For more than fifteen years, Nibulon has been one of the largest Ukrainian grain exporters.

Despite significant competition with both Ukrainian and international traders, thanks to its modern asset base and good vertical integration, Nibulon continues to occupy a significant share of the Ukrainian grain market.

For thirty years Oleksiy Vadatursky, the Hero of Ukraine, has been the main owner and CEO of the company.

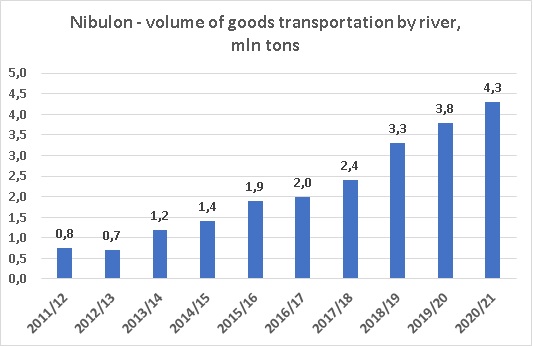

The absolute difference between Nibulon and other large players in the grain market and its competitive advantage is the use of a water transportation system to ship grains from river elevators to the port. The share of river logistics in the total volume of grain transportation by the company in recent years has been 70-80% (for all other Ukrainian and international competitors, this share is insignificant).

To implement such a large-scale logistics project, Nibulon built a network of river elevators on the Dnieper and the Southern Bug, as well as more than 85 vessels of various types at its own shipyard Liman (having invested more than $ 600 million in its river fleet over the past 10 years).

The company also owns a port terminal in Mykolaiv with a total transshipment capacity of more than 5 million tons of grain per year, more than 100 railcars, as well as its own fleet of vehicles. The land bank of Nibulon is about 80 thousand hectares.

Nibulon effectively implements the grain supply chain from farmer to vessel. As a rule, grain is transported from the farm by road to the river terminal, where it is dried, cleaned, accumulated, and transshipped onto barges (or wagons), which deliver the grain to the port terminal. In the port terminal grain is loaded onto vessels, which deliver it to destination - to the countries of Europe, Africa, and Asia.

Due to the location of the grain elevators (with an emphasis on the river), historically Nibulon has a stronger position in wheat exports, but weaker in corn exports.

Start of business

Nibulon was created in 1991 and initially engaged in barter operations - exchanging fuel and fertilizers from collective farms for agricultural products, which were then exported. Also, the company gradually began to build up its land bank, as well as acquire inland silo capacities.

Unlike many other competitors, already in the 90s, Nibulon stood out with the relative transparency of its activities, which allowed the company, the first in the country, to attract a loan from the International Bank for Reconstruction and Development in the amount of $ 5 million already in 1998.

In 2002-03, a grain terminal was built in the Mykolaiv seaport, and Nibulon started to gradually increase export supplies of Ukrainian grain. One of the most successful seasons for the group was the marketing year 2005/06, when Nibulon exported 1.7 million tons of grain, occupying more than 15% of the total market. During the same time, the company's annual revenue exceeded $ 100 million, while the operating profitability averaged about 10%.

2006 and 2007 were not very successful for the entire Ukrainian agricultural market in terms of yields (the annual wheat harvest in these years was about 14 million tons, compared to 19 million tons in 2005), which led to a decrease in exports. In 2007, Ukrainian exports of wheat amounted to only 1.2 million tons, corn - about 2 million tons. At the same time, export quotas were introduced, and Nibulon exported out of Ukraine only a few hundred thousand tons of grains. In our opinion, own farming operations helped the company a lot to stay afloat in those years.

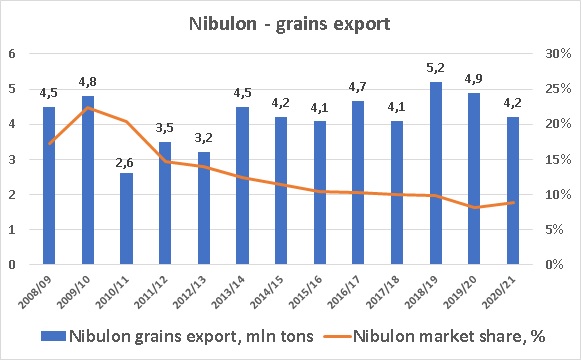

Everything changed in 2008. In general, 2008 will be remembered by all of us as the beginning of the global financial crisis. But for the Ukrainian agricultural market, it became the year of a record grain harvest. The wheat harvest amounted to 25 million tons (record-high since Y1990), corn - 11.5 million tons (at those time - a record for Ukraine). Nibulon came to this moment fully prepared, having exported 4.5 million tons of grain in the 2008/09 season - more than 20% of the total, becoming the number one exporter of Ukrainian grain.

Shipbuilders

With the increase in the yield of grains and oilseeds in the country, logistics problems became more and more acute. In railway transportation services there was one monopolist, Ukrzaliznytsia, which dictated its own, not always clear rules to the cargo owners. The idea of Vadatursky was the re-establishing of river navigation in Ukraine, which after the collapse of the Soviet Union almost disappeared.

In 2009, Nibulon ordered a series of vessels at the Okean Nikolaev shipyard. The shipyard constantly missed the deadlines of the order, and this forced Nibulon to look for new solutions to implement its ambitious idea. Thie decision was made to acquire in 2012 a small Mykolaiv shipyard Liman. More than $ 35 million was invested in the acquisition and its subsequent modernization.

In parallel, in 2009, Nibulon launched the construction of a series of river terminals on the Dnipro and the Southern Bug. The total investment program announced in 2009 (a crisis year!) was $ 150 million. The first river elevators were opened in 2010-11, and already a few years later Nibulon became the absolute leader in river logistics in Ukraine, far ahead of its competitors.

The company partially financed the construction of elevators and barges with the involvement of credit resources. Among the lenders were top-notch international banks such as the EBRD, World Bank, European Investment Bank, ING, BNP Paribas, and others.

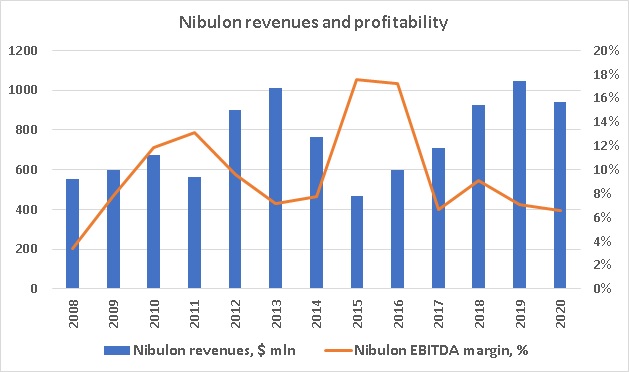

Nibulon's market share and financial performance continued to improve. The market share in 2009-2011 was about 20%, the average revenue during this period was about $ 600 million per year with good profitability. On average, the trading EBITDA margin was about 7-8% or $ 12-13 per ton of exported grain.

Defense mechanism

In 2010, a new strong player appeared on the grain trading market of Ukraine. The name of this player was Khlebinvestbud, and this name was associated with the well-known member of the Ukrainian parliament Yuriy Ivanyushchenko (reportedly he was very well connected with Victor Yanukovich).

With full political support, which consisted primarily in establishing of export quotas and “correct” distribution of quotas between market players, Khlebinvestbud began to increase its turnover, substituting other players' shares (in 2011/12 its market share made 14%). At the same time, even taking into account "special" conditions, it was difficult for this company to compete with such a company as Nibulon. And then other tools were activated. According to information from various sources, Vadatursky was made an offer that cannot be refused. But he refused.

Then the full pressure was put on the business via different channels. The only son of Alexei Vadatursky was even taken under arrest, after which there were rumors of the transfer of 50% of the company's stake to Ivanyushchenko. However, in Nibulon itself, this information was denied. There have been no changes in the official structure of the company's ownership.

By our estimation, the fact of Nibulon's cooperation with the EBRD, as well as other international banks, played a significant role in protecting the company from the raiders. At that time, the Ukrainian authorities were still declaring their intention to move towards the EU, and Yanukovych could not allow himself to mess with international banks over Nibulon.

But as a primary force behind the strong stance, we should mention the character of Mr. Vadaturskiy himself. In his BigMoney project, well-known Ukrainian businessman Evgeny Chernyak told a story on how he saw Aleksey Vadaturskiy at this period of time, alone, without bodyguards, leaving his modest car and heading for a business meeting.

Nibulon continued its activities, occupying about 15% of the market, while Hlebinvestbud, for well-known reasons, stopped its operations.

Kings of the river

2014-15 became the most severe test for Ukraine in its entire history. The agricultural industry was one of the few in which the situation remained relatively good. Moreover, both the yield of the main crops and the total grains harvest increased at a high rate.

Since the 2013/14 marketing year, Nibulon's grain exports have been always at above 4 million tonnes. At the same time, due to the general growth of Ukrainian grain exports, its market share has been constantly decreasing. The company does not focus on maintaining its market share (for this, it would first need to invest in expanding its port grain handling capacities, as Kernel does, for example).

Nibulon's focus is on river logistics and thus improving its vertical integration. Barges, tugs, and river silos are under construction. The company is also engaged in the dredging of the Dnipro and the Southern Bug. All this leads to the fact that due to the advantages in logistics, Nibulon wins price competition in a fairly wide radius around its river elevators and does not face many problems in ensuring transshipment volumes through the port terminal. And it is vertical integration that allows the company to make money in different market situations, in the face of increased competition in the grain market and falling exporters' margins.

The dynamics of Nibulon river transportation volumes are impressive - in the last five years alone, they have more than doubled.

At the beginning of 2021, Nibulon's fleet consisted of about 90 vessels - the company has almost completed its shipbuilding program.

In 2018, Nibulon announced his interest in entering the Egyptian market - Alexey Vadatursky told about plans to invest $ 1.1-1.2 billion in the Nile's logistics infrastructure. These plans have not yet been implemented - for the current financial standing of the company investment of such a scale would probably be too much.

Financial performance

Nibulon's revenue in recent years has been in full accordance with the dynamics of exports, but profitability has declined. Until 2015-16, the company's average EBITDA margin was about 10% (in 2015 and 2016, profitability increased due to the devaluation of the hryvnia).

Since 2017, the performance has worsened - the average profitability of the business was about 7% (including farming activity). This is not a very high figure, given that Nibulon earns at every link in the supply chain - from the field to the vessel, so this margin includes the profit of assets related to river logistics, as well as the profit of the port terminal.

Nibulon's debt burden has historically been considerable. But what has always distinguished Nibulon on the positive side is the financing term structure in which long-term obligations predominated. The debt repayment schedule almost always corresponded to the planned return on investment. In our opinion, this has always been one of the key factors in the financial stability of the company.

2020 was not the most successful year for the company. In the 2020/21 season, Nibulon exports amounted to 4.2 million tons - the lowest value since 2017, while the profitability of grain logistics in Ukraine - both domestic and port - was at a very low level (as can be seen from the reports of Nibulon's competitors). All these factors led to relatively low profits for the company as a whole.

In the 2021/22 season, the financial standing of Nibulon should improve. Firstly we should not forget about the significant increase in world prices for grains and oilseeds, and secondly, a high yield of both early and late grains will lead to a significant increase in exports - according to our estimates, in the new season, Nibulon will export 5-6 million tons of grain. In the first quarter of the new season alone, grain exports by Nibulon amounted to 1.8 million tons.

Finally, we note a significant rise in the cost of grain logistics in the second half of 2021 - both by rail and by road. This should significantly improve the profitability of the company (which has a competitive advantage due to cheaper logistics).

Nibulon will begin his fourth decade of life in quite good shape.

Key financials of Nibulon:

UAH mln

2020

2019

Revenues

25 840

27 667

Gross profit

1 067

1 935

EBITDA

1 707

1 956

EBITDA margin, %

7%

7%

Net income

-1 876

1 597

31.12.20

31.12.19

Assets

33 841

29 694

Fixed assets

25 037

22 712

Current assets

8 803

6 982

Equity

12 286

12 143

Debt

10 991

8 017

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer