For more than fifteen years, the family business of Vladislav and Irina Chechetkin has grown into the absolute leader of e-commerce in Ukraine, it is the largest online store and marketplace in the country, a company with a turnover of more than $2 billion.

Family business

Rozetka online store was launched in 2005 by Vladislav and Irina Chechetkin, and initially the goal was to create a website for the sale of cosmetics and perfumes. After some time, it was decided to do what the founders already had expertise in - trading in electronics (actually in everything that “can be plugged into a socket”, hence the name – Rozetka means socket). Initially, $250,000 was invested in the project.

At that time, there were several recognizable online stores in Ukraine - Fotos, Fotomag and others - while the e-commerce market in the country was only in its infancy (in 2005, only five million people had the Internet in the country, and there was no mobile Internet yet).

The business model was simple - the buyer placed an order, the online store immediately bought the goods from the wholesaler and delivered them to the buyer. In such a way online stores moved away from creating their own inventory. At the same time, they paid distributors practically upon receipt of goods and without any deferment, while offline networks worked with a payment deferment of 60-90 days. Also, online stores saved 6-10% of the cost of goods, which traditional chains spent on renting stores and salaries for personnel.

Before the creation of Rozetka (and during the creation, too), Vladislav Chechetkin worked for his brother Igor's company Skyline, which sold electronic devices. As a result, Vladislav has formed extensive contacts with electronics distributors, which was one of the advantages of a new business.

The second advantage was the content of the web-site. Chechetkin clearly understood that users use online stores not only for shopping, but also to obtain information and compare products. Thus, from the first days of its existence, Rozetka has relied on content and its quality. During and immediately after the launch of the online store, Vladislav himself was involved in filling in information to the site. Often at nights, during the spare time from the main activities.

Finally, the third advantage was customer loyalty. While other online stores were reluctant to return and exchange goods, Rozetka had fewer problems with this.

It should also be noted that almost all the profits of the online store were reinvested in the business - everything was put at stake for growth and development.

Winner Takes All

In line with the market, the Allo network also grew - already in 2006 it consisted of 258 stores in 53 cities of Ukraine. The format was small stores of 30-40 sq m. Mobile phones, gadgets, sim cards and different kinds of related services were sold in the stores. Allo's revenue in 2006 amounted to about UAH 550 million (or more than $100 million at the Y2006 FX rate).

The entire mobile phone market in Ukraine in 2006 was estimated at about $1.5 billion. Among the competitors at that time were retailers of electronics and home appliances, as well as networks operating in similar to Allo format - Euroset, Mobilochka, MobiDik.

First test

Rozetka was established at the right time and in the right place. The owners chose the right development strategy, and the business of the Chechetkins skyrocketed.

The company had a clear division of responsibilities - Vladislav was in charge of the overall strategy and sales, while Irina was in charge of the operational part and logistics. Irina is described as a rather demanding and tough leader who knows how to establish internal processes and effectively negotiate with counterparties.

This skill was especially needed during the global financial crisis of 2008-2009. Rozetka entered it already as one of the leaders of the Ukrainian e-commerce market (which was still not very large in terms of total volume due to weak Internet penetration).

In 2008, the company moved to a new building with a warehouse and a more spacious showroom - in Kyiv, on Yaroslavskaya street. For a long time, this pickup point was essentially the only one for the online store.

In the same 2008, shortly before the devaluation of the hryvnia, the company took a dollar loan in the amount of $2.5 million. In her interview with Forbes, Irina Chechetkina noted this decision as the most unfortunate business decision in the history of Rozetka's development.

In the fall of 2008, the market for electronics and household appliances went into a panic. Sales began to fall (in 2019, in dollar terms, the market volume decreased by 50-60%), many chains and wholesalers became overstocked, which led to delays in payments to suppliers and financing banks.

Not all networks managed to survive this crisis (Citicom, Euroset, Megamax and Domotekhnika went bankrupt).

Due to its price advantages and the fall in the purchasing power of the population, the e-commerce market only benefited from the crisis. Its volume in 2009 decreased by only 10-15%, and already in 2010 it was higher than in the pre-crisis period. Rozetka, for its part, became more aggressive in its pricing policy, increasing its sales volumes and its importance to suppliers, which, in turn, helped to receive larger discounts from the latter.

In March 2009, the company launched its first advertising campaign on television (a few years later, Rozetka became the country's largest TV advertiser), and in early 2010, other products appeared on the store's "showcase" in addition to electronics and household appliances - accessories, perfumes and cosmetics, goods for children, etc. Rozetka became a full-fledged online supermarket.

The new products were more profitable than electronics (which had a 15% profit margin), but inventory turnover was lower, requiring slightly different business approaches.

Rozetka coped with a new challenge - in 2011 Forbes estimated the company's total turnover at $130 million (about 12-15% of the entire e-commerce market). The closest competitor - Allo.ua - was five times smaller. Along with it, revenues have been lower vs. the largest players of the offline market of electronics and household appliances, then their turnover was higher. Allo had a comparable revenue (about $100 million, but the company traded almost exclusively in mobile phones), Eldorado turnover was at about $150 million, while Comfy - $600 million and electronics market leader Foxtrot - $900 million.

At least some of the offline players already understood that online trading is expected to skyrocket, but they had something to lose offline, so could not focus on full-scale online business. It is psychologically difficult to accept the fact that it is necessary to carry out certain actions directed, as it were, against the main offline business. Hence rather slow reaction to market changes.

Rozetka was in a completely different position, the company took full advantage of the increase in Internet penetration in Ukrainian families from 23% in 2010 to 49% in 2015. The total turnover of Rozetka in 2014 was already estimated at $300 million (about 40% of the online electronics and household appliances market) – more than a twofold increase compared to 2011.

At the same time, this period was not easy for the company. In 2012, a well-known “hit” on business by law enforcement and tax authorities took place (reportedly such hits were organized by the people close to former Ukrainian president Yanukovich). Based on open sources of information, those hostile actions resulted in nothing (except for the nerves of the owners spent).

The events that took place in 2014-2015 in Ukraine as a whole had a negative impact on the purchasing power of the population. In this situation, the fact that the company had low debt burden was in favor of Rozetka (in one of his interviews, Vladislav Chechetkin admitted that he was simply afraid of taking loans) and could use the crisis as another opportunity to increase its market share.

Ukrainian Amazon

New opportunities for Rozetka lay in the area of business development as a marketplace. However, to fully use the opportunities, it was necessary to attract new sources of financing - there were not enough own funds to implement ambitious development plans.

The solution was to attract a portfolio investor in 2015, the private equity fund Horizon Capital. The fund's stake in Rozetka is not disclosed; according to our estimates, it is about 15-25% of the company. The amount of investment was not disclosed as well, according to information from open sources, it could be up to $40 million.

Horizon Capital is a classic portfolio investor that does not intervene in operational management of the company and takes part only in the discussion of strategic issues. Attracting such an investor, the Chechetkins killed several birds with one stone - they retained full operational control over the business and attracted equity funding for its development (as well as financial expertise in general).

First of all, the raised funds were used to strengthen the company's position in logistics - a new Class A warehouse complex with a total area of 49,000 sq m was purchased near Kyiv. The purchase amount was about $16 million, and significant funds were directed to the modernization and automation of the complex.

Rozetka continued to increase its advertising budgets (according to Forbes, total advertising spending during 2015-2017 was about UAH 60 million annually) and made competitors takeovers.

Finally, a significant transaction on the Ukrainian e-commerce market was the merger of Rozetka with EVO Group, completed in 2017-2018. Rozetka took over EVO, buying a 54% stake from the South African fund Naspers. At the same time, the remaining owners of Evo received a minority stake in the Rozetka business.

EVO Group united the Prom.ua marketplace, as well as a number of niche projects. As a result, taking into account the fact that since 2015, Rozetka itself has been actively developing as a marketplace, using its website, it has become the market leader in this segment too (Olx can be called the main competitor here, but this site occupies a leading position primarily in the used goods).

Being the most popular platform for sellers and owning significant warehouse space, Rozetka offered its partners a fulfillment service in 2021 – providing sellers with warehouse space and an order processing service.

The range of goods on Rozetka website has become so large, and recognition and popularity among Ukrainian people was so large that, being interested in buying almost any product, users first of all visited Rozetka website.

In an effort to create maximum convenience for customers, the next step in the development for the company was a significant increase in the number of offline showrooms and points of issue of goods.

In November 2017, the company's first full-fledged offline hypermarket opened its doors - in Kyiv, on Stepan Bandera Avenue. The total area of the hypermarket was 6000 sq. m, trade area - 4000 sq m.

The first opening was followed by the next ones - a store in the center of Kyiv on Maidan Nezalezhnosti, then in Odessa (the first supermarket outside Kyiv was opened there in 2018), Lviv, Dnipro and so on.

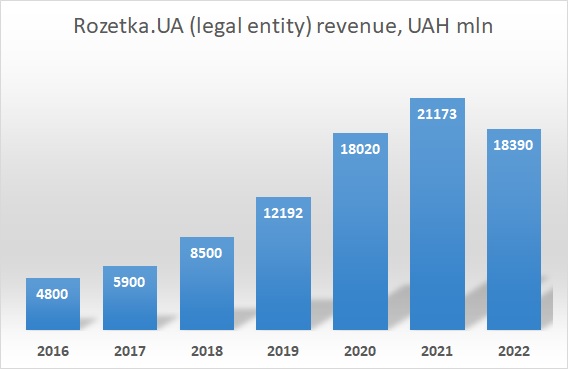

Rozetka turnover grew by a high rate as well. In an interview with dou.ua, Vladislav Chechetkin reported a 40% increase in hryvnia sales in 2019 and 40% in 2020.

In another interview Vladislav said that the total revenue of the group of companies for 2020 has already exceeded $2 billion. It’s difficult to verify this data, because according to the official reports of the main companies of the group, the revenue of Rozetka.UA in Y2020 made UAH 18 bln, its sister company OTK Europlus UAH 4.1 bln.

In any case, this is more than the turnover of the largest electronics networks - Comfy in 2020 had a revenue of UAH 16 billion, Foxtrot - UAH 14 billion, Eldorado - UAH 11 billion (Rozetka has a much wider assortment of goods than electronics networks, so this direct comparison is not quite correct, but the trends of changes in the market are obvious).

As for the profits of Rozetka, in 2020 the consolidated EBITDA of the group of companies (according to official reports, includes the companies Rozetka.UA, OTK Europlus, Prom.UA) amounted to about UAH 300 million.

The coronovirus pandemic only spurred the development of the company, because during the lockdown period, Rozetka continued its work, while competitors' offline stores were closed. As a result, from March 2019 to December 2020, according to Similar Web, the company's average monthly traffic increased from 38.3 million unique users to 45.6 million (the fifth most visited website in Ukraine).

Rozetka continued to develop a network of pick-up points for the goods - in the beginning of Y2022 their total number exceeded 200. The company also launched a program for opening outlets under a franchise scheme, but at the same time it tried to be selective enough in choosing partners so as not to lose quality.

Rozetka is cautiously keeping an eye on the other countries. In 2019, the online supermarket entered the Moldovan market, and in 2021, Uzbekistan.

Also in 2020, the company launched sales of goods under its own RZTK brand. In the interview with the CEO podcast, the owner of Rozetka noted that so far the company is satisfied with the development of the brand, but it is too early to draw conclusions about its success.

Present day

After good performance in Ys2020-2021, positions of the company on Ukrainian e-commerce market looked quite strong. Rozetka was a clear market leader with a good reputation. In comparison with offline competitors, Rozetka looked much more flexible and dynamic. Its good financial condition (at least, the absence of a significant debt burden) allowed us to say that it had good magrin of safety against adverse market situation.

But full-scale russian invasion in February 2022 changed the situation a lot. Revenues fell from pre-war level of UAH 3-4 bln per month to UAH 23 mln in March'22. Rozetka had very big inventory stock and quite high operating costs. The company was absolutely not prepared for such a downturn.

When in March war actions were taken in several hundred meters from main warehouse of Rozetka near Brovary (Kyiv region) it looked that there was non-minor probability of very negative scenarios for the future of the company.

In the end of the day the warehouse was not destroyed, russians withdrawn from the Kyiv region, so the Rozetka business survived. In his interview in autumn Chechotkin noted that one of main factor of survival was marketplace. While Rozetka itself and other large players have been busy rebuilding their logistic routes (Ukrainian deep sea ports were blocked by russians), small players' share in total sales grew.

Already in August Rozetka revenues almost reached pre-war level, so in the end of Y2022 its market positions are as strong as they were before the beginning of full-scale war.

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer