30 May 2017

Low profitability of main business segments of the group negatively impacts Kernel Holding financial performance, along with it financial standing of the largest Ukrainian sunflower seeds crusher remains good.

Key Financials*

USD M

Q3 FY2017

Q3 FY2016

9m FY2017

9m FY2016

Sales

615

607

1 658

1 606

EBITDA

81

99

283

301

EBITDA margin, %

13%

16%

17%

19%

Net Profit

33

92

192

232

Main business segments

USD M

Q3 FY2017

Q3 FY2016

9m FY2017

9m FY2016

Oilseeds crush

Sales

338

347

882

888

EBITDA

30

37

78

106

Grains trading

Sales

268

255

745

690

EBITDA*

26

36

96

96

Farming

Sales

72

10

344

352

EBITDA

34

33

135

123

In reporting quarter due to decrease of sunoil sales volumes total proceeds of the company in this segment declined by 3% vs. corresponding period of previous year to USD 338M. Crushing margin remains close to the minimal for the last decade level (segment’s EBITDA margin in Q3 FY2016/17 made 9% vs. 9.4% in previous quarter and 10.7% a year ago).

As for financials results of Sunflower Oil segment for 9m FY2016/17, its revenues remained flat y-o-y (USD 882M), along with it EBITDA decreased by 26% to USD 78M.

At the current stage management of the company does not expect significant changes in profitability of crushing industry in the short-term period of time (total sunflower seeds harvest in Ukraine in Y2017 is expected to be below previous year’s record, so there will be no improvement on the market in terms of raw materials supply).

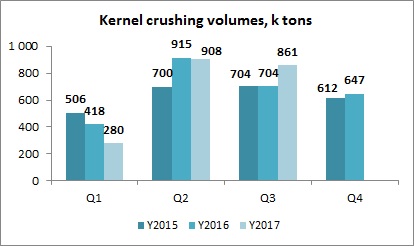

As for crushing volumes, Kernel management expects that in FY2016/17 they will reach 3M tons (vs. 2.7M tons a year ago). So it is expected that in the last quarter of FY 2016/17 (during April-June) sunflower seeds processing volumes will be at 850-900k tons, which means that crushing plants of the group will work with capacity utilization close to 100%:

Relatively large inventory stock of sunflower seeds as of 31.03.17 (USD 127M vs. just USD 37M a year ago) is indirect evidence that crushing volumes in Q4 will be better y-o-y.

Volume of Kernel grains trading in Q3 FY2016/17 made 1.39M tons, which has been slightly lower than in previous quarter (1.525M tons) and in Q3 FY2016 (1.415M tons). Segment’s revenues made USD 268M (+5% y-o-y), but EBITDA margin dropped – from 8% a year ago to just 2% (Kernel management notes rather aggressive market stance of international traders active on Ukrainian grains market).

Good results have been showing by Silo segment of the group (EBITDA at USD 8.7M vs. USD 3.1M a year ago), reasons – good grains&oilseeds crop in Ukraine in Y2016) and higher level of moisture in grains vs. previous year.

As for Port terminals business direction – in reporting quarter EBITDA made USD 12.5M with margin of over 80% (vs. last year’s 66%).

Sales in Farming segment in Q3 FY2017 comprised USD 72.5M, EBITDA – about USD 34M. Kernel management expectations of segment’s EBITDA for the whole financials year – about USD 140M, which is in line with our previous expectations that EBITDA margin of Kernel’s Farming direction would make not less than 40%.

Balance Sheet structure

USD M

31.03.17

31.12.16

31.03.16

Total Assets

1 917

1 920

1 590

Fixed Assets

756

765

785

Current Assets

1 161

1 155

804

Inventory

584

644

295

Cash

205

69

137

Equity

1 129

1 089

953

Debt

572

619

435

Main changes in assets of the company vs. last year’s level – growth of inventory (stocks of sunflower seeds for further crush increased by USD 90M, stock of finished production in Sunoil segment – by USD 74M, stock of grains for further resale – by USD 82M). VAT Receivables on the balance sheet of the company decreased both y-o-y (by USD 31M) and vs. last quarter (by USD 67M).

Financing structure of the group remains rather good. After recent Eurobonds placement (for USD 500M) the structure of debt by its maturity improved as well (due to refinancing of ST debt with Eurobonds). Current Debt/Equity ratio of Kernel is close to 0.5x, Equity (USD 1.129bln as of 31.12.17) fully covers Fixed Assets and is main source of assets activity for the company.

Overall financial standing of Kernel remains rather good, which is especially important, taking into account quite ambitious investment plans (Kernel plans to double its port terminal capacities, significant increase of land bank, acquisition of new oilseeds crushing capacities).

Management of the company expects completion of new acquisitions – agri-holdings UAI (with land bank of 190k ha) and Agro-Invest (40k ha) – in the nearest future.

Popular on site:

Ukrainian sunflower seeds and oil market

Ukrainian soybeans market is ready for new records

MHP reports Q1 2017 financials