12 March 2017

The worst week for Ukrainian companies and main export markets since the beginning of Y2017 – decline of steel and iron ore prices from local highs, weak dynamics of the largest Ukrainian public companies.

Stocks

Largest Ukrainian companies share prices weekly dynamics

Company

Currency

Price

Weekly change, %

Monthly change, %

Capitalization, USD M

MHP

USD

9.25

-2.6%

3.9%

977

Kernel

PLN

73.5

-4.6%

-6.9%

1 444

Ferrexpo

GBx

146.9

-6.6%

-9.9%

1 046

Astarta

PLN

67.0

-1.5%

8.7%

413

Ovostar

PLN

92.9

-1.0%

1.5%

137

IMC

PLN

9.3

-0.6%

3.8%

72

All largest Ukrainian public companies showed negative results during last reporting week. Driven by iron ore slump, share price of Ferrexpo declined by 6.6% to GBX146.9 (dynamics would be even worst unless on Friday quotations of Ukrainian iron ore pellets producer grew by 5%). From positive side we note that on Thursday analysts of Credit Suisse increased their target price of Ferrexpo from GBX 120 to GBX 170. Current market capitalization of the company still exceeds USD 1bln and now stands at USD 1 046M.

WIG-Ukraine – index of Ukrainian public companies traded at Warsaw Stock Exchange – during last week declined by 3.2%. Main driver has been Kernel, which dropped by 4.5% to PLN 73.5 – the level of price lastly seen in the first part of January (monthly decline of Kernel share price made almost 7%).

Better results have been shown by Astarta. Share price of the largest Ukrainian sugar producer and soybeans processor declined vs. previous week close by 1.5%. Same dynamics has been shown by Industrial Milk Company and Ovostar.

Commodities

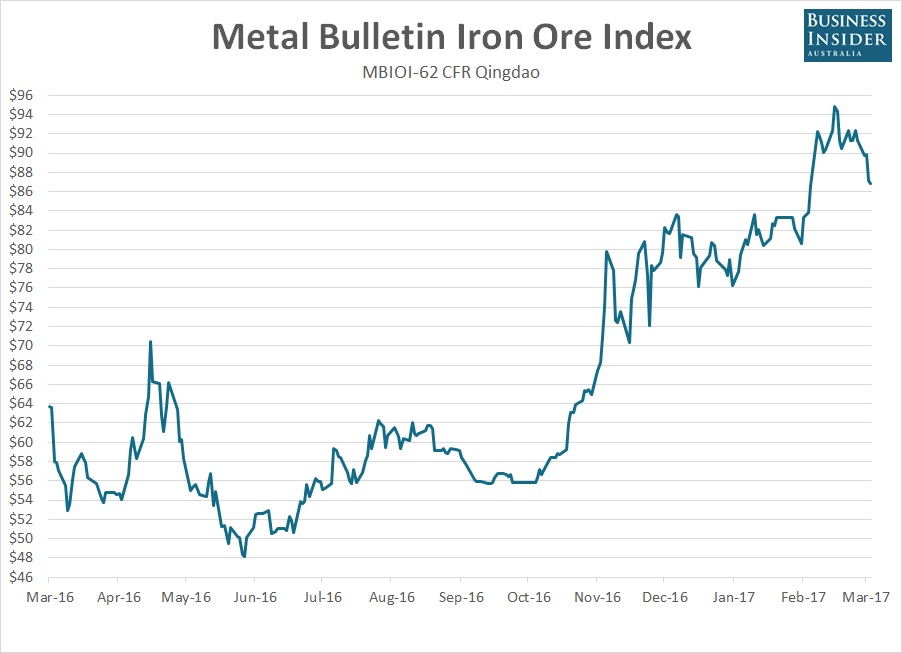

For iron ore last week has been the worst in nearly three months as rally in steel prices lost its stream and investors started to worry more about large stockpiles of iron ore in Chinese ports. Before this iron ore rallied along with steel despite all the bearish fundamental factors.

Spot benchmark iron ore index lost 5% this week (closing at about USD 86.7/t), on the other hand, up to the moment we can speak only about correction of iron ore price which rallied during the last four months (source - BusinessInsider):

Agri-commodities prices during reporting week decreased as well, for example in Chicago corn price declined by more than 4%. Main reason of decline was USDA report, according to which world grains production estimations have been increased. In addition current week has been negative for almost all commodities (crude oil declined by more than 8%), which put additional pressure on grains and oilseeds prices.

Ukrainian market reaction to world prices decline has been smoother – corn lost USD 3-5/t and finished the week at the level of USD 152-155/t (CPT), similar dynamics has been shown by sunflower oil (dropped on Friday to USD 715-720/t again). On the other side wheat prices in Ukrainian ports almost did not change, they have been in the range USD 160-175/t (depending on quality). As we expected decrease of wheat stocks put upward pressure on Ukrainian wheat premiums and prices.

Soybeans on CPT terms have been traded at USD 380-390/t (almost unchanged vs. previous week).

Popular on site:

Ukrainian Y2016 agri-commodities export digest

Ukrainian sunflower seeds and oil market

Ukrainian soybeans market is ready for new records