22 July 2023

Overview of the Ukrainian soybean market - 2022/23

After several years of stagnation, the sown area and soybean harvest are growing in Ukraine again. How the Ukrainian soybean market has changed in recent years - in our review.

Global soybean market

Soybean is the main source of protein for feed - on average, the protein content in the seeds of this crop is at the level of 38-40%. In terms of protein content, one kilogram of soybeans is equivalent to approximately two kilograms of meat or fish.

China accounts for the bulk of demand for soybeans in recent decades. If in the late 1980s, meat consumption in China was 20 kg per capita per year, then in the early 2020s this figure increased to more than 60 kg.

China currently accounts for more than 25% of global meat consumption (including more than 50% of global pork consumption). So it's no surprise that Chinese demand has been the main driver of global soy consumption growth over the past decades.

China's soybean imports increased from 25-30 million tons in the mid-2000s to 98 million tons in the 2022/23 season. At the same time, soybean production in China has been 15-20 million tons per year in recent years.

Another relatively large importer of soybeans is the EU - European countries produce only 2-3 million tons of soybeans per year, and import an average of 15 million tons (and, additionally, 16-17 million tons of soybean meal).

Soy currently ranks third among all grain and oilseed crops in terms of total world acreage, second only to wheat and corn.

The main soybean producing countries are Brazil, USA and Argentina. In recent years, the share of three countries - the largest producers - in the total world production was more than 80% (at the same time, the share of Brazil alone was 35-40%).

It was the increase in production in Brazil that made it possible to meet the growing demand from China. Over the past twenty years, soybean acreage in Brazil has increased two and a half times, and total production has more than tripled.

In the 2022/23 season, soybean acreage in Brazil was a record 43.4 million hectares, the average yield was 3.6 t/ha, and the total crop size was 156 million tons. An increase in production in Brazil (by 26 million tons compared to the previous season) allowed for an increase in total world production, despite a significant negative impact from the drought in Argentina (where the harvest fell from 44 million tons in the 2021/22 season to 25 million tons), as well as a decrease in production in the United States (from 121 million tons to 116 million tons).

Brazil exports most (about two-thirds) of its soybeans without processing (mainly to China). As for the USA, in recent years, exports and processing had approximately equal parts, while Argentina processes almost all of the soybeans grown.

It is Argentina that is the world's largest exporter of soybean meal with a share of 35-40% (when processing 1 ton of soybeans, on average, up to 200 kg of soybean oil and about 780 kg of soybean meal are obtained).

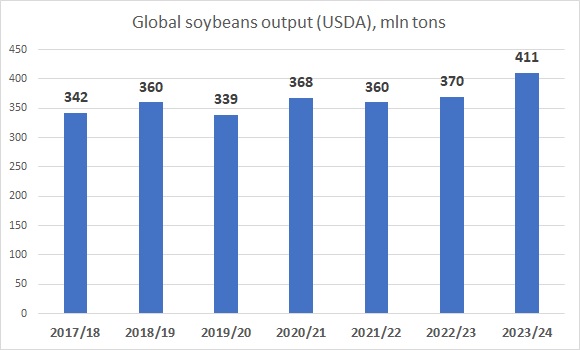

Total world production of soybeans in the 2022/23 season according to the latest (June 2023) USDA estimates was about 370 million tons, compared to 360 million tons in the previous season).

The current forecast for the next season is that production will exceed 400 million tons, which may become a new absolute record. The main drivers of the growth are the increase in the harvest in Argentina after a significant drop in the 2022/23 marketing year, as well as the further increase in planted area in Brazil.

*-source - USDA data, production in the 2023/24 season - preliminary estimate

World prices for soybeans are quite strongly correlated with other commodity groups, primarily with corn. The price spread between corn and soybeans affects both the shift in demand between these crops and the decisions of farmers (primarily American and Brazilian) regarding the allocation of acreage between soybeans and corn.

Undoubtedly, the dynamics of oil prices also have a significant impact on prices (part of soybeans and corn are processed into biofuel).

The dynamics of soybeans prices in the USA (and a comparison with US prices for corn) is shown in the following graph:

Soybeans growing in Ukraine

The sown area of soybeans in Ukraine, its yield, as well as the total soybean harvest since 2005 are shown in the table below:

Year

Area, k ha

Yield, t/ha

Output, kmt

2005

422

1.45

613

2006

715

1.24

890

2007

583

1.24

723

2008

538

1.51

813

2009

623

1.68

1 044

2010

1 037

1.62

1 680

2011

1 110

2.04

2 264

2012

1 411

1.71

2 410

2013

1 351

2.05

2 774

2014

1 800

2.17

3 900

2015

2 100

1.79

3 761

2016

1 860

2.31

4 297

2017

1 982

1.97

3 905

2018

1 729

2.58

4 461

2019

1 579

2.29

3 616

2020

1 351

2.07

2 797

2021

1 310

2.64

3 493

2022

1 538

2.43

3 740

2023

1 780

n.a.

n.a.

Soy does not belong to the traditional crops that were usually grown by Ukrainian farmers. Until 2010, the total sown area of soybeans in the country did not exceed 1 million hectares.

In the first half of the 2010s, there was both a quantitative and a qualitative jump in the development of soybeans growing in Ukraine - both the sown area and the yield of soybeans increased significantly. The profitability of cultivation for farmers was also good, and in some years soybeans were one of the most profitable of all crops.

In addition to nominal profitability, it should not be forgotten that soybean is a very good predecessor for almost all crops from the point of view of crop rotation, so it has an indirect positive effect on the profitability of growing its successors in crop rotation.

It is not surprising that some medium-sized Ukrainian agricultural holdings (such as ATK or TAKO (now - AST)) began to actively develop the so-called American model of grain cultivation, when there are only two crops in the crop rotation - corn and soybeans, which have relatively equal proportions in the cultivated areas.

Gradually, Ukraine made itself known as a notable exporter of soybeans. Processing capacity also grew, for example, in 2013, Astarta put into operation a large soybean processing complex, in 2015, MHP launched its own processing company.

Soybean acreage reached its highest value during 2015-17 (approximately 2 million ha), and at that time it looked like the increase in soybean acreage in Ukraine (at least to 2.5-3 million ha) would continue. But reality was quite different. Starting from 2017 and until 2021, the sown area of soybeans in Ukraine steadily decreased, reaching the level of 1.3 million hectares.

In our opinion, a whole complex of factors led to this situation - both on the domestic and global markets. One of the main reasons for the decrease of soybean area in Ukraine is the changes in the VAT refund regime for soybean exports, which came into force on September 1, 2018.

According to the new regulations, only farmers - producers of soybeans - could receive the right to obtain VAT refund when exporting soybeans. Middlemen were eliminated from the market, which actually meant closing access to soybean exports for small producers (farmers with a land bank of less than 1,000 ha who could not export their products on their own), whose share among Ukrainian soybean producers was 30-35%.

The changes in the legislation were aimed to stimulate the domestic soybeans crush and to create a powerful new industry (based on the example of sunflower processing).

During 2018-2020, processing indeed increased (more details on soybean processing are provided below), but at a big cost in terms of soybeans production volume.

In parallel with changes in the domestic market, important events took place in the global soybean market. First of all, it is a trade war between the USA and China. In 2018, in response to US sanctions, China imposed a 25% tariff on soybean imports from the US. Accordingly, if in previous seasons the US exported more than 30 million tons of soybeans to China per year, after the introduction of the tariff, supplies fell to almost zero.

In addition, in China itself due to the outbreak of ASF, the number of pigs was significantly reduced, which had a significant negative impact on soybean imports (in the 2018/19 season, it amounted to 83 million tons compared to 94 million tons in the previous marketing year).

In the Chinese market, US soybeans were replaced by increased supplies from Brazil, and the US redirected its soybeans to other markets, dumping and thus creating competition for other producing countries, including Ukraine. Accordingly, Ukrainian export prices for soybeans and soybean meal decreased significantly in 2018 (the drop was more than 20% with a relatively stable production cost). The profitability of soybean production began to lose significantly compared to the profitability of growing other main crops - primarily sunflower and corn.

As a result, Ukrainian farmers (especially small and medium-sized ones - due to the peculiarities of VAT refunds during export) began to gradually reduce the sown area of soybeans.

In the 2018/19 season, when the area was reduced, due to the then-record yield (2.6 t/ha), the total harvest (almost 4.5 million tons) exceeded the figure of the previous season (which led to the fact that soybean stocks at the end of the 2018/19 season - more than 400 thousand tons - were the highest in recent years).

Subsequently, production only declined, reaching a mark of 2.8 million tons in the 2020/21 marketing year, which was the lowest value since 2013.

In the 2021/22 season, with stable acreage (about 1.3 million hectares), but with a new yield record (2.64 t/ha), soybean production increased (up to 3.5 million tonnes), and since in 2020, the normal VAT reimbursement regime was restored in the country.

The new and biggest test for Ukrainian farmers was the full-scale Russian invasion in February 2022.

Sown area of soybeans in Ukraine by region

During the last decade, the central regions of the country - Poltava region, Kirovohrad region, Vinnytsia region and Kyiv region - were the basic regions for soybean cultivation, in recent years the share of western regions such as Khmelnytskyi region, Lviv and Ternopil region has significantly increased.

Soy also had a significant share in the crop rotation of farmers in the Kherson region, where a significant part of the land under soybeans was under irrigation.

In 2015 (when the area under soybeans in Ukraine reached a historical maximum), the cultivated area in Poltava region was 540,000 hectares, Cherkasy region – 370,000 hectares, and Kherson regions – almost 450,000 hectares.

For comparison, in 2022 soybeans were sown on only 134,000 hectares in Poltava Oblast, 110,000 hectares in Cherkasy Oblast, while Kherson Oblast was occupied by Russian troops.

In 2023, the total sown area of soybeans in Ukraine increased compared to the previous year - from 1.5 million hectares to 1.78 million hectares. The main reason is the shortage and significant increase in the cost of nitrogen fertilizers, which prompted Ukrainian farmers to significantly reduce area under the corn (which is the most demanding crop for nitrogen fertilizers). Instead of corn, farmers planted more sunflowers and soybeans.

The dynamics of soybean acreage by main cultivation regions in recent years was as follows (data for 2015, 2017, 2022 and 2023 are given to assess the dynamics):

Region

Area 2015, k ha

Area 2017, k ha

Area 2022, k ha

Area 2023, k ha

Poltava

540

221

134

150

Kherson

447

117

-

-

Cherkasy

368

129

110

110

Sumy

292

152

98

96

Khmelnytskiy

279

190

180

192

Vinnytsya

219

145

106

151

Kyiv

214

172

106

150

Zhitomyr

173

151

160

183

Kropyvnytskiy

175

160

77

88

Ternopil

105

83

97

148

Lviv

39

58

109

112

Total

2135

1982

1538

1780

As for the regions - the leaders in yield - in 2022 they were the Poltava region (3.0 t/ha), Khmelnytskyi region (2.9 t/ha) and Ternopil region (2.9 t/ha).

Processing of soybeans in Ukraine

Kakhovka Protein Agro (Kherson region), Tegra Ukraine (Vinnytsia regions) and Zaporizhzhia-based group Sistema were among the first companies to focus on soybean processing in Ukraine on a large scale. Their facilities were built in the early or mid-2000s.

With the increase in the sown area and soybean harvest, the processing capacity also increased.

In 2009, the Protein Production plant was built (and in 2013 - expanded), which belonged to the Kirovohrad Kreativ group, at the end of 2013 - the Astarta plant was put into operation, and at the end of 2015 - the MHP plant.

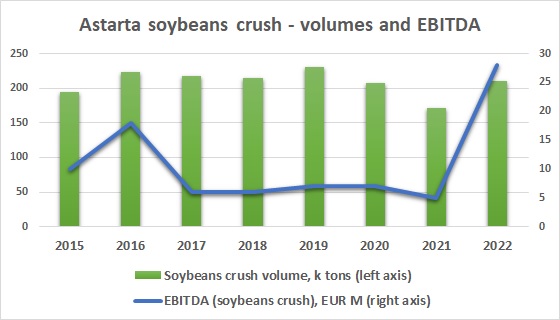

It is the last two companies that are the undisputed leaders in Ukrainian soybean processing, starting from 2016. Their combined share in the total volume of soybeans crush in Ukraine each year is from 30% to 40%.

2017-2018 was the next stage of significant capacity growth - several large enterprises were launched, including the Viktor & Co. plant in Kirovohrad region, AdampolSoya (Khmelnytskyi region, ATK group), Protein-Invest (Khmelnytskyi region, owners of one of the largest alcohol producers in Ukraine - Nemiroff).

Also, among the largest processors of the last decade, there are large multi-seed plants that process various types of oilseeds - sunflower, rapeseed, soybean. These are companies such as Pology crushing plant, ViOil and Oliyar.

Already in 2018, the total soybean processing capacity in Ukraine was estimated at 5.5-6 million tons. With a harvest of 3-4 million tons and significant soybean exports, it is not surprising that in the last years before a full-scale Russian invasion in 2022, competition among processors was high, which negatively affected the crushing margins.

Below we present data on the profitability of soybean processing during the last years of one of the largest market players - the Astarta group:

The high competition between processors was accompanied by some problems with the export of processing products - soybean oil and meal. Soybean oil is almost 100% exported, the main buyers are China and the EU, and the demand for these products has always been quite good.

The situation is more complicated with soybean meal. The domestic demand for meal has been from 300 to 400 thousand tons per year, production fluctuated between 700 thousand tons and 1.1 million tons, the surplus was exported. At different times, the main importing countries of Ukrainian meal were Belarus, the EU, and Turkey, but in general, it cannot be said that export was very well developed, the share of Ukraine in the total global market supplies was small.

This lack of soybean meal export development works against Ukrainian soybean processors, who still find it quite difficult to compete with processors of other countries (especially such giants as the USA, Argentina or Brazil).

It looks like, from the point of view of logistics, EU countries should become the main market for Ukrainian suppliers. So we hope that a more active integration of Ukraine into the European community will also contribute to the stability of supplies of Ukrainian soybean meal to the European market (every year the EU imports 16-17 million tons of soybean meal).

One of the important tasks, which concerns both the development of soybean and meal exports, is to determine whether Ukraine is more interested in growing GMO soybeans (with a potential focus on China, but there Ukrainian suppliers will have to withstand tough competition with Brazilians) or non-GMO (in this case, we can talk about the development and significant increase of soybean exports to the EU).

The shares of the largest Ukrainian soy processing companies in recent years are shown in the table below:

Company

2019

2020

2021

2022

MHP

16%

17%

20%

22%

Astarta

14%

17%

13%

19%

ATK

12%

9%

11%

14%

Viktor & Co*

14%

15%

10%

7%

Falcon-Agro**

2%

6%

9%

7%

Pology

9%

4%

9%

-

**-Protein Production (ex-Kreativ)

The impact of a full scale invasion

Despite the occupation of part of the territory of Ukraine and full-scale military actions, in 2022 Ukrainian farmers increased the sown area of soybeans from 1.3 million hectares in the previous year to 1.54 million hectares. The main part of the increase was in Khmelnytskyi, Zhytomyr, Cherkasy and Vinnytsia regions.

The yield decreased compared to the record-high one 2021, but even with significant harvesting difficulties (largely caused by adverse weather conditions), it was the third highest in Ukrainian history (2.43 t/ha).

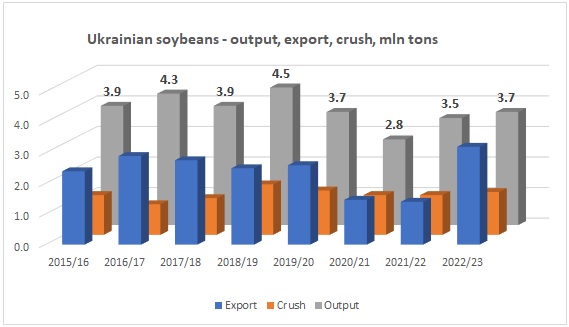

Accordingly, a good harvest contributed to an increase in soybean supply in Ukraine, active processing and export.

Despite the full-scale invasion, soybean exports in (calendar) 2022 totaled 2 million tons, nearly double the 2021 figure. The export of soybean meal showed a slight decrease - from 471 thousand tons to 414 thousand tons, soybean oil - remained almost unchanged (237 thousand tons and 241 thousand tons, respectively).

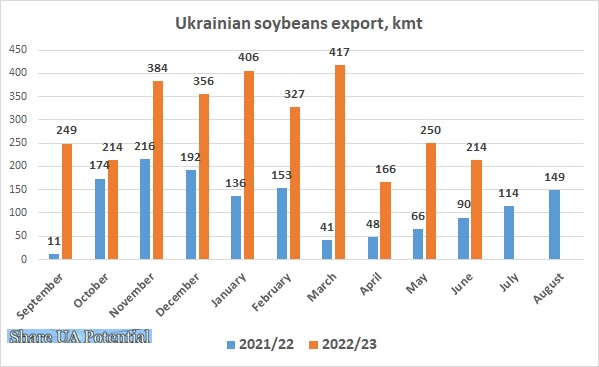

At the beginning of 2023, the export of soybeans and products of its processing remained active, significantly exceeding last year's figuress. So from the beginning of the 2022/23 season until the end of June, Ukraine exported 3 million tons of soybeans, for the entire 2021/22 season - only 1.4 million tons.

The main reasons for such dynamics were the good harvest of 2021 and the not very active export of soybeans at the beginning of the 2021/22 season - from September 2021 to February 2022, Ukraine exported 880 thousand tons of soybeans, another 650-700 thousand tons were processed. So as of the beginning of the full-scale invasion, soybean stocks in Ukraine amounted to 1.9-2 million tons.

After the blockade of Ukrainian ports began, already from April-May 2022, Ukrainian companies tried to increase soybean supplies through alternative routes - through the Danube ports and by rail through the western borders. The new export routes were significantly longer and more expensive than traditional routes, but soybean exports were less affected by this increase in cost compared to grains.

Due to the fact that soybean is a more expensive crop (per 1 ton) compared to the corn, the share of logistics costs in the overall structure of the total cost of exported soybeans (in relative terms) was lower (than for corn). Even after the opening of grain corridors from Ukrainian ports, the bulk of soybeans continued to be exported via alternative routes. Of the 3 million tons of exports in the 2022/23 season (from September to June), only about 30% was exported through the Black Sea ports. A little more than a third was exported through Danube ports, the rest by rail and road.

The main direction of Ukrainian exports in the 2022/23 season was Turkey, where more than a third of Ukrainian exports were sent. The rest of soybeans were exported mainly to EU countries.

Due to the significant domestic supply of soybeans in Ukraine, during 2022 domestic prices for soybeans decreased significantly (by 25-30% year-on-year on average).

Therefore, the good export statistics did not in any way affected the financial performance of farmers - on average, the profitability of its cultivation in 2022 was close to zero.

In season 2022/23, due to the significant difference between the domestic and export prices for soybeans, profits were made mainly by exporters and crushing plants.

As mentioned above, the profitability of soybean (as well as sunflower) processors in the current season is the highest in the last decade.

As we have already noted, in 2023 there was an increase in the sown area under soybeans - almost to 1.8 million hectares. With the average yield for the previous seven years - 2.3-2.4 t/ha - Ukraine can harvest about 4.2 million tons of soybeans.

The main issue for both farmers and exporters is the issue of further functioning of the grain corridor from Ukrainian deep-sea ports. If the ports will function normally, logistics costs related to exports will significantly decrease, which will contribute to both the growth of domestic prices and the profitability of soybean cultivation by farmers.

In this case, the profitability of soybean processing will significantly decrease compared to the 2022/23 season. If logistical problems with exports continue, the processing margin will remain relatively high, while the profitability of farmers will remain low.

Returning to the global prospects of soybean cultivation and processing in Ukraine, it seems that there is now a second chance for development, as evidenced by the (albeit somewhat forced) increase in planted areas.

In our opinion, Ukrainian farmers and processors should establish themselves as an important supplier of soybeans in the European market and as a reliable alternative for North and South American soybeans in this market. The GMO/non-GMO dilemma must be resolved.

Finally, farmers should not forget about the importance of soybeans from the point of view of crop rotation, realizing that slightly lower profits today can mean a significant increase in the profitability of operations tomorrow.