26 October 2017

Despite continuing decline of sunflower seeds crushing margin, during reporting period earned more than USD 300M of EBITDA.

Key Financials*

USD M

Q4 FY2017

Q4 FY2016

FY2017

FY2016

Sales

510

382

2 169

1 989

EBITDA

36

47

319

346

EBITDA margin, %

7.1%

12.3%

14.7%

17.4%

Main business segments

USD M

Q4 FY2017

Q4 FY2016

FY2017

FY2016

Oilseeds crush

Sales

326

245

1 208

1 134

EBITDA

22

23

100

129

Grains trading

Sales

198

146

1 042

917

EBITDA*

15

12

110

107

Farming

Sales

38

6

381

358

EBITDA

5

23

144

146

In last quarter of FY2017 Kernel significantly increased sales volumes in Sunflower Oil segment (+42% y-o-y up to 320k tons), which allowed the company to increase segment’s revenues in both Q4 and the whole financial year.

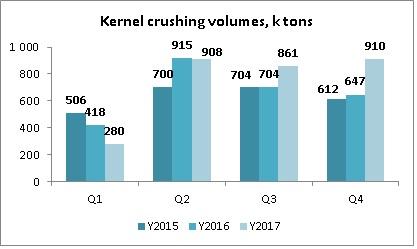

Volumes of oilseeds crush and sunflower oil sales in reporting financial year have been record-high for the history of Kernel activity. In FY2017 Kernel crushed 2.96M tons of sunflower seeds, produced and sold 1.2M tons of sunflower oil. Crushing dynamics during last years looked as follows:

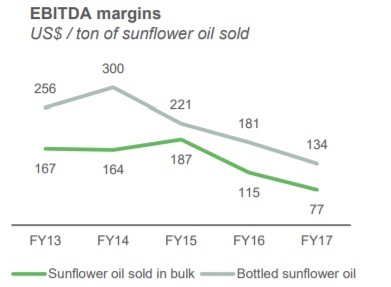

Sunseeds crushing margin of the company (and it is the case for the whole industry) remains close to historical minimal levels – in Q4 FY2017 it made USD 70 per 1 ton of sunflower oil, average figure for the whole FY2017 - USD 83. Kernel management expects that in new season crushing margin of the company can decrease even more, but in the middle-term there will be some recovery up to more than $100 per 1 ton of sunoil. Crushing margin dynamics is represented during last period of time looks as follows:

Total Sunflower Oil segment EBITDA in FY2017 amounted to USD 100M (vs. USD 129M a year ago and USD 213M in FY2015).

According to Kernel management expectations Ukrainian sunflower seeds harvest in new season is to make about 13M tons (vs. 15.2M tons in MY2016/17, which is more or less in line with our estimations, while according to official statistics it total crop in last season made 13.6M tons). So, we expect that competition between crushers for raw materials in new season will only grow. Despite this expectation Kernel intends to increase annual volume of crush up to 3-3.2M tons (current capacities are close to 3.5M tons), which means the company is ready to operate with really low margins to push small crushers out of the market.

Kernel’s grains trading volume in FY2017 made record-high 5.060M tons, which led to y-o-y growth of segment’s revenues by 12.5% up to USD 923M. Along with it due to high competition between different (both local and international) players of Ukrainian grains market export margins are going down as well – in FY2017 segment’s EBITDA margin comprised 2.5% (USD 4.5/t) vs. 5.6% during previous three years (apart from growing competition we note that in previous years margin was not sustainable due to positive influence of UAH devaluation).

Good results have been showing by Silo segment of the group (EBITDA at USD 40M vs. USD 23.4M a year ago), reasons – good grains&oilseeds crop in Ukraine in Y2016 and higher level of moisture in grains vs. previous year.

As for Port terminals business direction – in reporting financial year EBITDA made USD 47.6M with margin of over 80% vs. last year’s 66% (in FY2017 total port terminals transshipment volume of Kernel made 6.1M tons).

Final results of Farming segment in FY2017 have been in line with our previous expectations – segment’s revenues (taking into account Intragroup sales) made USD 381M (+6.5% y-o-y), EBITDA – USD 143.6M with margin of 37.7% (our forecast was 40%). Vs. previous financial year’s results segment’s profitability almost has not changed (in FY2016 EBITDA made USD 146M with margin 41%), but we note two important points: 1) positive (but not sustainable) influence of UAH devaluation on nominal profitability of operations in previous year; 2) lower (by USD 23M) income from biological assets revaluation in FY2017.

So disregarding two a/m points segment’s results have been better vs. previous financial year, main reason – higher vs. previous year crops yields – for corn in made 8.9t/ha (vs. 7.2t/ha a year ago), wheat – 5.8t/ha (5.1t/ha), higher yields have also been shown for sunflower seeds and soybeans.

We also note that in FY2017 Kernel obtained Other operating income from VAT benefits in amount of USD 31M (USD 23.4M a year ago). This income has also been related to Farming segment, we expect its decrease in FY2018.

In total management of Kernel expects worsening of Farming segment performance in new season. Main reasons – decrease of yields from record-high level of previous year at the core land bank of the group (due to far less favorable weather conditions in some key regions of Kernel farming operations) and low expected yields at new land bank (previously operated by UAI and Agro-Invest Ukraine recently purchased by Kernel).

If Kernel can be related to middle cost agri-producers (so their yields are at middle+ level), UAI is classical for Ukraine low-cost producer (“low cost – low yields” model). For example, basing on Kernel expectations if corn yields at “core” land will make 7.3t/ha, at new – just about 5.5t/ha. The same picture is for other crops.

Balance Sheet structure

USD M

30.06.17

30.06.16

Total Assets

2 009

1 509

Fixed Assets

888

789

Current Assets

1 121

720

Inventory

643

391

Cash

143

60

Equity

1 158

997

Debt

655

320

Main changes in assets structure of the company we as follows:

- Increase of assets by USD 232M due to new acquisitions (including future crops in form of biological assets of USD 59M, which is about USD 300/ha, while for “core” land this figure is about USD 450/ha

- growth of Inventory (sunflower seeds stock grew by USD 76M up to USD 90M, sunflower oil – by USD 84M up to USD 204M, which allowed the company to increase its volumes of sunseeds crush and sunoil sales in Q1 FY2018)

- growth of Cash from USD 60M up to USD 143M

Financing structure of the group remains rather good even despite growth of debt (from USD 320M as of 30.06.16 up to USD 655M). After recent Eurobonds placement (for USD 500M) the structure of debt by its maturity improved as well (due to refinancing of ST debt with Eurobonds). Current Debt/Equity ratio of Kernel is close to 0.56x, Equity (USD 1.157bln as of 30.06.17) fully covers Fixed Assets and is main source of assets activity for the company.

Overall financial standing of Kernel remains good.

Popular on site:

Ukrainian sunflower seeds and oil market

Ukrainian soybeans market is ready for new records

MHP reports Q2 2017 financials