4 April 2018

Low global sugar prices led to significant worsening of Astarta performance in Q4 2017, while results for Y2017 as a whole have been relatively good even despite lower y-o-y MY2017/18 yields for main crops in some key for the company regions of Ukraine.

Key Financials for Q4 2017

EUR k

Q4 2017

Q4 2016

Sales

109 683

152 413

EBITDA

8 569

22 994

EBITDA margin, %

7.8%

15.1%

Net Profit

-12.3

4.0

Brief comments to Q4 2017 results

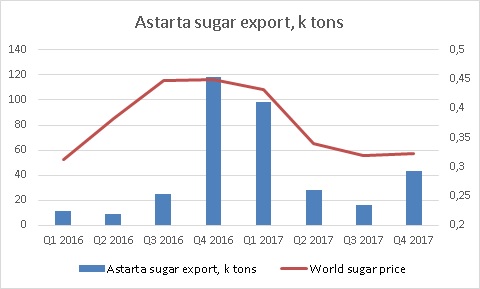

Significant decline of global sugar price (which with some delay led to decrease of Ukrainian domestic prices as well) had significant impact on activity of the company. First of all, average sugar selling price of Astarta in the last quarter of Y2017 made EUR 347/t vs. EUR 443/t in Q4 2016. Secondly Astarta significantly reduced its sugar export (43k tons in Q4 2017 vs. 118k tons a year ago).

As a result of two above-mentioned reasons total Astarta Sugar segment revenues declined y-o-y by 40% and comprised EUR 44.7M. Along with it segment’s profitability decreased even more substantially – in Q4 2017 its EBITDA margin made just 7% vs. 22% a year ago (with relatively stable net cost, i.e. profit from sugar beets growing is accounted at Farming P&L).

Also due to unfavorable market situation (significant decline of crushing margin) financial performance in soybeans processing segment worsened as well – revenues declined y-o-y by 33%, EBITDA margin fell from 32% in Q4 2016 to 6%.

In Farming segment results of Q4 have not been representative as main part of profits related to grains growing operation is booked by the company before the harvesting campaign as gain from biological assets revaluation.

Total Astarta EBITDA decreased from EUR 23M in Q4 2016 to EUR 8.6M in Q4 2017.

Key financials for Y2017

EUR k

2017

2016

Change, %

Revenues

458 601

368 891

24.3%

EBITDA

120.2

152.0

-20.9%

EBITDA margin, %

26.2%

41.2%

-

Net profit

61.8

82.6

-25.2%

Revenues breakdowns by business directions looked as follows:

EUR k

2017

2016

Change, %

Sugar

200.6

174.5

15%

Soybeans crush

72.7

75.0

-3%

Farming

219.4

188.1

17%

Dairy

31.8

24.8

28%

TOTAL

458.6

368.9

24%

Profitability of main segments in Y2017 looked as follows:

EBITDA

2017

2016

Sugar

61 710

59 120

margin,%

30.7%

33.9%

Soybeans processing

6 056

18 654

margin,%

8.3%

24.9%

Farming

39 080

76 019

margin,%

17.8%

40.4%

Dairy

17 150

3 615

margin,%

53.9%

14.6%

Total EBITDA

120 242

152 000

margin,%

26.2%

41.2%

Comments to Y2017 results

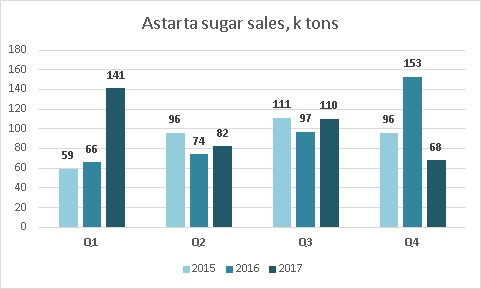

In Y2017 Astarta produced 463k tons of sugar (vs. 505k tons a year ago, reduction has been driven by decrease of sugar beets yield in key for the company regions, in particular, in Poltava region). As main part of segment’s sales in Y2017 was realization of sugar produced in Y2016, total sugar sales of Astarta in Y2017 increased y-o-y by 14% up to 444k tons.

General quarterly sugar sales dynamics of Astarta during lastest years looked as follows:

Active sugar export in Q4 2016 – Q1 2017 became main driver of total sugar sales growth in these periods of time, along with it one should note that sugar export volumes significantly declined starting from Q2 2017 (in line with global market trends – significant global sugar prices decrease took place in H1 2017):

As for Astarta sugar selling prices dynamics, due to significant decrease of sugar stocks in Ukraine (driven by active export in the first half of MY2016/17), domestic price remained at much (by 25-30%) higher level vs. global one during April-August, having declined only after sugar produced in MY2017/18 appeared at the market. It allowed Asrtarta to keep its average selling price at relatively high level till Q4 2017 (when it declined to EUR 347/t vs. EUR 421/t in Q3). So in Y2017 as a whole average sugar selling price of Astarta made EUR 425/t (relatively stable y-o-y).

Regarding profitability, EBITDA margin in Y2017 made 31% vs. 34% a year ago. Total EBITDA of the segment made EUR 62M (EUR 59M in Y2016) or slightly more than 50% of total EBITDA of the company in Y2017. We expect significant decrease of segment’s profitability in Y2018.

Farming segment’s results in Y2017 significantly worsened. While total grains and oilseeds sales to 3rd parties increased from EUR 84M in Y2016 up to EUR 141M (due to high Y2016 harvest stocks as of beginning of Y2017), profitability slumped – in Y2017 Farming EBITDA made EUR 39M (vs. EUR 76M a year ago).

Main reasons of such profitability dynamics are following. First is decrease of gains from biological assets revaluation (-EUR 13M y-o-y) due to decrease of main crops yields: corn – to 6.4t/ha (8.8t/ha in Y2016), sugar beets – 50t/ha (57t/ha), soybeans – 2.0t/ha (2.2t/ha), sunflower seeds – 2.0t/ha (2.3t/ha).

The second reason is cancellation of VAT subsidy starting from Y2017 (in Y2016 income made EUR 14.5M), the third one – growth of transportation expenses (Astarta sells main part of its grains on CPT-port terms).

Financial results of Soybeans processing segment worsened vs. previous year as well. Operating performance and revenues of the segment (EUR 73M in Y2017) have been relatively stable, but profitability largely declined (EBITDA margin made 8% vs. 25% a year ago).

Revenues of Dairy segment in Y2017 made EUR 32M, by 28% higher y-o-y. Main reason – growth of Ukrainian domestic prices for raw milk driven by dairy products global prices increase and active export (mainly butter). Sales in natural terms remained flat y-o-y at about 105k tons of raw milk.

Dairy segment’s EBITDA in reporting year increased from EUR 3.6M in Y2016 up to EUR 17M, reasons – above-mentioned raw milk prices growth and gain from biological assets revaluation which in Y2017 comprised EUR 10M (EUR 3.5M in Y2016).

Total EBITDA of Astarta in Y2017 made EUR 120M (-EUR 32M vs. Y2016).

Net operating cash flow of the company in last reporting year made EUR 59M, difference vs. EBITDA (EUR 120M) appeared mainly because of influence of gains from biological assets revaluation in Farming and Dairy segments on EBITDA of the company (EUR 45M). Operating cash flow has been mainly directed to investment activity (improvement of energy efficiency, expansion of grains and sugar silos).

Negative fact is that during several last years there has been significant difference between Astarta EBITDA and its operating cash flow. One of the reasons – influence of UAH devaluation on formal profitability of the company, but other reasons are to be analyzed in more details.

BS structure

EUR k

30.12.17

31.12.16

Total Assets

533 297

574 570

Fixed Assets

266 589

280 014

Current Assets

266 708

294 556

Inventory

211 831

236 354

Equity

347 800

353 175

Debt

145 708

158 313

As for assets structure, main changes in it vs. 31.12.16 have been related to decrease of finished goods stocks (due to logistics issues stocks as of 31.12.16 have been higher than expected).

Fixed assets decreased because of revaluation, but increased due to new investments, so that net effect has been insignificant.

Financing structure of Astarta remains good. As of 31.12.17 Equity of the company stood at EUR 348M, total debt – EUR 147M, so that Debt/Equity ratio – 0.4x. During FYs2015-16 Asratra decreased its debt burden by more than EUR 110M. As for current debt structure, EUR 101M is represented by current liabilities, along with it, we do not expect any problems with short-term debt prolongation or renewal.

Popular on site:

Ukrainian grains market 2017

Avangard reports Y2017 financials