Bunge Ukraine is one of the largest Ukrainian sunflower oil producers and grain exporters, a subsidiary of Bunge Ltd, one of the leading commodity trading groups in the world.

Bunge Group was founded back in 1818 in Amsterdam, and today with annual revenue of about $ 40 billion it belongs to the list of the largest multinational traders in agricultural commodities ABCD (ADM, Bunge, Cargill, LDC). The company's headquarters are currently located in New York, while the company's assets are located in North and South America, Europe and Asia.

Like most other international traders, in recent years Bunge's financial performance has been far from ideal, with significant improvements in 2020 as a result of skyrocketing global prices for grains and oilseeds. The main financial indicators of the group are presented in the following table:

$, M

2020

2019

2018

2017

Revenue

41 404

41 140

45 743

45 794

Gross profit

2 785

542

2 266

1 765

Net income

1 165

-1 291

233

126

The group entered Ukraine in 2002, acquiring the Cereol company of Ted Margellos, one of the pioneers in Ukrainian grains trading.

For several years, the main asset of Bunge in Ukraine was Dnepropetrovsk Oil Extraction Plant, which produces sunflower oil under the trade mark Oleina. At that time, this crushing plant produced about 250 thousand tons of oil per year, and TM Oleina was the leading brand in the local retail market of bottled sunflower oil.

The main trading legal entity of Bunge group in Ukraine was DP Suntrade. In the early 2000s, there were frequent changes in the company's management, which ended in 2007, when Dmitry Gorshunov became country manager of Bunge in Ukraine and managed the company until 2019.

Almost from the very beginning of its activity in Ukraine, Bunge was keen on having its own port terminal and oilseeds crushing plant in the port. Initially, the bet was put on Ilyichevsk, where Bunge began construction of the oil extraction plant in partnership with local businessmen Rafael Katinyan and Michael Sarkesyan (the company was called Black Sea Industries). Katinyan and Sarkesian also owned adjacent Transbalkterminal port terminal, which was sold to Kernel in 2008. Apparently, without a terminal, this crushing plant was far less attractive for Bunge, so after litigation with partners, the group left the project. Crushing plant itself was sold to Kernel for $ 140 million.

No success in Ilyichevsk - let's try in Nikolaev. In 2009 Grintur-Ex company started construction of grains port terminal, which was commissioned in 2011. Its total capacity made 3 million tons of grains transshipment per year. Formally, Grintur-Eks at that time belonged to the Belarusian businessman Nikolai Nemogai, who exported potash fertilizers through the Nikolaev port in the early 2000s. At the same time, Bunge factually controlled this project and after construction finalization became its owner. Unfortunately, in Ukraine, for well-known reasons of corruption, it is much easier for a foreign company to buy a ready-made terminal than to receive all the permits and build a terminal from a scratch. Other international traders also built their terminals having used the same scheme.

So, the total capacity of the terminal's annual transshipment was 3 million tons of grain, the capacity of one-time storage was 120 thousand tons.

Considering that the 2010s were the years of the agrarian boom in Ukraine - the country significantly increased both production and export of grains - there was a shortage of grains port transshipment capacities, and transshipment tariffs were quite high. It means very good payback for investment. According to information from open sources, about $ 100 million was invested in the project, and according to our estimates, it paid off in no more than 5-6 years.

From an operational point of view, the project allowed Bunge to be one of the leaders of Ukrainian grains trading market.

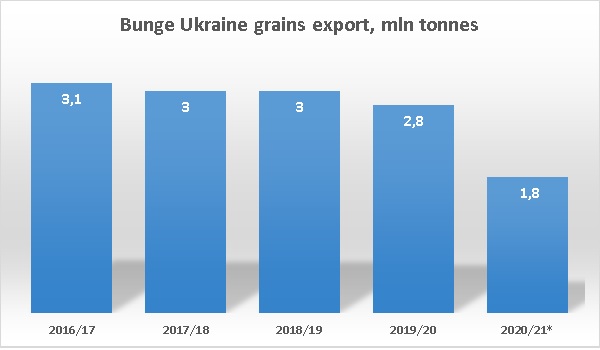

*-July-June

The next step of Bunge development in Ukraine was the construction of an oil extraction plant on the territory of the Nikolaev port, which began in 2013. An investment of $ 180 million was made in the project; the launch of the plant along with a complex for transshipment of oil and meal took place in mid-2016. As a result of this investment, Bunge has firmly established itself in second place among the largest sunflower processors in Ukraine.

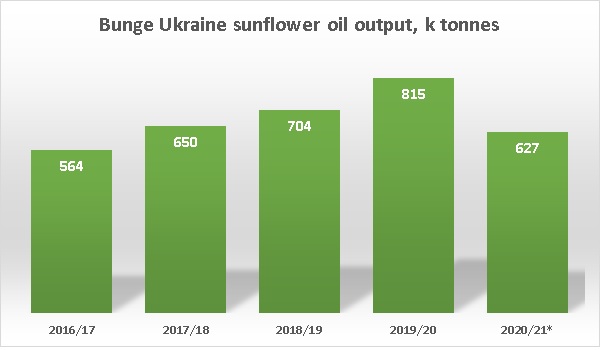

In recent years, the production volumes of sunflower oil by the group (consisting of two oil extraction plants - Dnepropetrovsk and Nikolaev) were as follows:

*-September-May

The market share of the group in Ukraine among sunflower oil producers after the launch of the crushing plant in Nikolaev has been stable at about 11% (while in the current marketing year (September 2020 - May 2021), the share of Bunge has increased to about 13%).

We can note that recent years have not been the best for Ukrainian oil and fat industry in terms of profitability. As a result of the commissioning of new oilseeds processing facilities (including the new Bunge plant in Nikoaev), competition among processors has increased significantly, and crushing margins have decreased (by more than two times). However, it should be noted that this decrease was much less harmful to multinational companies than to Ukrainian ones. The reason is their relative financial stability and the availability of cheap financing from the parent group.

If we talk about the payback of such projects, the cost of financing plays a significant role - it is one thing when a Ukrainian company finances an investment project at 10-12%, and quite another when an international company attracts debt at 1-2%. So we can say that the current level of profitability of sunflower processing is quite acceptable for Bunge.

The most recent investment by Bunge in Ukraine was the construction and launch at the end of 2020 in the Vinnytsia region (in partnership with the Spanish group Dacsa) of a cereal corn processing plant with a capacity of 100 thousand tons per year. It is planned that 80% of new plant's production will be exported.

The group's activity in Ukraine has not been without pitfalls. First, Bunge has featured in several VAT refund scandals over the past ten years. VAT story is generally quite a sensitive topic for all international commodity trading companies, almost all of them, to one degree or another, had problems with VAT refunds in Ukraine.

Due to higher compliance standards vs. locals, multinationals should provide for much higher transparency of operations and grains procurement structure (it is not a secret for anyone that part of Ukrainian grains and oilseeds market has been in "grey zone" in recent years), so they are less competitive vs. locals in this respect. But we note that usually, even in case of problems with VAT refunds, everything ends in favor of multinationals, frequently after litigation. So final loss for them is just the cost of financing.

Also Bunge's activities in Ukraine were impacted by the scandal with the Agroinvestgroup group in early 2019. Agroinvestgroup Ц group of companies, which operated in Ukrainian grains growing and trading market. Having increased its loans portfolio and a portfolio of prepayments from buyers, as well as having sold grains allegedly stored in the group's own elevators, it has stopped to fulfill its obligations. When buyers wanted to get access to the grain they bought at Agroinvestgroup silos, there was significantly less grain on the elevators than on paper

Almost all international grain traders suffered as a result of this event, and Bunge was among those companies which suffered the most, having lost more than $ 8 million.

Perhaps it was the Agroinvest scandal that led to the fact that after 12 years of leadership, Dmitry Gorshunov left the group, replaced by an experienced Pole Andrzej Ruzycki (who previously worked at Cargill, LDC and Bunge itself).

The 2020/21 season has been controversial for the company. On the one hand, it increased its share among sunflower oil producers, on the other hand, grains export fell to a record low in recent years of 1.8 million tonnes (from 2.8 million tonnes in the previous season). The volume of grain transshipment through the Grintour terminal also decreased by almost the same rate.

The main reason is a significant decrease in Ukrainian corn harvest in 2020 compared to previous year. Moreover, in the regions from which it is logistically more efficient to ship grain to the port of Nikolaev (in comparison with Odessa, Ilyichevsk and Yuzhny) - and this is central and eastern Ukraine, - the decrease in corn yields was greater than the average in Ukraine. That is why grain traders mainly operating in Nikolaev (mainly Ц Nibulon, Bunge and Cofco), suffered more than those based in big-Odessa region - Kernel, Cargill, LDC.

Anyway on the local level all international traders working in Ukraine have a good margin of safety in their activities. Our country is one of the key grains and oilseeds origination markets for all of them, so there is no doubt about the further development of Bunge in Ukraine.

The main financial indicators of DP Suntrade, as well as the consolidated EBITDA of Bunge enterprises in Ukraine, are presented in the following table:

UAH mln

2020

2019

2018

2017

Revenue

24 367

23 008

22 000

20 000

EBITDA

1916

15

540

420

EBITDA consolidated*

2 520

1 502

1 512

1 393

Net income

814

-331

100

70

* -consolidated EBITDA of the main companies of the Bunge group in Ukraine - DP Suntrade, Grintur-Ex, Dnepropetrovsk MEZ, European Transportation and Stividor Company.

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - the biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer