6 July 2017

Financial performance of the company worsened vs. previous month due to lower sales of steel products and decline of prices for iron ore.

According to latest monthly report, in April Metinvest revenues made USD 603M, which has been by 9% lower than in previous month (in March proceeds of the company made USD 663M).

EBITDA margin of the company during latest months has been relatively stable, in April it made 23% (EBITDA in absolute terms made USD 136M) vs. 28% in previous month (USD 183M, disregarding loss in amount of USD 87M related to loss of control by the group over several enterprises situated at the non-controlled by Ukrainian government Donbass territory).

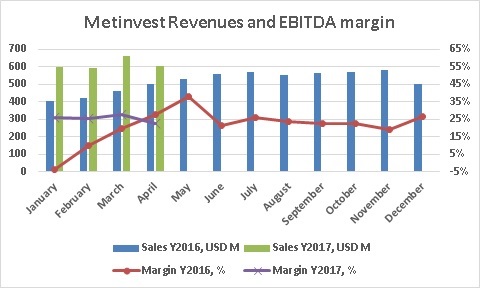

Metinvest revenues and EBITDA margin dynamics since the beginning of Y2016 look as follows:

In reporting month Metallurgical division revenues (USD 478M, -10% vs. previous month) made about 80% of total Metinvest sales (the share have been rather stable during latest months). The company decreased its sales of finished production in tons (by 22% vs. March to 597k tons), but increased realization of semi-finished products (+60% to 184k tons mainly at account of pig iron, which price increased vs. March by more than 10%, while prices for other types of production have been relatively stable).

Segment’s EBITDA has been at USD 36M with the margin of 7.5% (in March – USD 64M disregarding above-mentioned one-time loss with margin of 12%). Decrease of margin can be related to higher prices for raw materials – iron ore (here there is just Intragroup redistribution of profits between divisions) and coking coal.

As for Mining division, its revenues (disregarding Intragroup sales) remained close to the level of previous month (USD 125M). EBITDA margin of division made 37% (vs. 54% in March), we note decrease of margin due to decline in average realization price for iron ore vs. previous month by 24%.

Operating cash flow dynamics of the company worsened – in April Metinvest showed operating cash outflow (before income tax and interest payments) of USD 24M, main reasons – growth of Inventory (by USD 54M) and Receivables (by USD 64M disregarding changes in VAT Receivables).

In April Metinvest spent USD 23M for investment activity. Cash balance of the company decreased from USD 215M as of 31.03.17 to USD 137M as of 30.04.17.

See all news

All about Metinvest

Popular on site:

Interpipe - fighting for survival

Ukrainian crude steel output in June was close to 1.6M tons

Epicenter-K - leader of Ukrainian DIY retail market