23 October 2017

Net sales of ATB-Market in Y2016 made UAH 48.3bln, its EBITDA – about UAH 2.2bln, net profit – UAH 1.65bln.

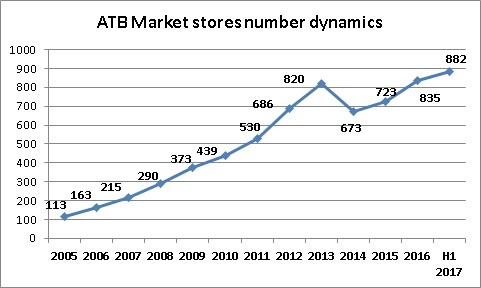

We note that in Y2016 ATB-Market increased its sales y-o-y by 25%. Main factors of growth – prices inflation and network expansion – in last year ATB opened 112 new stores as of the year-end their number was 835. In H1 2017 chain increased by another 47 new stores:

As for profitability of activity, ATB-Market EBITDA in Y2016 amounted to UAH 2.2bln, which has been lower than a year ago (UAH 3bln in Y2015). EBITDA margin decreased from 7.7% to 4.6%. Along with it we should note that the company pays significant amounts of rental fees to related companies which own real estate objects – ATB-Invest, ATB-Torgstroy, LLC Real-Estate and others.

By our estimations, total EBITDA of the group, which includes operating income of main operating company ATB-Market and above-mentioned related asset-holders, in Y2016 made not less than UAH 4.4bln (in Y2015 – UAH 4.8bln).

Operating efficiency of the chain remains on the good level – Inventory Period in Y2016 has been at below 30 days, which is the best figure for Ukrainian food retail industry. Taking into account Payables Period (average terms of payments towards suppliers) makes about 60 days, negative financial gap of 30 days provides ATB with financial source for its development in amount of about UAH 3bln.

As a reminder two main sources of chain development for ATB are Equity (reinvested income) and open credit provided by suppliers. ATB does not utilize bank loans in its assets financing.

See all news

All about ATB-Market

Popular on site:

Ukrainian sunflower seeds and oil market

Ukrainian grains market

Ukrainian soybeans market is ready for new records