Updated sunflower seeds and oil market report as of Y2021 is available here.

6 February 2017

Ukrainian sunflower seeds and oil market

During last years Ukrainian market of sunflower seeds and products of its processing is booming. Since Y2000 sunflower seeds production grew by more than four times, crushing capacities - by more than seven times, in Y2016 sunflower oil and meal accounted for about 12% of total Ukrainian export.

Common information and world market

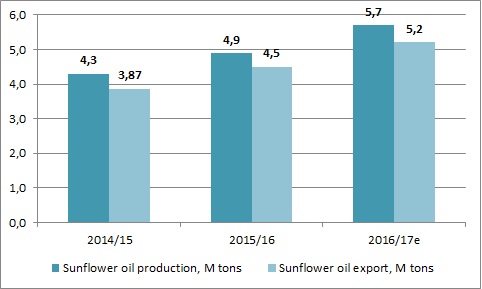

In current season Ukraine obtained another record-high sunflower seeds harvest at about 13.6M tons, current crushing capacities stand at about 18.5M tons, so Ukraine is expected to break new record in sunflower oil production and export (according to current estimations production will make 5.7M tons, export 5.2M tons).

Ukrainian production drives up the whole world market. Historically in the structure of world oils consumption sunflower oil did not refer to the most popular types (taking 4th place after palm, soybean and rapeseed oils), however with the course of time it becomes more and more popular as demand from importing countries is rather good, exporters have no problem with sales even in case of noticeable increase of production volumes.

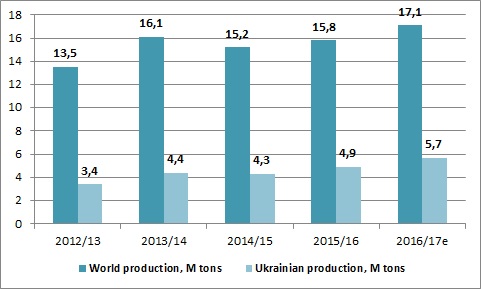

In current season total sunflower oil production in the world is estimated at slightly higher than 17M tons, general dynamics during last years is represented on the following chart (along with Ukrainian production figures):

It is estimated that in current season Ukraine will account for one-third of total world production and for more than a half of total world export of sunflower oil. Other important exporters are Russia (estimated export share in current season is 20%, share in world production up to 25%) and Argentina (8-10% of global export).

Main importers of sunflower oil are India (20% of global import, it was expected that India import of vegetable oils in MY2016/17 would reach 16M tons, thereof 9.4M palm oil), China and EU (the largest market in Europe is Spain with consumption over 550k tons per annum). These countries are main importers of vegetable oils in general, so global demand is largely dependent on them.

Sunflower seeds growing in Ukraine

During last decade both sown area for sunflower seeds and yields in Ukraine are growing, summary table is represented below:

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

3 743

1.26

4 706

2006

3 964

1.34

5 324

2007

3 604

1.16

4 174

2008

4 306

1.52

6 526

2009

4 232

1.50

6 364

2010

4 572

1.48

6.772

2011

4 739

1.83

8 671

2012

5 194

1.61

8 387

2013

5 051

2.19

11 051

2014

5 257

1.93

10 134

2015

5 105

2.19

11 165

2016e

6 071

2.24

13 600

During FYs2014-15 sunflower seeds were considered the most profitable (on average) crop for Ukrainian farmers. Good demand from the side of oilseeds crushers, acceptable prices and the fact that sunflower seeds are less susceptible to negative effect from draught comparing, for example, with soybeans, led to increase by Ukrainian farmers of their sunflower seeds sown area to record-high 6M ha in MY2016/17.

On the other side normal crops rotation practices imply that suflowers can be sown on the same land once in 5 years at most (better once in 7 years).

Some Ukrainian farmers, focused mainly on short-term profitability rather than long-term sustainable development (so just trying to get more income with less inputs), increase sunflower seeds sown area disregarding crop rotation principles and even general common sense. Such farmers increase the share of sunflower seeds in total sown area up to 40-50% or more.

Main negative consequences regarding such practices are decrease of moisture levels in the soil and worsening of the soil structure. In addition crops become more susceptible to some type of pests and weeds, so even in short-term yields fall while costs grow.

It means that taking into account dynamics during last years potential for sunflower seeds sown area increase is almost exhausted. Increase of total harvest can be possible only in case of yields growth. We believe it can take place in Ukraine, though in any case process is not linear and rate of growth can not be as high as it was since mid-2000s.

Main Ukrainian regions concentrating on sunflower seeds production are Southern and Central:

- Kirovograd (about 10% of total Ukrainian sown area during last years)

- Dnipropetrovk (10%)

- Zaporizhzhya (10%)

- Mykolaiv (9%)

During last years there is a trend of sunflower seeds sown area increase even in Nothern and Western regions, but their share in total production is still relatively small.

Current season

As was noted in MY2016/17 average sunflower seeds yield made record-high 2.24t/ha, which along with growth of sown area (apart from good profitability of sunflower seeds growing for the farmers, area grew because of winter rapeseeds and wheat losses during Y2015 autumn draught) led to total production of about 13.6M tons (vs. 11.2M tons in previous year, basing on statistics of Ukrainian Ministry of Agriculture).

According to some estimations official statistics understates real volume of production (some sources estimate total output even at above 14M tons). In any case positive for Ukrainian farmers was the fact that they were able to fully harvest sunflower seeds crop till mid-November (when showfalls started in Ukraine), so that there have been almost no losses of crop.

Sunflower seeds prices

As for sunflower seeds prices dynamics, several years ago because of crops pressure, lack of storage facilities and necessity to repay working capital loans and trade payables, Ukrainian farmers sold main part of sunflower seeds crop in short of time after harvesting. In such case purchasing price declined after harvesting works and gradually recovered thereafter.

In latest seasons situation changed Ukrainian farmers became more financially sound, their storage capacities increased, because of good demand from the crushers sunflower seeds are perceived as rather liquid type of investory vs. other grains, so realization of seeds by farmers takes place more uniformly throughout a season, which leads to less prices fluctuations related to supply factors. Currently prices largely depend on the level of world prices for sunflower oil and USD/UAH exchange rate fluctuations.

Holdings data

Data for sunflower seeds sown area and yields of largest Ukrainian public agri-holdings is represented in the following table:

Season

2016 est

2015

2014

2013

MHP

Sown area, ha

67 400 57 450 49 550 38 290

Yield per 1 ha, tons

3.2 3.1 3.4 3.5

Kernel

Sown area, ha

81 400 57 480 69 744 103 000

Yield per 1 ha, tons

3.0 2.7 2.5 2.1

Astarta

Sown area, ha

27 042 23 000 7 350 4 687

Yield per 1 ha, tons

2.6 2.8 2.2 3.3

IMC

Sown area, ha

25 095 24 606 19 138 25 500

Yield per 1 ha, tons

3.1 2.8 2.5 2.5

Agrogeneration

Sown area, ha

30 000 18 900 32 000 17 320

Yield per 1 ha, tons

2.5 2.6 2.5 2.3

In general Ukrainian agri-holdings try to keep to normal crop rotation practices, having the share of sunflower seeds in total area at not higher than 20-25%. Yield per 1 ha is generally higher than average value for Ukraine.

We note that despite Kernel and MHP are highly dependent on sunflower seeds origination for their crushing businesses main crop rotation principles during last years have been mostly fulfilled.

Sunflower seeds crush in Ukraine

If we take a look on the history of oilseeds crush in Ukraine, active development started after in Y1999 Ukrainian parliament passed a law imposing 10% duty on export of sunflower seeds. This measure significantly stimulated development of domestic crush in Ukraine. Both local and international companies (Cargill, Bunge, ADM) constructed new oilseeds crushing plants in Ukraine and started trading with Ukrainian sunflower oil on international market.

Since Y2000 total Ukrainian crushing capacities increased by more than seven times, moreover they kept growing during latest crisis years: in Y2012 they made about 12M tons of raw materials processing, in mid-2014 14.5M tons, in the end of Y2016 already 18.5M tons. As a result total volume of sunoil production during last years depended solely on raw materials availability.

Largest completed projects of new oilseeds crushing capacities construction in Ukraine during last years have been as follows:

- in Y2015 group Allseeds launched new oilseeds crushing plant with total capacity of 2.4k tons of sunflower seeds processing per day in Yuzniy;

- in Y2016 Bunge commissioned new oilseeds crusher with the same daily capacity of about 2.4k tons of oilseeds in Mykolaiv;

- ViOil increased capacities of its Vinnitskiy MEZ by 600 tons/day up to 2.8k tons/day.

Other market players, such as ADM, Delta Wilmar, Bessarabia, Ukroila and others actively expanded/modernized their crushing facilities as well, providing for general capacities increase in Ukraine.

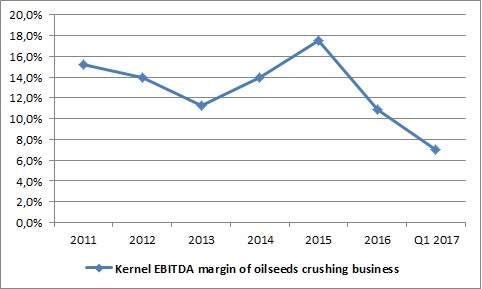

Despite increase of sunflower seeds harvest during last years (driven by good demand from crushers), as processing capacities growth rate is higher, competition on the market for sunflower seeds from crushers side is growing, bringing down margins of sunflower oil producers. Below we present EBITDA margin of oilseeds processing segment of the largest Ukrainian producer Kernel:

We also note that as after starting of full-scale geopolitical and economic crisis in Ukraine in Y2014, banks significantly reduced working capital credit lines to crushers, which somewhat reduced competition (as some crushers could not obtain necessary for their activity funding, so reduced volume of production) and positively influenced margins. Along with it, as industry remained attractive for new investments, while in Ukraine in general there was a lack of new investment opportunities, already in MY2015/16 problem was resolved, partially by tolling scheme, which started to be actively used by a lot of producers.

As a result, competition increased again, margins - declined. According to Kernel data (confirmed by other market participants) in Y2016 they reached the lowest for the history of the industry in Ukraine level at less than 10%.

As of today Kernel Holding is the largest sunflower seeds crusher in Ukraine, followed by multi-nationals Bunge, Cargill and Delta Wilmar, and local companies ViOil, MHP and Allseeds.

According to information of latifundist.com, in Y2015 TOP-10 largest sunflower oil producers have been as follows:

- Kernel - 28%

- Optimus (Privat) - 9%

- MHP - 8%

- ViOil - 8%

- Cargill - 5%

- Bunge - 4%

- Pology - 4%

- Delta Wilmar - 4%

- Glencore - 3%

- Noble (Cofco) - 3%

We estimate that with putting into operations of new oilseeds crusher, in Y2016 the share of Bunge in total production is to increase. We also expect that Allseeds Group is to be definitely present in the list of TOP-10 producers of the last year.

Kreativ case

Almost any sizable industry in Ukraine has its cases of fraudulent companies and oilseeds crushing industry is not an exception. Notorious case related to this industry is Kreativ company operated in Kirovograd region, which just in Y2014 had more than 10% market share in Ukrainian sunflower seeds crushing volume.

Detalied description of bankruptcy of this company can be found elsewhere, so here we present just main facts (important note just facts, no opinions) of it.

Despite sizable margins in oilseeds crushing business until recent seasons, business of the company was fully financed by bank loans. Their total volume reached more than USD 600M, with main part related to Ukrainian state banks (with production assets as collateral). Smaller portion was owed to the group of international lenders, which financed working capital needs of the company.

In Y2015 previous owners of the company Berezkin family announced that they sold Kreativ to some group of investors. Sunflower seeds which was pledged as collateral to international lenders disappeared, Berezkin accused new owners/management and visa versa. The best and most modern asset of Kreativ (annual capacity of 650k tons) was sold to Kernel Holding. Asset was pledged under USD 96M loan of state-owned Ukrgazbank, which sold the debt, not an asset. Selling of debt implied potential problems for any buyer of this debt (usually international banks spend several years in Ukrainian courts before getting their collateral from bad debtors), unless this buyer could effectively deal with former/new Kreativ owners.

As of today former owners of Kreativ established new group Green Stone and position themselves as one of the largest soybeans crusher in Ukraine, Kernel has bought the best ex-Kreativ crusher without any competition and operates under tolling scheme at another one (with annual capacity of 350k tons), while entity which is still called as Kreativ group has huge indebtedness towards Ukrainian state and international banks.

Domestic consumption, export

Ukrainian consumption of sunflower oil during last years remain stable at approximately 0.45-0.5M tons (which is just 10% of total estimated production in current season). As a result growth of production (along with relatively good demand for Ukrainian sunflower oil on international market) led to boosting export:

TOP Ukrainian exporters of sunflower oil in Y2016 have been Kernel, Cargill, MHP, Bunge, ViOil, Allseeds. The largest Ukrainian ports which transship sunflower oil are Nikolaev, Chernomorsk and Yuzhniy. Total number of oil teminals more than 15 (key ones are Everi, UPSS, Olir (another sad story of the industry), Risoil and others).

In Y2016 sunflower oil export comprised 4.8M tons (+23% vs. Y2015), average export price made USD 765/t, which has been slightly lower than in Y2015 (USD 769/t). In money terms during last year amount of sunflower oil export comprised USD 3.7bln.

Main destination for Ukrainian sunflower oil is India (more than 30% of Ukrainian export in Y2016), followed by China (13% of export according to Ukrainian customs statistics figures).

Sunflower Meal

Along with growth of sunflower oil production, sunflower meal output increased as well (on average 1 ton of SFS contains 440kg of SFO and 390kg of SFM). Total production in MY2015/16 is estimated at about 4.7M tons, expectations for current season 5.5M tons.

Sunflower meal (SFM) is used as a source of protein for feed production. Part of Ukrainian SFM is consumed domestically (about 1M tons), the other part is exported to Belarus, France, Poland and other countries. During last period of time negative impact on Ukrainian export of sunflower meal has spread of African swine fewer all over the country. It led to certain restrictions of Ukrainian export from several countries side, notably Belarus (some producers have been forced to change geography of its sales to other destinations).

Summary

During last years Ukrainian sunflower seeds and oil market has been one of the most dynamic industries in the country. Good demand on sunflower oil from countries-importers led to futher increase of crushing capacities in Ukraine and growth of sunflower seeds sown area by farmers. On the other side from crop rotation perspective potential for further sown area growth is exhausted, so that we do not expect significant growth of sunflower seeds production in the next years. It means competition between crushers is not to decrease, which means most likely the industry will start to consolidate.

Popular on site:

Ukrainian sugar market - new perspectives

Ukrainian soybeans market is ready for new records

Ukrainian Y2016 agri-commodities export digest