Allo is the leader of Ukrainian mobile phones and gadgets market with the share of about 30%

At the right time in the right place

In the late 90s, the mobile phone market in Ukraine (and throughout the world) was just beginning to emerge.

The founder of Allo - Dmitry Derevitsky - in one of his interviews said that he decided to trade mobile phones after the introduction of the GSM communication standard by Ukrainian mobile operators, which was supposed to lead to the active development of the mobile phones market in the country.

In 1998, two stores selling telephones were opened in Dnipro, and Derevitsky also opened two stores selling household appliances in parallel.

Initially, $ 50k was invested in the business of selling mobile phones. In his endeavors, Dmitry was supported by his father, Grigory Derevitsky, who was already a quite well-known person in Dnipro at that time. For example, he was the founder of one of the first construction cooperatives in the Ukrainian SSR in the late 80s (as for involvement in the construction business - in the 2000s the Allo group built a large office center "Steps" in the center of the Dnipro, in which the main office of the chain is located).

Until the mid-2000s, Grigory Derevitsky was also among the official founders of the Allo company.

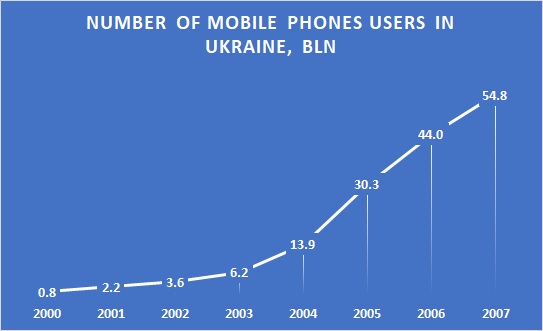

Meanwhile, the mobile phone market grew at a tremendous pace - if back in the late 90s mobile phones were a rarity, then by 2007 the number of cellular subscribers in Ukraine amounted to almost 55 million people (including people who had more than one sim- card):

In line with the market, the Allo network also grew - already in 2006 it consisted of 258 stores in 53 cities of Ukraine. The format was small stores of 30-40 sq m. Mobile phones, gadgets, sim cards and different kinds of related services were sold in the stores. Allo's revenue in 2006 amounted to about UAH 550 million (or more than $100 million at the Y2006 FX rate).

The entire mobile phone market in Ukraine in 2006 was estimated at about $1.5 billion. Among the competitors at that time were retailers of electronics and home appliances, as well as networks operating in similar to Allo format - Euroset, Mobilochka, MobiDik.

First test

The crisis of 2008-2009 was a serious test for Allo. The purchasing power of Ukrainian population fell, so correspondingly the sales of electronics, decreased significantly, and the company was forced to revise its development strategy. The owners and management decided to significantly reduce inventory (selling goods even at a loss) and conduct a general optimization of the network - to reduce the number of outlets, starting with the most inefficient ones.

Negotiations were also held with lessors of retail space to reconsider the terms of the lease. If earlier Allo paid a fixed rent, after negotiations the size of the fixed fee has been reduced, while, when a certain volume of store sales was reached, Allo paid to premises owners a certain percentage of its revenue. This model was less risky for the company, as it reduced the share of fixed costs in its general cost structure.

In the first half of 2009, the number of Allo chain stores decreased by 20% to 288, and for several months thereafter this number remained relatively stable - at about 300 stores.

In 2010-11 there was a recovery of the Ukrainian electronics market as a whole, but for mobile phones the situation was even better. The reason was appearance of smartphones on the mass market. This period can be characterized as the second wave of "mobilization" of the population of Ukraine (the first wave was the appearance of mobile phones themselves, and the third was launch of 3G standard in the country in Y2015).

Smartphones

In 2011, only 10% of the country's population owned smartphones, while only one in six phones sold that year was a smartphone. Smartphones were more expensive than conventional mobile phones (UAH 2,200 versus UAH 720 in 2011), but it was clear that the potential demand for more functional devices in Ukraine was huge.

Already in 2012, with the same size of the mobile phone market as compared to 2011 (about 8.3 million devices), smartphones already accounted for 26% of sales in unit terms, while in monetary terms, the share of smartphone sales was 60%).

Trying to capitalize on this wave, Allo began to expand the network again, and by 2013 it already included about 500 outlets.

In the same period, one of Allo's main competitors, the Euroset company, left the Ukrainian market, and in 2013 another significant event took place - Allo's takeover of its second main competitor, the Mobilochka chain.

The owners of Mobilochka decided to go out of business, and the Allo company partially (by 90%) rented the stores and also bought out part of the inventory from Mobilochka.

At the time of the acquisition, the Allo network consisted of about 500 stores, Mobilochka - 417. Thus, after the departure of Euroset and Mobilochka, competition among offline stores of this format has significantly decreased. The Allo network has grown in scale, but has faced new challenges.

A new way

In 2011-13 e-commerce started to actively develop in Ukraine - and Allo, according to its owner himself, missed the opportunity to gain a significant market share.

The allo.ua online store was created back in 2008, moreover, it was in the leading position in the electronics segment - in 2013 it was named the number two market player. However, the gap from number one - Rozetka - was more than significant and increased all the time.

Then in 2014, a new and more severe crisis broke out in Ukraine, which hit Allo quite painfully. As in 2009, the purchasing power of the population of Ukraine has significantly decreased. However, as Dmitry Derevitsky later told the Big Fish project, there were plenty of problems inside Allo itself. The company entered the crisis being cumbersome and inefficient - immediately after the takeover of Mobilochka outlets, just starting to integrate them into its network.

There was only one way out - a significant reduction in the number of stores. If in 2009 only about 20% of retail outlets were closed, then during 2014-16, the Allo network was reduced by more than half.

Also, as a result of the crisis, Dmitry Derevitsky decided to change the company as a whole. To look at the business from the outside and understand what is wrong with it, consultants from the Adizes Institute were invited.

The main conclusion was that there was a little spirit of entrepreneurship left in Allo, but at the same time, there was a lot of bureaucracy. Owners and management tried to change that.

The company also started to pay much more attention to online, having launched a marketplace in 2016. There was also a certain reformatting of the offline segment. Stores of a new format were opened in large cities - large (300-400 sq. m) and modern Allo-max stores.

At the same time, the total number of stores has remained fairly stable since 2017 – 300-350 outlets. Sales are shifting online - the buyer no longer needs stores everywhere.

The Allo chain began to position itself as a seller of smart devices, and eco-systems for the technology of the future. Everything that has a smart- prefix is sold in Allo. The concept was similar to the new competitor, Citrus, which actively developed at that time.

There was an integration of offline and online segments. The principle - click and collect - with a single click a buyer buys on the company's website and picks up the goods in a conveniently located store. Or a buyer chooses a product according to the specified characteristics in the store, and if it is not available in this particular store, he receives it at home.

Lastly, as a final touch to the transformation of the company, the attitude of the owner towards publicity and openness has completely changed.

If earlier Dmitry Derevitsky was non-public person, in recent years he has constantly given fairly high-quality and informative interviews to various Internet projects. After all, a consumer does not buy a product at some “Allo” store, he buys it from specific people - sellers and owners of the company.

The New times

Considering that 2017 and 2018 were generally good years for electronics retail in Ukraine (due to deferred demand for 2014-16 and renewal of phones by the population), Allo's performance began to improve.

In 2018, the market of electronics and home appliances in Ukraine grew by 25%. At the same time, Allo's revenue increased by 43% (online direction grew immediately by 55%, offline - by 39%, in 2018 the share of internet-store in the total sales of the company made about 20%).

Allo's share in the key smartphones market - increased from 24% in 2017 to 26% in 2018.

Sales of other goods also grew - the assortment on the marketplace increased, which allowed Allo to attract more user traffic to its website.

At one time, it was the attraction of traffic due to a greater variety of commodity items that became the main reason for launching the marketplace - search engines better index online stores with a wider range of products. In 2018, the total traffic of Allo.ua increased by 40% compared to the previous year. The average number of unique users per month on the site was about 4.8 million people.

It was still far from Rozetka, but if to compare with others, positions of Allo have been quite good (Allo.ua has been in the TOP-3 of online stores and marketplaces in terms of the main parameters of their evaluation for almost all recent years).

After a surge in sales in 2017-18, the smartphone market stagnated in 2019, however, the very next year, despite the coronavirus epidemic, it returned to growth (+6%).

According to our estimates, the average life of a smartphone in Ukraine is 3-4 years. The market dynamics of recent years is in line with this assumption - more successful years come after less successful ones, while general trends are set by changes in the purchasing power of the population, as well as the evolution of gadgets themselves.

As for competition in the electronics market, it remains quite serious. There is a clear e-commerce leader, there are leaders among electronics and household appliances networks - Comfy and Foxtrot, there is Epicenter, which has huge financial resources (with operating cash flows generated by other directions), and which has ambitions to become the leading marketplace in Ukraine.

Among the players of the format similar to Allo, Citrus stands out (Allo benefited due to the recent conflict between the owners of this network), as well as Moyo.

Given the global trends in the retail electronics market (the winner takes all - the share of the largest players is only growing), the Ukrainian market is expected to consolidate.

It can be expected that in the near future the market positions of Rozetka and Epicenter (if its owners are interested in developing in this market) will remain strong. All other players are subject to change.

Where Allo will be - among the buyers or those who are taken over - depends on the company's ability to be more efficient than its competitors (in recent years, in our opinion, steps have been taken in the right direction), financially stable and meet the changing preferences of consumers.

Key Financials

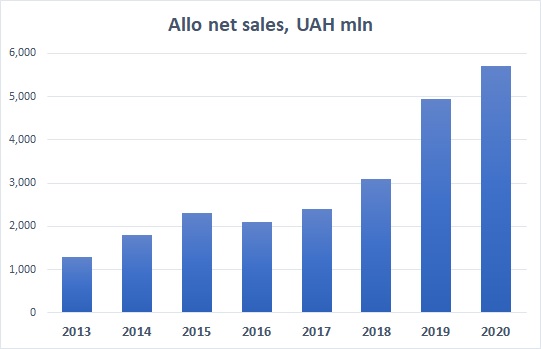

Allo revenues dynamics is represented on the following chart:

The main financial indicators of Allo LLC over the past few years are presented in the table:

UAH mln

2017

2018

2019

2020

Revenues

2 400

3 100

4 934

5 706

EBITDA

242

137

366

380

EBITDA margin, %

10.1%

4.4%

7.4%

6.7%

Net Income

11

15

22

26

Average Inventory Period, days

65-70

Popular:

Nova Poshta - blue chip of Ukraine

Epicentr - biggest Ukrainian DIY retailer and one of the largest agriholding

ATB-Market - the biggest Ukrainian food retailer