2 December 2016

At least despite during last two quarters eggs prices in Ukraine have been relatively low, production volumes are stable. In addition in Q3 2016 EBITDA of USD 3M was reported by the company.

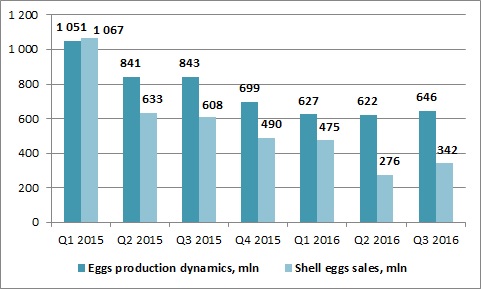

In Q3 2016 total shell eggs production of the company made 646 mln pieces, approximately on the level of two previous quarters. For the total 9m 2016 period production comprised 1 895 mln eggs, by 30% lower than in corresponding period of previous year. Quarterly dynamics during last period of time looks as follows:

Because of significant drop of Ukrainian domestic eggs prices in Q2 2016, Avangard decreased shell eggs sales and concentrated on processing. As a result, in 9m 2016 sales of shell eggs in natural terms declined y-o-y by more than 50%, whereas processing volumes grew by 33% and made almost 40% of total 9m 2016 production.

Average shell eggs selling price in Q3 made UAH 1.08 per egg (+8% to previous quarter, but -15% y-o-y), as in October retail eggs prices in Ukraine significanly grew, we expect increase of Avangard average price in Q4.

As for main financial performance figures, at the moment we can hardly estimate if they reflect real picture in the business (taking into account all uncertainties related to owner of Avangard in Ukraine), anyway, for Q3 and 9m 2016 in general they have been as follows:

Key financials

USD k

Q3 2016

9m 2016

9m 2015

Sales

46 328

111 105

176 477

EBITDA

2 982

-10 018

-84 300

EBITDA margin, %

6%

-9%

-48%

Net Profit

-6 162

-38 769

-150 486

During 9m 2016 Avangard paid less than USD 5M of interest under its debt pile of USD 345M (average effective interest rate is 2%. Reminder – a year ago Avangard restructured its Eurobonds in amount of USD 200M. According to restructuring scheme, until H1 2017 the company pays to bonholders only 25% of coupon, bonds maturity shifted till October’18.

BS structure remains weak, we see debt burden of the company as not sustainable under current market fundamentals.

Balance Sheet structure

30.09.16

31.12.15

Total Assets

548 383

624 171

Fixed Assets

392 310

430 357

Current Assets

156 073

193 814

Inventory

73 281

71 885

Equity

158 304

235 055

Debt

345 347

336 419

Popular on site:

Agrogeneration releases its financial report for 1H 2016

Industrial Milk Company reports Q3 2016 financials

MHP reports Q3 2016 financials