10 October 2017

Apart from good financial performance in terms of P&L we note good operating cash flow dynamics for the third consecutive month.

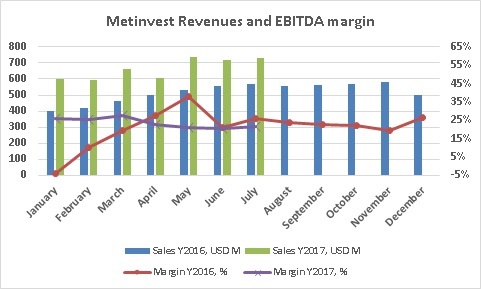

According to Metinvest report for July total revenues of the company in reporting month made USD 732M, almost unchanged vs. two previous months and by 29% higher y-o-y.

EBITDA margin of the group remains relatively stable, in July it made 22% (with EBITDA in money terms at the level of USD 160M vs. USD 147M in June).

Metinvest revenues and EBITDA margin dynamics since the beginning of Y2016 look as follows:

In reporting month Metallurgical division revenues (USD 616M) made about 84% of total Metinvest sales. The company slightly decreased sales of finished production vs. June (from to 777k tons, which has been the highest value since November 2016 to 757k tons), which was offset by growth of semi-finished products sales. In total in July Metinvest steel products sales in natural terms have been flat vs. previous month at about 1 022k tons.

Selling prices of Metallurgical division declined vs. June by 1-3%, EBITDA margin made 5.5% (flat vs. Previous month, though margin has been at about 8% in April-May).

As for Mining division, its revenues (disregarding intragroup sales) increased vs. previous month by USD 8M up to USD 120M.

Average iron ore products selling price after sharp decline during previous months increased in July (by 23% vs. June for iron ore concentrate, by 8% - for pellets), which has been in line with general trends of the global iron ore market. In June global prices reached its local trough at the level of USD 54/t with increase thereafter. EBITDA margin of the segment in reporting month comprised 41%.

As for operating cash flow, disregarding factually paid income tax and interest expenses, in July it amounted to USD 137M (vs. EBITDA disregarding result of joint ventures (Zaporizhstal and YuGOK) at USD 141M). We note decrease of inventory by USD 39M, while growth of receivables (USD 74M disregarding VAT Receivables) has been partially offset by increase of payables (USD 28M).

In reporting month Metinvest directed USD 11M for investment activity (since the beginning of Y2017 – USD 182M, disregarding investments realized by joint ventures), so amount of cash of the company grew from USD 215M as of 30.06.2017 up to USD 424M (which is the highest value for the last period of time).

See all news

All about Metinvest

Popular on site:

Interpipe - fighting for survival

In September Ukrainian steel output further increased

Epicenter-K - leader of Ukrainian DIY retail market