13 January 2023

Ukrainian sugar market 2022

Despite the negative impact of the full-scale russian invasion, in 2022 Ukraine returned to the list of global sugar exporters.

Global sugar market

The world sugar market is quite volatile in terms of production and prices, but quite stable in terms of total consumption.

During the last four marketing years, the world consumption of sugar was in the range of 171-173 million tons of sugar per year. The largest consumers were countries such as India (with a consumption of 29 million tons of sugar in the 2021/22 season), EU countries (17 million tons) and China (14.8 million tons).

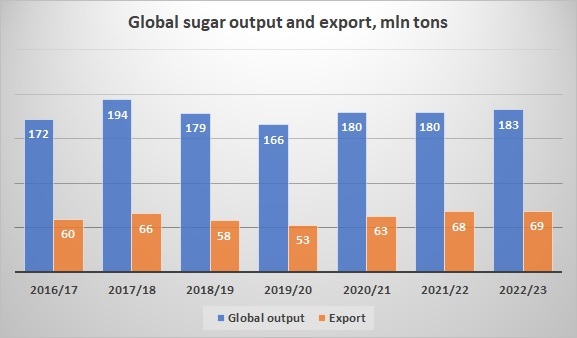

As for production, it was much more volatile - after a record (194 million tons) in the 2017/18 season, there was a significant reduction in the following two seasons (in the 2019/20 marketing year, global production was 166 million tons).

In the last two seasons, production was stable - about 180 million tons, the USDA forecast for the 2022/23 season is 183 million tons.

More than half of world production is cane sugar (on average, it has a lower cost of production compared to beet sugar). The main producing countries are India and Brazil. Each of them produces approximately 35 million tons of sugar.

The main sugar exporting countries are Brazil (in the last season it exported about 26 million tons or 38% of the total global export) and Thailand (10 million tons in the 2021/22 season). In recent years, India began to significantly increase the volume of exports.

Ukraine was a non-minor exporter of sugar on the global market during 2016-18, exporting an average of 550,000 tons per year and being among the TOP-10 global exporters.

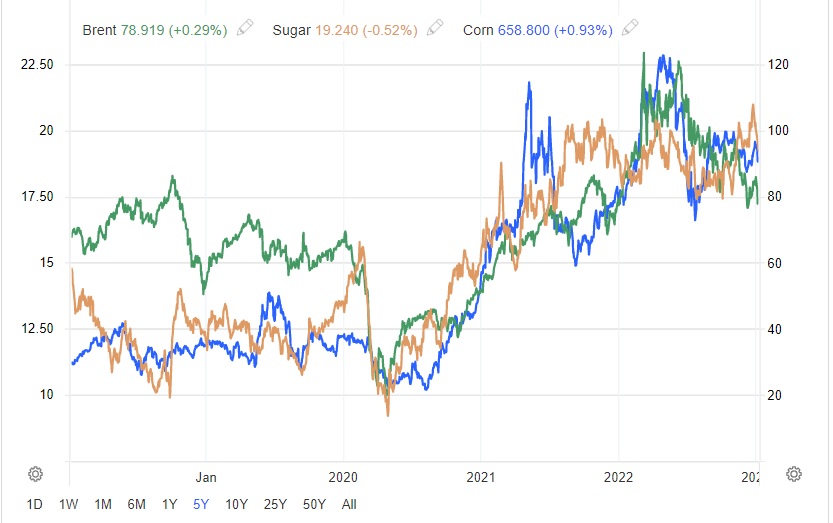

The main factor that affects production volumes is, of course, the weather in the main producing countries, but there are also others - for example, the price of oil, since the global sugar prices depend on the amount of cane that is directed to the production of bioethanol, instead of sugar production (mainly in Brasil).

It is therefore not surprising that there is a significant correlation between the world prices of oil and sugar. The graph below shows the dynamics of oil, sugar, and corn prices over the past five years (source):

Цукор - помаранчевий колір, нафта - зелений, кукурудза - синій

As we can see, the global upturn in commodity prices that started in 2020 was also fully affected by sugar - from April 2020 to early 2022, the global price of sugar more than doubled.

Ukraine - production, consumption, and export of sugar

The cost of sugar production in Ukraine is quite high compared to the countries that are the main world producers.

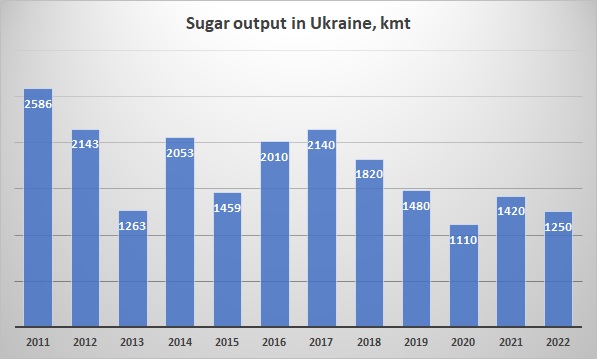

During the times of the USSR, Ukraine fed half of the country with sugar - the production amounted to more than 5 million tons. In general, factories were inefficient, so if right after the collapse of the "great and mighty" Ukraine still continued to export sugar to russia and other countries of the former USSR, in further years export gradually decreased, and production stabilized at the level of 1.5-2.5 million tons.

The dynamics of Ukrainian sugar production is shown in the following graph:

2022 рік-оцінка

The dynamics of sugar production depended mainly on two parameters – sugar beet planted area and its yield (the third one is the sugar content of beets):

Year

Sugar beet

Sugar

Area, k ha

Yield, t/ha

Total crop, kmt

Output, kmt

Consumption, kmt

Export, kmt

Import, kmt

2010

501

27.4

13 749

1805

1704

65

90

2011

532

35.2

18 740

2586

1758

51

48

2012

458

40.3

18 439

2143

1713

174

10

2013

280

38.5

10 789

1263

1686

163

11

2014

331

47.5

15 734

2053

1559

6

1

2015

237

43.6

10 331

1459

1600

115

2

2016

292

48.2

14 011

2010

1450

465

47

2017

316

47.5

14 882

2140

1450

599

2

2018

276

50.9

13 968

1820

1350

585

10

2019

222

46.1

10 234

1480

1350

237

2

2020

220

41.6

9 152

1110

1300

151

2

2021

226

47.9

10 854

1420

1210

25

164

2022

180

50.1

9 017

1250*

950*

181

5

As a rule, the acreage of sugar beet in Ukraine depended to a large extent on the profitability of sugar production in previous years. Production profitability in its turn depended on the domestic market situation.

In recent years, before the start of full-scale russian aggression, the domestic demand for sugar in Ukraine had a clear downward trend. Until 2014, it amounted to about 1.7 million tons, after 2014 it decreased to 1.3-1.4 million tons, primarily due to a decrease in the production and export of sugar confectionery, as well as due to a general decrease in the country's population.

The domestic market of Ukraine is protected from imported sugar by a duty of 50%. So Brazilian sugar, which is cheaper in terms of cost, does not compete with domestic production. In recent years, only in 2021 Ukraine faced a shortage of sugar and was forced to import it.

Regarding exports, Ukraine becomes competitive on the global market at a time when the price of sugar exceeds $300 per ton.

Usually, when the situation on the world market is favorable, the surplus of Ukrainian production was exported, producers received decent profits and did not reduce the acreage under sugar beet. This was the situation in 2016-18, when Ukraine became a noticeable player in the world sugar market.

When global sugar prices were low, exports declined, excess domestic production put significant pressure on domestic prices, and producers had large sugar inventory overstocking. Their profitability significantly decreased, which led to a reduction in beet sown areas for the following years.

The situation developed in this way in 2018-19 - world prices collapsed in 2017 and remained at a low level until 2020. Exports decreased significantly, domestic prices also decreased, and the profitability of producers was close to zero.

The drop in profitability led to a significant reduction in sugar beet acreage in 2019 and 2020. Also, in 2020, the beet yield decreased from 45-50 t/ha in previous years to about 40 t/ha. Thus, the total Ukrainian sugar production in 2020 amounted to only 1.1 million tons - this was the lowest production in the entire history of Ukraine.

Accordingly, domestic prices began to rise gradually in 2020 (do not forget about the significant increase in global sugar prices starting in 2020), and in 2021 there was a real shortage in the market, so Ukraine needed to import sugar.

To avoid a further increase in domestic prices (in general, in 2021, sugar prices in Ukraine increased by more than 60%), the government introduced quotas for duty-free sugar imports into the country. As a result, for 2021, the total import of sugar to Ukraine amounted to 164 thousand tons, and export - only 25 thousand tons.

Sown areas under sugar beet in 2021 remained at the level of previous years, but yields increased compared to 2020 (by more than 15% - to 48 t/ha), so it was expected that in 2022 the market would be more balanced, and production will fully satisfy domestic demand (with some surplus for export).

Year 2022

The full-scale russian invasion in February significantly affected domestic demand, primarily due to the departure of a significant number of Ukrainian people to other countries.

In 2022, farmers managed to sow 181,000 hectares of sugar beet (the reduction compared to 225,000 hectares in 2021 primarily concerned the Kyiv region, where the reduction in the area amounted to 16,000 hectares, Kharkiv and Khmelnytskyi regions).

On the other hand, the sugar beet yield increased, having averaged to 50 t/ha, so the total beet harvest compared to last year decreased by 17% and amounted to about 9 million tons (potential sugar production – 1.25 million tons).

Starting from the summer of 2022, it was clear that Ukraine had a surplus of sugar for export. At the same time, a negative factor was a significant increase in logistics costs, since the Black Sea ports of Ukraine were blocked until August.

On the other hand, the EU canceled customs duties on Ukrainian goods (usually the internal EU sugar market is also protected from cheap imports by customs duties), so since October, Ukrainian sugar exports have grown significantly and reached 181,000 tons by the end of 2022.

Under current circumstances, it is difficult to estimate the total consumption of sugar in Ukraine. According to our rough estimates, in 2022 it could amount to not mot more than 1 million tons.

With the production of sugar in the current season at the level of 1.25 million tons (estimate) and taking into account the remaining sugar stock from the previous season, we expect that the total export potential of Ukraine for 2023 may amount to 300-400 thousand tons (exports in the second half of the year will largely depend on sowing area under sugar beet in 2023).

The main Ukrainian producers of sugar

During the last decade, the leading sugar producers in Ukraine are Astarta, Radekhiv-Tsukor and Ukrprominvest-Agro. The total share of these companies in production in 2021 was about 56%. Other notable producers are Svitanok and Panda agricultural holdings, Aspik Group.

Astarta and Ukrprominvest-Agro are large Ukrainian agricultural holdings (the latter is owned by the former President of Ukraine, Petro Poroshenko). As for Radekhiv-Tsukor, it is part of the Pfeifer & Langen international group (at the same time, the company's management is close to local agri-company Zahidny Bug).

The dynamics of sugar production in recent years of each of these companies is shown in the table below:

2017

2018

2019

2020

2021

2022

Astarta

463

352

302

226

344*

282

Radekhiv-Tsukor

433

327

296

220

266*

н.д

Ukrprominvest

241

292

228

171

263*

н.д.

**-estimation

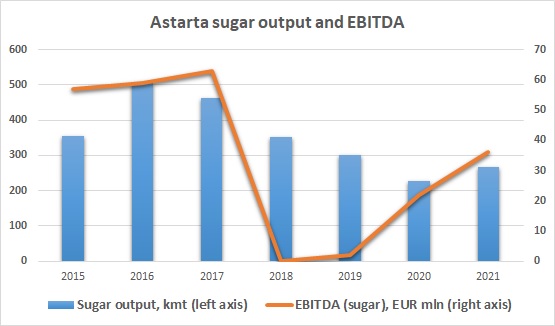

The profitability of the main sugar producers in Ukraine can vary greatly from year to year, depending on the market situation. The graph below shows data on production volumes and EBITDA of Astarta sugar segment:

In recent years, the company achieved the highest level of profitability of sugar sales in 2017, while in 2018-19 sugar was sold with zero margin. Starting from 2020, profitability began to recover.

Conclusions

The Ukrainian sugar market is quite difficult for its players, but in recent years the leading producers have demonstrated that they have enough margin of safety to survive in difficult times. Despite the war, sugar production in Ukraine in 2022 is sufficient to satisfy domestic consumption, moreover, in 2022 Ukraine again began to show up as a sugar exporter.