11 April 2017

The largest Ukrainian sugar producer and soybeans processor demonstrated solid operating and financial results in all segments of its activity. The company keeps its deleveraging having repaid more than EUR 50M of its debt in Y2016, so its balance sheet structure and quality further improved.

Key Financials

EUR k

2016

2015

Sales

368 891

313 997

EBITDA

152 000

130 694

EBITDA margin, %

41.2%

41.6%

Net Profit

82 643

15 941

Speaking about revenues of the company, firstly we should note that because of boosting sugar export and increase of export share in soybeans processing segment sales, the share of export in total revenues of Astarta in Y2016 increased up to 51% vs. 36% in previous year. This fact is especially important as export realization mitigates FX risk of the company related to debt nominated in foreign currency.

Revenues of the company in key segments during last reporting quarter and for Y2016 in total is represented in table below:

EUR k

Q4 2016

Q4 2015

Change, %

2016

2015

Change, %

Sugar

74 342

47 679

55.9%

174 519

151 497

15.2%

Soybeans processing

21 878

11 570

89.0%

74 951

50 684

47.9%

Farming

46 121

50 248

-8.1%

84 366

81 549

3.5%

Dairy

7 921

6 235

27.0%

24 827

23 952

3.7%

TOTAL

152 413

113 879

33.8%

368 891

313 997

17.5%

Profitability of main business segments in Y2016 looked as follows:

EBITDA

2016

2015

2014

2013

Sugar

59 120

57 022

41 116

14 467

margin,%

33.9%

37.6%

24.1%

7.3%

Soybeans processing

18 654

10 324

19 481

0

margin,%

24.9%

20.4%

26.3%

n.a.

Farming

76 019

70 699

63 393

47 085

margin,%

40.4%

38.5%

32.8%

25.0%

Dairy

3 615

2 185

8 034

18 610

margin,%

14.6%

9.1%

27.3%

55.4%

Total EBITDA

152 000

130 694

116 857

61 182

margin,%

41.2%

41.6%

33.2%

18.7%

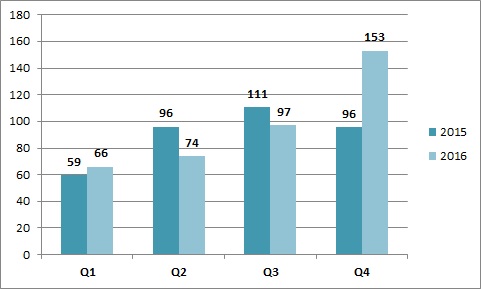

As we reported earlier, Astarta largely increased its sugar sales volume in the last quarter of Y2016:

The reason is boosting export, which in Q4 made 135k tons out of total sales of 153k tons. Factually in a view of higher export price vs. domestic one Astarta almost stopped sugar realization on Ukrainian market. Total Sugar segment revenues in reporting quarter made EUR 74M, which is much higher vs. both previous quarter and Q4 2015 (EUR 48M).

In total in Y2016 segment’s revenues of Astarta made EUR 174.5M, +15% y-o-y. Growth in natural terms (tons) comprised almost 8%, while average realization price grew by 7% up to EUR 423/t, which is slightly below our expectations, which were based on both domestic and international sugar price dynamics.

Sugar segment EBITDA in Y2016 made EUR 59M (with 34% margin), which is just slightly higher than in Y2015. Basing on previous Astarta financial reports, in H1 2016 segment’s EBITDA was at EUR 27M, so that despite growth of both average realization price and sugar sales volumes in tons, increase of EBITDA in H2 vs. H1 has been quite moderate. Main reasons: 1) selling price in H2 was not as high as we expected; 2) reclassification of part of G&A expenses from Unallocated expenses to Sugar (as a result increase of Sugar business direction G&A expenses grew vs. Y2015 by almost EUR 5M).

As a reminder, we note that in current season Astarta produced 505k tons of sugar, about 25-30% of this volume has been produced from sugar beets originated from 3rd parties, part of it – with tolling scheme (so that proceeds from this sugar realization will not be reflected in revenues of Astarta).

Along with it, we make a point that sugar inventory stock as of 31.12.16 has been rather high – in money terms it made EUR 84M (according to our estimations in natural terms it should be in range 250-280k tons). Taking into account good export price for Ukrainian sugar in January-February, recent growth of domestic sugar price in Ukraine, we expect additional EBITDA of about 35-40M after this stock realization.

So for the current season we can estimate EBITDA of Astarta sugar segment (w/o profits related to sugar beets growing, which is reflected in gain from biological assets revaluation) at about EUR 60-65M. Earlier we forecast that total segment’s EBITDA (taking into account sugar beets growing operations) in MY2016/17 would make EUR 90M. Now we can make some downward adjustment of this forecast in a view of already mentioned factors – lower than expected realization price in Q4 2014and reclassification of earlier unallocated expenses.

As for Farming segment, its results have been expectedly (taking into account good yields of main crops in current season) good. Total segment’s EBITDA in Y2016 made close to EUR 76M (which is slightly higher y-o-y), significant part of it – gain from biological assets revaluation (EUR 48.7M). Taking into account logistics problems, segment’s sales to 3rd parties in Q4 (EUR 49M) have been significantly below expectations.

On the other side, lower than expected sales in Q4 led to large grains stock of the company as of 31.12.16 (EUR 90.7M, which is by almost two times higher vs. previous year), which can lead to significant y-o-y growth of Astarta Farming business direction revenues in H1 2017. Though significant part of profits related to this realization is already booked by the company in form of gains from biological assets revaluation. According to our estimation in current season segment’s EBITDA of Astarta (disregarding sugar beets production profitability) will make EUR 60-70M with EBITDA per 1 ha at EUR 350-400.

In Y2016 Astarta demonstrated good results in soybeans processing. Being #1 soybeans processor in Ukraine (with market share in Y2016 at 21%), the company increased its revenues in this segment y-o-y by 48% up to EUR 75M (partially because of low base of Y2015 when it partially worked on tolling basis with MHP). Total Astarta soybeans processing volume in Y2016 comprised to 217k tons (+9% y-o-y), soybean meal output – by 8%, soybean oil – by 15%. Astarta exported 82% of segment’s production, which was much higher than in previous year. EBITDA of soybeans processing direction in Y2016 amounted to EUR 18.6M with 25% margin.

In Y2016 revenues in Cattle farming (Dairy) made slightly below EUR 25M, which is by 3.7% higher y-o-y, reason – growth of raw milk sales in natural terms (up to 103k tons). Astarta continues its efforts to increase segment’s efficiency, so we traditionally note growth of cows’ productivity by 5% vs. Y2015. In Y2016 Cattle farming EBITDA made EUR 3.6M with 14.5% margin (9% in Y2015).

In total in Y2016 EBITDA of Astarta made EUR 152M, which is by EUR 22M higher vs. previous year. By our estimations, in current season (October 2016 – September 2017), total EBITDA of the company is to make EUR 160-170M (vs. EUR 150M in previous season, formally increase is not large, but one should take into account that because of short-term influence of devaluation profitability of operations in FYs2014-15 has been somewhat overstated).

Important to note also the fact that net operating cash flow of the company (EUR 62M, taking into account paid interest of EUR 20M) adjusted on increased stock (+EUR 67M vs. 31.12.15, reasons are objective – growth of sugar production and problems with logistics which led to high grains stock as of 31.12.16) is generally in line with reported EBITDA (EUR 152M).

Balance Sheet structure

EUR k

31.12.16

31.12.15

Total Assets

574 570

491 639

Fixed Assets

280 014

251 594

Current Assets

294 556

240 045

Inventory

222 615

153 384

Equity

353 175

240 477

Debt

158 313

203 936

As for assets structure, its main changes have been related to revaluation of fixed assets (by EUR 53.5M) and above-mentioned increase of Inventory stock.

Financial structure of Astarta remains quite good. In Y2016 the company repaid more than EUR 50M of its debt, as of 31.12.16 its Equity (taking into account revaluation of fixed assets) made EUR 353M, Debt/Equity ratio stood at 0.45x. As for current debt structure, out of total debt of EUR 158M (as of 31.12.16) short-term liabilities made EUR 110M, along with it, we do not forsee any problems with liabilities renewal/refinancing in Y2017.

According to our estimations financial standing of the company remains quite good.

Popular on site:

Avangard reports Y2016 financials

MHP reports Y2016 financials

Kernel reports financials for Q2 FY2017