Eva chain is the leader in the cosmetics and household goods market of Ukraine in terms of the number of stores, trade area, and sales volume.

Early stage

Eva and its main operating company Rush LLC were founded in Dnipro in 2002 by businessmen Ruslan Shostak, Vadim Tugay, and Valeriy Kiptyk.

At that time, each of them, to a certain degree, was involved in the retail market or the production of cosmetics and household goods. Ruslan Shostak was involved in the import, production, and distribution of baby food, while Valery Kiptyk was one of the shareholders of the Olvia Beta company, one of the success stories of Ukraine in the early 2000s. Several Dnepropetrovsk businessmen, among whom such well-known persons as Vadim Ermolaev and Sergey Kasyanov, together with Turkish partners, produced and sold household goods under the trademark Gala. Having taken a significant market share, they sold the project to Procter & Gamble in 2004.

So the founders Eva chain had financial resources and trading experience, while the market itself was full of opportunities - the organized trade in cosmetics and household goods in Ukraine had just started to develop.

In parallel with Eva, the same founders launched the Varus food retail chain, which later also became one of the leaders in the Ukrainian retail market. Also, businessmen were prominent players in the commercial real estate market of the Dnipro region.

Eva started very actively - already in 2004 the number of chain stores increased to 19, revenue amounted to more than UAH 60 million, and net profit – to almost UAH 2 million. Taking advantage of the growing banking system in Ukraine, almost immediately the company began to attract credit resources, which allowed it to develop faster - in 2005, the first chain stores were opened in the Donetsk region, and in 2006 - Kyiv, Odessa, and Kharkiv regions.

In parallel, the structure of the company's shareholders has changed - Vadim Tugay left the company and started a new business of almost the same format – drogerie chain Prostor. Remaining shareholders - Valeriy Kiptyk and Ruslan Shostak own Eva in equal shares up to this day.

Early development and 2008 crisis

2006-2007 were years of rapid growth both for the Ukrainian economy as a whole and for the retail market. Number one in the Ukrainian retail market of cosmetics and household goods at that time was the DC chain, which at the end of 2006 consisted of more than 100 outlets that generated revenue in the amount of UAH 420 million (Eva had 86 stores and UAH 260 million of revenue). In 2006, 65% of this chain was acquired by the Watsons group, the world's largest drogerie chain (in 2011, the share was increased to 100%). At that time, Watsons had quite serious plans for the development and expansion of its chain in Ukraine.

The second competitor, Cosmo, operated 51 stores at the beginning of 2006 and had a turnover of UAH 270 million. At the beginning of 2007, more than 50% of this chain was acquired by the SigmaBleyzer investment fund, which planned to invest $40 million in the development of the network and open 200 more stores.

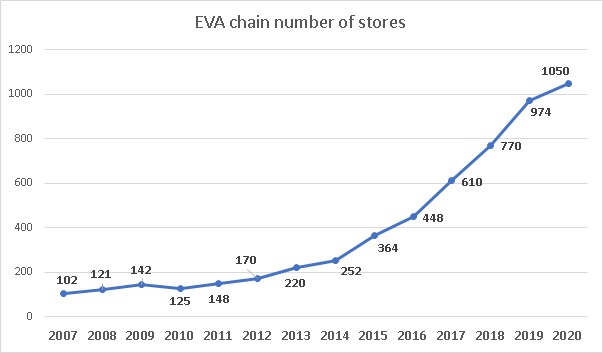

Eva tried to keep up with the competition. The owners of the company also seriously considered attracting an external investor in both the Eva and Varus businesses, however, these plans did not come true. Meanwhile, the chain continued to grow, surpassing 100 stores in 2007.

And then the crisis happened. And it was this event that Ruslan Shostak in one of his later interviews called the most memorable one over the years of Eva's operations. At the end of 2008, banks that had fallen into a liquidity crisis began to ask their clients to reduce credit lines. Clients, in turn, used the situation for their own benefit - they simply stopped servicing loans. Even if they were able to serve them. The situation with Eva and its sister business Varus looked ambiguous. Either the banks “overpressed" the company, or the businessmen used the opportunity to push the banks, but Eva went into the official reorganization procedure. At the same time, operationally the business looked absolutely viable - the total debt was about UAH 80 million, with a turnover of UAH 455 million in 2008. So even if the chain was in some kind of crisis, it was only a liquidity crisis - nothing more.

Best Price and Explosive Growth

It is not surprising that Eva emerged from the crisis and reorganization stronger than before. Having prolonged its obligations to banks, the company could focus on operational efficiency and further development. Moreover, it was the crisis that forced the chain to switch to a new strategy - “the best price”. Prices in Eva were lower than those of competitors (who relied more on service and assortment), and this is what the Ukrainian buyer needed because after 2008 the state of crisis for Ukraine was almost permanent.

This change along with some unsuccessful actions of competitors, in our opinion, predetermined the decisive breakthrough of Eva in achieving sole leadership in the market.

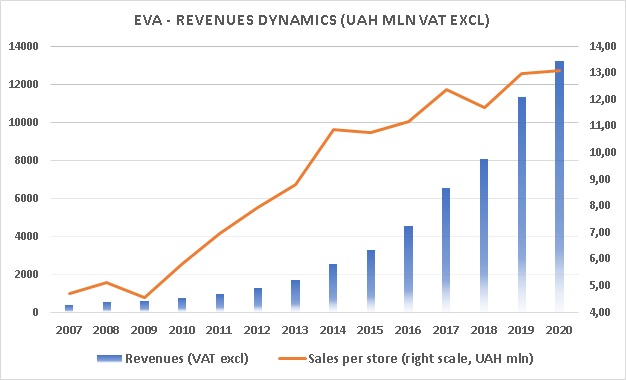

From 2009 to 2013, the number of chain stores increased from 142 to 220, while revenue tripled and amounted to UAH 1.8 billion in 2013. The payback of the stores was excellent, and, according to our estimates, was 3-4 years. Considering that the company's inventory was financed by trade credit from suppliers (with an inventory turnover of about 100 days), and investments in fixed assets were financed with reinvested profits, the growth occurred at the expense of own funds, while debt to banks did not increase.

In 2013, Eva almost caught up with Watsons in terms of revenue, despite the fact that at the end of the year the latter's network consisted of 320 outlets (220 for Eva). It indicates higher sales of EVA per one store. The most likely reason is the lower prices compared to competitors (which is confirmed by the higher profitability of Watsons - its operating margin in 2013 was 7% compared to about 5% for Eva).

Cosmo's situation was worse. In 2012, the chain announced plans to open 70-80 stores a year. New stores did indeed open, however, operating efficiency was not high. Cosmo was unable to offer consumers a coherent strategy - it was clearly losing to Eva in terms of prices while in terms of convenience it was worse than Watsons. Also, Cosmo was owned by the investment fund, which factually started to think about exiting from this business.

The events of 2014-15 had a negative impact on the development of Eva - the chain lost more than 30 stores, however, in money terms, the losses were small since the stores were rented. On the other hand, operating in the low-price segment, the chain was actively taking market share from its competitors. In 2016, the chain already consisted of 448 stores (twice as many as at the end of 2013, with a 2.5-fold increase in turnover). Eva began active development in the western region of Ukraine, where it was not present before.

With an annual EBITDA of UAH 300-400 million, the chain could well afford to increase the number of stores by 100-200 annually (investments in one store amounted to UAH 1-1.5 million). The debt of Rush LLC increased, while its ratio to sales gradually decreased - from a quite low 10% at the end of 2013 to 8% in 2016. And over the next five years, this ratio even decreased to 5%, while the company not only received loans from banks but also issued bonds. So, in 2018, Rush LLC issued bonds for UAH 200 million. At the beginning of 2021, these bonds were redeemed, while a new placement was announced - already for UAH 500 million with a maturity of 6 years.

From 2017 to 2020, Eva opened an average of 188 stores per year, so at the end of 2020, their number exceeded 1,000. The network's revenue (excluding VAT) increased from UAH 6.6 billion in 2017 to UAH 13.4 billion in 2020.

It should be noted that, like some other chains, over the past few years Rush LLC has acted as an exporter of grain and oilseeds (the reason is tax optimization). Thus, the network's total revenue was slightly lower than Rush's revenue. This export reached its maximum in 2019 (UAH 1.3 billion). Below is the dynamics of the network's revenue over the past years, excluding those "technical" exports:

But what about the competitors? Watsons increased its network from 320 stores in 2013 to 450 in 2017, and revenue (over the same period) from UAH 1.8 billion to UAH 3.4 billion. After that, the growth of the network stopped, and the number of stores even decreased slightly by 2020. Cosmo, in 2020, was bought by another competitor - the Prostor network of Vadim Tugay (as a reminder - one of the founders of Eva).

The coronavirus has made some adjustments to the development of Eva - in 2020, "only" 88 new outlets were opened compared to 219 a year earlier. At the same time, the average revenue per store remained practically unchanged, and profitability even increased.

Eva today

As of mid-2021, Eva is the absolute leader in the retail market of cosmetics and household goods in Ukraine. The number of stores - 1080 - significantly exceeds the chain of its main competitors - after the takeover of Cosmo, Prostor had 426 stores at the end of 2020, and Watsons had about 400 stores.

Eva's revenue in 2020 amounted to UAH 13.4 billion (Watsons - UAH 2.7 billion, Prostor - UAH 4.1 billion). About 20% of the chain's revenue comes from its own brands. The group operates three distribution centers (in Dnipro, Lviv, and Boryspil). Inventory turnover is about 100 days.

The main financial indicators of Rush LLC over the past few years are presented in the table:

UAH mln

2016

2017

2018

2019

2020

Revenue (w/o VAT)*

4 800

6 630

10 050

12 594

13 445

EBITDA

387

444

650

1 389

1 916

EBITDA margin, %

8.1%

6.7%

6.5%

11.0%

14.2%

Net Income

210

245

350

319

540

Inventory turnover, days

100-110

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer