Agroprosperis Group is one of the largest Ukrainian producers and exporters of agricultural products, the company produces about 1.5 million tons of grain and oilseed crops every year.

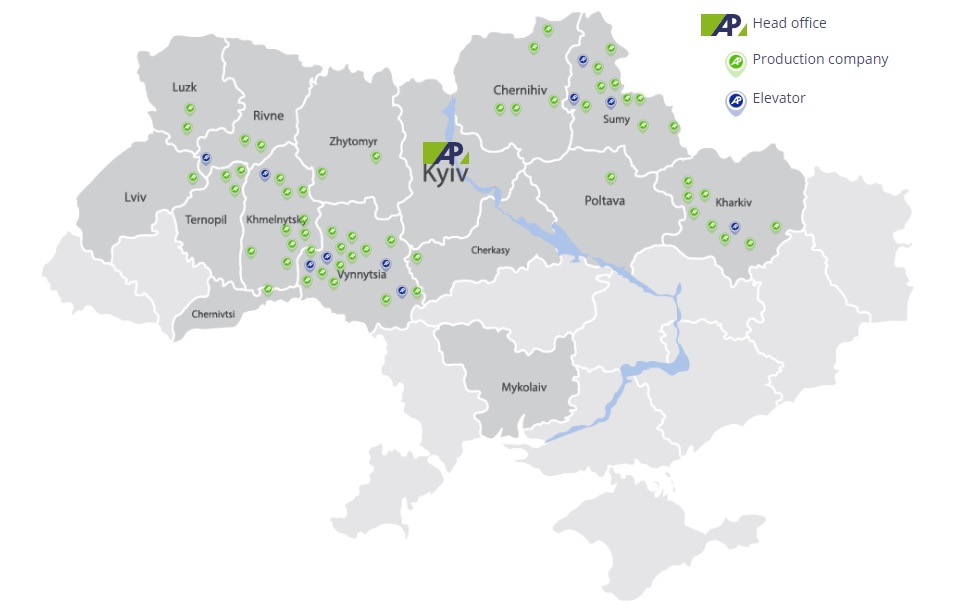

The group's total land bank as of the beginning of 2023 is about 300,000 hectares (by the size of the land bank, Agroprosperis is among the top five largest Ukrainian agricultural producers) and is located mainly in the Vinnytsia, Khmelnytskyi and Sumy regions (the holding is represented in 12 regions of Ukraine).

The group also has 12 elevators with a total storage capacity of about 550,000 tons. The company's elevator capacity is not very large, considering that the annual harvest of the group varies between 1.3 million tons and 1.8 million tons of grain and oilseeds.

In addition to its own grain and oilseeds growing, Agroprosperis has a fairly large grain origination business in Ukraine.

On average, during the last several years before the full-scale Russian invasion into Ukraine, Agroprosperis exported about 2-2.5 million tons of grains and oilseeds per season (the company belongs to the TOP-10 Ukrainian grain exporters).

According to our estimates, 50-60% of the total amount of exports is the group's own harvest, the rest – grains originated from 3rd party farmers.

To ensure logistical support for exports, the group purchased 400 grain wagons - Agroprosperis is one of the largest private owners of grain wagons in Ukraine. According to our estimates, in one season (marketing year), Agroprosperis wagons transport 700-800 thousand tons of grain from elevators to ports.

Considering the group's relatively small capacity for grain storage in Ukraine, as well as the availability of grain wagons, the group bets on a quick turnover of goods (some Agroprosperis elevators make 5-6 of grains turnover per season), while the average term of grain storage in the silos is not very long. This modus operandi is significantly different from the model of other Ukrainian agricultural holdings - such as IMC, Astarta, Epicenter, ULF, and is more similar to the work model of traders.

A separate part of the group's business in Ukraine is the supply of seeds, plant protection products and mineral fertilizers to farmers, as well as financing of farmers.

For the financing needs of farmers, in 2015 the group bought the bankrupt Astra Bank, on the basis of which Agroprosperis Bank was created. The bank began to actively lend to Ukrainian farmers, especially those who had relations with other divisions of the group. We should especially note that Agroprosperis has become one of the leaders among Ukrainian banks in the volume of lending to farmers under the pledge of agricultural receipts.

As of the end of the third quarter of 2022, the total amount of assets of Agroprosperis Bank was UAH 2.2 billion (among them the loan portfolio was UAH 1.2 billion), the bank's equity was UAH 301 million.

Agroprosperis is owned by a group of American investment funds managed by NCH Capital. Shareholders of NCH Capital funds, according to data from open sources are EBRD, as well as funds of such well-known organizations as Harvard University, John Hopkins University, Skoll Foundation and others. NCH Capital itself is owned by Americans George Rohr and Maurice Tabacinich.

NCH started investment activity in Ukraine back in the 90s. The first were investments in commercial real estate, for example, NCH Capital invested in the Dnipropetrovsk business center Citadel, the Kyiv office center Millenium, the shopping mall "Ukraine", the hotel "Lybid" and others (in total, the fund invested $100 million in Ukrainian real estate).

NCH started investing in Ukrainian agriculture in 2006, when the asset management company created a separate fund for investments in the agricultural sector of Eastern Europe in the total amount of $1.2 billion.

NCH began to steadily increase its land bank in Ukraine and neighboring countries, concentrating 820 thousand hectares in Ukraine, Russia, Moldova, Bulgaria, Kazakhstan and Romania in a few years. In Ukraine, by 2011, the group had concentrated 400,000 hectares of land (by the size of the land bank, NCH ranked second among Ukrainian agricultural holdings, after Oleg Bakhmatyuk's Ukrlandfarming).

Until 2014, the land bank of the holding was at a relatively stable level, but starting from 2014-2015 and until 2019-2020, due to significant optimization of assets, it decreased to approximately 300 thousand hectares. First of all, the company sold the farms that showed the worst results among all the assets of the group for several consecutive years.

It was during this period of time, starting from 2016-17, that Agroprosperis became a fairly large Ukrainian trader of agricultural products. The company started as a trader making deliveries to ports, then, having received quotas in Ukrainian port terminals, started its own transshipment of grain onto ships, working on FOB and CIF terms.

Based on the fact that the company's owner is investment management company, the business model of Agroprosperis is focused on the main goal - obtaining the maximum return on investments. The company is cautious about new investments, carefully calculating their payback and investing only in projects with a quick return (in our opinion, this is why the group does not invest significantly in the expansion of silo capacities - the payback of such projects is not always quick and obvious).

Also, the desire to maximize current profits may influence crop rotation decisions, increasing the share of more profitable crops in the short term (such as sunflower), despite potential negative consequences in the longer term.

On the other hand, Agroprosperis is almost the only employer in Ukraine (among agricultural companies) that offers its employees to invest personal funds in the companies they work for and receive income from investments depending on the company's financial results. In one of the interviews in 2019, Ms. Maria Osyka, CEO of Agroprosperis, noted that in 2018, the amount of such investments from the company's 1,200 employees amounted to $10 million (78% return on investment).

Since the company is not public, there is little publicly available data on the operating and financial results of Agroprosperis.

Adding the data on the Agroprosperis land bank to the average profitability of grain and oilseed growing in Ukraine over the past few years, it is possible to estimate that starting from 2017-18 and until 2021, the company’s average EBITDA from grain growing was in the range of $80-120 million (financial results from trading and financial operations came on top of this estimate).

As with other Ukrainian agricultural holdings, according to our estimates, the financial results of Agroprosperis should have improved significantly in 2021 (which was influenced by high prices and good yields of grain and oilseed crops in the main regions of Agroprosperis operations).

Given that a significant number of the company's assets are located in the Kharkiv and Sumy regions (a large part of the Agroprosperis land bank is located in the Sumy region - 60,000 hectares, as well as three elevators, in the Kharkiv region - 31,000 hectares and two elevators), a full-scale invasion of the Russian Federation is estimated to have big impact on the group's activities.

On the negative side, we also note a significant decrease in corn yield in 2022 in the Vinnytsia region, where a large part of the Agroprosperis land bank is located (71 thousand hectares).

On the other hand, since Agroprosperis finances its activities with its own funds, the company has a fairly high margin of safety, so we can only estimate a decrease of return on investments.

In the first half of the 2022/23 season, according to our estimates, Agroprosperis entered the top five largest Ukrainian grain exporters, so the company continues to actively work and develop its business in the current extremely difficult conditions.