16 November 2016

Despite negative situation on Ukrainian domestic eggs market during last two quarters, for Ovostar it just resulted in decrease of profitability, while general results remain solid. Taking into account good financial standing of the company, active development of its export operations, we maintain our positive view on future activity of the company.

Realization of the company in money terms in both Q3 and 9m 2016 remained on the level of previous year, as growing sales in natural terms offset prices decline.

Q3 2016 financial results

Key financials

USD k

Q3 2016

Q2 2016

Q3 2015

Sales

19 213

16 697

19 268

EBITDA

3 600

3 698

8 396

EBITDA margin, %

19%

22%

44%

Net Profit

3 157

2 960

6 433

Shell eggs sales in natural terms in Q3 2016 comprised 292M pieces, thereof 31.5% - export (record-high quarterly export volume for the company, +24% to Q3 2015). Along with export growth domestic realization was stable vs. previous quarter (200M eggs), but grew y-o-y as well - by 24%.

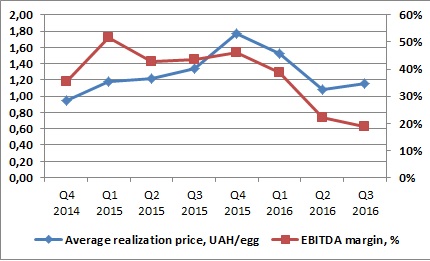

Average realization price in last quarter made UAH 1.16/egg vs. USD 1.34/egg in Q3 2015 (in USD terms decline was even more significant due to UAH devaluation). Along with it average price somewhat increased vs. Q2 2016, when it made UAH 1.09/egg. Average quarterly realization prices of Ovostar (and its profitability in corresponding quarters) during last period of time looked as follows:

In Q3 2016 EBITDA margin of Ovostar operations made 18.7%, which is the lowest value for last two years, but we see it higher vs. competitors, so the company clearly relates to the most efficient companies of Ukrainian eggs industry and shows profits despite negative market conditions.

In absolute terms Ovostar EBITDA made USD 3.6M and was fully directed to further expansion – total investments in reporting period made USD 4.1M.

Lastly one should note that in October domestic eggs retail prices in Ukraine increased vs. previous months by more than 50%, there was correction in the beginning of November, but in any case we expect growth of Ovostar profitability in Q4.

9m 2016 results

Key financials

USD k

9m 2016

9m 2015

Change, %

Sales

53 665

52 777

1.7%

EBITDA

14 200

24 271

-41.5%

EBITDA margin, %

26.5%

46%

-

Net Profit

12 219

22 326

-45.3%

For the whole period of nine months revenues of the company made USD 53.7M, on the level of previous year, as growth of export (along with increase of domestic shell eggs realization in natural terms by 9%) offset decline in average realization price, which remained stable in UAH terms, but due to UAH devaluation decreased by 17% in USD.

Export made 36% of total Ovostar revenues (29% in 9m 2015), in absolute terms it increased from USD 15.4M a year ago up to USD 19.4M, main factor – growth of EU realization from USD 0.5M in 9m 2015 to USD 4.3M. Sales on main export market for the company up to now – Middle East – in money terms have been stable at about USD 14M.

In 9m 2016 EBITDA margin of the company made 26.5% (46% a year ago), main reason – above-mentioned decline of prices in USD terms. In addition, due to changes in taxation, Ovostar lost about USD 3M of its 9m 2015 profits.

Balance Sheet structure

30.09.16

31.12.15

Total Assets

107 177

100 718

Fixed Assets

64 739

59 556

Current Assets

42 438

41 162

Equity

83 219

78 507

Debt

18 149

17 032

Balance sheet structure and quality of Ovostar remains good, as debt burden is low, the company has very good margin of safety in its activity.

Popular on site:

Astarta reports financials for Q3 2016

MHP releases Q3 2016 operating report

Kernel reports financials for financial year 2016