Kyivstar is the leading Ukrainian mobile operator with a total number of users of about 25 million people and annual revenue exceeding UAH 30 billion.

First years

Kyivstar was founded by Ukrainian businessman Ihor Lytovchenko and his partners in 1994 and at the beginning was called Bridge. For the first three years, the company was almost dormant, the first phone call using the Kyivstar network was made on December 9, 1997.

At that time, the company "Ukrainian Mobile Communications" (UMC), which was the first mobile operator in Ukraine, had been operating on the market for several years. Utel (one of the founders was the American mobile brand AT&T) and Donetsk-based DCC (later became part of Rinat Akhmetov's SCM holding) were also present on the market.

In those years, mobile communication was quite an expensive service (it was necessary to pay $850 just to connect to the network, and the average monthly communication costs started from $100, with the average salary in the country at that time below $100), so only wealthy people could afford to have a mobile phone.

Everything changed with the introduction of the GSM mobile communication standard in the country. In 1997, a tender was held for a license for the GSM-900 standard, the winners of which were UMC, Kyivstar, as well as the company Ukrainian radio systems (TM WellCom). After that, the years of rapid development of mobile communication in Ukraine began.

Mobile phones have gradually become cheaper and more convenient to use, and the market for mobile communication services was rapidly undergoing innovations: prepaid tariffs, SMS text messages, per-second pricing for calls and, finally, cancellation of incoming call charges. In most cases Kyivstar was the first to implement those innovations.

In the early 2000s, Kyivstar and UMC were already the undisputed leaders of the Ukrainian mobile services market (as of the end of 2002, the Kyivstar network had 1.75 million users, UMC - 1.62 million users, together it accounted for approximately 90% of the market).

Shareholders of Kyivstar

The story of changes in the shareholders structure of Kyivstar is one of the most interesting among all large Ukrainian companies. At the beginning of its activity, more than 50% of the interest in Kyivstar was controlled by the state, namely the State Committee for Communications, the Ministry of Energy and Ukrzaliznytsia. After obtaining the license, already in 1998, the structure of shareholders changed radically.

51% of the shares were owned by two Ukrainian companies - Storm and Omega, another 35% - by the Norwegian telecom operator Telenor (in 2001, the share was increased to 45%), 14% - by the investment fund Sputnik.

Telenor became the first strategic investor of Kyivstar, it had technical expertise and financial resources for business development in the fast-growing market. As for the other shareholders, according to available information from open sources, the Storm and Omega companies were backed by Lytovchenko, Yuriy Tumanov (brother of the wife of the then President of Ukraine Lyudmila Kuchma, Mr. Tumanov became the head of the Board of Directors of Kyivstar) and the well-known Ukrainian businessman Oleksandr Yaroslavskyi.

The Sputnik Fund, according to the information of Ihor Lytovchenko in his book "Igniting the Star", belonged to the structures of the Russian investor Leonid Rozhetskin.

There were many rumors that the main shareholders of Kyivstar were people close to Leonid Kuchma. Indirect confirmations are the role of Yury Tumanov, as well as the fact that for several years the position of deputy marketing director of Kyivstar was held by the daughter of Leonid Kuchma - Olena Franchuk. In fact, Ihor Lytovchenko mentions his good relations with Leonid Kuchma's family since the beginning of the 90s in his book.

Therefore, to a large extent, the rapid development of the company in the difficult Ukrainian market is explained by its proximity to Kuchma.

In 2002, the controlling stake in the Storm company was bought by the Russian Alfa Group of Mykhailo Fridman and his partners. In the same year, Storm and Telenor signed a new shareholder agreement, in which they agreed that the shares of shareholders in Kyivstar will be distributed as follows: Telenor - 56.5%, Storm - 43.5%.

It should be noted that Telenor and Alfa Group have already been partners in the Russian telecommunications business - in the company Vimpelcom (with shares of 27% and 33%, respectively). But at the same time, the shareholders had different views regarding the further structure of the joint business in Ukraine and Russia. Telenor wanted to keep a controlling stake in Kyivstar, while Alfa Group preferred to include Kyivstar in the structure of Vimpelcom.

After Alfa bought out the remaining shares of Ukrainian shareholders in the Storm company in 2005, a series of corporate conflicts between Alfa and Telenor began, which became famous as one of the most high-profile corporate conflicts in Ukrainian history.

The stakes were very high - to create pressure on Telenor, Alfa even introduced a new operator to the Ukrainian market - Beeline (buying out the operator Ukrainian Radiosystem for $231 million). Alfa sabotaged meetings of Kyivstar shareholders and initiated several lawsuits in various jurisdictions.

In the end, after losing about $500 million as a result of significant UAH devaluation at the end of 2008 (in 2007 and 2008, due to the lack of decisions of shareholders' meetings, Kyivstar was unable to pay dividends, having accumulated about UAH 8 billion in cash at the end of 2008, when the significant devaluation of the hryvnia happened), the shareholders decided that it was time to negotiate. As a result, in 2009, Telenor lost a controlling stake in Kyivstar, receiving 36% in the combined company VimpelCom.

At the moment, VEON Holding (former VimpelCom) owns 100% of Kyivstar. Veon is 47.9% owned by the investment company Letter One, whose shareholders are the owners of Alfa group, 8.3% is owned by the Stitching trust (owned by the same Russian group of investors, but controlled only by independent directors), the rest is free float (Veon shares are traded on Nasdaq and the Dutch Stock Exchange).

Market leader

In the early 2000s, the market of mobile services in Ukraine grew at a frantic pace. Operating and financial performance of Kyivstar demonstrated very good dynamics.

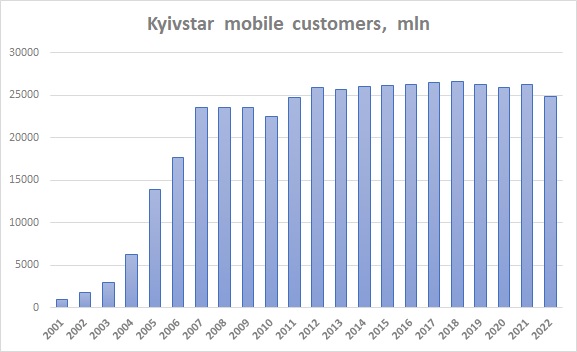

If at the end of 2002 there were less than 2 million subscribers in the Kyivstar network, in 2005 there were more than 10 million, and in 2007 - 20 million.

It was in 2007-2008 that the Ukrainian mobile services market became saturated in terms of the number of users, although the nominal level of penetration (the number of subscribers to mobile services to the total population) reached 100% in 2011.

Along with the growth of volumes - the number of users and the average time of the calls - tariffs for mobile communication in Ukraine rapidly decreased (the decrease in tariffs, in principle, contributed to the rapid penetration of mobile communication among the Ukrainian population).

Already in 2010, tariffs for mobile services in Ukraine were among the lowest in the world. The main reason for this is competition in the market among network operators. In 2005, Kyivstar and UMC were joined by a new player with great ambitions - life:), created on the base of Rinat Akhmetov's DCC company with the involvement of a foreign investor - Turkish operator company Turkcell. This player had quite large resources for development and was actively dumping in the market in an attempt to increase its share.

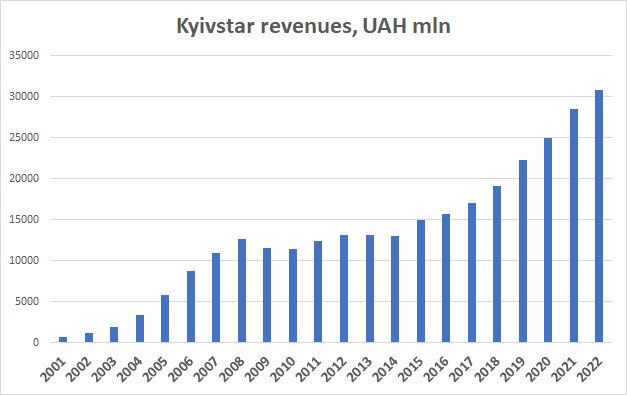

As for the financial performance of Kyivstar, in the first few years of the company's existence, its operations were unprofitable, and the first profits were obtained in 2001 (in that year, the net profit of Kyivstar amounted to about UAH 110 million or $20 million at the then exchange rate).

Building the network required significant external investments. At first, the main source of financing was the funds of shareholders – Kyivstar statutory fund at the end of 2000 amounted to UAH 210 million, and during 2001-2002 it was increased to UAH 530 million.

Debt financing was also attracted - in 2002, Kyivstar became the first Ukrainian private company to issue Eurobonds. Kyivstar needed external financing until 2006. This year, for the first time, the business generated operating cash flow that exceeded the amount of investment into development. The communication network was already almost built, and the number of subscribers increased significantly, increasing the company's profits.

Since 2008-2009, Kyivstar has become a "cash cow" for its shareholders. At first, most of the loans were repaid, and since 2009, Kyivstar has started paying quite large amounts of dividends.

From the point of view of the company's revenue dynamics, it generally corresponded to changes in the number of subscribers in the network, adjusted for the decrease in the cost of mobile services in the mid-2000s.

Starting from 2007 and until 2014, revenues in hryvnias per subscriber of Kyivstar were almost unchanged at the level of about 500 hryvnias per subscriber per year. Due to inflation, the company's costs gradually increased, but the profitability (EBITDA margin (operating profit before depreciation)) did not fall below 40% until 2014.

During the same period, the company's EBITDA amounted to about UAH 4.5 - 5 billion per year. It was necessary to invest 1.5-2 billion UAH in the maintenance and development of the business, therefore every year Kyivstar generated for its owners 3-3.5 billion UAH (about $400 million) of cash flow, which was mainly directed to the payment of dividends.

The aggression of the Russian Federation in 2014 and the financial crisis in Ukraine that accompanied it worsened the results of Kyivstar, but relative to many other Ukrainian industries, the situation was much better.

The demand for mobile communication services is inelastic, the share of communication costs in the overall spending of Ukrainian households was small, the tariffs were relatively low, so even with the decrease in the purchasing power of the Ukrainian population, mobile services were one of the last thing Ukrainians saved on.

In 2014, the company's turnover in hryvnias remained at the level of previous years (about UAH 13 billion), the EBITDA margin decreased to "only" 34%, EBITDA amounted to UAH 4.5 billion, net profit - UAH 2.2 billion (compared to UAH 3.8 billion in 2013). Of course, in dollar terms, performance dynamics was worse.

3G revolution

Starting from 2015, the general situation in the market of mobile services changed, along with the financial performance of Kyivstar.

First, in 2015, a new standard of mobile services was introduced in Ukraine, which belonged to the third generation of 3G mobile communications. At the auction held on February 23, 2015, Kyivstar won a license to develop a new generation network (the license cost was UAH 2.7 billion).

Accordingly, in 2015, Kyivstar's total investments in network development increased significantly compared to previous years and amounted to UAH 6.4 billion. Accordingly, 2015 was the only year since 2009 when Kyivstar did not pay dividends to its shareholders - all profits were directed to 3G network development.

Starting from 2016, the general situation in the Ukrainian economy began to improve, the purchasing power of the Ukrainian population increased, accordingly, mobile operators began to increase their tariffs for the first time in years (at the same time, significantly expanding the range of services provided, namely - including 3G Internet).

With a stable number of subscribers, Kyivstar's revenue and profits finally began to grow. The average annual growth rate of revenue, starting in 2016 and till 2021, was 12%, expenses did not increase so quickly, so profitability grew - EBITDA margin reached 67% in 2020-21, total EBITDA in 2020 amounted to UAH 17 billion, in 2021 - UAH 19 billion. The net profit of Kyivstar in 2021 amounted to UAH 11.3 billion, which is twice as much as that of competitors - Vodafone Ukraine and Lifecell - combined.

Of course, in dollar equivalent due to the devaluation of the hryvnia in 2014-15, the situation in recent years did not look so attractive - even in 2021, Kyivstar's revenue and profit in USD terms were lower than in 2012-13. Despite this, if you compare the amount of dividends paid by Kyivstar to its shareholders from 2009 to 2021 (70 billion UAH, which is equivalent to more than $4.5 billion) with their initial investments in the company at the beginning of its development, it is clear that the return on these investments is very high.

From an operational point of view, the focus of Kyivstar was the development of the 4G network (4G communication was launched in 2018), as well as IT. The company Kyivstar.Tech was created, which recruited about 400 IT specialists.

Full-scale russian invasion

Taking into account the already mentioned relatively small share of expenses for mobile communication in the overall structure of expenses of the Ukrainian population, there was a certain impact of full-scale russian aggression on the company's activities, but it was far from critical.

In response to the full-scale war In the shortest possible time, national roaming was launched by mobile operators, reservation of key services in the west of Ukraine was carried out, as well as back-up of communication channels was created.

Regarding the loss of users, the company notes in its reports that the total number of Kyivstar subscribers as of the fourth quarter of 2022 was 24.8 million (26.2 million a year ago), while the average monthly income per subscriber increased from UAH 88 to UAH 103.

Financial performance was relatively good.

In 2022, Kyivstar increased its turnover compared to the previous year by 8.2% to UAH 31 billion (in dollar terms, turnover decreased by 8%).

Due to the increase in costs (primarily, an increase in electricity tariffs by an average of 38% compared to the previous year), the profitability of the activity decreased slightly, but still remains at a high level - in 2022, the EBITDA margin was 58.9%, total EBITDA - 18 billion UAH (19.2 billion UAH in 2021).

Regarding direct losses from military operations, we note that Kyivstar lost base stations in the occupied territories. In the territory of Kyiv, Sumy and Chernihiv regions, according to the company's estimates, up to 35% of stations were damaged, 10-15% were destroyed.

Capital expenditures in 2022 amounted to UAH 6 billion, or about a third of EBITDA (in 2021, the amount of investments amounted to UAH 5.1 billion). Part of these costs is the repair and restoration of damaged base stations and costs associated with backup equipment.

Kyivstar also continues to try to partially diversify its activities - in 2022, the company acquired the Helsi medical service. The development of Kyivstar.Tech continues - in 2023, it was planned to hire 60-80 new IT employees. Some strategic projects, such as the replacement of the ERP system, have been postponed for now.

The main shareholders of Kyivstar as of 2022 - the beginning of 2023 remain sanctioned Russian businessmen (since Veon is 47% owned by Alfa, the company declares that it does not have a controlling shareholder), the big question is whether they can remain shareholders of Kyivstar in the conditions of war and imposed sanctions.

During 2022, some news and rumors about a possible nationalization periodically appeared, but as of the beginning of 2023, no relevant decision had been made.