The Fozzy group is one of the largest players in Ukrainian grocery retail, operating Silpo, Fora, Fozzy, and Thrash food retail chains.

Over the past twenty years, the group has been among the leading Ukrainian grocery chains in terms of trade area and revenue. At the end of 2021, the Silpo chain consisted of 333 supermarkets, Fora - 276, Thrash! - 90, Fozzy - 9 hypermarkets.

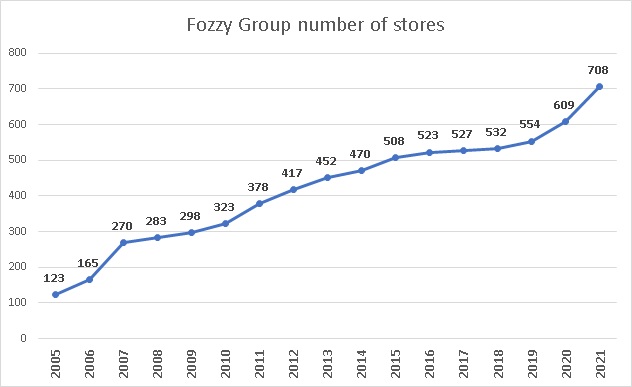

In total Fozzy group at the end of 2021 was represented by 708 grocery stores of various formats with a total trading area of more than 700 thousand square meters. In terms of revenue, Fozzy takes second place (after ATB Market) among grocery retailers. EBITDA of the group in 2020 amounted, according to our estimates, to more than UAH 5 billion.

Fozzy's market share among Ukrainian grocery chains can be estimated at 15-18% (the leader, ATB, has about 25-30%, while the shares of other market players do not exceed 5%).

In addition to the anchor business - grocery retail - the group has other assets - several restaurants, the Bela Romashka pharmacy chain, Ringoo personal electronics stores, several food industry enterprises, Justin delivery service, Vostok Bank, and some others.

The founders of the group were four graduates of the Dnepropetrovsk Metallurgical Institute - Volodymyr Kostelman, Oleg Sotnikov, Roman Chigir, and Yuriy Gnatenko (at the same time, the founders of Fozzy were members of Remont Vody music band, and in general they can be noted as one of the most informal and creative among all Ukrainian big businessmen).

At the moment, the main owner of the group is Kostelman (according to Forbes, he owns 51% of Fozzy).

From Franchise to Market Leadership

Like many other market players, the founders of Fozzy came to retail from the distribution business. Since the mid-nineties, Kostelman and co have been engaged in the wholesale trade in food products. Initially, the partners worked in the Dnipro, and in 1997 they moved to Kyiv.

At that time, businessmen had good relations with the Dnipropetrovsk group Rainford, which had a strong position in wholesale trade, and in 1995 opened the first cash-and-carry grocery store in Ukraine. It was named Partner and was situated in Dnipro (in Kyiv, Furshet became a pioneer with respect to cash and carry stores, it opened the first cash and carry store at the end of 1998).

In 1998, Kostelman and his partners opened a wholesale supermarket in Vyshneve near Kyiv under the name "Partner" (in fact, it was a Rainford franchise). After a short period of time, this supermarket was renamed Fozzy and became the first supermarket of the group (by the way, the Rainford retail chain ceased to exist in 2010-11, its stores became part of Silpo and Varus chains).

The first few years of operations were spent on understanding processes, improving technology, and building relationships with suppliers. Then since 2001 growth and business scaling began - the first five supermarkets under the Silpo name were opened in Kyiv. Initially, the company opened stores at the locations of old Soviet supermarkets - of course, they were inferior to more modern stores, but, as a rule, they had a good location.

Fora was founded in 2002. This network consisted of smaller stores (about 400 sq m on average) that initially operated in the format of a discounter. The first Fora stores were opened in Kyiv on Obolon and near the Svyatoshyn metro station. The group switched to multi-format - Silpo worked in the middle price segment and had medium-sized (1-1.5 thousand sq m) supermarkets, Fora - small shops in the low segment, Fozzy - wholesale hypermarkets.

The following year, the Dnipryanka chain was acquired (38 stores in Kyiv, which were reformatted into Fora). The purchase did not go smoothly – Dnipryanka was in the sphere of interests of some companies related to Ukrainian General Prosecutor, which resulted in a lot of issues with law enforcement agencies and the tax authorities.

It took several months to deal with these conflicts, after which both networks - Fora and Silpo - began to develop rapidly. Fortunately, the market situation favored this as much as possible. In one of his early interviews, Vladimir Kostelman said that any store in Kyiv is a success story, no matter how good and efficient it is.

No wonder it was during this period that several grocery chains were established, which later became leaders of the Ukrainian retail market for the past twenty years.

Until 2005, Furshet was the leader of the grocery retail market of Ukraine - initially, the company bought up old real estate objects and converted them into a kind of shopping malls, in which supermarkets acted as anchor tenants.

In 2001, the first store Velika Kyshenya was opened, in the same year, ATB Market grocery stores were reformatted into cash and carry stores. The first international company entered Ukraine - Rewe Group, which opened Billa supermarkets, a little later - another German network Metro and several Russian networks. Regional networks were also developing - there was enough space on the market for everyone.

The Fozzy group became the leader of Ukrainian food retail in 2005. At the end of this year, the Silpo chain included 81 stores, Fora had 39 outlets, and three Fozzy hypermarkets were already operating. The group's total turnover was estimated at $750 million.

According to Kostelman, initially, the focus was on the speed of development, after which the analysis of the business processes in different stores took place and best practices were scaled up for the whole network. The development strategy was rather empirical - by trial and error. The company was not afraid to experiment and openly talked (and talks) about it.

As for the sources of financing, like all other chains, one of the main ones was trade payables provided by suppliers (Payables Period significantly exceeds Inventory Period, which means that with the opening of new stores the company received additional funds that could be invested in further development).

Also, the owners reinvested almost all the earned profit into the business and attracted loans.

Despite its multi-format nature within grocery retail, unlike some of its competitors (for example, Furshet or Rainford), Fozzy practically did not make sizeable investments into other projects, in particular, shopping malls. Fozzy's owners focused on what they could do best - selling food to Ukrainians.

Crisis is an opportunity

As a result of the Y2008 crisis, Fozzy group became the leader of the Ukrainian food retail market. At the end of 2007, the Silpo chain had 143 stores, Fora - 123 stores (the number of stores more than doubled compared to the end of 2006, largely due to the acquisition of the Bumi-Market (Kyiv) and Kit (Zaporozhye) chains).

According to information from open sources, the group's gross turnover in 2007 amounted to about $1.5 billion (about UAH 7.5 billion at an exchange rate of Y2007), EBITDA was about $70-75 million. while ATB's turnover in 2007 was two times lower than Fozzy’s.

As for Fozzy's debt burden, it was at a more or less acceptable level (according to our estimates, the group entered the Y2008 crisis with a debt-to-sales ratio of no more than 15%). However, like many other networks, Fozzy used short-term loans to finance investments in the development of the network and was also partially funded in dollars.

At the time of the crisis, some banks refused to roll over credit lines to borrowers, which led to problems - networks that used "short" money to finance investments simply could not repay loans.

At those time Fozzy's main competitors, Furshet and Velyka Kishenya, did clearly worse than Kostelman and Co. The share of dollar loans for these networks was higher, which means that as a result of UAH devaluation, their debt burden (as a ratio of debt to sales) was also higher. These chains had a larger trade area per store compared to Silpo and Fora, their assortment was higher, and the turnover of goods was lower. So their profits per unit of trade area were also lower than the profits of Fozzy.

Although there is an opinion among some experts that the main factor in the success of Fozzy in the post-crisis period was a tough stance towards banks, we believe that was not the case.

The stance towards the banks was in fact quite tough, but this was by no means the main success factor. What was it? Definitely higher operating efficiency and lower debt burden. As for negotiations with banks, in 2009 the group managed to successfully roll over most of the loans and continue its development.

Of course, this development could not be compared with the pre-crisis one - if during 2006 and 2007 the total network of Fozzy increased from 123 stores to 270, then in 2009 the network grew by 15 stores, in 2010 – by 25, 2011 – by 55 stores.

Data includes grocery retail outlets only, sources: GT Partners, Liga.net, Fozzy press office, ShareUAPotential data

From 2007 to 2011, Fozzy's revenue in hryvnia terms increased by more than 2.5 times and in 2011 amounted to about UAH 17 billion. In terms of revenue, the group remained number one in the Ukrainian food retail market, however, a competitor that gained momentum just in the post-crisis period, ATB Market, was right behind (ATB's revenue in 2011 amounted to UAH 15 billion).

Unlike Fozzy, which had multi-format chains, ATB had a strict concept - stores of 500-600 sq m in the format of a discounter in the low-price segment (after the crisis, this was important due to the fall in the purchasing power of the population).

ATB had good profits per unit of the trade area, excellent inventory turnover, and good payment discipline in relations with suppliers.

Fozzy, on the other hand, has never been among the best networks in terms of payment discipline with suppliers, which we consider as a quite negative factor - if in the late nineties and early 2000s this was considered normal, in the 2010s relationships between wholesalers and retailers became more civilized and good payment discipline created maximum loyalty of suppliers to retail networks.

Meanwhile, other networks began to lag far behind. The parent company Metro (number two in the market by revenue in 2008) was too scared of crisis, UAH devaluation, and decline in the purchasing power of the Ukrainian population. Furshet and Velika Kyshenya tried to improve the operating efficiency of existing networks and negotiated with banks about new debt restructurings.

So by 2011-12, a duopoly was established on the market - the two strongest players (Fozzy and ATB Market) were increasing their advantage vs. other chains. This process continued further - in 2012-13, ATB increased its network from 530 to 820 stores, revenue - from UAH 15 billion to UAH 28 billion (and overtook Fozzy in terms of revenue in 2013).

Over the same period, Fozzy increased the number of stores from 378 to 452, revenue - from UAH 17 billion to UAH 25 billion. The group lost its first place among Ukrainian grocery chains but increased its advantage over other competitors (revenue of the number three in the market in 2013 - Metro - amounted to only about UAH 9 billion, compared to UAH 7.2 billion in 2007 – growth rate was far lower vs. Fozzy and ATB Market).

What happened in 2014 and 2015

By 2014, Fozzy came up in fairly good shape. In fact, in terms of finance, the situation was almost identical to 2008. With revenue in 2013 at the level of UAH 25 billion, the group's loan portfolio at the end of the same year, according to our estimates, was about UAH 3 billion, which is quite a normal indicator for food retail.

On the other hand, a significant part of the loans was short-term - maturing in 2014-15, and a significant part of the loans was denominated in dollars.

As a result of the devaluation of the hryvnia in 2014-15, the group's total debt burden doubled compared to the end of 2013 and at the end of 2015 amounted to about UAH 6 billion. But the group's revenue also increased, up to UAH 45 billion in 2015, so the debt burden looked ok.

Where, then, are the stories of tough negotiations with financing banks, courts with VTB and other creditors coming from? First, given that the loans financed investment activities, the company could not repay them on demand. Debt prolongation was needed.

Secondly, the group did not want to stop its development and preferred to invest funds to open new stores instead of repaying the debt. During 2014-15 Fozzy's total network increased from 452 to 522 stores.

As for the lenders, such behavior, of course, did not look very good. However, it should also be taken into account that some banks, in particular VTB (the largest creditor), Kyiv Rus, Khreschatyk, were already in default themselves by 2016, and Fozzy, having realized the weakness of creditors, was in no hurry to negotiate with them terms of restructuring (as a result, the loans were repaid with a large discount).

Not quite nice as well? C'est la vie. Other banks continued to work with the group, moreover, in 2020, Fozzy attracted a $60 million loan from the EBRD (which implies sufficient business transparency and a level of confidence in it).

Reformatting

Since 2016, Fozzy has practically stopped its growth and started reorganizing networks and optimizing business processes.

The new Thrash! network has been launched (Thrash! Crushing prices!). This network began to work in the format of a hard discounter (narrow assortment and low prices). At the end of 2016, there were already 30 Trash! stores operating, at the end of 2017 - 37 (these were mostly reformatted stores of the Silpo and Fora chains). After that, the network practically did not develop for two years, and in 2019 it changed the concept. The assortment was significantly expanded, and the format was called “market super”.

The Fora chain has also slightly changed its concept, trying to get stores out of direct competition with ATB. The new concept was convenient convenience stores.

As for Silpo, in 2015-16 the chain began to reformat its stores into uniquely designed thematic supermarkets operating in the middle+ price segment. Initially, this concept raised questions due to the fall in the purchasing power of the population of Ukraine in 2014-16, but with the growth of household incomes in subsequent years, the situation changed.

Each new Silpo store has its own unique design

The competition in this niche was already significantly less than in the middle and low-price segments, and the new format brought Silpo into a new niche in terms of customer experience. This format has no analogs in the world, and this is another bold experiment by Fozzy, which, as of the end of 2021, looks quite successful.

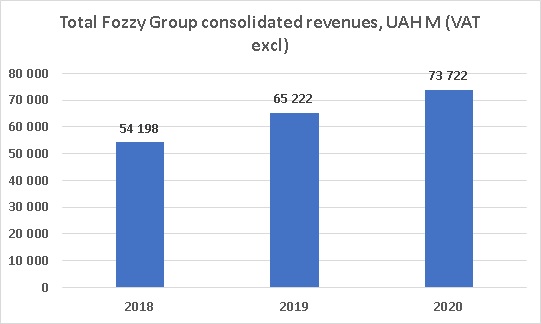

In terms of market position, it seems that Fozzy is no longer very interested in the increased gap from ATB Market in terms of the number of stores and revenue (ATB network has grown to more than 1300 stores at the end of 2021, revenue (in 2020) was about UAH 124 billion, while Fozzy had 708 stores and consolidated revenue (in 2020, and taking into account only food retail) – UAH 74 billion).

“We are not a leader in terms of costs, we do not compete on price, like ATB. Our story is to create a unique product, democratize, ensure the availability of products and create a cool shopping experience,” Fozzy representatives told Liga.net.

Also interesting to note that since 2013, the group has been consistently present among the largest Ukrainian exporters of agricultural products. The original goal seems to have been to optimize VAT. This opportunity was also used by other retailers, and Epicenter-K, for example, starting with a similar VAT optimization scheme, in a few years turned into one of the largest agricultural holdings in Ukraine.

So, do not be surprised to see the companies of the Fozzy group among the largest exporters of sunflower oil and meal (in 2019, the group's export revenue amounted to more than UAH 10 billion).

New time

In 2019-2020, the networks of the Fozzy group began to grow again. In total, more than 50 stores were opened in 2020 (and at the end of the year their number was 609).

The Silpo chain increased from 259 supermarkets to 278, its trade area grew by 7%, and its revenue increased by 12% (due to growth of the area and inflation) and amounted to almost UAH 50 billion (including retail sales only).

Mostly new stores of a new design format were opened - at the end of 2020, the network already had 69 such supermarkets (at the end of 2021 - more than 100).

In 2020, the network received a loan of $40 million from the EBRD, and here it is not the amount that matters, but the very fact of receiving a loan from such a reputed institution, especially taking into account the credit history of Fozzy, which was perceived far from perfect.

Another $20 million loan from the EBRD was received by the Fora company - the funds should be spent on updating stores, while in 2020 the Fora chain increased by 18 stores (up to 265 at the end of the year), its revenue (retail sales) amounted to UAH 16 billion, which was 27% higher than in 2019.

In 2021, the growth of the group accelerated even more, moreover, it was this year that a significant event took place - the Silpo network absorbed most of the outlets that remained at the beginning of the year in the Furshet network. Ironically, in 2003-04, Fozzy tried to catch up with Furshet in terms of the number of stores and the amount of revenue. After more than 15 years, it was Silpo who absorbed the last Furshet outlets.

As a result, at the end of 2021, the total number of Fozzy group stores was 708 (333 Silpo supermarkets, 276 Fora stores, 90 Thrash!, 9 Fozzy hypermarkets).

Financial standing and prospects

In recent years, the development of the Fozzy group has been quite dynamic, as a result, the total revenue of the group's grocery chains (only retail sales) has increased from UAH 54 billion in 2018 to UAH 65 billion in 2019 and UAH 74 billion in 2020. This data is ShareUAPotential's own estimate based on networks’ operating companies’ data.

According to official information, the total consolidated revenue of the group in 2019 amounted to about UAH 78 billion (at the same time, exports accounted for more than UAH 10 billion).

Also, according to our estimates, the consolidated EBITDA of the retail business (represented by Silpo-Food, Fora, Expansion, Trash, as well as some companies - fixed assets owners) amounted to about UAH 5.3 bn (EBITDA margin - 7%).

The group's overall leverage remains low, with consolidated debt at the end of the year totaling UAH 4.6bn, just over 6% of revenue and less than the group's annual EBITDA.

The inventory turnover of the group's chains, according to our estimates, averages around 45 days, which is more than covered by supplier delays (a standard situation for grocery retailers).

So the financial condition of the group at the end of 2020 was quite good.

Among the weaknesses of the Fozzy group, we can note high fragmentation of the business and the frequent change in the concept of networks.

The Silpo chain has more than 100 stylish designer supermarkets in the medium + price segment, in which the network is the market leader (in fact, the only competitor in this segment is the Novus chain, which absorbed Billa supermarkets in 2020 and consisted at the end of 2021 of 87 stores).

On the other hand, Silpo still has a lot of old-format stores that are absolutely different from designer stores, which can negatively affect the shopping experience of customers.

It will probably be logical if in the future the remaining Silpo stores of the “old” format will either be converted to designer ones, or (if the first option is not possible) also reformatted, but will already be transferred to the Thrash! network.

Based on the profile of the owners of the network (who are clearly creative people), the development of “designer” Silpo is what the owners themselves get the most pleasure from.

What are the prospects of the group in other areas? We will not be surprised if subsequently Trash!, old-style Silpo stores (which cannot be converted into designer ones), or Fora, is sold (for example, these stores could become part of the Lidl chain if this chain decides to enter the Ukrainian market, about which there has been a lot of talks lately).

Financial condition of the group allows its owners to experiment - to do what they, in principle, have been doing during the entire time they have been working in the grocery retail market of Ukraine.

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer