13 December 2016

Because of certain sales in natural terms decline in last reporting quarter revenues of Metinvest slightly decreased. On the other side, due to some prices recovery and cost reduction (largely in a view of UAH devaluation) EBITDA more than doubled.

Key financials

USD M

Q3 2016

Q3 2015

-

9m 2016

9m 2015

Sales

1 688

1 747

-

4 568

5 397

EBITDA

409

193

-

989

816

EBITDA margin, %

24%

11%

-

22%

15%

Metallurgical division accounted for 82% of total Metinvest proceeds in Q3 2016. Revenues in the segment declined y-o-y by 2% due to 10% drop in sales (in tons) of semi-finished products. On positive side is y-o-y increase of average realization prices by 2-3% (along with it growth of prices vs. H1 2016 made close to 20%). Taking into account latest steel prices dynamics in China (growth by about 50% during October-November to the highest levels for last two years) we expect better results in Q4 2016- beginning of Y2017.

For the whole 9m 2016 decline in sales of Metallurgical direction made almost 14%, mainly on the back of average realization prices decline.

As for Mining direction, in last reporting quarter realization of iron ore (concentrate and pellets) in natural terms declined by 10% (y-o-y). This fact mainly resulted from lower rate of overburden removal due to unsatisfactory condition of mining transportation equipment. It can be direct consequence of lower than necessary Group’s maintenance expenses in H1. On the other side in Q3 2016 average realization price of iron ore increased by 4% y-o-y and by more than 20% vs. H1 2016.

In Q3 Metinvest EBITDA made USD 409M, which is lower than in Q2, however, by more than two times higher than in Q3 2015 (USD 193M). Along with it, we can note on negative side that Net Operating Cash Flow of the company in last reporting quarter made USD 257M, by USD 152M less than EBITDA. We would name two main reasons of this fact – 1) USD 86M of EBITDA is share of joint ventures – mainly Zaporizhstal and YuGOK; 2) growth of Inventory and Receivables (disregarding VAT Receivables) during Q3 made USD 97M.

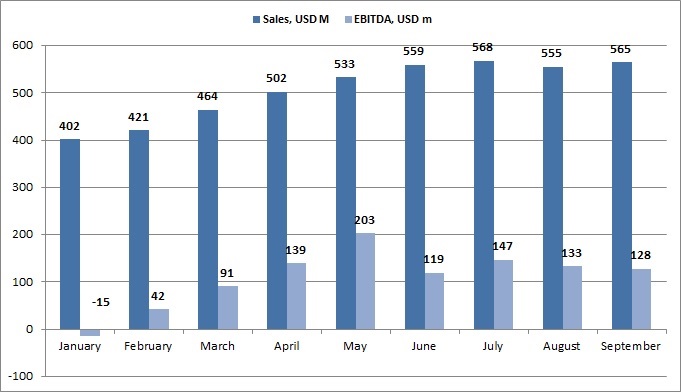

Interest payments by Metinvest made USD 4M in July, USD 6M in August, USD 19M in September. The company continues negotiations with creditors on restructuring of its obligations and plans to finalize them in the beginning of Y2017.

Popular on site:

Agrogeneration releases its financial report for 1H 2016

Industrial Milk Company reports Q3 2016 financials

MHP reports Q3 2016 financials