27 February 2017

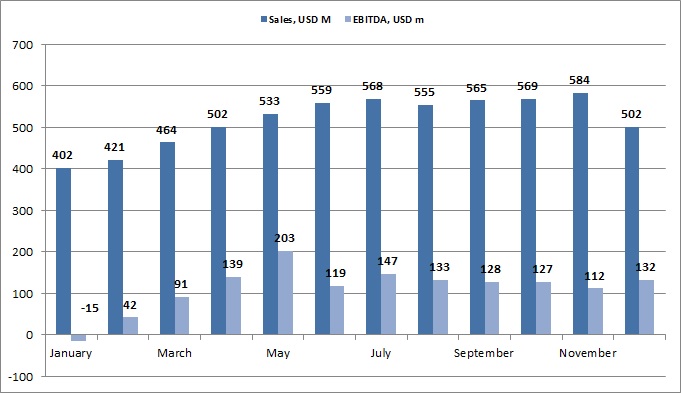

EBITDA of the largest Ukrainian steel manufacturer increased up to USD 132M vs. USD 112M in November, operating cash flow improved as well, but still lags EBITDA, at least partially due to weak payment discipline of some key customers.

According to the statement of the company in December’16 its revenues made USD 502M, which is much less than November figure (USD 584M). Main factors are drop in flat products realization in tons m/m by 27% (to 462k tons vs. 630k tons in November, partially – because of lower realization at Zaporizhstal due to maintenance repair works in reporting period) and decrease of iron ore pellets sales m/m by 57%.

On the other hand realization prices of the group increased: by 9% vs. previous month for semi-finished production of metallurgical division, by 2.3% for finished production and by 15% (on average) – for iron ore products.

In last reporting month Metallurgical division accounted for 80% of total Group sales (USD 403M) with EBITDA margin of 7% (10% in November and 15% in October), Mining Division – 20% of Group sales with 40% margin (stable vs. November despite growth of realization prices).

In total in Y2016 revenues of Metinvest made USD 6.2bln (vs. USD 6.8bln in Y2015), EBITDA – 1.359bln:

We note that despite growth of realization prices net cost of the company increased as well – mainly at account of skyrocketing in Q4 2016 coking coal price (the company is self-sufficient with own coking coal by about 50%).

Additional negative factor – operating cash flow dynamics is far worse vs. EBITDA:

USD M

July

August

September

October

November

December

EBITDA

147

133

128

127

112

132

OCF before changes in WC*

110

104

104

93

86

83

NOCF

41

169

47

33

12

41

Main factors of such dynamics:

- Growth of Inventory (by USD 200M during H2 2016), which is not negative as steel&ore prices during have been growing during reporting period of time.

- Increase of Receivables (by USD 185M during H2 2016), generally offset by growth of Payables by USD 232M, but structure of both should be analyzed additionally. In any case in latest report Metinvest stated about weak payment discipline of some key customers, which can lead to impairment of receivables in amount of up to USD 225M in Y2016.

Two additional positive factors for the company are still growing in January-February world steel&ore prices and finalization of negotiations with bondholders on debt restructuring.

Highly negative factor – escalation of the conflict in the East of Ukraine (large impact on operations of Avdeevka Coke – main coke producer of the Group) and disruptions of supplies to/from not controlled by Ukraine territory when part of Metinvest production facilities are situated.

See all news

All about Metinvest

Popular on site:

Interpipe - fighting for survival

Ferrexpo reports its production for Q4 2016

Epicenter-K - leader of Ukrainian DIY retail market