4 May 2021

Ukrainian sunflower seeds and oil market - Y2021

Sunflower seeds growing and crush is key Ukrainian industry, accounting for more than 10% of total country export. The share of Ukraine in world sunflower oil production is 30%, sunflower oil trade – 50%.

Common information and world market

After a decade of constant growth, since Y2015 Ukrainian sunflower seeds harvest has been relatively stable in the range of 12-15M tons.

In MY2020/21 Ukraine produced 13.1M tons of seeds according to official statistics (14.2M tons basing on information from the biggest Ukrainian crusher Kernel), -2.1M tons y-o-y. Sunflower oil production is expected to make (as per USDA) 5.9M tons (7.4M tons in previous season).

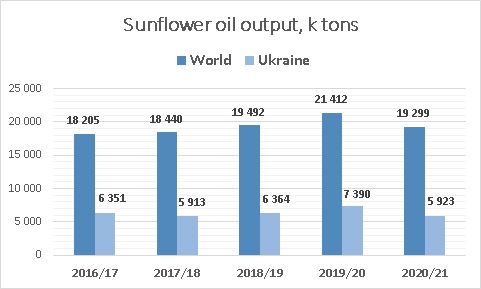

Sunflower seeds and oil Ukrainian production drives up the whole world market. In current season global sunflower oil production is estimated at 19.3M tons, general dynamics during last years is represented on the following chart (along with Ukrainian production figures, source - USDA):

It is estimated that in MY2020/21 Ukraine will account for about 30% of global production and for a half of total world export of sunflower oil. Other important exporters are Russia (25-30% of global export) and Argentina (5-10%).

Global importers of sunflower oil are India, China and EU. They are main importers of vegetable oils in general, so global demand is largely dependent on them.

It is estimated that in the current season sunflower oil will account for about 10% of total world vegetable oils consumption (palm and soybean oil take a lead here with 36% and 29% correspondingly).

Sunflower seeds growing in Ukraine

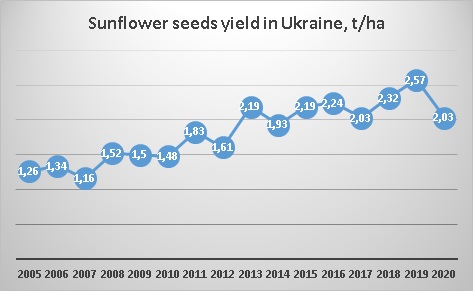

Sown area, yields and total crop of sunflower seeds in Ukraine since Y2005 are represented in the following table*:

Year

Harvest area, k ha

Yield per 1 ha, tons

Total harvest, k tons

2005

3 743

1.26

4 706

2006

3 964

1.34

5 324

2007

3 604

1.16

4 174

2008

4 306

1.52

6 526

2009

4 232

1.50

6 364

2010

4 572

1.48

6.772

2011

4 739

1.83

8 671

2012

5 194

1.61

8 387

2013

5 051

2.19

11 051

2014

5 257

1.93

10 134

2015

5 105

2.19

11 165

2016

6 073

2.24

13 627

2017

6 034

2.03

12 236

2018

6 117

2.32

14 165

2019

5 928

2.57

15 254

2020

6 457

2.03

13 110

During the last years sunflower seeds have been considered as one of the most profitable crop for Ukrainian farmers. Good demand from the side of oilseeds crushers and the fact that sunflower seeds are less vulnerable to negative weather shocks vs. other crops led to an increase by Ukrainian farmers of their sunflower seeds sown area to record-high 6M ha.

South and East of Ukraine have been historical regions for sunseeds growing, which took more than 30% of the total sown area during last decade. Main Ukrainian regions for sunseeds in Y2020 were as follows::

- Kirovograd (610k ha, 38% of total region sown area)

- Dnipro (622k ha, 34%)

- Kharkiv (600k ha, 36%)

Taking into account that it’s a rather dry region of Ukraine and as 30% is quite a high share from crop rotation perspective, we believe that in the medium-term there is no potential to increase either sown area or yields in this region. In the above-mentioned regions average yields per 1 ha in Y2020 were in the range 1.5-1.8t vs. average for Ukraine 2.03t/ha (Kharkiv region was an exception with average yield of 2.27t/ha).

In the Central part of Ukraine (from Cherkassy region and to the West) the share of sunseeds in the total sown area is more healthy – at about 20-25%, while in Western region it’s still under 15%, so it’s the only region of Ukraine with potential to increase sunflower seeds output (no surprise is that the only new sizable investment into oilseeds crush during last years has been construction of new crusher by Kernel in Western region of Ukraine).

Y-o-y decrease of yields in Y2020 happened because of drought in many regions of Ukraine in summer. It had a negative effect on all late crop yields (for example Ukrainian corn yield declined y-o-y by 25%).

Sunflower seeds crush in Ukraine

If we take a look at the history of oilseeds crush in Ukraine, active development started after in Y1999 Ukrainian parliament passed a law imposing 10% duty on export of sunflower seeds. This measure significantly stimulated development of domestic crush in Ukraine. Both local and international companies (Cargill, Bunge, ADM) constructed new oilseeds crushing plants in Ukraine and started trading Ukrainian sunflower oil on the global market.

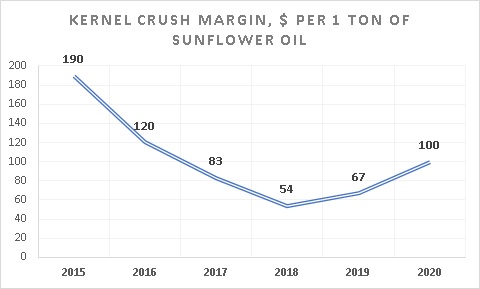

Since Y2000 total crushing capacities increased by more than seven times, in Y2012 they made about 12M tons of raw materials processing, in mid-2014 – 14.5M tons, in the end of Y2016 – already 18.5M tons. After that capacities have been stable at about 19-19.5M tons. As we see they have been steadily exceeding sunseeds harvest during last 6-8 years, which resulted in falling crushing margins.

Below we present Kernel Holding crushing margin for the last several years:

Because of quite good sunseeds harvest in Y2019 crushing margins in 2019/20 season somewhat increased but they are estimated to fall again in 2020/21.

In MY2019/20 TOP-10 largest sunflower oil producers have been as follows:

- Kernel - 21%

- Bunge - 11%

- MHP - 5.4%

- Optimus - 4.8%

- Delta Wilmar - 4.7%

- ViOil - 4.7%

- ADM - 3.3%

- Allseeds - 3.2%

- Cargill - 2.9%

- Cofco - 2.4%

If to speak about market structure in general, during last years the share of Kernel was in the range 20-30%, the same as multi-nationals (Bunge, Cargill, Cofco, ADM, Glencore and Delta Wilmar), then the rest of the market was split between relatively big local players and small ones.

As for big locals, only MHP has a good margin of safety in its operations CHECK, others are highly leveraged ones. Small locals should be less efficient vs. large ones by definition (as they are mainly old facilities from Soviet time).

It was expected that due to significant drop in crushers profitability since Y2015 locals will start to go bust and leave the market. Up to the moment, we do not see these projections come true (because of different reasons – probably some grey market schemes are not the least), though in the middle-term we can still expect it to happen.

In season 2020/21 with a decrease of total sunflower seeds harvest we expect the share of Kernel and multinationals to grow, while the share of locals to decrease.

Domestic consumption, export

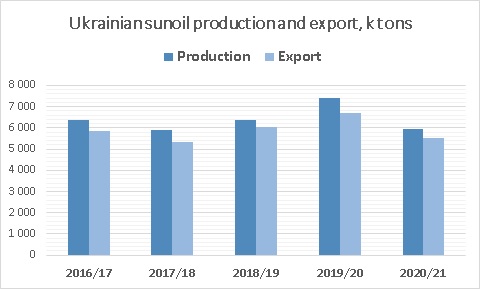

Ukrainian consumption of sunflower oil during last years remains stable at approximately 0.5-0.6M tons (which is just 10% of total estimated production in the current season). It means the main portion of Ukrainian production is exported:

TOP Ukrainian exporters of sunflower oil have been Kernel, Bunge and MHP. The largest Ukrainian ports which transship sunflower oil are Nikolaev, Chernomorsk and Yuzhniy (three ports account for more than 70% of export). A total number of oil terminals – more than 15.

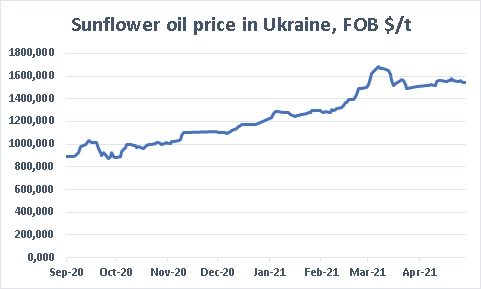

Average price of Ukrainian sunoil which fluctuated in the range of $650/t-$800/t since Y2015, significantly increased during the current season, reaching $1100/t in December’20 and more than $1500/t in March’21.

Sunflower Meal

Sunflower meal output is fully in line with sunoil data (on average 1 ton of seeds contains 440kg of oil and 390kg of meal). Total production in MY2020/21 is estimated at 5.7M tons.

Sunflower meal is used as a source of protein for feed production. Part of Ukrainian meal is consumed domestically (about 1.3M tons), the other part is exported (4.6M tons is to be exported in MY2020/21).

Summary

During the last years Ukrainian sunflower seeds and oil market kept its position as a key one for the country. Ukraine remains a key sunoil producer, farmers enjoy good profitability for sunseeds growing, while crushing margins have been subdued due to excess crushing capacities over availability of raw materials.

Popular on site:

Ukrainian sugar market - new perspectives

Ukrainian soybeans market is ready for new records

Ukrainian Y2016 agri-commodities export digest