5 March 2017

Positive week for Astarta Holding, grains prices are close to the highest levels since the start of current season, iron ore remains at above USD 90/t.

Stocks

Largest Ukrainian companies share prices weekly dynamics

Company

Currency

Price

Weekly change, %

Monthly change, %

Capitalization, USD M

MHP

USD

9.50

3.8%

5.6%

1 004

Kernel

PLN

77.0

-2.5%

0.2%

1 515

Ferrexpo

GBx

157.3

-2.2%

1.1%

1 134

Astarta

PLN

68.0

11.2%

10.7%

420

Ovostar

PLN

93.8

3.0%

3.6%

139

IMC

PLN

9.35

-3.0%

4.7%

72

During reporting week the best results among Ukrainian largest public companies have been demonstrated by Astarta, which share price grew by more than 11%. Total capitalization of the company increased from USD 374M up to current USD 420M. On previous week-end the Ukrainian largest sugar producer and exporter reported its preliminary financial performance figures for Y2016, which have been generally good (but somewhat below our expectations for the last quarter of the year).

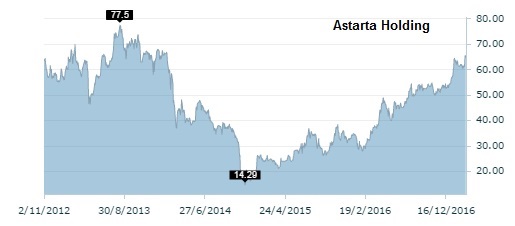

Astarta share price dynamics during last years looked as follows:

As for other Ukrainian public companies, we note progress of MHP, which quotations grew by 7% during last three weeks and now reached the highest level for the last five months. Capitalization of the largest Ukrainian poultry producer exceeded USD 1bln again. Despite this fact MHP share price dynamics during last period of time lags behind other largest Ukrainian public agri-holdings – Kernel and Astarta, it still trades by 50% lower of Y2013 peaks:

Commodities

Iron ore price in China remains at above USD 90/t level for the third consecutive week, while rebar futures in Shanghai added to its value another 3% (monthly gain is about 15%), amid further talks on Chinese steelmaking capacities decrease. China will cut steel capacities by 50M tons and coal output by 150M tons this year said its top economic planner on Sunday, which should support steel prices in the future.

Corn price added 3% during last week in Chicago (being close to the highest level since June’16), which resulted in some increase of corn price in Ukrainian ports, so that in the second half of the week CPT price stood at USD 158-160/t.

As because of active export wheat stocks in Ukraine significantly declined, we can expect that Ukrainian wheat premiums can start to gradually increase (though it will be restricted by Russian wheat supply (Russia has very big wheat stocks at the moment due to record-high harvest and below expected export volumes). Wheat prices at Ukrainian ports during last week have been in the range USD 159-175/t (depending on quality).

Finally we note certain rebound of local sunflower oil prices, which during reporting week increased from USD 720/t up to USD 730-735/t (CPT). Soybeans prices have been at USD 380-385/t.

Popular on site:

Ukrainian Y2016 agri-commodities export digest

Ukrainian sunflower seeds and oil market

Largest Ukrainian retailer ATB-Market - history of success