18 March 2023

Ukrainian sunflower seeds and oil market 2022/23

Despite full-scale invasion of russian federation Ukraine remains the biggest global exporter of sunflower oil.

In Y2021 Ukraine harvested record-high sunflower seeds crop. According to official information it made 16.4M tons (unofficial data of Kernel Holding – 16.9M tons), which was by more than 3M tons higher than a year ago.

Taking into account good sunflower oil demand on the global market and high global prices, it was expected that Ukraine would renew its records for oil production and export.

Full-scale russian invasion led to blockade of Ukrainian deep sea ports and stopping of main part of Ukrainian oilseeds crushers operations, so crushers focus shifted to development of new export logistics routes.

For the first time during the latest decade Ukraine became noticeable exporter of sunflower seeds – because of general uncertainty farmers preferred to speed up sales of their crops.

Opening of grains corridors from the part of Ukrainian deep sea ports in August 2022 largely improved the situation with export, so in total in calendar Y2022 Ukrainian sunflower oil export made 4.3M toms for $5.5 bln (in calendar Y2021 – 5.1M tons for $6.4 bln). Ukraine remains leading sunflower oil producer and exporter.

Global sunflower oil market

Sunflower oil takes the fourth place among the vegetable oils in the global consumption volumes (after soybean palm and rapeseeds oil) with the share of 10%.

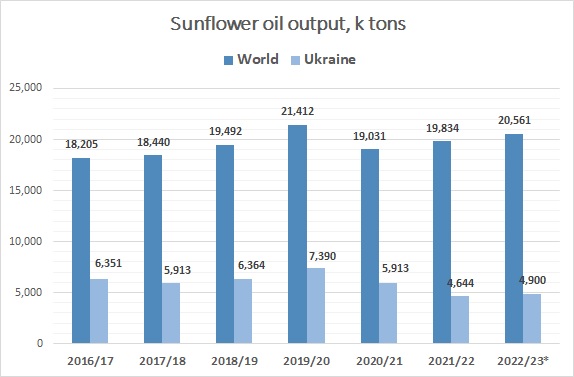

As per USDA data in season 2021/22 total global sunflower oil output made 19.8M tons vs. 19M tons a year ago.

* - source – USDA data, Ukrainian production in MY2022/23 – ShareUAPotential estimation.

Main producing countries were russia (5.8M tons, +0.7M tons y-o-y), Ukraine (4.6M tons, -1.3M tons) and EU (4.4M tons, +1M tons y-o-y).

Despite decrease in output and export in season 2021/22 Ukraine remained the biggest global sunoil exporter with the value of 4.5M tons (in MY2020/21 – 5.3M tons), russia exported 3.1M tons, other exporters in total – 3.5M tons.

The share of Ukraine in global sunflower oil export in season 2021/22 made more than 40%.

Main countries-importers of the oil are EU, China and India.

As for global sunflower oil prices, usually they change in accordance with the general global commodities (mainly soybeans, grains and palm oil) prices trends. Prices significantly increased during Y2020 – first half of Y2021, after that there was a correction followed by another jump in the beginning of Y2022 after full-scale russian invasion into Ukraine.

*-source – Trading Economics, sunoil – orange color, palm oil – green, corn – blue.

Sunflower seeds growing in Ukraine

Sown area, yields and total crop of sunflower seeds in Ukraine since Y2005 are represented in the following table*:

Year

Area, k ha

Yield, t/ha

Output, k tons

2005

3 743

1.26

4 706

2006

3 964

1.34

5 324

2007

3 604

1.16

4 174

2008

4 306

1.52

6 526

2009

4 232

1.50

6 364

2010

4 572

1.48

6.772

2011

4 739

1.83

8 671

2012

5 194

1.61

8 387

2013

5 051

2.19

11 051

2014

5 257

1.93

10 134

2015

5 105

2.19

11 165

2016

6 073

2.24

13 627

2017

6 034

2.03

12 236

2018

6 117

2.32

14 165

2019

5 928

2.57

15 254

2020

6 457

2.03

13 110

2021

6 622

2.46

16 392

2022

4 817

2.17

10 473

During last 15 years sunflower seeds relate to the most profitable crops for Ukrainian farmers. Moreover it is less vulnerable vs. many other crops from soil moisture level perspective. So there is no wonder that during last years planted area under sunseeds have been growing. The biggest sunseeds area of plantation was achieved in Y2021 – 6.6M tons.

Historically the largest sunflower seeds production regions in Ukraine are Southern and Eastern regions. The share of sunseeds of the whole sown area in these regions is more than 30%.

In Y2021 the share of TOP-5 regions – sunflower seeds producers (Kirovograd, Dnipro, Kharkiv, Zaporizhya and Mykolaiv) in total Ukrainian sunseeds sown area made more than 40%.

In the key regions the share of sunflower seeds in total sown area has already been too high to expect its increase going forward. During last several years the area increase was driven by the regions where historically the share of sunseeds in crop rotation was traditionally not high (for example – Sumy and Chernigiv regions).

The biggest sunflower seeds yield in the history of Ukraine was achieved in Y2019 – 2.57 t/ha, the biggest crop – in Y2021 (16.4M tons).

Full-scale russian invasion in Y2022 significantly impacted sown area and total sunseeds crop in Ukraine. Total sown area made 4.8M ha (vs. 6.6M ha in Y2021).

By region changes in sunflower seeds area looked as follows:

Region

Area 2021, k ha

Area 2022, k ha

Change, k ha

Dnipro

608

556

-52

Kirovograd

608

603

-5

Kharkiv

582

240

-342

Zaporizhya

535

71

-465

Mykolaiv

518

364

-154

Lugansk

442

0

-442

Odesa

416

399

-17

Poltava

388

434

46

Donetsk

358

99

-259

Kherson

349

0

-349

Others

1818

2059

199

Total

6622

4825

-1840

As one can see decrease of sown area relates mainly to the regions which are/were occupied by russia (-2M tons in six regions). Other Ukrainian regions factually increased their sunseeds sown area.

Taking into account certain deficit of nitrogen fertilizers in Ukraine in the beginning of Y2023 we expect that in the new season sown area under corn will decrease, while under soybeans and sunflower seeds - increase.

If to speak about longer term perspective – 6-7M ha is the maximum area under sunflower seeds in Ukraine from normal crop rotation perspective.

Sunflower seeds crush in Ukraine

If we take a look at the history of oilseeds crush in Ukraine, active development started after in Y1999 Ukrainian parliament passed a law imposing 10% duty on export of sunflower seeds.

Ukrainian and international companies (such as Cargill, Bunge, ADM) started to build new crushing plants and do marketing of sunflower oil on the global market.

Since Y2000 total crushing capacities increased by more than seven times. In Y2012 they comprised 12M tons, Y2014 – 14.5M tons, in the end of Y2016 – almost 18.5M tons, in the beginning of Y2022 – more than 20M tons.

Such a large increase in capacities led to bigger competition among the crushers and decrease of their profitability.

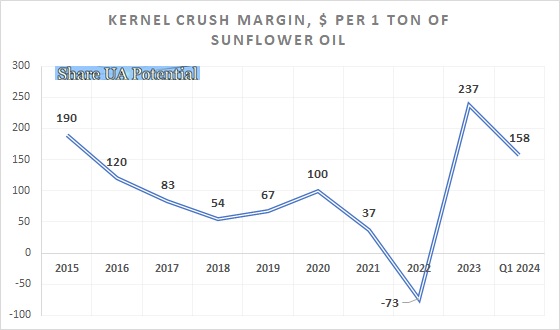

Below we present Kernel Holding crushing margin for the last several years:

Due to decrease of sunseeds crop in Y2020 crushing margins in the season of 2021/22 declined, having reached the minimum for the whole Ukrainian history level.

On the contrary in Y2021 sunseeds crop size in Ukraine was the biggest in the history of the country, so in the first months of MY2021/22 profitability increased.

Full-scale russian invasion was an absolute shock for the industry. Firstly part of crushing plants remained on occupied territory or in close proximity to the front-line.

As for international players crushing plant of Cofco remained in occupied Mariupil, Cargill’s plant – in occupied Kakhovka (each of them accounted for 2-3% of the whole market capacity).

Regarding locals, large enterprise remained in occupied Pology (Zaporizhya region), another one – in Melitopil.

Before de-occupation of Kharkiv region in September 2022 two crushing plans of Kernel were under occupation – in Vovchansk and Prykolotne.

Several other crushers were/are situated near the front-line. We can note Zaporizhya OEZ (belonging to Optimus group, which market share stood at 5-6% of the whole Ukrainian market), Mykolaiv plant of Bunge, Chuhuyev OEZ, Viterra Kolos in Kharkiv region and OEZ in Vilnyansk (Zaporizhya region).

In the list above we included only relatively large producers.

The second event which significantly impacted the market was the blockade of Ukrainian Black Sea ports since February and till August 2022 (in August Grains corridor agreement was signed which allowed Ukrainian companies to export agri-production through the ports of Odessa, Pivdenniy and Chornomorsk).

Due to blockade sunoil export dropped, while quite a lot of crushers suspended their activity.

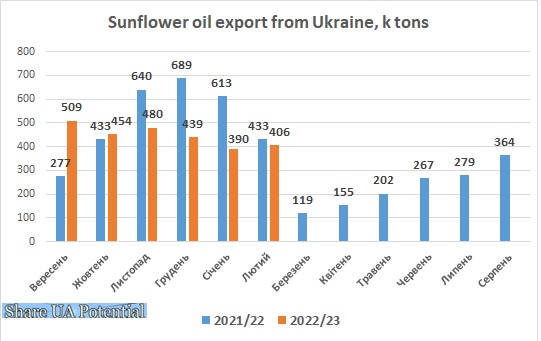

Monthly Ukrainian sunflower oil export dynamics during MY2021/22 and beginning of My2022/23 is presented on the chart below:

Due to significant decrease of crushing volumes and high sunseeds stocks in the hands of Ukrainian farmers, domestic sunseeds prices inside Ukraine largely dropped, which led to increase of crush profitability. It is also opened the door for sunflower seeds export out of Ukraine.

In My2021/22 total sunflower oil output in Ukraine made 4.6M tons (eqv. to around 10M tons of sunseeds crushed), sunflower seeds export made 1.6M tons. By our estimation up to 2M tons of sunseeds was lost on the occupied area. So, total sunseeds stocks in Ukraine in the end of 2021/22 season made from 2.5M tons to 3.5M tons.

As sunflower seeds harvest in Ukraine in MY2022/23 made 10.5M tons (as per official data), its total supply on the market in the current season is to make about 13.5M tons.

Taking into account that since the start of the season (September 2022) and till the end of February 2023 Ukrainian companies exported 1.6M tons of sunflower seeds, we can estimate that in total in MY2022/23 Ukraine will export 2.0-2.5M tons of sunseeds, volumes of crush will make about 11M tons, which is equivalent to 5M tons of oil.

Domestic sunoil consumption in MY2022/23 is to make 350-400k tons, which means that total Ukrainian export will make about 4.5M tons (USDA projects much lower export figure at about 3,9M tons).

In the first half of the current year (since September 2022 till February 2023) Ukraine exported 2.7M tons of sunflower oil.

Main Ukrainian sunflower seeds crushers

As for the biggest sunseeds crushers, in one of our previous market reviews we presented the rating of the biggest crushers in season 2020/21. We do not have precise statistics figures for MY2021/22, but basing on available data we can make some important conclusions.

Kernel remains an absolute market leader. In season 2021/22 it processed about 2.2M tons of sunseeds and produced 1M tons of sunoil with the market share of 22%.

International companies are loosing their market share. Assets of Cofco and Cargill are still situated in the occupied area, Bunge stopped operations of its crushing plant in Mykolaiv, production at ADM facility in Chornomorsk were suspended as well.

In season 2020/21 Bunge had the biggest market share among international companies (around 11%). As per our estimations its share made about 10% in season 2021/22, but dropped significantly in 2022/23.

On the other side MHP (for which oilseeds crush is secondary activity in the poultry production process) in Y2022 used the opportunity and increased its volume of crush.

As per our estimations MHP share among the Ukrainian sunseeds crushers made about 6% (we also project increase of the share in MY2022/23).

In new season 2022/23 we also expect that the market share of large and middle-size local crushers – such companies as ViOil, Oilyar, Gradolia, Allseeds – will grow.

In more long term perspective international companies will get back its share while competition among producers is to increase as it was a couple of years ago.