed to significantly strengthen its market position.

Unlike most Ukrainian food retailers, ATB focused only on its main activity - retail trade. Many competitors, in addition to food retail, were actively building shopping malls, attracting significant credit resources (sometimes in foreign currency, i.e. bearing FX risk). The ATB chain also mostly built (rather than leased) its own stores, but did it at a rather low cost and did not participate in any other expensive business projects.

The development of the network was financed mainly with reinvested profits (as well as trade payables with suppliers), bank loans were not attracted.

Another important factor was the fall in the purchasing power of the Ukrainian population as a result of the financial crisis. For an increasing number of consumers, it was the low price that became an important factor for choosing a supermarket, so the ATB-Market chain, working in the "medium-" price segment, received additional advantages compared to competitors (many of whom simply could not define their market position during the crisis years).

Unlike most other market players, the ATB network continued active development during 2009-2010. In 2009, 83 new supermarkets were opened, in a year - another 66. By amount of revenue the chain took the second place among Ukrainian food retailers, leaving behind Furshet, Velyka Kishenya (both companies had significant financial problems due to the crisis) and Metro (the Germans were frightened by the impact of crisis), second only to Fozzy Group.

Efficiency - profitability - scaling

Already at that time, ATB Market activity could be compared, if not with a Swiss watch, then definitely with a German car. All business processes were built as efficiently as possible - the assortment of goods, logistics operations were optimized. Last but not least, relations with suppliers were transparent, honest, but at the same time rather strict.

Due to low prices and a relatively narrow assortment ATB Market sales per square meter of trade area were among the highest on the market (together with Fozzy, which had a large number of supermarkets located in the Kyiv region, in which the purchasing power of the population was significantly higher than in the rest of the country).

ATB had (and still has) the best inventory turnover rate among Ukrainian chains. The company's average inventory period was about 25 days, compared to 40-50 days standard for other chains. As average payables period with suppliers was 60-90 days, with each new store opened, the chain received additional resources for development.

According to the data provided by Gennadiy Butkevich, the average amount of investment into opening of one ATB store is $1.5-2 million. With trade credit from suppliers the company got back approximately 25-30% of this amount almost immediately after the opening of the store (on average, in 2012, the inventory per one store was $250,000, accounts payable to suppliers per one store - $700,000).

According to our estimates, the average profitability of the business in those years (in terms of EBITDA margin) was 7-8%.

Such a development model allowed the company to increase the network by 20% annually due to the reinvestment of profits and trade credit of suppliers.

In fact, in line with this model, the ATB Market network increased by 447 supermarkets during 2010-2013, the total number of stores grew from 373 at the end of 2009 to 820 stores at the end of 2013.

Another very important point is that ATB's payment discipline with suppliers has been probably the best among Ukrainian food retail chains. The financial crisis of 2008-2009, the loss of business in eastern Ukraine and Crimea in 2014-2015, the full-scale Russian invasion of 2022 - despite all the troubles, the company continued to fulfill its obligations to suppliers timely and in full.

Taking into account the rapid growth of the number of stores and revenue of the chain (in terms of turnover, ATB took first place among Ukrainian food chains already in 2013), the company has become a very important buyer for its suppliers. Accordingly, the network was able to set rather strict conditions for suppliers both regarding the price of goods and deferment of payments. At the same time, the terms of the contracts were fulfilled by 100% - the suppliers were sure that they would be paid on time.

Sometimes in later years, ATB's tough negotiating position led to conflict situations - during some periods, the products of well-known manufacturers - such as Coca-Cola, Roshen and MHP (Nasha Ryaba) - disappeared from the network. ATB Market very clearly understood the strength of its market positions and utilized this strength in full.

Player number one

The crisis of 2014-2015 and the aggression of the Russian Federation against Ukraine in the Crimea and Donbas had big impact on the activities of the network, as these regions were one of the key ones for business development in previous years. In total, ATB lost 152 supermarkets and a large distribution center in the occupied territories. In one of the interviews, the general director of ATB Market, Boris Markov, estimated the company's losses from occupation at UAH 7 billion.

Due to these events and losses, the development of the network slowed down significantly (only about 60 new stores were opened during 2014-15), but the overall impact on the financial standing of the network was limited. Already in 2015, the EBITDA of ATB Market amounted to UAH 3 billion, and taking into account the results of related companies - owners of commercial real estate objects - almost UAH 5 billion.

The years 2014-2015 were spent on the normalization of activities after the loss of assets, and starting from 2016, the network returned to growth - the number of stores increased by 112, and at the end of 2016 their total number exceeded the corresponding figure at the end of 2013.

It should be noted that despite the large number of new stores during 2016-2021 in absolute terms (an average of 100 new stores were opened per year), in relative terms - in relation to the total number of existing supermarkets - the chain's growth rate decreased.

If during 2010-13 the ATB Market network grew by approximately 20% per year, in 2016-2021 the growth rate averaged 10%.

In our opinion, this means that if in previous years the owners and management of the network were 100% focused on scaling an effective business model, investing all available resources in opening new stores and developing logistics, then after 2014-15 the situation has somewhat changed (for example – with respect to dividends).

The geography of opening new supermarkets has also changed significantly - the company began to actively enter the Western and Southern regions of Ukraine, where before that there were almost no ATB Market stores. The network also developed in Kyiv. As of mid-2018 the largest number of ATB stores – 136 - operated in Kyiv (in Dnipro there were a little less than a hundred stores).

The company also started restyling part of the stores - into more modern supermarkets in black colors. Supermarkets with a larger area were selected for restyling, the goods assortment in these stores was increased as well. In fact, they were middle-class supermarkets (whereas the "old" blue-and-white stores are typical "middle-"). As of the beginning of 2021, 35% of all supermarkets of the chain worked in the new format.

The development of logistics did not stop either - the total area of the company's own modern warehouses exceeded 150,000 square meters in the years before the full-scale Russian invasion.

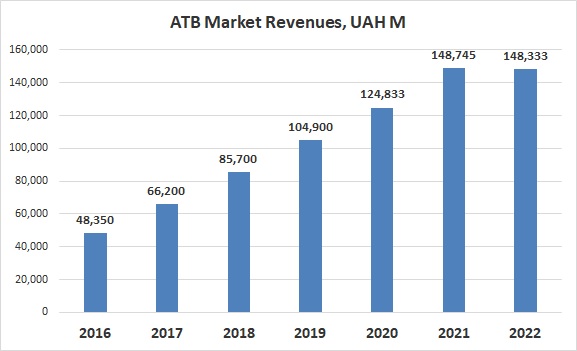

With an increase in the number of stores by 10% per year, due to inflation and the growth of the population's income, the company's revenue during 2016-2021 grew by an average of 25%.

So as of the end of 2021, there were 1,314 supermarkets in the ATB Market network, and the company's total turnover (without VAT) in 2021 comprised UAH 148.7 billion.

If compared with the market, ATB Market is clearly the number one Ukrainian food retail chain. The closest competitor - Fozzy Group (which operates the Silpo, Fora and Fozzy chains) - had 708 stores as of the end of 2021, and the total revenue of all three Fozzy chains was about UAH 85 billion.

All other competitors were far behind. The turnover of the number three player among Ukrainian food retailers - the Metro chain - in 2021 was only UAH 26 billion.

According to our estimates, the market share of ATB Market among food retail enterprises in 2021 was about 30%.

ATB Market financial performance

UAH mln

2019

2020

2021

2022

Revenue

104 900

123 864

148 745

148 332

EBITDA

6 571

12 118

16 209

8 951

Adjusted EBITDA*

5 110

7 855

10 048

3 302

Consolidated Group EBITDA**

11 328

15 216

18 316

11 765

Net Income

4 400

5 768

8 329

2 811

Average Inventory Period, days

20-25

Average Payables Period, days

45-50

**- includes the consolidated profit of the companies ATB Market, Farovit Plus, Kvyten, ATB Invest, ATB Torgstroy, Eastrate, Real Estate, Trans Logistics, Logistics Union

ATB Market's business profitability figures, starting from 2015, had a clear upward trend. If earlier the formal profitability of ATB Market was close to zero, the situation has changed over the past 7-8 years. In 2018-2021, the company's EBITDA margin was approximately 5% (taking into account lease payments, which, starting from 2019, do not affect EBITDA, but are related to financial cash flow - it is important to take this peculiarity into account when analyzing the company's financial performance).

EBITDA of ATB Market on stand-alone basis in 2020 was UAH 12 billion (including lease payments - UAH 7.8 billion), in 2021 – UAH 16.2 billion (UAH 10 billion).

It is also worth noting that since more than two-thirds of the group's stores are owned by companies related to ATB Market - such as ATB Invest, ATB Torgstroy and Eastrate, and the warehouses are owned by the Logistics Union company, a large part of the group's profits is formally reflected in the financial statements these companies.

Taking into account the profits of these companies, we estimate the total consolidated EBITDA of ATB Corporation in 2020 at UAH 15 billion, in 2021 – about UAH 18 billion (margin – 12%).

Regarding the structure of the balance sheet of the company and the group as a whole, the main takeaways are following: the group does not use bank loans to finance its activities, the main sources of development financing are reinvested profit and trade payables to suppliers.

At the same time, we should note that the importance of terms of payments with suppliers for business has slightly decreased over the past five years compared to 2010-2013.

If earlier the average payables period was about 70-80 days, in recent years it has decreased to 50 days. We can connect this, firstly, with a decrease in the rate of development of the network from 20% of new stores per year to 10%, and secondly, with a greater focus of ATB in relations with suppliers for low purchase prices (vs. deferred payment term). Having lower, compared to competitors, purchase prices, the network can offer lower prices to the buyer, almost without losing profitability.

The inventory period in ATB remains short - the average period of sale of goods is still the same 20-25 days, so despite the reduction of payables period, the operational business continues to be 100% financed by the funds of suppliers.

Regarding dividends to shareholders, in 2020 the sum of dividends paid amounted to UAH 3.6 billion, in 2021 – UAH 4.7 billion.

The impact of a full scale invasion

According to an interview given by ATB CEO Boris Markov to Forbes on April 29, 2022, the company, unlike many others, took warnings about a possible war very seriously. Various scenarios were considered, including the worst - with the occupation of a large part of the territory of Ukraine.

Immediately after the start of the full-scale invasion, a partial relocation of the central office from Dnipro to Lviv took place. The share of local producers in the range of products was also increased - in this way, the company responded to the logistical difficulties that appeared. Delays in payments to suppliers were also reduced.

The number of working ATB Market stores with the start of hostilities decreased from 1,314 (as of the end of 2021) to less than 1,000. Also, one of the company's warehouses was destroyed in the Kyiv region (another was partially destroyed). Two more warehouses ended up in the occupied territory.

Starting from the end of March, ATB gradually resumed the operation of its stores (where it was possible, including de-occupied territory). For example, in Kherson, three ATB Market supermarkets opened their doors within ten days after deoccupation.

The company again reached the mark of 1,000 operating stores in May, and at the end of 2022, the total number of ATB supermarkets was already 1,154. In general, due to the full-scale Russian invasion, the chain lost about 200 stores located in the occupied territory and in close proximity to the zone of active hostilities.

As for financial performance figures, the network's revenue in 2022 amounted to UAH 148 billion - at the level of the previous year. First of all, this result was achieved due to the increase in prices (+25%), in real terms the revenue of ATB Market decreased by approximately 20%.

The profitability of the business has significantly decreased. The formal value of ATB Market operating profit decreased from UAH 12 billion to UAH 5.8 billion, net profit – from UAH 8.3 billion to UAH 2.8 billion.

Taking into account the value of rental payments, which are part of the company's financial cash flow, as well as the financial result of related companies - real estate owners and logistics service operators - according to our estimates, the total consolidated EBITDA of ATB Corporation decreased from UAH 18 billion in Y2021 to UAH 11-12 billion in Y2022.

During 2022, the ATB Market company reduced its trade payables from UAH 16.6 billion to UAH 13.2 billion, while the amount of cash on the balance sheet increased from UAH 6.4 billion to UAH 8.4 billion.

As of the end of the first half of 2023, the company has a good financial position and continues to maintain its leading market position among the largest food retailers in Ukraine.