Comfy is the largest and most efficient Ukrainian multi-channel network selling electronics and household appliances.

Comfy today

As of the end of 2023, Comfy is the largest Ukrainian chain of electronics and household appliances in terms of revenue. The network currently consists of 102 supermarkets, which exceeds the number of stores before the full-scale invasion, while the online segment is also actively developing - in terms of user traffic, comfy.ua is among the TOP-3 Ukrainian retailers.

In recent years, Comfy has clearly been the most effective multi-channel electronics chain, betting on the integration of various sales channels - the online store and traditional offline supermarkets, and trying to provide customers with the maximum level of service.

The history and growth of Comfy retail chain

The founder of the Comfy network, Stanislav Ronis, began his business activities in the early 90s with the trade of consignment goods in an underground passage not far from the Dnipropetrovsk railway station.

By the end of the 90s, he was already trading in jewelry, watches, and household appliances through a small chain of stores. The Akustika company was created, which started wholesale trade in electronics and household appliances. Ronis also agreed with the owners of the Domotechnika network about the joint development of this network in the east of Ukraine.

First of all, the idea was to build a single large chain of supermarkets throughout the country, but after some time, Ronis and the owners of Domotechnika parted their ways, which, in turn, led Ronis to the decision to develop his own retail business in electronics retail.

That is how, on the basis of Domotechnika, in 2005, the Comfy network was born. That time was very successful for almost any business development in Ukraine, and especially retail trade - due to the shortage of modern formats in Ukraine, all areas of organized retail grew at incredible rates (the electronics market - from 20% to 40% per year).

As of the beginning of 2007, the Comfy network had 26 stores in 13 cities of Central Ukraine, with a focus on the Dnipropetrovsk region. The turnover of Vist-Service LLC, which operated chain supermarkets, in 2006 amounted to approximately UAH 380 million (or more than $75 million at the exchange rate of those years).

In 2007, a significant event for the development of the network took place - the merger with the Donetsk-based Pobutova Technika chain, which was owned by Svitlana Hutsul, and which at the time of the merger had 29 stores. As a result, in the combined network, Stanislav Ronis received a 70% share, Svitlana Hutsul - 30%.

Stanislav Ronis - the majority owner of the Comfy network

It was decided that the chain would keep the Comfy name. The format of supermarkets was quite different, with the area in the range from 1.5 thousand square meters to 3 thousand square meters, which was quite typical for those times - the assortment of supermarkets was quite bug, and as the profits of retailers grew, so it did not make a lot of sense to think about the cost optimization.

The crisis of 2008-09 and the scale of its impact on the economy came as a big surprise for Ukrainian business, so many of the large and medium-sized players in the electronics and home appliances market (mainly those that had a significant debt burden in foreign currency) went bankrupt. Among the well-known players that were out the market in those years, one can note Domotechnika, Citicom, Megamax, MKS and others.

As of the end of 2007, the Comfy chain had a relatively small credit exposure (Vist-Service's bank debt was approximately UAH 30 million with sales in 2007 at the level of UAH 650 million), so it used the years of the crisis as an opportunity for growth and capturing a significant share of the market - number of Comfy stores during 2008-09 increased by 65%.

At the same time, Stanislav Ronis himself was actively studying - the businessman talked in his interviews about the fact that several times he was escorted out of European supermarkets by security for photographing the location of goods on store shelves without permission. He also invited expats from Western Europe to various positions in the management of the company, and also involved Western consulting companies in strategic planning.

As a result, it was during these years that Comfy turned from a regional network into a national one (the same as ATB Market) and entered TOP-4 of the largest electronics and household appliances chains in Ukraine (together with Foxtrot, Eldorado and Technopolis). Moreover, in 2010-11, Comfy became number one among all competitors in terms of sales per unit of retail space.

The most efficient network

Already in those years, the owner and management of Comfy understood that the explosive development of the Internet would lead to a significant increase in the share of online sales in the overall electronics market structure. But this did not prevent the company from not being able to take a proper note on the development of online competitor – Rozetka.UA.

In 2011, Rozetka's turnover was $130 million, compared to Comfy's $600 million and Foxtrot's $900 million. But due to the growth of Internet penetration in Ukraine (from 23% in 2010 to 49% in 2015), Rozetka doubled its revenue by 2014, while the sales of traditional offline networks, after post-crisis recovery in 2010, remained relatively stable in the following years.

Instead of learning and adopting the experience of new online players, offline networks competed with each other and waited for market consolidation.

At the beginning of 2013, the first major takeover deal took place in the Ukrainian market of electronics and household appliances - the Technopolis chain bought the Eldorado chain (while Eldorado had more than 100 stores at the time of the takeover, Technopolis had 65). The combined network continued its development under the Eldorado brand and became the second largest store chain in Ukraine after Foxtrot, which at that time had 220 stores (by the way, in 2015 Eldorado tried to merge with Foxtrot as well, but the negotiations did not lead to an agreement).

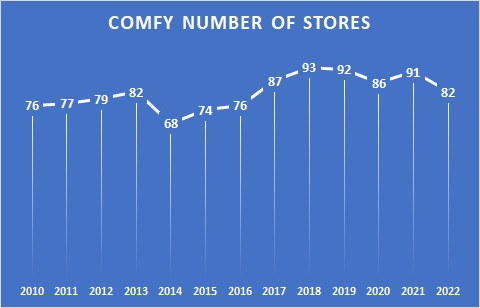

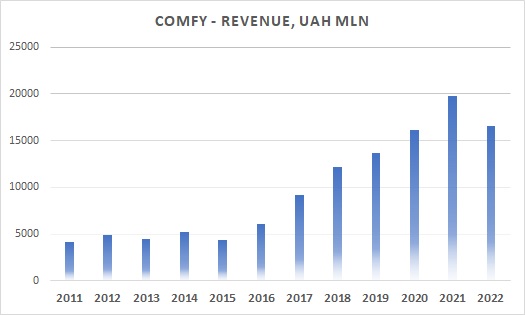

The number of Comfy stores during 2010-2013 was relatively stable (76 supermarkets at the end of 2010, 82 supermarkets at the end of 2013). The turnover of Comfy Trade LLC (the new operating company of the network began to function in 2010) during the same period of time was also stable at the level of UAH 4.5-5 billion per year.

Such development was very far from the company's plans in 2008-09 - at that time it was planned to increase the chain to 27 supermarkets in 2010 and 25 stores in 2011 - but at the same time the chain did not lose its efficiency and was number one on the Ukrainian market in terms of sales from 1 square meter of retail space, as well as from the point of view of the speed of inventory turnover.

Despite the significantly smaller number of stores vs. main competitors, in 2013 the share of Comfy among the top three retailers of the electronics segment in Ukraine was 27%.

Having greater efficiency compared to competitors, at the end of 2013 the owners and management of Comfy planned to return to growth - by 2015, the number of supermarkets in the chain should have increased to 125.

Loss of 25% of business and reformatting of the network

Since the Comfy network historically had a significant presence in the East of Ukraine, the loss of business in Crimea and Donbas was very painful for the company. In fact, the network has decreased by 25% of stores. In addition, in 2014-15 there was a significant devaluation of the Ukrainian national currency and a drop in the purchasing power of the Ukrainian population.

Another blow to the Comfy activity was the loss of more than UAH 300 million on the accounts of the bankrupt Delta Bank. But thanks to the generally good financial standing in which the company approached the new crisis, Comfy withstood the blow, moreover, already in 2015, 17 new stores were opened - despite all the problems, the chain once again tried to use the crisis as an opportunity and increase its share market.

As of the end of 2015, the total number of stores of the Comfy network was 74, its turnover decreased from UAH 5.3 billion in 2014 to UAH 4.3 billion in 2015, but increased again to UAH 6 billion within the year. It is clear that the growth occurred only due to higher prices on goods caused by devaluation of the hryvnia and inflation, but in real terms the sales figures were very far from Y2013.

The war, the financial crisis and the growth of competition from Rozetka forced the management of Comfy to reconsider the format of the network again. It was already clear that having a wide range of products in each store of the network is ineffective. On the other hand, the total diversity of goods offline and online had to be significant, and the integration between different sales channels should be extremely high.

In order to maintain their share in the fight against "pure" online retailers (who have an advantage over traditional retailers in terms of store rental costs and wages of personnel), multi-channel players had to minimize their per unit cost of selling a product and/or to be much more competitive vs. online stores in terms of customers service - it was still important for buyers of electronics goods to see the product with their own eyes and get quality advice from the seller before buying.

It was at this time that Comfy's management changed its sales concept - the company moved away from intrusive service (“sell it at any cost”) to trying to understand the needs of the buyer and satisfy these needs as much as possible.

After 2015, the competitive price environment in the Ukrainian electronics market also began to change. The market became significantly less "grey", more and more goods were imported into Ukraine by local representative offices of foreign manufacturers (such as Samsumg, LG and others), who themselves set the retail prices of their goods.

This led to the fact that the prices of the same goods at the main online and offline stores were also the same, which, on the one hand, facilitated competition for offline and multi-channel players (previously, due to lower operating costs, online players could afford dumping), and with another - led to a shift in competition to the quality of customer service and additional means of sales promotion (for Comfy it was a bonus program).

As for the format of offline stores, during 2016-17 Comfy significantly updated the network - now its basis was supermarkets with an area of about 500 square meters, only flagship stores located in large shopping malls with significant visitor traffic had a larger area.

A little later, the chain began to bring to the market stores of an even smaller format - 300 square meters, which were mostly opened in relatively small cities, and also points of delivery of goods purchased online (Comfy-point) were opened.

With a generally stable number of supermarkets in the chain (80-90 stores) during 2017-2020, as well as a significant reduction in their retail space, the total turnover of Comfy increased from UAH 6 billion in 2016 to UAH 16 billion in the 2020 "Covid" year.

The average period of turnover of goods in the network during these years was 35-40 days - this is better than that of a large part of food retailers, which is a very strong result, considering that electronics and household appliances are not essential goods.

Integration between online and offline sales channels, as well as good inventory management, have become factors of Comfy's success in recent years and a significant advantage compared to competitors, some of which (for example, Eldorado) were also significantly less stable from financials perspective.

In fact, it was Comfy that was the market driver both in terms of format and service, other players were less adaptive and largely copied Comfy's actions which proved themselves successful.

As for Rozetka, this company also tried to improve its service and be much closer to the customers, massively opening its offline points of delivery of goods. In addition, Rozetka was already a full-fledged marketplace with a wide range of products, not focusing only on electronics.

A full scale invasion

As for a large part of Ukrainian business, 2021 was a good year for Comfy. During the year, the chain increased the number of its supermarkets from 86 to 91 (six stores in the Comfi-point format were opened on top), its turnover increased from UAH 16 billion to UAH 20 billion, and EBITDA (according to the official financial statements of Comfy Trade LLC) was about 270 million hryvnias

The network is present in 53 Ukrainian cities, the most stores were in Kyiv (18, including 6 Comfy-points), Dnipro (8) and Kharkiv (8).

Immediately after the beginning of the full-scale Russian invasion in February 2022, Comfy stores were closed, but within a few days the chain began to partially resume its operations.

At the end of March, the number of operating stores was 45, in mid-April – 63, and already at the end of May, 79 Comfy stores were operating (in particular, supermarkets were newly opened in Kharkiv, Mykolaiv, Zaporizhzhia, and the store in Bucha damaged because of military actions was restored).

Comfy's management decided not to move the company's central office, which remains in Dnipro all this time. The central warehouse, located in the village of Velyka Dymerka of the Brovary district (it remained undamaged, despite the hostilities near the village), was moved to Lviv (Foxtrot was less fortunate - its main warehouse in Gostomel, Kyiv region was destroyed).

A sad page - as a result of a missile attack on June 27, 2022, the Comfy store, which was located in the Amstor shopping mall in Kremenchuk, was destroyed. 12 employees of the company died as a result of the strike. Comfy's revenue in 2022 amounted to UAH 16.6 billion, 16% less than in the previous year, gross profit amounted to UAH 3.5 billion, EBITDA – UAH 271 million.

The dynamics of the company's turnover in 2022 compared to 2021 was comparable to those of Rozetka (-13%) and significantly better compared to Foxtrot (-35%, the network's turnover in 2022 was UAH 9.8 billion) and Eldorado (-49%, UAH 7.3 billion).

Regarding the structure of the company's balance sheet, as of the end of 2022, the size of Comfy's inventory was almost unchanged compared to last year and amounted to UAH 1.7 billion (the average period of inventory turnover in 2022 was about 50 days). The amount of cash at the end of December 2022 was almost UAH 1.3 billion (UAH 2 billion at the end of 2021), while there were no loans on the company's balance sheet as of the end of both 2021 and 2022.

ComfY Trade's equity amounted to only UAH 135 million, the main source of financing for the company is accounts payable to suppliers (UAH 3.1 billion compared to UAH 4.1 billion as of December 31, 2021).

In 2023, Comfy opened 23 new supermarkets, bringing their total number to 102 (and even exceeding its own plans for the year). The total number of chain stores now exceeds the figure before the full-scale invasion. As for the online segment, Comfy is also making progress in it, entering the top three retailers in terms of user traffic in 2023 (while Rozetka still remains clear market leader by the traffic).

For the first nine months of 2023, Comfy significantly increased its revenue (by more than 50%) compared to last year, so it can be expected that by the end of the year, the company's total revenue will be close to UAH 25 billion. At the same time, not all competitors are doing well.

As of the beginning of December 2023, the Foxtrot network consisted of 121 supermarkets, 25% less than the number before the full-scale invasion, which, accordingly, is reflected in the turnover dynamics (the turnover of this chain in 2023 is unlikely to exceed the figure of 2021).

As for Eldorado, at the end of 2023, this network is on the verge of bankruptcy and is trying to negotiate with creditors to write off part of the debt. The number of Eldorado stores decreased from 106 outlets in February 2022 to 68 in August 2023, and continues to decrease (Comfy opened 14 of its new stores in 2023 on the sites of the closed Eldorado stores).

So by the end of 2023, the Comfy is the largest multi-channel player in the Ukrainian electronics and household appliances market in terms of turnover, and its financial condition remains good.

Key financials Comfy

UAH mln

2019

2020

2021

2022

Revenue

13 650

16 171

19 795

16 580

Operating profit

82

126

50

23

Net profit

14

81

23

2

Average inventory period, days

35-45

Average payables period, days

60-70