29 October 2017

Since the beginning of Y2017 EBITDA of the company already exceeded USD 1bln.

According to Metinvest report for August total revenues of the company in reporting month made USD 745M, almost unchanged vs. three previous months and by 34% higher y-o-y.

EBITDA margin of the group also remains relatively stable, in August it made 21% (with EBITDA in money terms at the level of USD 157M vs. USD 160M in July, since the beginning of Y2017 total Metinvest EBITDA already exceeded USD 1.150bln).

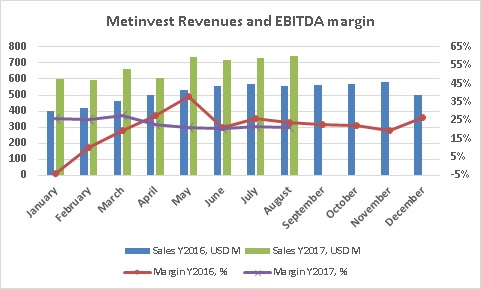

Metinvest revenues and EBITDA margin dynamics since the beginning of Y2016 look as follows:

In reporting month Metallurgical division revenues made USD 616M (or 81% of total Metinvest revenues, segment’s revenues remain quite stable during last several months). As for revenues structure, we specially note presence of re-sale of square billets (55k tons for USD 26M) and long products (14k tons for USD 8M). In this case most likely it represents sales of DMK production (the rumors have it that Metinvest realizes full control over DMK operations).

Due to above-mentioned re-sale of square billets, sales of semi-finished production remained flat vs. previous month (269k tons for USD 104M). Volume of finished production sales decreased vs. July by 6% (to 709k tons). So total sales of Metallurgical division in natural terms made 978k tons (-4% vs. previous month).

Selling prices of Metallurgical division have been lat vs. July, EBITDA margin made 6% (relatively stable since June).

As for Mining division, its revenues (disregarding intragroup sales) increased vs. previous month by USD 21M up to USD 141M (one of the factors should be launching of operations by DMK, Metivest supplies iron ore products to this mill).

Average iron ore products selling price after sharp decline during previous months increased in July (by 23% vs. June for iron ore concentrate, by 8% - for pellets) and August (+8% m-o-m for concentrate, +26% for pellets). EBITDA margin of the segment in reporting month comprised 45% (EBITDA made USD 128M).

As for operating cash flow, after good figures during May-July, situation worsened in August. Disregarding factually paid income tax and interest expenses, in August operating cash flow amounted to USD 70M (vs. EBITDA disregarding result of joint ventures (Zaporizhstal and YuGOK) at USD 138M). Main reason - growth of receivables (by USD 53M disregarding VAT Receivables, which can be also connected with re-start of iron ore supplies to DMK).

In reporting month Metinvest directed USD 65M for investment activity (since the beginning of Y2017 – USD 247M, disregarding investments realized by joint ventures), so amount of cash of the company decreased from USD 424M as of 31.07.2017 to USD 342M.

See all news

All about Metinvest

Popular on site:

Interpipe - fighting for survival

Interpipe can establish joint venture with Valourec

Epicenter-K - leader of Ukrainian DIY retail market